by: Eric Parnell, CFA

Summary

- Talk is widespread about the strong U.S. economy.

- Is it really that strong?

- What are the implications for investors if it's not?

“The overall U.S. economy right now looks strong.”

--Judy Woodruff, Democratic Presidential Primary Debate, December 19, 2019

I'm hearing a lot about the strength of the U.S. economy lately. Just this afternoon, I heard one pundit on the radio describe the U.S. economy as “stellar.” Another said it's “booming.”

Knowing that the economy is an important determinant of market returns over time, it's worthwhile to take a closer look. Is the U.S. economy really so strong right now?

The economy is indeed solid. The unemployment rate is at cycle lows that mark the lowest levels in half a century. Homebuilding activity has been picking up as of late, and real personal consumption expenditures continue to increase at a respectable pace.

And while corporate earnings growth has certainly cooled in recent quarters, it's still projected (at least for now) to achieve mid-single digit growth on an annualized GAAP basis over the next couple of quarters.

All solid readings. But here’s the thing. All of the above descriptions about the U.S. economy were true at this same exact time last year in December 2018. I wrote as much in an article on Seeking Alpha from Dec. 22, 2018.

The only differences were that housing starts were trending weaker, corporate earnings growth was a lot stronger, and the latest reading on U.S. real GDP growth was marginally higher at 2.9% then vs. 2.1% today.

But the most notable difference between then and now is the following: last December, stocks were plunging to the downside and financial experts were sounding the alarm about the looming recession.

Today, stocks are surging to new all-time highs and financial experts are talking about the “stellar,” “booming” economy. A notable difference indeed.

This leads to three questions that I have about today’s strong economy.

First, if the U.S. economy is so strong, why did the U.S. Federal Reserve need to cut interest rates by a quarter point three times in the second half of 2019?

Presumably, if the U.S. economy was “booming,” the Fed should be raising interest rates, not lowering them. This should be particularly true today given how extraordinarily low interest rates were kept for extraordinarily long in the aftermath of the financial crisis.

Of course, the Fed had been on track in doing just that, having raised interest rates by a quarter point on nine different occasions from December 2015 through December of last year.

But then the Fed abruptly reversed its policy course in the wake of the 2018 Q4 stock market correction. This included shifting from raising to cutting interest rates and shrinking to expanding its balance sheet. Such a dramatic shift despite no discernible change in the underlying economic data.

Second, if the U.S. economy is so strong, why is the federal budget deficit ballooning to record levels last seen in the wake of the financial crisis? It's estimated that the federal budget deficit will approach $1 trillion in 2019, which is more than double the sizable-in-its-own right $441 billion deficit from just a few years ago in 2015.

Presumably, if the U.S. economy was “stellar,” the federal budget deficit should be shrinking in size, not expanding. Ideally, the strong economy should be leading to federal budget surpluses.

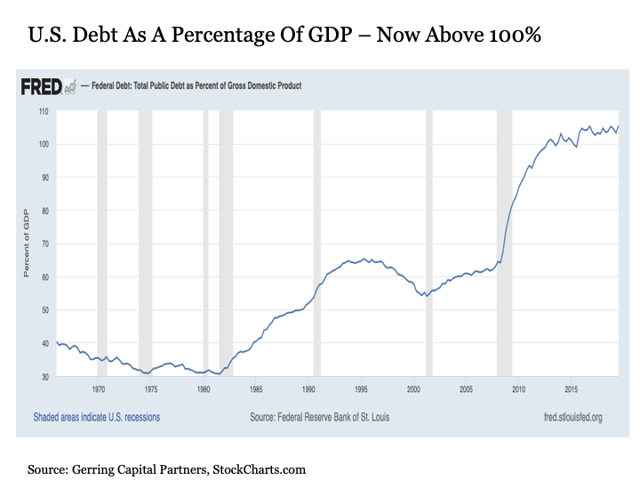

And with the total federal debt reaching a record high approaching $23 trillion that's also at an alarmingly big 105% of U.S. GDP, we not just want but urgently need these surpluses that today’s “stellar” economy should ostensibly be capable of providing.

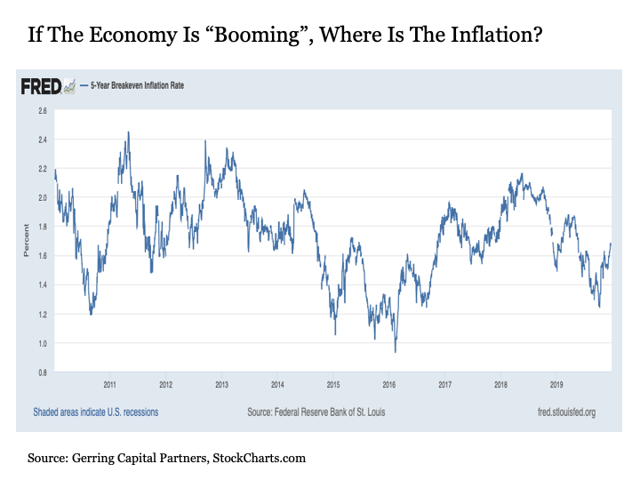

Third, if the U.S. economy is so strong, where are the inflation pressures? Presumably, if the U.S. economy was so strong today, we would be seeing it in increased inflation expectations as an increasing amount of much money would be chasing an increasingly insufficient amount of goods.

Instead, forward inflation expectations remain toward the low end of the range over the past decade despite rebounding some in recent months.

The talk has resurfaced lately that the U.S. Federal Reserve is willing to let the economy run hot with inflation running at an above trend rate for an extended period in order to support economic growth.

This sounds great, but let’s see if the Fed can actually bring the inflation rate back to its long-term target, as inflationary pressures remain well below trend today.

Why do these questions matter to stock investors? Because many are at least theoretically allocating to stocks today based on fundamentals that are driven by the strength of the underlying economy. If the underlying economy is truly strong, then the gains generated by stocks should be sustainable. Conversely, if the underlying economy only appears to be strong but in reality is much more fragile, so too are the associated gains generated by stocks.

Is the neighbor with the big house, fancy sports car and high-end gas grill truly that wealthy and successful, or are they overextended on debt and living beyond their means? One is sustainable. The other is only a matter of time.

In the meantime, today’s market is a matter of perspective and liquidity. A year ago, under virtually the same if not arguably better economic conditions than today, the stock market was plunging and experts were fretting about recession risks.

Today, the stock market is surging and experts are celebrating the strong economy. The only key difference is that the Fed was raising rates and shrinking their balance sheet a year ago, whereas today they are cutting interest rates and expanding their balance sheet.

Know the stock market in which you are investing. Continue to participate in the gains that the stock market has on offer, but resist the delusion and complacency that recent gains are somehow justified by underlying economic fundamentals, because they are not.

That went out the window about 1500 or so S&P points ago. Instead, know that today’s stock market rally is just expansionary liquidity driven as last year’s stock market cascade was contractionary liquidity driven.

Also know that when the lights go out on the stock buyback craze of the last many years, which is likely to occur once the next recession finally arrives, that the direction of the S&P 500 Index is likely to be definitively and relentlessly down. Thought the decline last year at this time was jarring?

You ain’t seen nothing yet.

For if the retail and institutional investor has been steadily exiting this market throughout the entire past decade despite the fact that it has been steadily rising, they are certainly not going to start buying once corporations finally stop repurchases.

Stay long stocks. But resist hubris and complacency. Be prepared, watch the economic data, and most importantly monitor global liquidity conditions closely and carefully as we proceed through 2020.

0 comments:

Publicar un comentario