How The Machine Works

by: The Heisenberg

Summary

- Why does the cycle keep "rolling on?"

- It's a simple question, with a simple answer, but investors who came to the party post-crisis aren't well-apprised.

- With but a brief interruption in 2018, the dynamics that have dominated for a decade are still in place.

- Remember: Acknowledging reality doesn't make you less rich, although it might make you less enamored with your own assumed genius.

- It's a simple question, with a simple answer, but investors who came to the party post-crisis aren't well-apprised.

- With but a brief interruption in 2018, the dynamics that have dominated for a decade are still in place.

- Remember: Acknowledging reality doesn't make you less rich, although it might make you less enamored with your own assumed genius.

Earlier this month, I was perusing a short 2020 look-ahead piece by BofA's US high yield strategist Oleg Melentyev and he struck a tone similar to something I would write.

"This credit cycle is turning eleven years old next year and it appears intent to keep on rolling," Melentyev wrote, in a note dated November 2.

"The pillars that defined the last 10 years – insatiable investor appetite for yield and corporations willing to take on more debt to improve their EPS – are still largely here," he added.

I occasionally have to remind myself that there's a whole universe of investors and would-be "asset managers" who were minted after the crisis, or who, even if they were investing prior to 2008, don't necessarily appreciate the extent to which circumstances have conspired to make it awfully easy to log double-digit gains in passive strategies.

Let me make a couple of quick points.

First, it's always been easy to log solid returns. I used to make a point of including this caveat in everything I wrote for this platform, but I grew weary of it - it felt perfunctory because it was.

I was constantly trying to preempt boilerplate comments from the handful of readers who are inclined to present the accumulated wisdom of Jack Bogle in congealed form as though they had discovered something the rest of us hadn't.

Let me just reiterate this for the thousands of new readers who have jumped aboard since I last included it: There is no question that the cornerstone of any portfolio should be a balanced fund with ~60% in the S&P, ~20% in long-end, developed market bonds and the rest split between bills, gold and some selected emerging market exposure.

You don't need to spend any time on investment forums to know that.

Just read Bogle.

I was replicating that exposure for myself using the tips I collected from serving grasshoppers to stuffy millionaires as a bartender before a lot of you knew what stocks were.

Second (and this might seem to run a bit contrary to the first point there because nobody drinks grasshoppers anymore), I'm actually not that old.

Of course, it's all relative, so to some readers I suppose I would count as "old," but folks who have read me for the last three years have probably gathered that I'm not ancient.

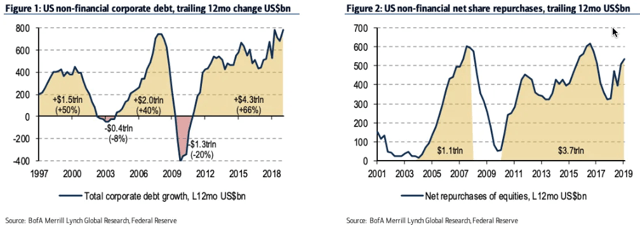

Okay, with all of that in mind, have a look at the following pair of simple charts from BofA's Melentyev:

In the current cycle, non-financial corporate debt has grown by $4.3 trillion.

That's in the left pane.

BofA describes the right pane, noting that "the value of equity repurchases in [the] form of both share buybacks and M&A [tracks] at $3.7 trillion."

To be absolutely clear, there is nothing at all wrong with milking that dynamic for all it's worth if you're a market participant.

And there are any number of ways to do that.

The simplest way has been to just sit in an index fund.

And here's why, from Melentyev:

Our earlier research on this topic has shown that about a 30% of total EPS growth in the last five years was derived from share buybacks alone. M&A transactions have undoubtedly made a meaningful contribution to artificially engineered earnings growth in recent years, although those are more difficult to isolate and measure. In essence, this was the music of this credit cycle – to borrow cheaply and to turn around to improve the bottom line through either share repurchases or M&A.

At the risk of rankling some folks, I'm using broad strokes here to make the point as succinctly and effectively as possible.

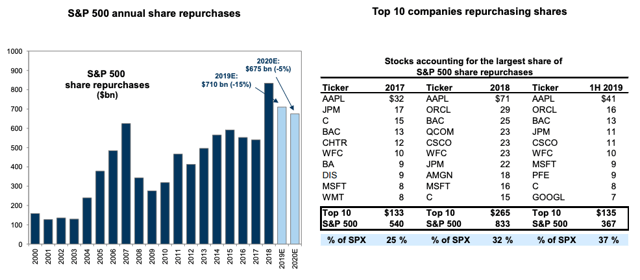

Have a look at the following two visuals from Goldman:

I want to emphasize that there are all manner of ways to slice and dice the numbers on corporate cash usage in order to argue that management teams are actually very good stewards of capital and don't simply plow it all into repurchases willy-nilly.

