Gold Headed To $2,000 On Fed Capitulation

Summary

- For the last decade, the monetary “experts” assured us that QE and ultra-low interest rates were a temporary crisis measure that could be reversed.

- For the last decade, the monetary “experts” assured us that QE and ultra-low interest rates were a temporary crisis measure that could be reversed.

- 2018 revealed the truth – that the Fed cannot normalize monetary policy without crushing financial markets.

- 2019 has shown that policymakers have no political will for tighter monetary policy. Radical easing measures is the new normal.

- Global central banks are getting ahead of this trend with the most aggressive gold purchases on record.

The precious metals bull market is on, and I see new record highs in both gold and silver prices looming on the horizon.

The fuel for this bull market will come from one word: capitulation. The U.S. central bank has officially capitulated on raising interest rates and unwinding its multi-trillion dollar balance sheet.

The experts assured us that the radical monetary easing measures of the post-2008 world were temporary responses to an extraordinary crisis. But now, it’s clear that ultra-low interest rates and a bloated Fed balance sheet have become the new normal.

As the world comes to grips with this new era of permanently radicalized U.S. monetary policy, investors will flock into precious metals as the ultimate store of value. To appreciate the significance of the Fed's capitulation on normalizing monetary policy, and what it means for precious metals prices, let’s first step back and review how we got here.

The U.S. Dollar Runs on Confidence

The Federal Reserve (FED) has acted as the steward of our nation’s monetary system since its founding in 1913. Like all banks, the Fed’s balance sheet contains assets and liabilities. The assets include U.S. Treasuries and mortgage bonds, which the Fed purchases by creating liabilities – from thin air – in the form of U.S. currency. The fact that our currency exists as the Fed’s liability is why you see “Federal Reserve Note” on your U.S. dollar bills.

If you look on the bottom of this 100-dollar bill, notice what it entitles you to – “One Hundred Dollars”. What this literally means is that today’s Federal Reserve Notes are backed by… more Federal Reserve Notes. So if you bring your 100-dollar bill to the U.S. Treasury, guess what you get for it? 100 dollars. That means the U.S. currency is a figment of our collective imagination – nothing more than a piece of paper with fancy artwork and dead President portraits.

But it wasn’t always this way…

Before 1971 when Nixon closed the gold window, the U.S. currency was backed by physical gold and silver. You can see this in the currency itself, including the following one-dollar bill from 1957.

Notice the difference in language on the top and bottom of the currency – instead of a “note” it’s a “silver certificate”. And on the bottom, you can see that this silver certificate was redeemable in physical silver:

So what’s the big deal, why does this all matter? The critical difference between hard money (i.e. redeemable in gold and silver) versus pure fiat money (i.e. backed by government decree and only redeemable in more paper currency) is the inherent value and limited supply of silver and gold versus the lack of tangible value and unlimited supply of paper currency.

In other words, the value of today’s U.S. fiat currency relies purely on confidence. And when confidence evaporates – typically during a period of rapid currency creation – the value of that currency can implode. Going forward, all signs point towards a major loss in the confidence of the U.S. currency. It all centers around the Fed’s balance sheet – which you’ll recall contains assets on one side and liabilities (our currency) on the other.

The Most Reckless Monetary Expansion in U.S. History

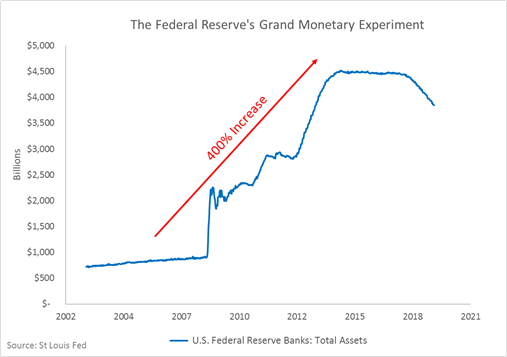

From its 1913 inception up until 2008, the FED gradually grew its balance sheet to roughly $900 billion. But when the Great Financial Crisis struck in 2008, the central bank bailed out the private banking sector by purchasing trillions in mortgage bonds. The Fed also purchased trillions in U.S. Treasures, with the stated aim of pushing down interest rates and jump starting sluggish economic growth. All told, in less than ten short years, the Fed’s balance sheet exploded to $4.5 trillion at the peak– or a 400% increase – in the most aggressive and reckless monetary expansion in U.S. history:

