by: Andrew Hecht

Summary

- Gold is money.

- Reason one - technicals favor the yellow metal.

- Reason two - central banks keep buying.

- Reason three - currencies are moving lower as an asset class.

- Reason four - uncertainty in the U.S.

- Reason one - technicals favor the yellow metal.

- Reason two - central banks keep buying.

- Reason three - currencies are moving lower as an asset class.

- Reason four - uncertainty in the U.S.

The other night, one of the "Austin Powers" movies was on the tube.

Mike Meyers is a comedic genius, and the highly successful sophomoric comedy trilogy grossed almost $1 billion at the box office.

Austin Powers is a parody of the James Bond films of the 1960s and 1970s.

In the final movie, Goldmember was a takeoff on Goldfinger, my personal favorite.

Source: 007james.com

Auric Goldfinger, a South African villain and Bond's foil in the film, planned to detonate a nuclear device rendering all of the gold in Fort Knox radioactive, thus obliterating the world economy.

If successful, Goldfinger's stash of gold would soar in value, making him the wealthiest man on the earth. The plan failed as James Bond saved the world.

According to a 1965 Forbes article and reports in the New York Times, Ian Fleming, the author who created Bond based Goldfinger on gold mining magnate Charles W. Engelhard, Jr. From the late 1970s through 1997, I worked for Philipp Brothers, the world's leading commodities trading company in the 70s and 80s.

When I joined, the company was a division of Engelhard, the namesake company founded by the inspiration for the character.

Source: Austin Powers Love GIF - GIPHY

Goldfinger was South African, but Mike Meyers' Goldmember was Dutch.

According to the movie, Goldmember lost his "member" in an "unfortunate smelting accident," and it was replaced by a prosthesis made of the yellow metal.

In one of his many roles in the final Austin Powers film, Mike Meyers, as Goldmember said in an exaggerated Dutch accident, "I love gooooold."

Going into a new decade, there is no plot to make a massive stockpile of the yellow metal radioactive.

However, all signs are that, just like Goldmember, the market loves "gooooold," and the price of the precious metal is heading higher.

If gold is going higher in the short-term, the Velocity shares 3X Long Gold ETN product (UGLD) will deliver a leveraged return compared to the price of gold futures.

If the product were available in the 1960s, Goldfinger would have likely cornered the market in the ETN product before attempting to remove all the gold in Fort Knox from the market to magnify his returns.

Gold is money

Gold has been money or a means of exchange for thousands of years.

Biblical references to the yellow metal are proof that the yellow metal has been a store of value and currency long before there were dollars, euros, yen, pounds, or any of the other world currencies that circulate through the financial system today.

Meanwhile, central banks may not talk about gold all that often, but almost every government holds gold as part of its foreign exchange reserves.

Gold is both a financial asset and a commodity.

At the same time, gold has industrial applications and is the principal ingredient in jewelry and ornaments that are ubiquitous around the world.

In 2019, the price of the yellow metal rose by almost 19% compared to its closing price at the end of 2018.

As we head into a new decade, all signs are that the market continues to favor higher prices for the yellow metal.

I see four compelling reasons for the price of the precious metal to add to recent gains in 2020.

Reason one - technicals favor the yellow metal

The long-term technical picture for gold is bullish.

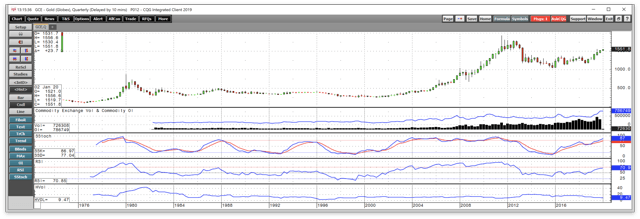

Source: CQG

The quarterly chart of COMEX gold futures illustrates the technical breakout to the upside in 2019, when the price rose above critical resistance at the 2016 high of $1377.50 per ounce.

Meanwhile, the bullish trend began after the correction that took the price from a high of $1920.70 in 2011, to a low of $1046.20 in late 2015.

Both price momentum and relative strength indicators bottomed in late 2015 and turned higher. The technical price action looks like it did when it comes to relative strength and the slow stochastic in the late 1990s and early 2000s.

Gold then embarked on a rally for nine years from the low of $255 in 2001. A repeat of the same price action from a timing perspective could mean the current leg of the bull market that commenced in late 2015 could last until 2024.

Meanwhile, the quarterly historic volatility measure was at 9.47% at the beginning of 2020. The price variance metric was at its lowest level since 2011-2012 when gold traded between $1526.70 and $1920.70 per ounce.

Finally, the total number of open long and short positions in the gold futures market stood at 786,749 contracts on January 2, 2020, an all-time high. Before October 2019, the metric never rose above the 622,000-contract level.

Rising price and increasing open interest is typically a validation of a bullish trend in a futures market.

From a technical perspective, gold looks like it is heading for a challenge of the 2011 high and could trade north of $2000 in 2020. Gold was back above the $1550 level at the end of last week.

Reason two - central banks keep buying

Central banks continue to have a voracious appetite for gold.

The official sector were net buyers of gold to increase reserves over the past years, and 2019 was no exception.

Poland not only purchased gold but repatriated one hundred tons of the metal in 2019.

China and Russia continued to vacuum up all the gold they could, taking in all domestic production and purchasing gold bars on the international market.

When it comes to China, a crackdown on the burgeoning digital currency assets likely led to more demand for gold from its wealthy citizens.

Gold has also taken on more shine for central banks and people around the world because currency instruments continue to lose their appeal.

