by: WWS Swiss Financial Consulting SA

Summary

- The S&P stock market index has made good the losses of December 2018 and reached new highs.

- The trade war with China might have adverse effects on the markets.

- The Fed has stopped raising rates and plans to end QT in September.

- The US national debt is currently 22.2 trillion dollars and rising.

- The US dollar is the canary in the coal mine.

Investors should beware of becoming complacent.

- The trade war with China might have adverse effects on the markets.

- The Fed has stopped raising rates and plans to end QT in September.

- The US national debt is currently 22.2 trillion dollars and rising.

- The US dollar is the canary in the coal mine.

Investors should beware of becoming complacent.

This article has an ambitious purpose, namely, to show investors how interconnected different financial sectors are and how they influence other sectors. The stock markets, the Fed, the debt and the dollar are not independent entities that go their own way. They influence each other. The US dollar is an indicator of what is happening, and investors should not be complacent even if the dollar is strong. The first area to be considered is the stock market.

The SPY will probably top 3,000 in the very near future, and some pundits are already talking about it going over 4,000. That is quite unlikely as the heightened volatility thanks to the China-US trade war shows. If the negotiations between China and the US fail, the market could suffer a marked downturn. The fact is that the stock markets have recovered from the December swoon. Investors that sold equities at the highs in September and waited to buy again until the markets bottomed in December did very well. At the present time stocks are expensive. But the markets may continue going up due to corporation stock buybacks. Apple plans to buy back 75 billion dollars of its own stock in 2019. The stock went up 6% on news of a good Q1. So buybacks will probably buoy up the stock markets as buybacks for over one trillion dollars are planned for 2019. This is good news for executives that are paid in stock or stock options as well as shareholders who sell their stocks while the prices are still high.

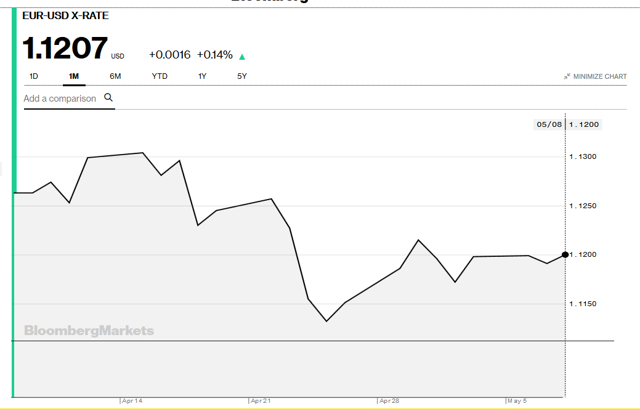

See the Bloomberg chart below.

Interest rates influence the stock market and the Fed has stopped raising rates and plans to end QT (Quantitative Tightening) in September. That is at least what one is led to believe even if the recent press conference of Chairman Powell confuses matters and hardly creates clarity.

The EFF is now at 2.44%, which is high if compared with what investors can glean from European sovereign bonds. The Germans and Swiss offer much lower interest rates. So the Fed has made American debt interesting for investors seeking fixed income securities.

Evan as the Fed claims that it will be patient, one wonders what is going to happen as the federal debt increases at a fast pace. See the debt clock.

The budget deficit for 2019 will be close to around one trillion and the 2020 budget deficit is projected to be over one trillion. The national debt may well be 30 trillion by 2030. Since the CBO has not reckoned on a recession or an economic slowdown, the debt could swell to as much as 40 trillion by 2030 if there is a recession. The massive federal debt is going to be a drag on the economy.

Given these factors, the strength of the US dollar should not be taken for granted. Present interest rates help to strengthen the US dollar but also result in higher costs for the Treasury to service the debt. In addition to that the Treasury is going to have to find the capital to fund not only rolling over existing debt but also the budget deficits. It is highly likely that the Fed will end up acquiring large amounts of Treasury paper in order to provide the necessary liquidity if capital markets do not make available the amounts needed. Monetization of the debt is the safety valve if the pressure on the Treasury mounts excessively.

Under these circumstances, the US dollar has been performing reasonably well against the euro, which suffers from various ailments like Brexit, high sovereign debt of most members of the EU and an economy that is not particularly robust.

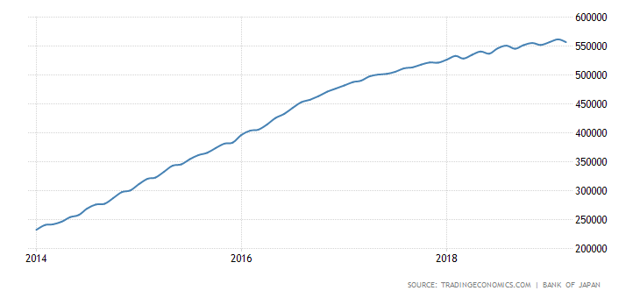

Investors should keep an eye on current exchange rates that can change fairly quickly. If the Fed raises interest rates to fend off higher inflation, then the US dollar should strengthen still more. If the Fed lowers rates in case of a recession and economic duress, then the dollar would probably suffer in the Forex markets. In the event that the debt increases to the point that monetization of the debt on the part of the Fed becomes necessary, then it is difficult to predict the result. Japan has managed to keep the yen as a sort of safe haven currency despite years of monetization and huge increases in the balance of the BoJ.