And remember, the Fed purchased these assets by creating liabilities in the form of U.S. currency. So over the same period, we saw a similar 400% increase in the U.S. monetary base – which surged from $800 billion in 2008 to as high as $4 trillion at its peak in 2014.

All along the way, critics worried that this reckless growth in the monetary base would eventually wreak havoc on the value of the U.S. currency. So far, we've avoided this fate, as much of the growth in the monetary base sits idle on private bank balance sheets as excess reserves. But this monetary kindling could eventually fuel an inflationary firestorm, if banks ever begin lending these reserves into the real economy. And if this money stays in the system long enough, it’s only a matter of time before such an event materializes.

Meanwhile, with the U.S. central bank becoming one of the largest buyers of U.S. Treasuries since 2008, critics also argued that we were simply monetizing government debt (i.e. financing government deficits with printed money). Normally, this type of financing scheme is reserved for banana republics, but not the good ole U-S of A. If this became the new normal, critics argued, it would destroy the confidence in the long-term value of the U.S. currency.

For the last decade, the “experts” told us not to worry… they claimed these problems would only materialize if the Fed kept the assets on its balance sheet permanently. When the Fed eventually unwound its balance sheet– and the experts assured the Fed would – then we could simply forget this whole monetary experiment ever happened in the first place.

Just think back to your high school days, when your parents left town for the weekend. Surely you could throw a wild party for you and 200 of your closest friends, so long as you cleaned the place up before your parents got home… no harm, no foul, right?

Essentially, the Fed used this same rationale to explain why we should should not fear the prospects of inflation or debt monetization. It was all spelled out in official communications, including the following excerpt from a 2013 Fed report rhetorically titled: Is the Fed Monetizing Government Debt?:

“… the FOMC has made unusually large acquisitions of longer-term securities, including Treasury debt…If this accumulated Treasury debt is supposed to be permanent, then it is reasonable to expect that the corresponding supply of new money would also be permanent … Thus, under this scenario, money creation becomes a permanent source of financing for government spending.

On the other hand, if the Fed's recent increase in Treasury debt holdings is only temporary (an unusually large acquisition in response to an unusually large recession), then the public must expect that the monetary base at some point will return to a more normal level… Under this scenario, the Fed is not monetizing government debt…”

This line of logic was reiterated by former Fed Chair Ben Bernanke even went on 60 Minutes in order to mollify public concerns about the reckless monetary expansion during his tenure (even though he contradicted previous remarks made on the very same program, as ridiculed in this terrific clip from Jon Stewart's Daily Show).

In other words, the Fed convinced the world not to worry, that it would have no trouble putting the monetary genie pack into the bottle. Once the economy found its footing, the Fed could simply raise interest rates and dump trillions in mortgage bonds and government securities off of its balance sheet and back onto the open market. After which, we could simply forget the whole thing ever happened and move on with our lives.

2018 Showed that Financial Markets Remain Hopelessly Hooked on Cheap Money

The Fed's plan to normalize monetary policy when the economy recovered sound like a great plan on paper. But to quote the great Mike Tyson… “Everyone has a plan until they get punched in the mouth.”

