Suddenly, There's Not A Lot To Like

by: The Heisenberg

Summary

- Over the past three weeks, the macro narrative has taken a decisive turn for the worst.

- The Huawei bombshell looks to have made negotiations between the US and China all but impossible in the near term and Beijing is circling the wagons.

- It wasn't clear that China's economy was out of the woods and the renewed trade tensions muddy the waters considerably.

- Meanwhile, things are going off the rails in Italy again ahead of the EU elections.

- The Huawei bombshell looks to have made negotiations between the US and China all but impossible in the near term and Beijing is circling the wagons.

- It wasn't clear that China's economy was out of the woods and the renewed trade tensions muddy the waters considerably.

- Meanwhile, things are going off the rails in Italy again ahead of the EU elections.

It took three business days from time the US effectively blacklisted Huawei for the Trump administration to offer a concession in the form of a temporary general license that permits some transactions with the company and its dozens of non-US affiliates.

Until August 19, Huawei is permitted to buy American goods necessary to ensure existing networks remain operational and to update software on existing Huawei devices.

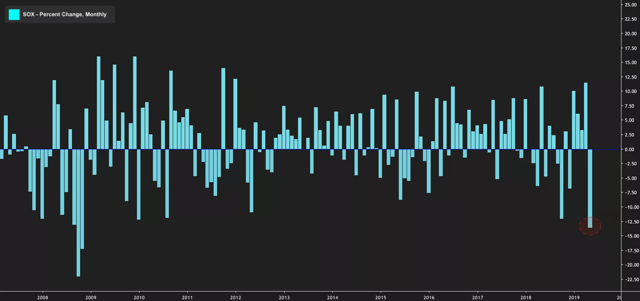

The decision came on Monday evening, following what I described over on my site as a "mini-panic" across the global technology supply chain. Last week, in a post for this platform, I suggested the Huawei gamble was something of a "crossing the Rubicon" moment for markets. In that post, I flagged the SOX (SOXX), which, through Friday, was headed for its second-worst month since May of 2012. By the closing bell on Monday, semi stocks were on track for their worst month since the crisis.

You didn't have to be any kind of seer to know that some manner of intervention from the US Commerce Department was in the cards. Monday wasn't an especially bad day for global equities on the whole, but the rout in semis was disconcerting for what it telegraphed about how the market was interpreting the Huawei decision. Literally minutes before the temporary general license announcement was posted to Commerce's website, I said the following in a short little post called "When The Chips Are Down":

Presumably, the Commerce Department will be forced to adopt some kind of middle ground that ameliorates market concerns and helps cushion the blow. Otherwise, this is going to quickly erode confidence. Given that the weakness in the chip space is indicative of an actual, real-world bid to dismantle the global technology supply chain, it’s difficult to imagine how this doesn’t spill over and prompt an across-the-board rout at some point in the very near future unless the Trump administration comes forward with something definitive regarding how they plan to mitigate the fallout from last week’s decision.

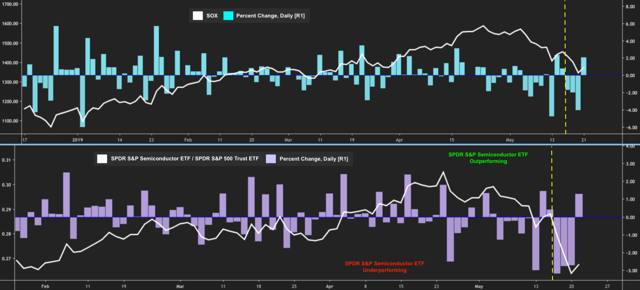

If you looked out across the headlines on Tuesday evening, most financial media outlets attributed Wall Street's good day to the temporary, partial reprieve granted to Huawei. The SOX rallied more than 2% and the SPDR S&P Semiconductor ETF (XSD) bested the S&P ETF (SPY) after three consecutive days of grievous underperformance. The yellow, dashed lines in the following visual mark the day the Huawei ban was announced.

