A sales-tax increase has once again dented the Japanese economy more than the government expected; the country can do better

By Mike Bird

For the third time, Japan has increased the country’s sales tax when a tightening of fiscal policy wasn’t merited. For the third time, the economic hit has been greater than expected.

This week, the Japan Center for Economic Research suggested the Japanese GDP contracted 3.7% in October from its level a month earlier, as the government increased the sales tax from 8% to 10%. The forecast is the worst since the last time the government made exactly the same mistake and raised the tax from 5% to 8% in 2014.

It’s not just the rise in sales tax; it’s also the effect of Typhoon Hagibis, which hit in October. But there were already signs of a greater-than-expected problem in September before the storm began.

Japan in October raised its sales tax to 10% from 8%. Photo: kim kyung hoon/Reuters

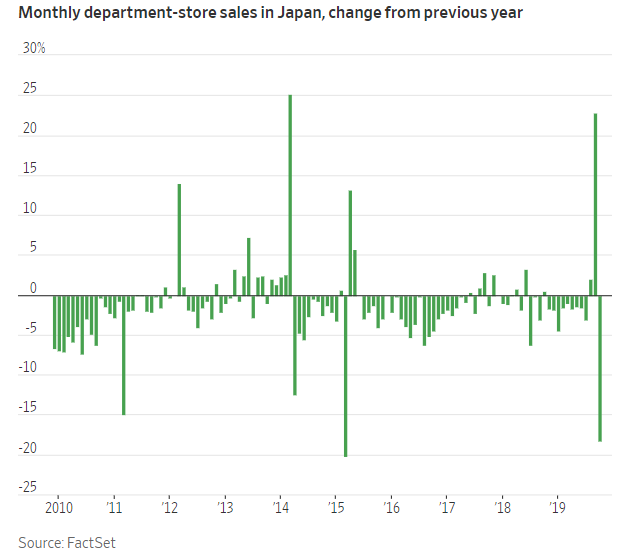

September retail sales at department stores surged 22.8% year over year, as consumers front-loaded purchases. The rise in March 2014 was only slightly larger, at 25.2%.

The Japanese government’s Economy Watchers Survey also showed a plunge in expected future conditions during September to the worst reading since March 2014. It’s impossible to tease apart exactly how much of the decline was caused by weather, and how much by policy.

But that does little to change the fact that the increase was misguided.

History repeats itself in Japanese economic policy, first as tragedy and then as farce. Given that tax increases in both 1997 and 2014 had similar effects, successive governments must one day stop acting surprised when raising the sales tax derails an economic recovery.

International bodies have been little help: The International Monetary Fund last month called for the consumption tax to be raised by another 5 percentage points in the next decade.

In the aftermath of this downturn, the government might also reconsider its tortured fiscal policy in general: The priority it places on debt sustainability is far too high, given that its net interest payments run to well below 1% of nominal GDP.

Even if rising government debt levels were a concern, it should be clear by now that repeated tax hikes actually contribute to the pile, by continually suppressing demand and further ingraining expectations of low nominal growth.

A good first step to fixing Japan’s neuralgic relationship with government spending would be not to let next year’s fiscal stimulus disappear into the ether. Japanese governments have a habit of overstating stimulus efforts by including non-stimulus spending and private investment incentives in headline figures.

Despite repeated errors, it’s never too late to start making things right. Japan should pursue a real fiscal stimulus, ignore the IMF and put the prospect of more sales-tax increases onto the garbage heap of economic policy ideas.

0 comments:

Publicar un comentario