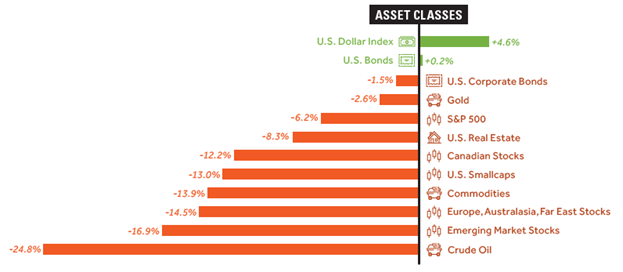

And in 2018, financial markets delivered the proverbial face punch when the Fed implemented its plan in earnest, with four interest rate hikes and selling off nearly half a trillion in securities from its $4.5 trillion balance sheet. The following chart of 2018's global asset class returns best sums up the carnage unleashed from this monetary tightening effort:

And the fallout wasn’t limited to falling asset prices. The Fed’s tightening campaign effectively froze the corporate bond market to the point where, in December of last year, not a single junk bond sale went through for the entire month. The last time we saw anything of this magnitude was - any guesses? - the Fall of 2008.

In other words, the façade of our financial system – erected upon the fragile foundation of easy money policies since 2008 - crumbles the moment those easy money policies go away.

Given the carnage from 2018’s monetary tightening, it’s no surprise that 2019 became the year of Fed capitulation. Last week, this capitulation became official, when - after one of the most tepid rate hiking cycles in history - the Fed began cutting interest rates once again at its July FOMC meeting.

Meanwhile, after selling down only 20% of its massive $4.5 trillion balance sheet, the Fed put an end to its balance sheet normalization plan.

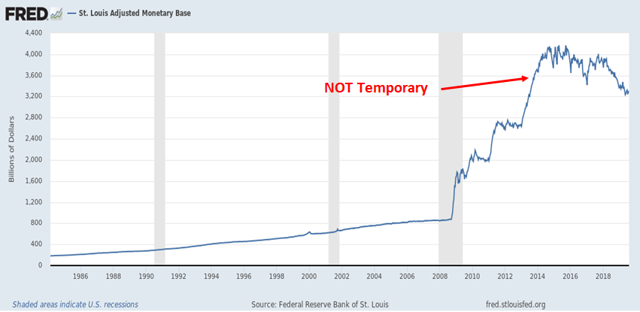

So we now know that the assurances from Fed officials about the “temporary” nature of easy money policies turned out to be just as wrong as their other predictions. Today, we’re stuck with a $3.2 trillion monetary base, which is about 300% larger than the pre-crisis level of $800 billion. In other words, we should very much fear inflation going forward, because this money isn’t going away:

As the world increasingly wakes up to the fact that the U.S. monetary base cannot return to normal levels, dollars will increasingly flow into gold as a store of value. Of course, there’s plenty of naysayers who dispute the inherent value of gold as a store of monetary value. After all, it’s just a worthless rock, right?

But these naysayers probably can’t explain why the world’s central banks just buy 374.1 metric tons of gold in the first half of the year – the fastest pace on record. That seems to be a lot of money spent on something with no intrinsic value…

The truth is, these central banks know what’s coming. The last 18 months revealed that 1) the U.S. can't normalize monetary policy without crushing financial markets and 2) U.S. policymakers have zero political will to tolerate a correction in financial markets.

And remember, we're in an environment of sub-4% unemployment and record high stock prices. So you can only imagine what’s coming down the pike when the inevitable next recession strikes.

During the next downturn, the stage is set for even more radical monetary policy measures. The possibilities include negative interest rates, widespread debt write-offs - both public and private - and even outright "helicopter money." The modern monetary theory crowd will likely get their chance to test the theory of limitless money printing, and it won't end well.

Global central banks see the writing on the wall. Given this backdrop, it’s no surprise why gold prices recently broke out to a new five year high. And as the world comes to grips with the new normal of ultra-low interest rates and a bloated Fed balance sheet, I see gold prices hitting new record highs of $2,000 per ounce and more in 2020 and beyond.

In the Atlas Portfolio Series blog, we’ve been positioning for this emerging new precious metals bull market with silver and one of my favorite miners – Pan American Silver (PAAS). We recently closed out an options trade in PAAS for a 40% return in under two weeks.

0 comments:

Publicar un comentario