To be clear, a 90-day partial reprieve from Wilbur Ross isn't going to cut it when it comes to restoring confidence and convincing market participants that the US fully appreciates the gravity of this situation. You might think the rout in the chip space is over done, but the reality is that nobody knows where this is headed. "We would expect that many, if not most, semiconductor companies will need to lower estimates," Raymond James wrote Tuesday, in a note cited by Bloomberg for a piece aptly entitled "US Chipmakers Preparing for China Trade Fight Fear That All Will ‘Suffer’".

Beyond the ramifications for semis, investors should step back and try to appreciate the big picture. I've attempted to communicate why the Huawei story is so momentous in at least a half-dozen posts over the past four days in addition to the two linked above. This is China's crown jewel on the line. Huawei is Beijing's national champion. Although the rhetoric from Chinese state media was already pretty shrill following the Trump administration's move to more than double the tariff rate on $200 billion in Chinese goods, the tone became overtly hostile following the Huawei decision. In remarks cited by a widely-read piece in the South China Morning Post, Xi on Tuesday appeared to suggest that China is preparing for an indefinite war of attrition.

Also on Tuesday, Bloomberg said the Trump administration has "for months" held off on punishing Huawei for fear of undermining the trade talks. That might sound like an innocuous headline, but it's not. Since the arrest of Meng Wanzhou in December, US negotiators have been at pains to insist that trade talks are separate from national security concerns. Implicit in that insistence was a promise that Huawei and Meng wouldn't be used as leverage. The Bloomberg story (which cited unnamed sources) suggests the US always intended to play the Huawei ace in the event the terms of a prospective trade deal weren't deemed favorable enough for Washington.

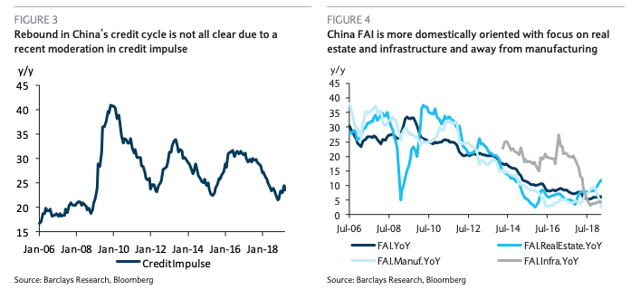

Importantly, some of China's recent stimulus efforts have been inward-looking, seemingly designed to bolster domestic demand rather than rescue the global cycle. That could be due to worries that the monetary policy transmission channel is clogged by lackluster demand for credit, or it could just be that Beijing is taking a "China first" approach this time around when it comes to stimulus. Whatever it's attributable to, it's reasonable to assume that in an all-out trade war scenario, that tendency to focus inward will be redoubled. Consider this from Barclays:

China’s stimulus has failed to boost exports from trading partners like Korea and Taiwan implying that China’s stimulus is domestically oriented and that the improvement in fixed asset investment is driven by real estate/ infrastructure at the expense of manufacturing, thereby increasing the efficacy of the policy measures domestically and limiting the amount of pass-through of this stimulus to the rest of the world. We therefore see risks of a prolonged and soggier soft patch in the global economic recovery compared to 2016.

When you throw in the fact that April activity and credit growth data missed estimates, you're left with somewhat vexing concerns about the outlook in an environment where the US is turning the screws as tight as they'll go.

With that in mind, remember that for the better part of a decade, China has been the engine of global growth and credit creation. That's a point that's been emphasized and reemphasized by analysts since 2015, when the yuan devaluation rattled markets and China concerns were top of mind.

"Following the Global Financial Crisis, Washington had too many problems to focus on China, plus the Chinese were the driving force behind global GDP and debt creation after 2008 in a world hungry for growth," Bank of America writes, in a note dated Monday, adding that "the European sovereign debt crises of 2011 and 2012 made Chinese economic activity an even more important pillar of the world economy."

