This Is No Time To Let Down Your Guard

by: The Heisenberg

Summary

- Mercifully, the Fed will go silent ahead of the July FOMC meeting, giving markets a welcome reprieve from incessant rate cut banter.

- That said, the ECB is on deck, which means that while earnings "should" dominate this week, monetary policy will still be in the news.

- Corporate bottom lines are still healthy in the US, but the outlook is cloudy.

- Watch for any FX "manipulation" allegations around the ECB meeting.

- And don't get too complacent.

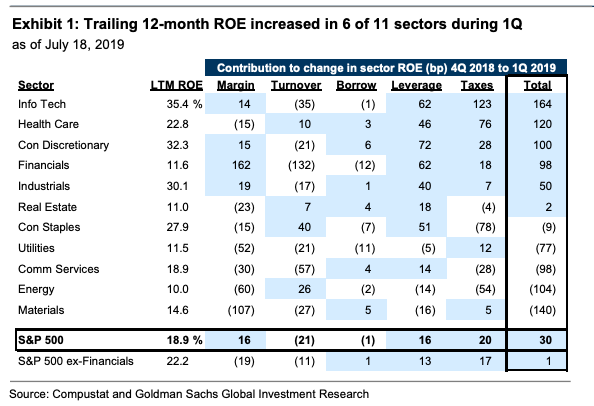

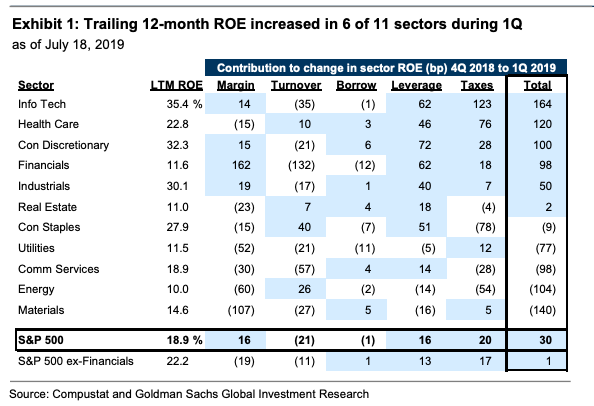

From a simplistic, fundamental perspective, valuations are getting stretched again. Bloomberg's blended forward P/E multiple is sitting near levels on par with September, on the eve of the October selloff. That said, Goldman on Friday argued that if you look back more than four decades at the relationship between price/book and return on equity, the S&P's current P/B multiple of 3.5X isn't stretched. Here's a short excerpt and one visual from the relevant note:

S&P 500 ROE increased by 30 bp to 18.9% during 1Q 2019, the highest level since 1998. Higher margins, lower taxes, and higher leverage all contributed to higher profitability during 1Q, while higher borrow costs and lower asset turnover reduced profitability. Excluding the Financials sector, S&P 500 ROE remained flat during 1Q at an all-time high of 22.2%.

(BofA)

(BofA)

- That said, the ECB is on deck, which means that while earnings "should" dominate this week, monetary policy will still be in the news.

- Corporate bottom lines are still healthy in the US, but the outlook is cloudy.

- Watch for any FX "manipulation" allegations around the ECB meeting.

- And don't get too complacent.

The Fed is in the blackout window ahead of the July FOMC, and mercifully so.

As we saw on Thursday, the market is exceptionally sensitive to communications around the likely scope of the forthcoming rate cut (i.e., "Will it be 25 bp or 50?"). John Williams's fumbled effort to extoll the virtues of "going big" (so to speak) out of the gate when operating near the zero lower bound underscores the notion that, for the time being we've reached the point of diminishing returns for Fedspeak. An insurance cut is coming, recent data (e.g., the June jobs report and a hot read on core CPI) aren't going to deter the Fed, there's a case for 50 bp predicated on academic literature but 25 bp is more likely - we all get it. Further elaboration isn't necessary.

With the Fed's lips zipped, the market will focus on earnings and geopolitics, and I just wanted to make a few quick points for readers here ahead of what promises to be an interesting week.

First, a simple observation: Waiting on dips to buy and hedging downside risk hasn't worked all that well since the May selloff. Although US equities are coming off their worst week since May, the average drawdown recently has been shallow indeed.

That is a simple chart, and purposefully so. The last several times things have looked like they look now, trouble was in the offing.

That doesn't mean things have to go "wrong" anytime soon, and, indeed, there are a variety of factors which argue for more gains. For instance, there's some remaining scope for re-leveraging/re-risking by systematic investors. According to JPMorgan's Marko Kolanovic, systematic equity exposure sits at roughly 60%, and absent an external volatility shock, will likely rise further. Additionally, dealers' gamma profile should keep things "pinned", as it were. Here's a short expert from Kolanovic's latest:

How stable is the current low volatility regime? Current dealer positioning in option makes them heavily long gamma (e.g. call – put gamma exposure is over $40bn per 1%). Long gamma exposure keeps volatility suppressed and would only change below ~2940 in SPX Summer also tends to have seasonally lower volatility.

