For bond allocations, think twice before reflexively allocating to index ETFs.

By David L. Braun, Avi Sharon

With investors looking to reduce risk in uncertain late-cycle markets, it’s not surprising that flows into bond exchange-traded funds (ETFs) have surged this year, outpacing flows to equity ETFs for the first time in a decade.

The lion’s share of the $97 billion in fixed income ETF flows through September have gone to passive, index-tracking ETFs (according to Bloomberg). But are investors missing out by defaulting to passive approaches?

Many investors may assume ETFs are passive by nature or by definition (they are not). Passive bond ETFs are not the only option – and for investors looking to potentially improve performance, actively managed fixed income ETFs may offer distinct advantages.

Bonds are different when it comes to active management

A key rationale many investors cite for preferring index-tracking equity approaches is that active management hasn’t paid off historically. But this has not held true for fixed income allocations.

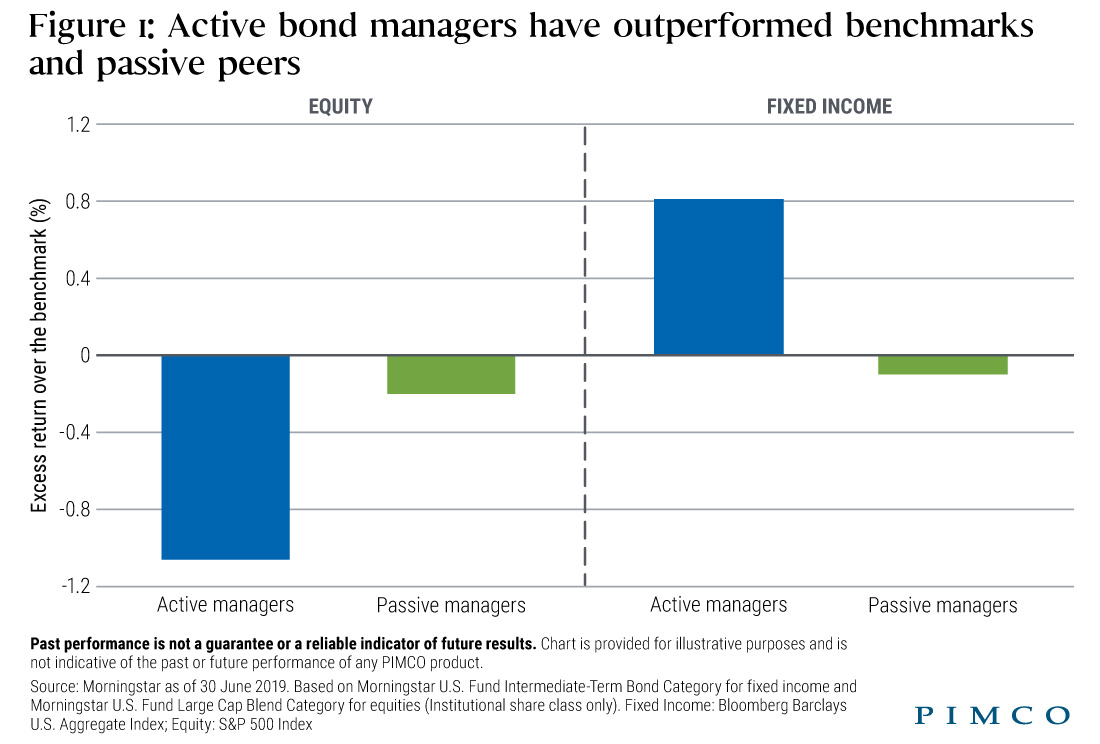

Over the past 10 years, the median active equity manager has underperformed passive peers by approximately 86 basis points (bps) and lagged stated benchmarks by another 20 bps (see Figure 1).

The opposite has been true for fixed income: The median active bond manager has beaten its stated benchmark by an average of 81 bps per year and outperformed passive peers by 91 bps over the past decade (as of 30 June 2019).

Bond market inefficiencies provide alpha opportunities

Why is the story so different for bonds than for equities? We believe it boils down to inefficiencies across the fixed income markets, which can provide rich ground for active managers to seek beyond-benchmark returns – often with more attractive risk profiles.

Equities are traded in milliseconds on public exchanges, while bonds are largely still traded over the counter, slowly and in large blocks. And whereas equities are highly standardized, perpetual securities, bonds are far more heterogeneous in their terms and have finite maturities.

New issues of bonds (analogous to initial public offerings for stocks) are frequent, constituting about 20% of the U.S. corporate bond market each year, versus about 1% for U.S. equities.

This can give a potential advantage to asset managers with strong credit teams to analyze these new issues.

Moreover, when looking at the most prominent bond and equity indices – the Bloomberg Barclays U.S. Aggregate Bond Index and the S&P 500 – both give greater weight to entities with some of the least attractive characteristics: stocks with the highest market caps, and issuers with the most debt outstanding. That means that passive bond investors are essentially lending more to those with more debt.

Reconsider being ‘aggressively passive’ in bond ETFs

The ETF vehicle offers certain advantages, including efficient trading on an open exchange, continuous pricing throughout the day, and a simple way to gain diversified allocations. But passive ETFs generally suffer from below-index performance given the impact of trading costs and fees.

And given that overall return potential for bonds may be modest relative to equities, the potential return differential between a passive and active approach could have a significant impact. Especially in a low yield world, the excess return potential from active management may be particularly meaningful as a means to boost overall returns (and it would represent a larger share of that overall return). Of course, as with all investments, it is possible to lose money.

For investors wanting to make the most of their fixed income allocations as they seek to manage risk, we believe the compelling potential return advantage of actively managed ETFs should not be overlooked.

0 comments:

Publicar un comentario