Goldman has done extensive work on this, and my use of those charts is not to suggest that the bank believes buybacks to be out of control or that management teams are reckless.

Again, I'm using broad strokes to make a simple point.

Generally speaking, this cycle has been characterized by low rates incentivizing debt issuance and financial engineering, where that latter term simply means using the proceeds from debt to fund corporate activities (buybacks or otherwise) that ultimately serve to inflate the bottom line and share prices.

The tax cuts at the end of 2017 catalyzed another wave of buybacks.

Some of the largest, most heavily-weighted names in the market have accounted for a ton of buyback activity, which in turn helps buoy those stocks.

Obviously, that props up cap-weighted indexes and thereby the products indexed to them.

Without naming names, too much of what you see on business television glosses over this rather simple reality in the interest of keeping viewers sated.

Allow me a brief aside on that.

I generally keep it tuned to Bloomberg or C-SPAN at home, but some of the local haunts I frequent on the island don't have Bloomberg TV and wouldn't turn on C-SPAN if I paid them, so I have to settle for CNBC.

Quite a bit of the programming the network runs centers around a familiar collection of personalities who, you might have noticed, present as experts on every stock and every sector under the sun.

Supposedly, they're "traders" and "portfolio managers," but over the course of an hour, they'll collectively claim to have an informed opinion on everything from Boeing to Apple to Ford to Kimberly-Clark and back again.

And it's not just "Well, I owned some of that 10 years ago, and I have no reason to think it's not still a great company."

No, these folks will speak authoritatively about any earnings report you care to ask them about, sometimes within minutes of its having been released, despite the fact that even an analyst who spent his or her entire career covering the name on Wall Street couldn't give you a comprehensive assessment that quickly.

Any real PM will tell you that's ridiculous. Think about your own portfolio outside of any index funds you might own. In all likelihood, you spent quite a bit of time researching your individual holdings because, you know, that's what one does when one decides to invest in an individual name.

Would you feel comfortable going on national television every day and weighing in on anything that happens to be moving during a given session no matter if you know something about it or not? Of course you wouldn't. Nor should you.

Now let me tie that brief tangent into our discussion.

One of the main reasons it's possible for a dozen or so people to speak comfortably in public every day about a range of wholly disparate stocks is that in the post-crisis world, it's really all just one trade.

Sure, there will be idiosyncratic company risk here and there, but in a world where investment grade corporates can borrow for free (basically in the US and literally in Europe) and TINA ("there is no alternative") is the law of the land, there's essentially no risk in going on television and pin-balling back and forth between "analysis" of whatever names are moving on high volume that day.

None of that is to say "it's all fake" or to suggest we're "building castles in the sky."

I generally don't like those derisive characterizations of financial engineering as long as "financial engineering" still means something that's on the right side of legal.

Although folks like SocGen's Andrew Lapthorne will be happy to explain to you why "borrowing money to buy back your elevated shares is clearly nonsense" (to quote one of his best notes), gains are still gains as long as you have the good sense to lock a portion of them in every once in a while.

And yet, there likely is a limit to this.

It's just that we haven't hit it yet.

What we learned in 2018 is that when policy is normalized it can be highly disruptive.

Things went along okay in the US for most of last year, but by the time Q4 rolled around, the combination of tighter monetary policy and political tumult was too much.

Given the juxtaposition between the second half of 2018 and 2019 in terms of how monetary policy has pivoted to reestablish the conditions outlined above and thereby engineer a recovery in asset prices, you'd think it would be abundantly clear to all but the most obtuse observers what's in the driver's seat here.

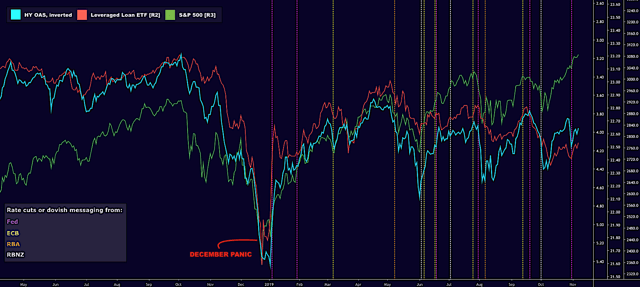

Have a look at this:

And that's just the Fed, ECB, RBA and RBNZ, and only what I can think of off the top of my head.

