Gold Decisively Breaches Major 2013 Overhead Resistance Wall

by: Gordon Long

Summary

- The $1,360/oz price level has acted as an invisible "Maginot Line" since 2013. The wall was decisively breached this week.

- The blow to the wall was decisive and a retreat by the Bullion Banks to a new higher resistance zone of $1,470/oz looks likely.

- Both the fundamentals and technicals suggest that there is just too much force to be held back for the $1,470 and $1,650 levels not to be tested in 2019.

- The blow to the wall was decisive and a retreat by the Bullion Banks to a new higher resistance zone of $1,470/oz looks likely.

- Both the fundamentals and technicals suggest that there is just too much force to be held back for the $1,470 and $1,650 levels not to be tested in 2019.

The $1,360/oz price level has acted as an invisible "Maginot Line" since 2013. The wall was decisively breached this week as both Chairman Powell and ECB President Draghi signaled monetary easing was ahead. This was sufficient confirmation to the gold market that currency debasement was again soon to be ignited.

The gold market delivered a crushing blow to once impenetrable wall. However, those that trade gold know only too well that gold is a manipulated market and will be looking for another "fat finger": billions of dollars of notional value of gold; in the middle of the night; offshore; executed in seconds; and sell order - thereby crushing price (once quadruple-witch is in the rear view mirror)! Where is the SEC?

However, the blow to the wall was decisive and a retreat to a new resistance zone is likely. $1,470/oz looks likely...

...but momentum may force the troops to select $1,650.

Both the fundamentals and technicals suggest that there is just too much force to be held back for these levels not to be tested.

FUNDAMENTALS: De-Dollarization is a core driver (See June 15th Seeking Alpha post: Gold Likely To Soon Be Lifted By Rising De-Dollarization Surge)

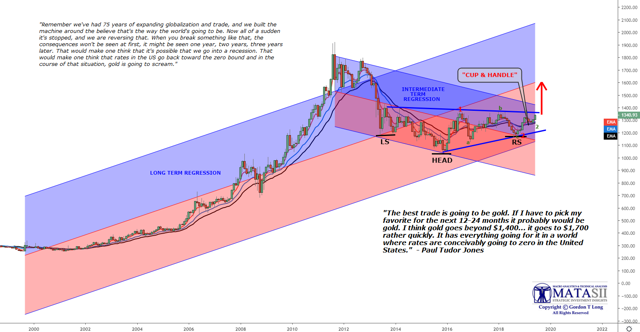

TECHNICALS: We have gold technicals which haven't looked stronger in a long time:

- A Bullish "Ascending Triangle"

- A Completed "Cup & Handle"

- An "Inverse Head & Shoulders"

(See June 20th Seeking Alpha Post: Renewed Currency Debasement Is The Magic Elixir For Gold)

The International Man, Nick Giambruno, lays out eight reasons in a multi-article analysis why a huge Gold-Mania is about to begin:

- No. 1: Basel III Moves Gold Closer to Officially Being Money Again

- No. 2: Central Banks Are Buying Record Amounts of Gold

- No. 3: Oil for Gold - China's Golden Alternative

- No. 4: The Fed's Dramatic Capitulation

- No. 5: Takeover Frenzy in the Gold Mining Industry

- No. 6: President Trump Is Pro-Gold

- No. 7: Socialism Is on the Rise

- No. 8: Gold-Backed Cryptos - A Monetary Revolution

We may have a perfect storm which the Bullion banks are ill prepared to combat!

0 comments:

Publicar un comentario