From a simplistic, fundamental perspective, valuations are getting stretched again. Bloomberg's blended forward P/E multiple is sitting near levels on par with September, on the eve of the October selloff. That said, Goldman on Friday argued that if you look back more than four decades at the relationship between price/book and return on equity, the S&P's current P/B multiple of 3.5X isn't stretched. Here's a short excerpt and one visual from the relevant note:

S&P 500 ROE increased by 30 bp to 18.9% during 1Q 2019, the highest level since 1998. Higher margins, lower taxes, and higher leverage all contributed to higher profitability during 1Q, while higher borrow costs and lower asset turnover reduced profitability. Excluding the Financials sector, S&P 500 ROE remained flat during 1Q at an all-time high of 22.2%.

The bank goes on to write that there are only two sectors which stand out as detached from the historical relationship between P/B and ROE. Specifically, only Consumer Discretionary and Utilities have P/B multiples that aren't justified by expected profitability. While Info Tech does trade in excess of 7X on a P/B basis, the sector boasts the highest ROE on the S&P.

That said, there are problems. The outlook for corporate profitability in the US is cloudy. Since "peak profits" during Q3 2018, analysts have warned that the waning of the fiscal impulse was set to collide with a trio of margin headwinds: Rising wage costs, higher interest rates and the effect of tariffs. All of that, combined with tough YoY comps, explains why some are pessimistic about corporate bottom lines, especially considering where we are in the cycle.

For their part, Goldman calls the near-term ROE outlook for Info Tech "bleak", as consensus sees just 2% topline growth for the sector in Q2 against 212 bp of margin compression. For the broader market, the good news is that while wage inflation and tariff worries are likely to weigh further on profitability, borrowing costs are set to fall. "Since 2000, every 20 bp decline in the 10-year US Treasury yield has corresponded with a roughly 10 bp increase in S&P 500 ROE excluding Financials", Goldman notes.

So, there's some context for this week's big slate of earnings reports, which, of course, includes several tech giants.

But while key corporate results and the absence of Fedspeak will give investors a chance to focus on company-specific news flow, central banks won't be missing from the headlines. The ECB is on deck this week and, as you're probably aware, another easing package is imminent.

While it's possible the Governing Council will cut rates at the July meeting, it's more likely that the ECB will use this meeting to lay the groundwork for September, when a more comprehensive package will be announced ahead of Christine Lagarde taking the reins from Mario Draghi.

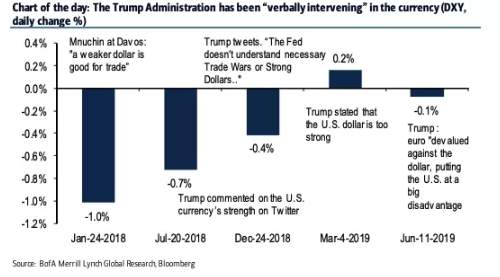

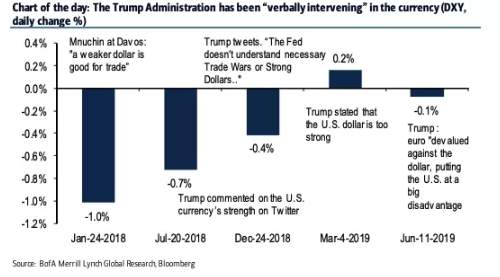

Draghi's comments in Sintra last month were variously described as a "whatever it takes 2.0" moment, and you're encouraged to recall that Donald Trump was not particularly enamored with the prospect of more ECB easing. Specifically, the president took to Twitter to call out "Mario D." and subsequent tweets raised the specter of outright US FX intervention to weaken the dollar in the event Fed cuts are offset by dovish policy turns on the part of America's largest trading partners.

The Fed's dovish pivot in 2019 has not succeeded in pulling the rug from beneath the dollar. The greenback's resilience is the product of a concurrent dovish tilt from the FOMC's global counterparts, still high US rates on a relative basis and the strength of the US economy (juxtaposed with weakening growth and a fairly deep manufacturing slump abroad).

The president's verbal interventions are losing their ability to impact the market (see visual below) and, so, analysts at every major bank have weighed in recently on the prospects for active intervention by Steve Mnuchin.

(BofA)

(BofA)

Why does this matter in the week ahead? Well, the point is that you want to watch for how the FX market and, perhaps just as importantly, how President Trump, responds to the ECB statement and any verbal cues from Draghi.

Meanwhile, both domestic political developments and geopolitics have the potential to make waves.

Robert Mueller testifies on Capitol Hill this week, and I don't think I have to explain why every financial news network in America will be running a split-screen on those proceedings alongside their market coverage. Additionally, the situation in the Gulf got considerably more tenuous on Friday afternoon, when Iran seized a UK tanker.

When it comes to volatility, you'll note that the VIX is actually higher now than it was when the majority of S&P levels above 2,400 were crossed.

(Heisenberg)

That said, considering the bevy of potential catalysts from earnings to geopolitical tensions to fraught domestic politics to the prospect of renewed trade escalations, a 14-handle VIX seems a bit sanguine.

As Goldman put it last week, "the combination of [event risk] and weakening economic growth seem incongruous with very low vol."

In other words, this is no time to let down your guard. Even as you won't be subjected to any Fed speakers.

0 comments:

Publicar un comentario