In other words, that doesn't include the myriad emerging market rate cuts and the dozens upon dozens of dovish pronouncements and other soundbites that have emanated from officials over the past nine months.

Here's BofA's Melentyev one more time:

The sharp volatility spike in Q4 2018 appeared meaningful enough to give birth to a theory that corporate behavior could change and more companies would engage in deleveraging. While there are some examples of this, the most noticeable change in behavior has happened at the monetary policy committees of major central banks. Both the Fed and the ECB have abandoned their plans to normalize policy and instead turned to more easing in the aftermath of this vol episode. Since then, global yields have collapsed and the appetite to reach for yield and borrow at low coupons has returned, again with some exceptions in cap structures levered to the limit. And if this behavior has defined most of the last ten years of this credit cycle, its ongoing presence suggests that it is likely to keep rolling for a foreseeable future. We think the cycle will turn when this behavior stops.

Does this mean that corporations aren't really healthy - that it's all an "illusion," so to speak?

Well, no. Or at least not in the US.

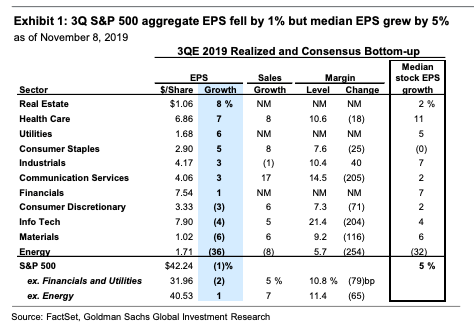

Clearly, the tax cuts helped (even if they contributed to more financial engineering) and it's worth noting that although the third quarter did, in fact, see the first YoY contraction in S&P 500 earnings since 2016, with nearly 90% of companies having reported, the decline in earnings is only 1%. That's much better than the 3% drop consensus was looking for and if you exclude energy, earnings actually grew.

(Goldman)

(Goldman)

But the crucial thing to remember (and I certainly hope this came through in the above) is that it simply isn't possible to disentangle these discussions.

Everything has become so tethered to the ebb and flow of monetary policy and its effects across assets that trying to describe the environment without reference to that is not only misguided, it's nonsensical.

Perhaps the most poignant illustration of this is the extent to which falling yields (i.e., the bond surge and "duration infatuation") has been reflected in equities.

As JPMorgan's Marko Kolanovic put it late last month, "low volatility crowding turned the conventional economics upside down: instead of high-risk stocks leading to higher returns, low-risk stocks consistently produced higher returns."

SocGen spelled it out in a recent risk premia outlook piece.

"With rates being pushed lower, investors have been forced into chasing the trend in bonds markets [while] in equities, funds have loaded up on Quality and Low Volatility," the bank wrote this month, adding that "CTA Trend funds have been allocating massively to bonds."

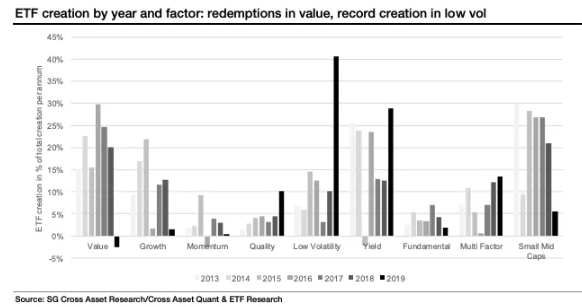

It goes without saying that the proliferation of "smart" beta products and the factor investing craze have facilitated this. Have a look at this visual:

(SocGen)

(SocGen)

Of course, the more money that gets funneled into popular stocks (e.g., tech heavyweights) the higher the likelihood that the line gets blurred between what's really a "low volatility" stock.

The potential exists for things like momentum, low volatility and and growth to become synonymous, especially to the extent growth (as a style) is en vogue in a world where growth (in the traditional sense of the word) is subdued by the standards of historical economic expansions.

What we've seen in this regard in 2019 is actually an extension of a long-running dynamic.

As bond yields declined over the post-crisis period and central banks persisted in accommodation, investors crowded into bond proxies.

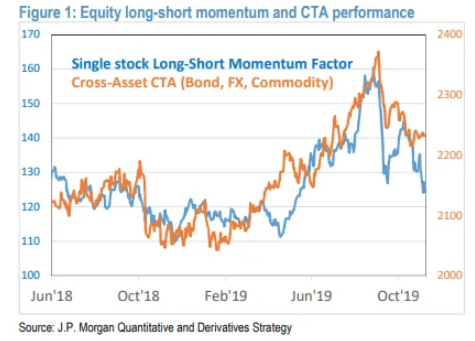

CTAs chased the momentum in rates and now the whole thing (duration, low volatility, momentum factors, etc.) is almost literally one trade.

