By Andrew Bary

Adam Neumann, founder of WeWork Photograph by Kelly Sullivan/Getty Images for the WeWork Creator Awards

The backdrop for stocks improved marginally in the past week, and major indexes responded as the S&P 500 index rose almost 2%, to 2978, finishing on Friday at its highest level since late July.

The U.S. and China agreed to new trade talks in October in a sign of cooling trade tensions. August employment data reported on Friday offered more evidence of a resilient U.S. economy, with payrolls growing by 130,000 in the month and the jobless rate holding at 3.7%.

Investors are taking comfort from the expectation that the Federal Reserve will remain accommodative and cut short-term interest rates later this month by a quarter-percentage point from the current range of 2% to 2.25%.

“The market is making several assumptions,” says Blackstone Groupstrategist Byron Wien. “There will be some sort of a trade deal with China in the next six to nine months. Interest rates and inflation will remain low, and the stock market is attractive, with stocks yielding more than bonds.”

The S&P 500 dividend yield is nearly 2%, while the 10-year Treasury yields 1.55%, marking a rare time when stocks yield more than government bonds. The S&P is valued at 18 times projected 2019 profits for an earnings yield—the inverse of the price/earnings ratio—of 5.5%. That stacks up well versus the entire bond market: Treasuries, municipals, mortgage securities, and corporate bonds.

The risk in Treasuries is now greater than in stocks, and the upside potential in government bonds looks more limited. The 30-year Treasury, now yielding about 2%, near its recent record low yield, would fall 20% in price if yields rise to 3%.

The floundering prospects for an initial public offering of the We Co., parent of WeWork, shouldn’t come as a surprise. The company is exhibit A for the ills of the unicorn market—private businesses with $1 billion-plus valuations—at a time when public-market investors are souring on several of them. Uber Technologies(ticker: UBER) is down nearly 30% from its IPO price after hitting a new low this past week.

We has big operating losses ($1.4 billion on $1.5 billion in revenue in the first half of 2019), opaque financials, and grandiose ambitions. “Our mission is to elevate the world’s consciousness,” according to the prospectus.

It has a dangerous business model, with long-term leases with landlords and short-term rental agreements, and an extreme private-market valuation of $47 billion. There have been recent reports that We may be seeking to cut that valuation to as low as $20 billion in an IPO—or put off the deal entirely.

An attractive and undervalued alternative to We is a pair of leading real estate investment trusts focused on the Manhattan office market: SL Green Realty(SLG) and Vornado Realty Trust(VNO).

Despite all the fuss about Google and Facebook(FB) snapping up space in the city, Manhattan is viewed as the nation’s weakest major office market. As a result, SL Green and Vornado have badly lagged behind peers and the roaring REIT market this year. SL Green, at $81, is up 2% in 2019, and Vornado, at $63, has risen just 1%, against a 25% gain in the broad Vanguard Real Estateexchange-traded fund (VNQ).

Both SL Green and Vornado yield about 4%. The combined market value of the two REITs is $19 billion, less than the reported low-end We valuation of $20 billion.

Investors are worried about several factors: new supply in the Hudson Yards on the far West Side, the high cost of renovating old Manhattan towers, and a retrenchment in the financial-services industry. These are legitimate concerns, but they seem amply reflected in the depressed stock prices.

Sandler O’Neill+Partners analyst Alexander Goldfarb is partial to SL Green. “Management has been doing everything that you would want them to—selling assets and buying back stock at a 30% discount to net asset value and generating growth in the portfolio,” he says.

Unlike WeWork, both SL Green and Vornado are asset rich and valued at a discount to private-market transactions in Manhattan.

The larger Vornado has the better balance sheet and could sit on $3 billion in cash following the sales of condos at a building on “Billionaires’ Row” near Central Park and from a joint venture involving its street-level retail space in Manhattan. Vornado is headed by founder Steve Roth, 77, who has brought a private-company, long-term orientation to Vornado for four decades.

There is uncertainty about the company’s direction in the post-Roth era. It is possible that Vornado could be sold—private real estate funds are bursting with money.

