A Champion Investment Bank Is the Wrong Solution for Europe

Even if Deutsche Bank and Commerzbank merge, they will still struggle with Europe’s flawed capital markets

By Paul J. Davies

The headquarters of Deutsche Bank and Commerzbank are seen in Frankfurt. Photo: Thomas Lohnes/Getty Images

Newsflash for financial deal makers: Europe doesn’t need an investment banking champion.

If Deutsche Bank DB -1.57%▲ and Commerzbank CRZBY -1.08%▲ agree to a merger, their executives should remember this and it should govern where they make cuts and invest for the future. Investment banking and trading should be curbed dramatically, especially in the U.S. The priority should be corporate and transaction banking.

To be fair, all Europeans should be thinking this way, not just the two struggling Germans. This isn’t defeatism in the face of powerful U.S. competitors; it is about the lack of proper capital markets in Europe.

European capital markets just aren’t that big, and despite years of European Union-level negotiations and proposals, they aren’t developing either. In fact, European equities-trading revenue in 2018 was down by nearly 20% from 2011, according to data from Coalition, a research firm owned by S&P Global. In the U.S., it has grown nearly 50% over the same period.

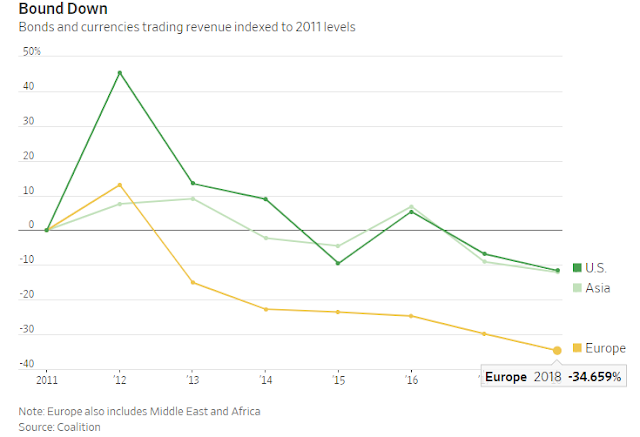

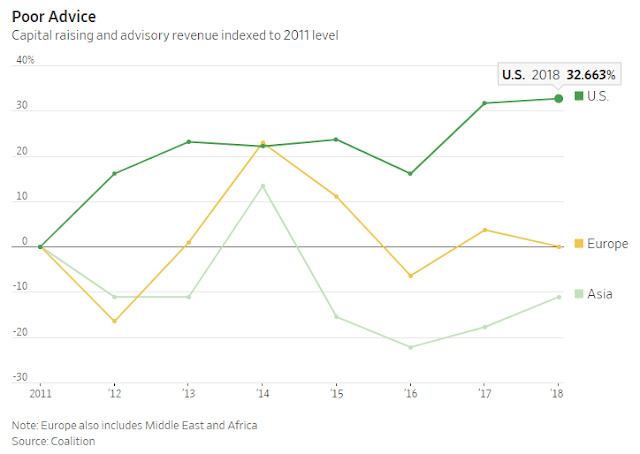

In bond and currency trading, which has struggled almost everywhere, the European picture is even worse than other markets. In capital raising and deal making, revenue has held up better, but is still less than half U.S. levels.

Advisory and capital-raising work matters because it is what creates the securities for investors to trade. The big reason Europe is so far behind in this area is well known: It still relies much more heavily on bank financing than capital markets. Three-quarters of corporate debt in the U.S. comes from bond markets and the rest from banks, while in Europe only around one-fifth comes from bond markets.

European capital markets have struggled to develop partly because of national rivalries within the EU that help local banks dominate their domestic markets. National champions tend to lead league tables in each country, followed by big U.S. banks, with other Europeans bringing up the rear.

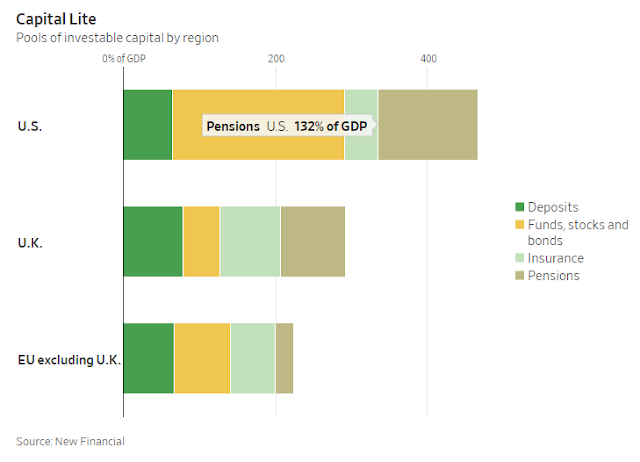

But there is also a problem with savings and investment habits: Europe has more pay-as-you-go pensions, by which current employees or taxpayers bear the cost of retirees, which means there are fewer pension funds to be invested.

Also, European households keep a greater share of savings in bank deposits rather than investing them in financial assets. Europeans keep about 30% of their funds in banks or cash savings, according to New Financial, a think tank, while Americans hold less than 14% this way.

This is a serious issue. It isn’t only bad for the bonus prospects of investment bankers, but it is bad for Europe’s ability to recover from financial or economic shocks. In capital markets, assets get revalued quickly, investors lose money and they move on. In banks, executives don’t want to take the losses so bad loans hang around, capital remains tied up in poorly performing assets and new loans and investments aren’t made.

Senior European officials know this, which is why they continue to push for reform to create the right sort of regulatory playing field. But as long as national politicians want to protect their local banks and Europeans prefer to keep savings in cash, none of those high-level reform efforts will do the trick.

Only in this old-fashioned world of national champions does a commercial-banking focused merger between Deutsche Bank and Commerzbank make sense. If Europe changes, a European investment-banking champion should emerge—but there is no point creating a vehicle for a road that hasn’t been built.

0 comments:

Publicar un comentario