In a note dated Friday, Kolanovic illustrated the point, observing that a momentum factor is now almost 100% correlated with a cross-asset CTA strategy which Marko notes "doesn’t even hold any individual stocks, but rather mostly fixed income instruments."

(JPMorgan)

(JPMorgan)

From a tactical perspective, Marko expects the recent bond selloff to continue.

That, he said Friday, will probably mean the rotation away from "bubbly" areas (like defensives and low volatility) and into value and cyclicals will continue at least through the end of the year.

For what it's worth, Kolanovic does not agree with me that yields will rise fast enough to derail stocks.

But for our purposes here, what I want readers to consider is that there's no glory to be had in pretending as though this cycle isn't defined by the dynamics outlined above.

It doesn't make you any less rich (your returns aren't any less real) if you come to terms with the reality of this situation.

On the flip side, I would argue that not coming to terms with this ultimately will make you less rich (and reduce your returns) because at some point, the machine as described above will bump up against some manner of limit.

That limit could come in the form of central banks hitting a lower bound beyond which rates simply cannot be pushed without something literally breaking (we often toss around the word "break" in a haphazard way, but eventually, banks in Europe and Japan won't be able to function no matter how expertly crafted any tiering regime might be).

It may also come in the form of a pushback against what this machine has created.

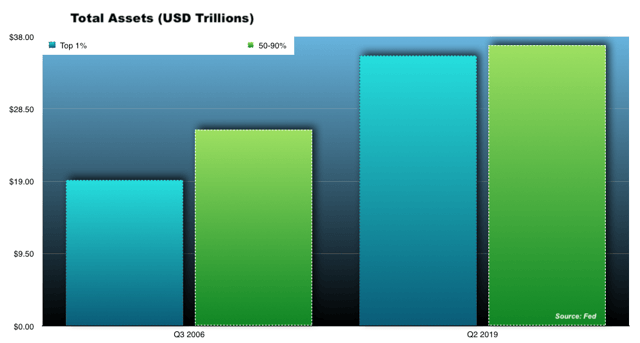

The following chart shows that the 1% in America now controls nearly as much wealth as the 50 to 90 percentile groups combined.

That is due in no small part to the explosion in value of the stocks owned by the wealthiest Americans. The one-percenters now control around $13.3 trillion in wealth tied to corporate equities and mutual fund shares, more than every other percentile group combined (i.e., more than the bottom 50%, the 50 to 90 percentile group and the 90 to 99 percentile group together).

Because financial assets are overwhelmingly concentrated in the hands of the affluent, the benefits of all the dynamics outlined above accrue exponentially, not linearly. That, in turn, means that the longer rates stay low, facilitating all of behavior detailed above, the faster this inequality machine is going to spin.

As BofA's Ajay Kapur put it this week, "the wealth effect on global plutonomists will be massive, boosting economies and consumption – dominated in size and volatility by rich people."

Eventually, that will become wholly untenable, leading to political shifts.

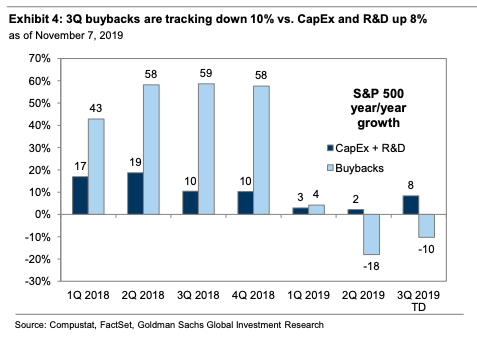

At the very least, margins are likely to be crimped going forward as pressure mounts on management teams to share the wealth. Indeed, growth in buybacks has turned sharply negative, even as repurchases are still elevated on an absolute level.

(Goldman)

(Goldman)

Don't look for what's been working over the last 10 years to keep working over the next decade.

The political tide is shifting, and central banks have hit the limit.

If I had to guess, what's coming next is some manner of public-private partnership between central banks and fiscal policy, that will see deficits directly monetized to fund public works and redistributive initiatives.

If that happens, expect a steeper curve and a prolonged rotation to cyclicals.

It doesn't require a Democrat to bring about that outcome, by the way. In the US, a second term for President Trump would likely lean in that direction too. Remember, the President is a populist first and a Republican second.

Plan accordingly.

0 comments:

Publicar un comentario