The 2 Loops

by: The Heisenberg

- The ongoing global manufacturing slump continues to argue for Fed cuts and central bank easing despite the trade truce.

- As rate cut bets remain "sticky", one bank worries about a "perverse feedback loop."

- Meanwhile, another bank warns that the Fed may be stuck in a "hall of mirrors."

- The intersection of those two self-feeding dynamics is perilous, but fortunately, two of the three circuit breakers entail relatively benign market outcomes.

Specifically, the bank warns that "the biggest risk going forward" (and those are their words, not mine) is that a "perverse feedback loop" develops between the Fed's efforts to buoy markets and the economy and the Trump administration's penchant for thinking about economic gains and stock market rallies as opportunities to "play with the house's money," so to speak.

- As rate cut bets remain "sticky", one bank worries about a "perverse feedback loop."

- Meanwhile, another bank warns that the Fed may be stuck in a "hall of mirrors."

- The intersection of those two self-feeding dynamics is perilous, but fortunately, two of the three circuit breakers entail relatively benign market outcomes.

On the heels of the Osaka trade truce struck between Donald Trump and Xi Jinping over the weekend, investors got the relief rally they were looking for on Monday. Gains were especially pronounced in tech and chip stocks, which surged thanks to the Trump administration's softer approach to the Huawei ban.

Despite ostensible progress on trade, the narrative around the Fed (and central banks more generally) has not changed. If anything, the case for further monetary accommodation has grown in light of abysmal PMI data out Monday. Although manufacturing gauges held up ok in the US, the global picture was dark indeed, both in Asia and in Europe. As Bloomberg put it, the global manufacturing slump is a "reality check" for investors hanging their hats on trade progress.

Of course, existing tariffs on China remain in place and the "deal" between Trump and Xi included no timeline for lifting them. Throw in the USTR proposing tariffs on another $4 billion in European goods, and one is left to ponder whether the outlook has changed. Even if it has, the latest global PMI data underscores the notion that some of the damage from the trade war is already done.

All of this argues for dovish central banks and, indeed, the RBA cut rates for a second consecutive meeting on Tuesday. Although the statement suggested the Board will remain on hold going forward, Philip Lowe was quick to reiterate (in a subsequent speech), that the door for more cuts remains open.

News that the ECB isn't "in a rush" to cut rates this month hardly changes anything (another easing package is coming, perhaps in September) and Christine Lagarde's nomination to succeed Mario Draghi is probably a dovish development.

In light of still rampant expectations for central bank easing amid what is likely to remain an extremely fragile economic backdrop, I wanted to briefly draw readers' attention to a pair of self-referential dynamics or feedback loops, as it were.

Regular readers know I like to talk about self-fulfilling market prophecies, and while these types of posts have a tendency to run long, I'll make this one relatively short.

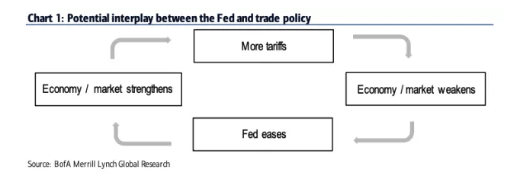

The first loop is between Fed policy, the economy, stocks and the trade war. This is something I've discussed in these pages before and written voluminously about on my own site. But, in a note dated Sunday, BofA captured it more concisely than I have in the past (which isn't hard to do considering my affection for verbosity).

The worry is that Trump is only deterred from tariffs when the economy looks set to roll over or when US equities are falling. Because Fed cuts are designed to deal with both of those issues (the former explicitly and the latter implicitly), successful monetary policy interventions that support the economy and bolster equity prices will tempt Trump to reengage on the trade war.

This could lead to a "collar" on the market.

Here's BofA to explain:

" In particular, suppose (1) the Fed is following a “risk management” approach, in which it tries to raise inflation by sustaining above-trend growth, and avoids disappointing the stock and bond markets, and (2) the Trump Administration only stops escalating the trade war if there are notable signs of pain in the economy or markets. If this “Powell Put” and “Trump Call” are strong enough, they could create an ever-escalating trade war matched by an ever lower funds rate. The stock market would be left in a range-bound “collar” trade, with its upside and downside capped by the trade war and the Fed, respectively. "

That is something investors should take seriously now that the Fed is set to start cutting rates.

Remember, the turning point for stocks following the May selloff came when Trump threatened tariffs on Mexico, prompting STIR traders to aggressively double down on Fed cut bets. Once market expectations for cuts went into hyperdrive, equities rebounded on the assumption that the Fed would be loath to disappoint market expectations.

I usually use eurodollar calendar spreads to illustrate this, but a reader on this platform

suggested that might not be the best way to communicate the point to readers, so instead I'll just use a simpler chart with 2-year yields and daily gains/losses on the S&P:

See that dramatic plunge in the short rate that played out in the wake of the Mexico tariff threat?

That's a rough proxy for the market pricing in Fed cuts. Subsequently, stocks surged on the way to a blockbuster June.

Now, you could argue that the decision to call off the Mexico tariffs and, later, the truce with Xi, is evidence that Trump is moving forward with the "crazy like a fox" strategy, which entails striking trade deals and generally deescalating the tariff tension once the Fed has pre-committed to rate cuts.

The idea would be to pile a final trade relief rally atop Fed cuts in a bid to supercharge the market. I outlined that thesis in a post for this platform last month and, indeed, BofA includes it as one of three possible outcomes that could break the loop illustrated in the figure from the bank shown above.