So the US dollar exchange rate becomes a sort of canary in the coal mine. The US government keeps going deeper and deeper into debt like a coal mine that goes deeper and deeper. That is going to mean increased costs for servicing the debt and less money available for defense and other government expenses. It remains to be seen how the Forex markets will react to excessive US national debt and a continually worsening financial situation of the government. If one adds to all these factors the serious problem of highly-leveraged corporations that have been making debts to buy back their own shares, then the scene is set for a serious economic crisis as well as a dollar crisis if the default rate should increase by even a small margin.

The complications of the economic situation can make it difficult for investors to keep track of all these different factors. The stock markets have done so well in Q1 that it is unlikely that stock prices are going to go much higher in Q2, and a correction is quite likely. The Fed is being “patient” and developments in the economy could lead the FOMC to raise rates if there is high inflation or to lower them if there is a recession.

The Treasury is going to have to raise large amounts of funds to cover the significant budget deficits that can be foreseen. If the Fed has to resort to QE or partially monetizing the debt, then confidence in the US dollar could be eroded, and this would become apparent in the quotations of the currency in the Forex markets. So investors should keep in mind that upward or downward movements of the dollar can be taken as signs of basic underlying developments in the economy that are influenced by the stock markets and the Fed. The bottom line here is that investors should carefully examine what investments they intend to make in foreign markets, both DM and EM. They should also carefully choose which currencies would fare better against the US dollar in a downturn. Betting on the Argentinean peso is an extremely risky proposition and is not to be recommended.

As mentioned above, the US dollar is still going strong. There are, however, various scenarios that could result in a fall in the value of the dollar. If the China-US trade war is not settled by an agreement, then the dollar could suffer as the global economy absorbs the fall in trade that would probably result. The stock markets would probably also suffer, and a bear market could ensue. That could have an adverse effect on the dollar. A stock market fall could induce the Fed to lower interest rates, and that would not be good for the dollar since international investors would find the US dollar less attractive both for equities and for fixed income investments. The trade dispute might also bring about a recession as the economy is already in the late stage of an expansion. This would result in company profits falling, which would make it more difficult for companies to carry out their plans for share buybacks. That would have a negative effect on share prices as buybacks have been the main support for the stock markets.

On the other hand, if there is inflation, the Fed could raise interest rates to fight inflation. That could attract foreign investors to buy US debt paper. Raising interest rates would also make refinancing corporate more difficult as over five trillion dollars in corporate debt has to be refinanced in the next five years. Higher interest rates could cause a higher default rate and could bring about a corporate debt crisis that would in its turn discourage investors and thus drag down the dollar. US inflation would also have the effect of making American products more expensive in global markets. This would probably have as a result that the trade balance would become more negative.

The increase in the national debt could result in monetization of a part of the debt by the Fed, and this could cause a loss of faith in the dollar with a consequent fall of its value in the Forex markets.

Demand for the dollar could also fall due to a stronger EU economy and a recover of the euro, which makes up a large part of the dollar index. This is presently unlikely as the EU has several difficult problems to solve besides Brexit and high sovereign debt on the part of members, especially Greece and Italy.

Demand for the dollar could also decrease due to the development of an alternative international payment system worked out by China and Russia so as to avoid having to use the SWIFT payment system. Then there is the recently established oil futures market in Shanghai, which favors the renminbi as the currency for oil contracts. Should Saudi Arabia no longer insist on payment for its oil only in US dollars, then the petrodollar would undergo a cataclysmic disaster very quickly instead of a slowly eroding position in the petroleum markets.

In this context one should consider the long-term plans of China to promote the renminbi as an international reserve currency. The decision of the BIS to revalue central bank gold holdings and have them count 100% of their market value instead of 50% is good for gold but not so good for the US dollar. If central banks decide to hold more gold in their reserves and more renminbi, then demand for the US dollar would not be as strong. This process could take some time, perhaps three to five years, but it will influence the value of the dollar.

So what investors should take away from this article is that complacency has no place in the current financial environment. The stock markets may well undergo a correction in the near future while the Fed remains in what could currently be considered a “neutral” position as the federal debt increases. This of course puts pressure on the capital markets. In the meantime the US dollar has remained strong in the Forex markets. Watch the dollar. If it falls like a canary in a coal mine, an explosion could soon follow.

0 comments:

Publicar un comentario