Reason three - currencies are moving lower as an asset class

Since the 2008 global financial crisis, central banks around the world unleashed a tsunami of liquidity in the form of historically low short-term interest rates.

At the same time, quantitative easing programs have pushed interest rates lower further out along the yield curve.

What began as a plan to encourage borrowing and spending and inhibit saving to avoid a global recession or worse, has become an addiction to monetary policy accommodation.

The US Fed attempted to kick the dovish habit in late 2015 when it began to increase the Fed Funds rate.

It later introduced a program that reduced its balance sheet by shedding some of the legacies of years of quantitative easing by tightening credit and allowing government debt securities to roll off without repurchases.

After pushing short-term rates to a high of 2.25-2.50% in late 2018, the market action in Q4 2018 caused the US central bank to reverse source in 2019.

The Fed ended its balance sheet reduction program and cut the Fed Funds rate by 75 basis points to 1.50% to 1.75%. The European Central Bank never made an effort to tighten credit.

After years of letting the deposit rate sit at negative forty basis points, and no attempt to reduce its balance sheet, the ECB cut the deposit rate to negative 50 points in September 2019 and starting asset purchases again in November.

The flood of liquidity has caused the value of paper currencies, that derives value from the full faith and credit of the governments that issue the legal tender, to decline. In a significant sign in 2019, gold broke out to the upside in US dollar terms and Swiss francs.

While the yellow metal did not rise to all-time highs in those two foreign exchange instruments, the dollar and franc were in an elite club.

Gold rose to record highs in almost all other foreign exchange instruments, including, but not limited to, euros, yen, pounds, Australian and Canadian dollars, yuan, rubles, and a host of others in 2019.

Currencies continued to lose value versus gold, in a long-term trend that looks set to continue during the new decade.

Reason four - uncertainty in the U.S.

For many years, the United States of America has stood as a bastion of political and economic stability in the world.

Today, the US economy remains the strongest, and the dollar continues to be the world's reserve currency.

Meanwhile, divisions in the US have been mounting for years and could intensify in 2020 with the most contentious Presidential election, perhaps since the Civil War.

On December 18, the House of Representatives, controlled by Democrats, voted to impeach President Trump under two articles. Not one Republican in the House voted in favor of impeachment.

This month, a trial in the Republican-controlled Senate seems certain to acquit the President, which will lead to the November 2020 election.

Democrats are fighting to see which candidate will challenge the sitting President.

While former Vice President Joe Biden has the lead in the national polls, two progressive Senators, Sanders and Warren, have more support on a percentage basis.

The rise of the progressive wing of the Democrats, who support policies like tax increases and the "Green New Deal" will have a substantial say in their party's platform.

The 2020 election will stand as a referendum or not only President Trump's performance following impeachment and acquittal, but for the future or economic and political policy for the nation.

President Trump heads into the election with a booming economy and after fulfilling campaign pledges.

The contest will be very close and should stoke uncertainty that will ripple through markets around the world.

The bottom line is that uncertainty in the wealthiest country in the world is likely to create an environment where gold will rise to new and higher highs.

Meanwhile, the US airstrike on January 2 that killed a high-ranking Iranian military commander has increased the temperature in the Middle East to a boiling point.

Gold responded by moving to a high of $1556.60 on the February futures contract last Friday, just $3.20 below the early September high and level of technical resistance on the continuous futures contract. Gold futures settled at $1552.40 per ounce on January 3.

If 2020 is going to be a golden year for the yellow metal, buying on dips will continue to be the optimal approach to the market.

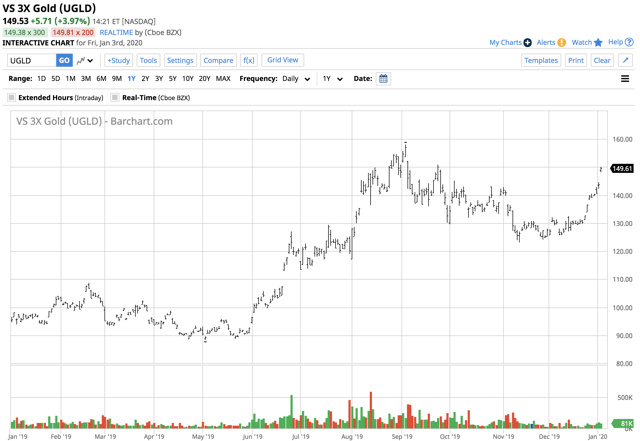

For those looking to turbocharge short-term trading results on the upside, the Velocity Shares 3X Long Gold ETN product could be a useful tool.

The fund summary for UGLD states:

The investment seeks to replicate, net of expenses, three times the S&P GSCI Gold index ER. The index comprises futures contracts on a single commodity. The fluctuations in the values of it are intended generally to correlate with changes in the price of gold in global markets.

Source: Yahoo Finance

UGLD has net assets of $172.58 million, trades an average of 85,995 shares each day, and charges a 1.35% expense ratio. The price of gold on the continuous futures contract on COMEX rose from $1266 in late April to $1559.80 in early September, a move of 23.2% to the upside.

Source: Barchart

Over the same period, UGLD appreciated from $88.43 to $158.04 per share or 78.72%.

The ETN product delivered a more than triple percentage return compared to the gold futures market.

I may not take a diabolical plan by Auric Goldfinger or Goldmember and Doctor Evil to make the yellow metal rise in 2020. Iran and the US election could be enough.

Many factors could be telling us that a price at $2020 is possible in 2020.

My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

0 comments:

Publicar un comentario