by John Rubino

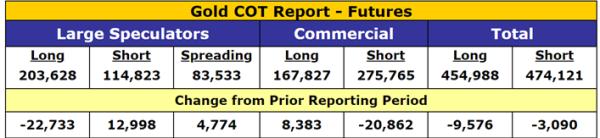

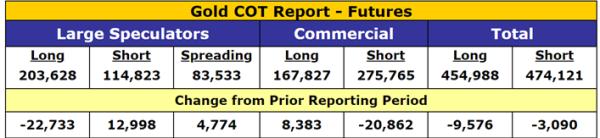

The gold futures market took a big step towards bullish — or at least neutral — in the past week. Speculators (usually wrong at big turning points) scaled back their long bets while commercials (usually right at turning points) reduced their net short positions.

This is progress, but still leaves speculators long and commercials short. The message: wait a few more weeks for 2019’s best entry point.

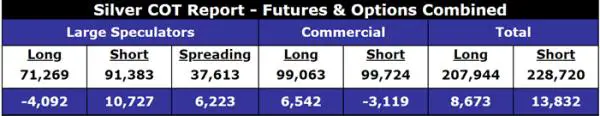

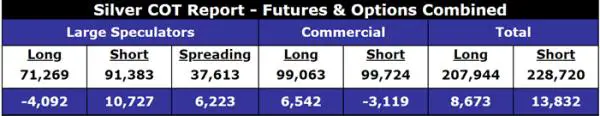

But silver’s story is a lot more interesting. In that market, speculators are now aggressively net short:

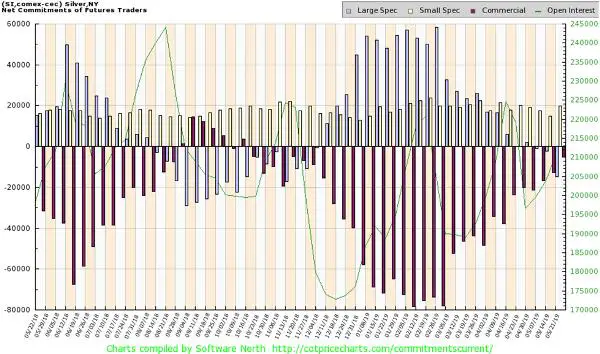

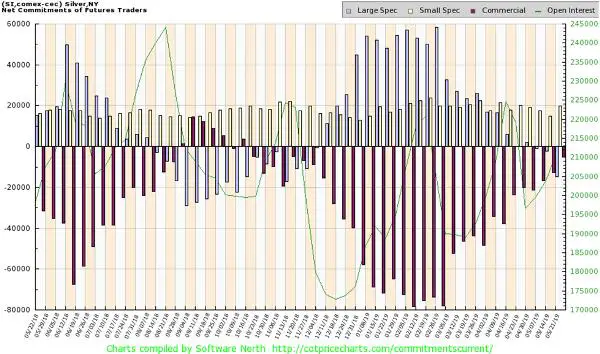

Here’s the same data in graphical form, with silver speculator positions represented by the gray columns.

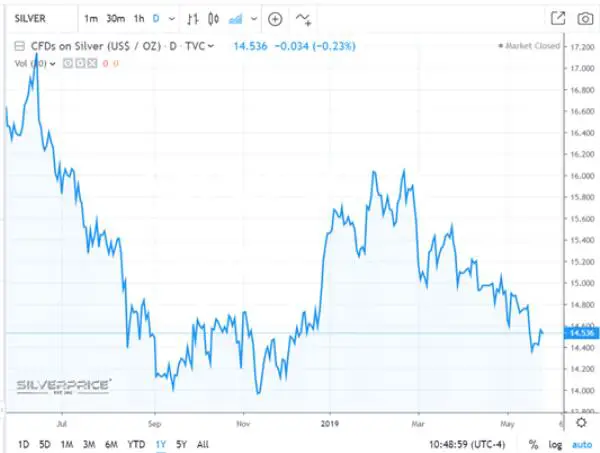

Note that in September 2018, the last time speculators were comparably net short (visually, with the gray bars below the above graph’s center divide), silver was putting in a bottom that preceded a nice run through February of 2019.

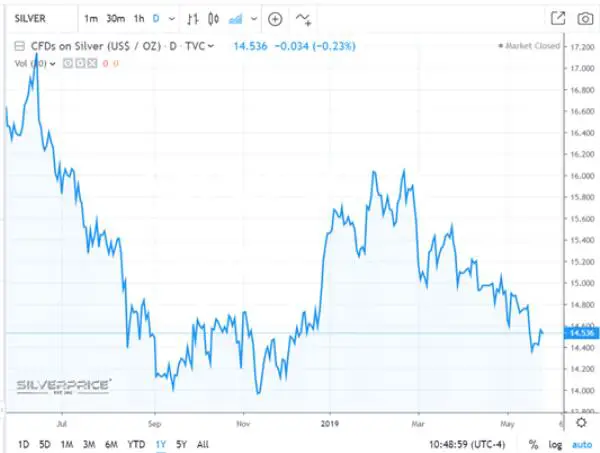

This divergence between gold (wait and see) and silver (start buying now) is confirmed by the gold/silver ratio, which is at a multi-year high, implying that silver is undervalued relative to gold. Past spikes in this ratio have preceded precious metals bull markets in which silver outperformed gold.

This is progress, but still leaves speculators long and commercials short. The message: wait a few more weeks for 2019’s best entry point.

But silver’s story is a lot more interesting. In that market, speculators are now aggressively net short:

Here’s the same data in graphical form, with silver speculator positions represented by the gray columns.

Note that in September 2018, the last time speculators were comparably net short (visually, with the gray bars below the above graph’s center divide), silver was putting in a bottom that preceded a nice run through February of 2019.

This divergence between gold (wait and see) and silver (start buying now) is confirmed by the gold/silver ratio, which is at a multi-year high, implying that silver is undervalued relative to gold. Past spikes in this ratio have preceded precious metals bull markets in which silver outperformed gold.

0 comments:

Publicar un comentario