Volume of currency swaps trading by non-reporting banks increased by 139% over 3 years

Philip Stafford and Anna Gross in London

London also increased its share of trading euro-denominated interest rate swaps

Rapid growth in the volume of foreign exchange swaps handled in London over the past three years has been fuelled in part by smaller European banks and hedge funds using currency derivatives to fund their short-term liquidity requirements, the Bank of England said.

Demand for short-term funds meant the volume of currency swaps trading by non-reporting banks increased by 139 per cent over the past three years, according to a BoE study published late last week. That takes the total volume of currency swaps traded in London to $1.8tn a day. Around two-thirds of contracts last for just a week, it added.

The move underlines how banks are increasingly turning to derivatives — which mimic the underlying markets — when liquidity in securities markets dries up. Unlike securities, the deals do not have to be reported on banks’ balance sheets.

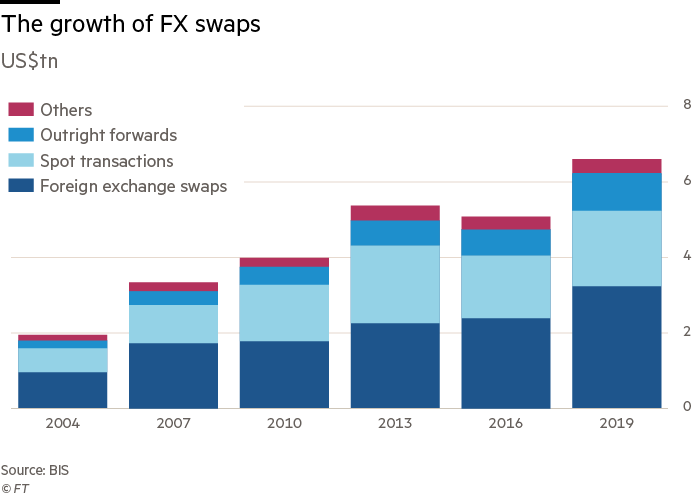

The findings are part of a deeper examination by authorities into the trends underpinning the Bank for International Settlements’s latest triennial survey into the vast global derivatives markets. The latest study, released in September, found that London had strengthened its grip on the market and pulled away from New York.

Half of all currencies market turnover globally and in the UK is attributable to derivatives such as swaps and forwards, in which two investors agree swap payment of loans in different currencies. For many banks it is a cheaper alternative than borrowing directly or hedging their loans.

Authors Harry Goodacre and Elias Razak at the BoE said banks and other institutions, based in countries where liquidity was cheap, “may have swapped their local currency liabilities into dollars via the FX market in order to lend US dollars at a higher rate.”

Their conclusions chime with findings earlier this month by BIS researchers, which found that many smaller banks have turned to the currency swaps market in the last few years because they have limited direct access to US dollar funding.

The trading of these smaller and regional banks outside the group of global FX dealers accounted for about half, or $404bn, of the total increase in swap turnover. “The actual need to fund longer-term dollar-denominated assets, by contrast, was reportedly a lesser consideration,” the BIS concluded.

They also concluded that volumes in FX swaps market were skewed by the reliance on short-term contracts, as extending or rolling the contracts would boost overall totals.

The BoE also said the large increase in volumes was “consistent” with the long-term trend to move to electronic trading. “The shift to electronic relative to voice tends to favour London as a financial centre because many major firms run their global e-trading from London,” it said.

The UK has long been established as the frontrunner in and main hub for trading interest rate derivatives.

The UK was also the largest centre for over-the-counter interest rate derivatives, according to the BIS survey. The UK’s market share increased to 50 per cent in 2019 from 39 per cent in 2016, returning to a longer-term trend. London had been displaced at the top in 2016 by New York, owing to the timings of new regulations.

0 comments:

Publicar un comentario