More than 20 years ago, Wien, then the chief domestic strategist at Morgan Stanley, wrote that Europe was in danger of becoming a “vast open-air museum.”

His warning has proved prescient. European economies have stagnated, interest rates have plunged to zero—or lower—and stock markets have badly lagged behind the S&P 500 in the past five and 10 years.

“What I meant was that Europe would remain a great place to visit, eat, and absorb the culture, but not necessarily a great place to invest,” Wien said this past week.

The issue now is whether European stocks are appealing. The Vanguard FTSE Europe ETF (VGK) has returned just 1.7% annually in the past five years, nine percentage points behind the S&P 500.

European stocks have been hampered by the lack of a dynamic tech sector and a large weighting in banks (which have badly trailed their U.S. peers), energy (one of the global markets’ worst sectors), and economically sensitive stocks like autos.

Part of the bull case for European stocks is that yield-starved European investors will gravitate to equities, given that government bond yields are low or negative, with the German 10-year Bund at -0.6%.

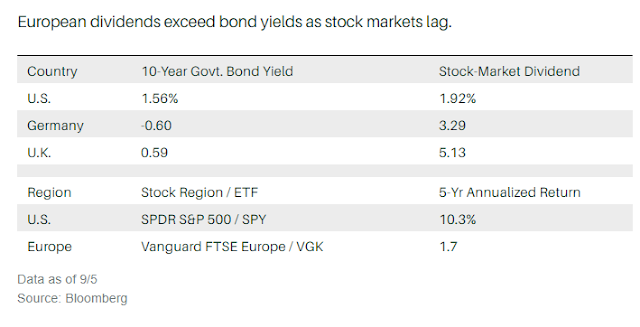

European dividends exceed bond yields as stock markets lag.

The stock-bond yield gap in Europe is about four percentage points, against less than a half-percentage point in the U.S. European stocks trade for 14 times projected 2019 earnings, a discount to the S&P 500 at 18 times. And European companies greatly favor dividends over stock buybacks. The result is dividend yields averaging close to 4%. For income-seeking U.S. investors, Europe beckons.

Among European stocks, Royal Dutch Shell(RDSB) and BP(BP) yield over 6%. Top bank HSBC Holdings( HSBC) yields 5.4% and UBS(UBS), 6%; Daimler (DDAIF) and BMW (BMW.Germany) yield over 5%. The Vanguard FTSE Europe yields 3.4%.

Value stocks started to stir last week, besting their growth counterparts and cheering embattled value investors after a long, brutal period of underperformance stretching back a decade.

“I take comfort in the duration of the underperformance and that so few people are true value investors anymore,” says Steve Galbraith, a former Morgan Stanley strategist and Wien colleague who now heads Kindred Capital Advisors in Norwalk, Conn. “This reminds me of 2000, but the difference is there aren’t as many value advocates.”

Many value investors have left the business, seen their asset bases wither, or stretched the definition of value by buying stocks like Netflix(NFLX) or Amazon.com(AMZN).

After the 2000 market peak, the S&P 500 tumbled more than 40% in the ensuing 2½ years. But some value managers showed positive returns because of the deep undervaluation of value stocks.

“Our portfolio is littered with single-digit P/E stocks and some have mid- to high-single digit yields,” Galbraith says. He ticks off LyondellBasell Industries (LYB), Goodyear Tire & Rubber(GT), CBS(CBS), and Delta Air Lines(DAL). Both Goodyear and Lyondell yield more than 5%.

Investors can also play a revival in depressed value strategies through Franklin Resources(BEN). Its shares, at about $27, trade for 11 times projected earnings in its current fiscal year ending this month and yield nearly 4%. Franklin’s net cash and investments total more than half of its current market value of $13.5 billion—probably the highest percentage for any company in the S&P 500.

Pzena Investment Management(PZN), founded and headed by Rich Pzena, is a small-cap play on a value-investing revival. Its shares, at about $8, trade for about 12 times annualized earnings in the first half of 2019. (There are no published estimates for the company.) Pzena’s trailing dividend yield, including an annual special payout, is 7%. Despite value investing’s woes, Pzena has experienced net inflows in the past year.

0 comments:

Publicar un comentario