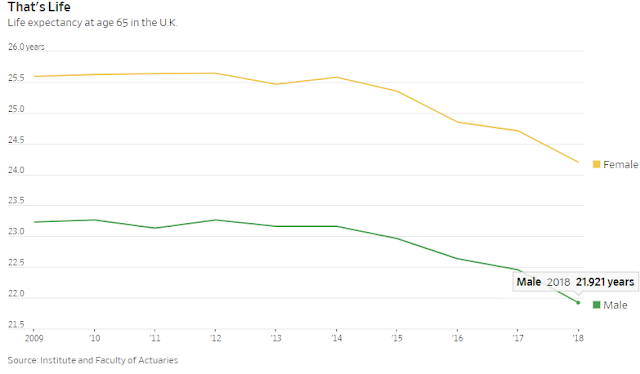

Life expectancy at 65 is falling and that means cash windfalls for insurers

By Paul J. Davies

The great gains in life expectancy as people gave up smoking and treatments for heart disease improved have run their course. In the U.K., at least, longevity has gone into reverse.

That’s sobering for people turning 65, but for life insurers it is turning into a cash windfall. The trend will boost earnings for some U.S. insurers, too, over time. Companies like Prudential Financial PRU 0.41%▲ and Pacific Life, a mutual insurer, have become big reinsurers of the risk that British people live longer than expected.

A string of British life insurers reported higher full-year profits this month, boosted by reserve releases totaling almost £2 billion ($2.6 billion) between them. Aviva’s windfall was largest, at £780 million, followed by those of Prudential PUK 2.26%▲ PLC (not to be confused with Prudential Financial in the U.S.) and Legal & General ,which released £441 million and £433 million respectively.

The British body that tracks deaths and makes predictions about longevity made its biggest ever cut to life expectancy at age 65. Photo: Joe Giddens/Zuma Press

Much more money will likely be freed up in coming years, according to analysts at Royal Bank of Canada .Life insurers are slow to update their expectations of how long people will live. And this month the British body that tracks deaths and makes predictions about longevity made its biggest ever cut to life expectancy at age 65. In 2012, life expectancy was more than 25.5 years for women aged 65 and 23.26 years for men. In 2018 that dropped to 24.2 years for women and 21.9 years for men.

It isn’t entirely clear what is behind the decline, but the main suspects are bad diet, high alcohol consumption and lack of exercise. Some policy makers also worry about problems with opiates, which are causing lots of deaths in the U.S. However, official statistics show only a small recent rise in drug-related deaths in people aged over 50. Rising costs and limited resources for health care might also contribute.

Life insurers put aside money as reserves to cover the long-term costs of paying pensions. In the early 2000s, life expectancy kept increasing, meaning insurers had to put more and more money away. They have also been buying reinsurance from groups like Prudential in the U.S. against the risk that longevity improvements would keep increasing their pension costs.

Now that people appear to be dying sooner than expected, U.K. reserves can be released. Different U.S. accounting rules mean insurers there will only get a boost to profits when people actually die, rather than just because expectations change. The benefits to investors in the U.S. will therefore take longer to emerge.

If there is good news for future pensioners here, it is that higher returns to shareholders and shorter retirements ought to give them better incomes in the time that they have.

0 comments:

Publicar un comentario