(BofA)

(BofA)

The recovery from the crisis has been tepid, and although 2017 was characterized by synchronous global growth, "gangbusters" isn't a term you'll hear anyone use to describe the pace of economic expansion in developed economies. There will probably never be an "ideal" time to confront Beijing on trade, and it's true that fiscal stimulus in the US has given the Trump administration a growth cushion (so to speak) when it comes to pushing the envelope, but there is a certain sense in which undercutting China's economy amounts to cutting one's nose of to spite the face.

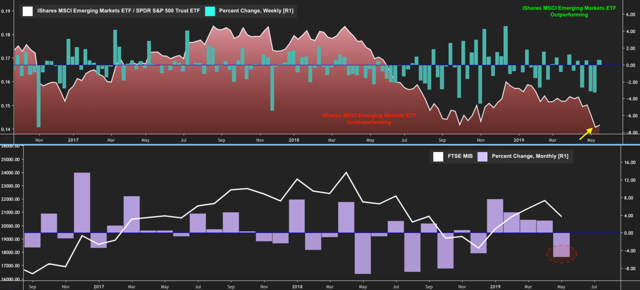

At the same time, the renewal of trade concerns is weighing heavily on emerging market equities which have now erased most of their gains for the year. Notably, recent underperformance has pushed the ratio of the iShares MSCI Emerging Markets ETF (EEM) to the S&P ETF below 2018's nadir (top pane).

Meanwhile, things are going off the rails in Italy again - perhaps you've heard. Matteo Salvini has ratcheted up his signature budget bombast ahead of the EU elections and there's rampant speculation he may attempt to capitalize on League's popularity by forcing a government shakeup.

The bickering between League and Five Star is becoming wholly untenable and it's doubtful that Salvini wants to wait too long to make a move lest the Italian economy should decelerate anew and/or Italian assets succumb to another bout of turmoil on par with what we saw last May. Amid the tension, Italian stocks are on track for their first losing month of the year (bottom pane in the visual above).

Here's a bit of color from Goldman that gives you some perspective on Italy in the context of the recent risk-off mood (this is from a note out Tuesday):

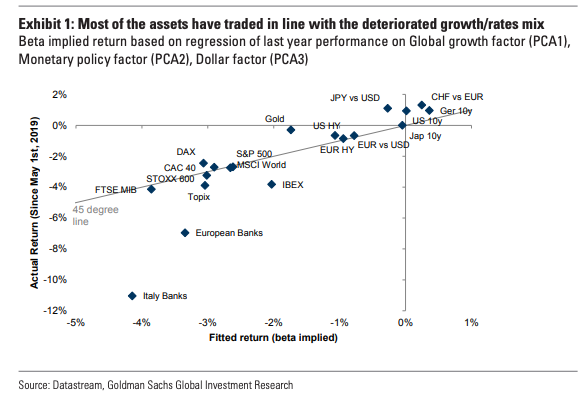

In order to assess how the deteriorating macro picture has influenced performance, we benchmarked cross-asset performance to the recent changes of our first three GS risk appetite indicator factors: global growth, monetary policy and the dollar. We found that cross-asset performances since beginning of month have been in line with their implied return, except the Banks sector which has underperformed materially.

Note that the FTSE MIB (i.e., Italian stocks on the whole) have actually performed inline with their implied beta, which means that things could get a lot worse for Italian equities in the event decent earnings are no longer sufficient to offset concerns about the banking sector, where exposure to the sovereign is actually running near historical highs.

To be clear, monetary policymakers are on high alert and will do what they can. The RBA minutes and a speech from Philip Lowe on Tuesday telegraphed a rate cut and the market still expects Fed easing. Meaningful ECB and BoJ normalization is out of the question for the foreseeable future.

Whether central bank accommodation will be enough this time around is debatable.

In case it didn't come through in all of the above, my current view is that there's not a lot to like about the setup right now.

Take that for what it's worth.

0 comments:

Publicar un comentario