By Nathaniel Taplin

The Federal Reserve looks almost certain to cut U.S. interest rates on Wednesday. The People’s Bank of China doesn’t need to follow suit to make its own stance looser.

Chinese monetary policy can seem bewildering. The central bank’s huge tool kit spans numerous short- and medium-term lending rates, plus other tools such as banks’ reserve requirements. On top of that, political pressure often forces it to pursue seemingly contradictory goals—like simultaneously controlling leverage and reducing corporate borrowing costs.

The two issues are intertwined: In fact, the array of instruments probably provides some political cover for the bank to act without antagonizing different bureaucratic factions or setting off unwanted, frenzied speculation in markets.

Right now, the economy still needs more help: Producer price inflation is flirting with zero, small banks are struggling, and the labor market is in trouble. But there are also very strong voices within the government calling for a hard line on debt control.

The People's Bank of China’s tool kit spans numerous short- and medium-term lending rates, plus other tools. Photo: Qilai Shen/Bloomberg News

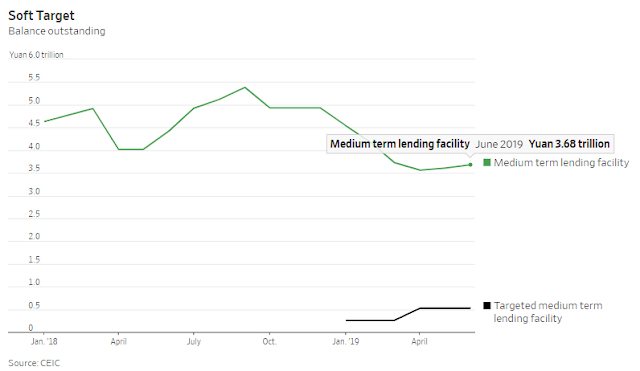

In this situation, a new toy looks particularly useful. After relying heavily on its one-year medium-term lending facility—currently pegged at 3.3%—to fund banks in recent years, the central bank has debuted a new tool. This is dubbed the targeted medium-term lending facility, and has a one-year rate of 3.15%. In theory, only banks that “provide strong support to the real economy” can use the facility, which is meant to boost small- and private-sector lending, but the central bank has discretion. These loans can be rolled over twice to last three years, meaning they are both cheaper and longer-lasting than their predecessors.

Replacing some maturing medium-term loans with funds under the new facility helps lower longer-term borrowing costs without making big headlines, or flooding money markets with liquidity, like cuts to reserve ratios typically do. This is exactly what the PBOC has been doing, most recently on July 23.

News coverage Wednesday will probably focus on whether Beijing’s central bankers will cut their benchmark one-year lending rate—a possible, but unlikely move. The real action is taking place in another compartment of China’s cavernous monetary-policy tool kit.

0 comments:

Publicar un comentario