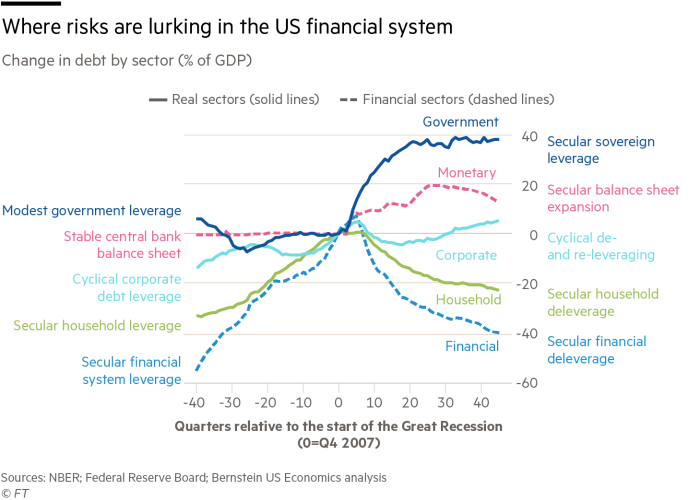

Two sectors at the heart of the crisis — household and financial — have undergone big changes

Colby Smith

© Bloomberg

More than a decade on from global financial crisis, the imbalances that appeared to precipitate the crash have been corrected.

While debt levels have built up elsewhere since then, the situation is less worrisome now, according to the US economics team at AllianceBernstein.

The two sectors at the heart of the crisis — household and financial — have undergone big changes, the New York-based asset manager notes, with both undergoing what it calls a “secular deleveraging”.

The banks, for their part, are in better health: capital and liquidity ratios are higher, loan delinquencies are low and regulators are performing regular stress tests on the biggest and most important institutions.

Households, too, have brought down their absolute levels of indebtedness, as a share of gross domestic product. Still, not all is rosy.

The US government enthusiastically stepped in to the breach in the wake of the crisis to support demand: its much heavier debt levels now make it less able to come to the rescue next time.

Parts of the corporate sector, too, are starting to groan under debt accumulated at a time of record-low borrowing costs.

But while some corporate credit looks “bubbly”, it is not what the analysts call “systemically lethal”.

In part, this is because much of that debt is not held by the banks but by fund managers less vulnerable to runs.

0 comments:

Publicar un comentario