But it's not likely Trump is there yet. That is, he doubtlessly realizes that striking a deal "too" quickly would, at the very least, prompt the seven Fed officials who, as of the June FOMC, saw 50bp worth of cuts as appropriate, to reconsider. The administration is still acutely focused on this issue. Trump brought up the Fed again in remarks delivered in South Korea on Sunday and on Tuesday, during an interview with CNBC, Peter Navarro cited Fed cuts as one of two things that "needs to happen to get the Dow to 30,000 or above."

The read-through is that the administration will likely keep trade tensions simmering just enough to ensure the Fed is vigilant and does in fact start to follow through on rate cuts. If the USTR's Monday evening proposal to add additional products to the list of EU goods subject to proposed tariffs is any indication, a standoff with Europe is likely even if the China dispute is resolved (and remember, the Monday evening jab at Europe relates to Airbus subsidies - the prospective auto tariffs are another issue entirely).

If the Fed starts to cut rates and that puts a floor under the US economy and stocks, Trump may well turn up the heat on China, Europe or both. That would put us squarely in BofA's "perverse feedback loop."

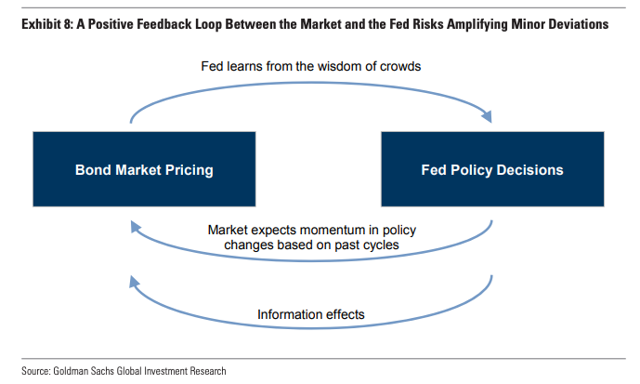

That's a perfect segue into the second self-fulfilling dynamic I promised to cover. If you recall, one of the main reasons the Fed had to be sure to deliver on dovish expectations for the June FOMC meeting was down to how crowded a variety of front-end trades (i.e., rate cut bets) had become. Similar crowding has taken place in duration, with US Treasurys seen as the most crowded trade on the planet in the most recent edition of BofA's Global Fund Manager survey. When market positioning gets that one-sided in rates, disappointing those expectations risks a disorderly unwind.

Contrary to simplistic "analysis" from those who might not understand how things work, it is not as simple as the Fed pushing back against "spoiled" markets. If you're the Fed and you're staring at lopsided positioning, leaning too hawkish in the face of that and knowingly triggering an unwind could easily lead to a tantrum-like scenario that tightens financial conditions via higher rates, a stronger dollar, a stock selloff and, with a lag, wider credit spreads. If that state of affairs persists for too long, it can dent business sentiment and even consumer spending in the event it carries on long enough for the "wealth effect" to go into reverse.

That's how market pricing "traps" the Fed. On Monday, Goldman was out with a kind of pseudo-lament for this "hall of mirrors" effect (the "hall of mirrors" is a nod to a quote from Bernanke).

Consider this excerpt:

To see what could go wrong if policymakers simply follow market pricing, imagine that the bond market begins to price a 25bp decline in interest rates and the Fed, interpreting this as a signal that the growth and inflation outlooks have deteriorated, responds with a 25bp cut. A positive feedback loop could ensue in either of two ways. First, the bond market might immediately price a higher probability of subsequent cuts, reflecting the assumption grounded in past experience that there is momentum in monetary policy decisions—the probability of cutting, for example, is higher conditional on having cut last time. As our interest rate strategist note, even when rate cuts appear fully priced, delivering them tends to lead to precisely this reinforcement. Quantitatively, these effects are large enough to tip market expectations toward expecting that the next 25bp move is more likely than not, an expectation that could be self-fulfilling if the Fed took it again as a signal about the outlook that it ought to respond to. Second, the bond market might interpret the cut as evidence that the Fed is worried about the growth outlook. If market participants view the Fed as having private information about the economy—either via privileged insights into the financial system or simply via better economic research—they might grow more pessimistic themselves.

Obviously, escalations on the trade front have the potential to prompt the bond market to price in worsening growth outcomes. If the Fed takes its cues from the bond market, triggering the positive feedback loop in Goldman's exhibit, the two self-fulfilling dynamics (that described by BofA and that illustrated by Goldman) can become entangled with one another.

Crucially, this is not merely an academic exercise or some kind of brain teaser. Rather, this is already happening and these loops will likely start spinning faster as the Fed actually begins to cut rates.

There are three ways out of this (call them circuit breakers) if you assume the Fed isn't likely to stop responding to what the bond market is "saying".

First, Trump could decide (say, in December) that two or three rate cuts is enough and that it's time to call an end to the trade disputes just as the calendar flips to an election year. The hope would be that between 75bps of Fed cuts and a deescalation of trade tensions, both the US economy and equities would be poised to soar in 2020.

Second, Trump could overestimate the power of the Fed to offset the potentially deleterious effects of the tariffs on the way to escalating things to the point where no amount of rate cuts are enough to rescue the economy and shore up market sentiment. At that point, the economy could fall into a recession, causing stocks to decline enough to convince Trump that the trade war is no longer worth it - at least not until the election is in the rearview.

Third, the tariff effects could show up in consumer prices and/or exert just enough of a drag on growth that public opposition to the trade war mounts, compelling the administration to back off before a recession actually materializes.

Obviously, the ideal scenario is some combination of circuit breaker number one and number three.

Two is no good for anyone - including and especially President Trump.

0 comments:

Publicar un comentario