by: Florian Grummes

Summary

- Gold in corrective down-wave since end of February.

- Gold needs to clear resistance around US$ 1,350 – 1,375.

- Commitments of Traders report does look promising.

- Seasonality urges to be patient until end of June at least.

- Ascending triangle is bullish and could push Gold towards US$ 1,500 by spring 2020.

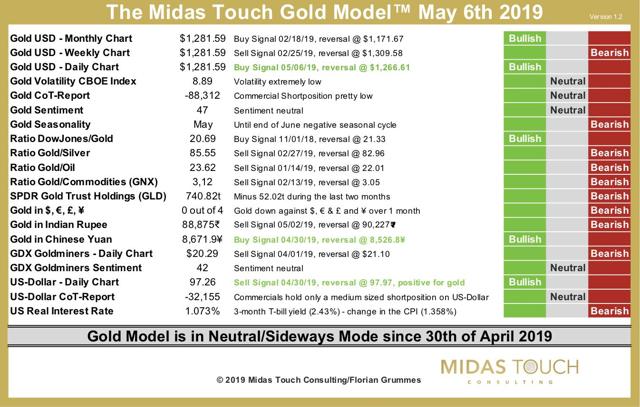

The Midas Touch Gold Model™ Update May 2019

- Gold needs to clear resistance around US$ 1,350 – 1,375.

- Commitments of Traders report does look promising.

- Seasonality urges to be patient until end of June at least.

- Ascending triangle is bullish and could push Gold towards US$ 1,500 by spring 2020.

The Midas Touch Gold Model™ Update May 2019

“The beginning of wisdom is the definition of terms.”

- Socrates

“Feelings are invulnerable to rational thought.”

- Stephen King

While gold (GLD) has been showing some signs of life over the last few days, I want to give you a comprehensive update about the current status of our Midas Touch Gold Model™. A detailed description of the model and its philosophy can be found on our website. As a summary, its strengths lie in versatility and quantitative measurability as it is carefully examining as many perspectives on the gold market as posible.

Since the nasty sell-off in summer 2018, gold prices had recovered in a slow but therefore convincing fashion towards the well-known multi-year resistance zone around US$1,350–1,375. But since February 20th at a peak of US$ 1,346, the gold market is in a clear correction and the final low of this down wave is not yet confirmed.

At the same time, the Midas Touch Gold Model has just recently improved to a neutral stance after flashing a sell signal since end of February. And although the three technical time frame components of gold in USDOLLAR (monthly, weekly, daily) currently do not look that bad, it still takes a gold price above US$1,310 to turn around the weekly chart. We need to consider that in such an extremely low volatile environment as gold finds itself right now, a fast US$30 plus move to the upside could already be the big game changer!

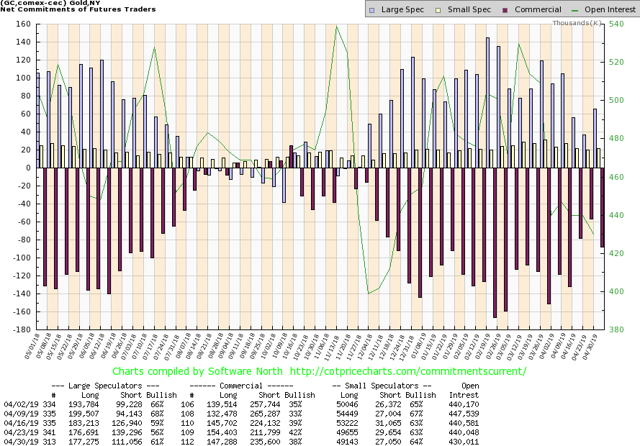

Source: CotPriceCharts.com

Source: CotPriceCharts.com

Looking at the current Commitments of Traders report (CoT), the medium-term outlook for gold is rather encouraging. The smart money, which of course are the commercial hedgers, does not hold a huge short opposition on gold futures. It might be still large enough to trigger a final panic sell-off towards June or July but certainly not a massive US$ 100 plus down wave.

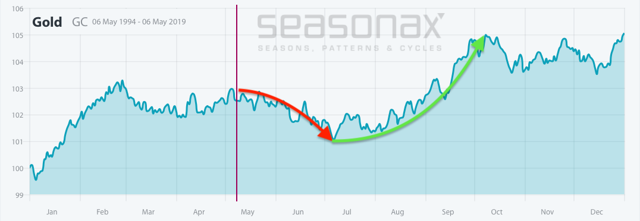

Source: Seasonax

Source: Seasonax

Combining the CoT-Report with gold's seasonality, the most likely scenario sees a continuation of the ongoing mild correction towards at least the 200- day moving average (US$1,253).

Probably between June and mid of August, gold should therefore find a bottom between US$ 1,200 and US$ 1,250.

Source: Tradingview

Source: Tradingview

In the bigger picture, this would not violate the series of higher lows but strengthen the promising ascending bullish triangle formation which gold seems to tinker since its low at US$1,045.

If you consider the four ratio components of the Midas Touch Gold Model, none of them is screamingly bullish at the moment. In fact, the DowJones/Gold-Ratio is rather close to lose its bullish signal! But should the “sell in May cycle” plus the US-China trade dispute force stock markets lower, this power ratio would remain in favour of gold. The other three ratios will likely catch up once gold has seen its trend reversal in the next few months.

When goldmining managers have to justify the weak performance of their stocks, they often complain about ETFs as a passive investment competitor. Certainly, the current holdings of the GLD Gold ETF of 740 tonnes are rather shallow, but you can be sure that once gold can break above US$1,360, generalist investors will rush into these products as they did between 2004 and 2011.

Back then, the ETFs were one of the main drivers behind gold's bull market. But for the time being, the Midas Touch Gold Model considers GLD's recent stock movements as bearish. And talking about the miners and ETFs, the GDX and GDXJ have a sell signal since April 1, but it does not take much to flip this into a bullish reading which would signal a bounce from oversold levels.

Finally, the US Dollar might be the missing puzzle for gold's return. So far, gold has held up surprisingly well as the US-Dollar has been strengthening over the last 14 months. Currently, the model detects a sell signal for the US-Dollar and therefore a bullish signal for gold, while US real interest rates above 1% remain an argument against gold.

Overall, the model is neutral and advises a neutral and patient stance until the typical summer low (normally to be found between end of June and mid of August). Should gold not dive too deep until these summer lows, the sleeping 5,000-year-old golden dinosaur might indeed have enough power to break through the resistance around US$1,360 later in autumn/winter and catapult himself towards US$1,500 by spring 2020!

0 comments:

Publicar un comentario