Trump’s China Deal Could Punish U.S. Allies

America first in a U.S.-China trade pact could deal a serious blow to the economies of friends around the world

By Nathaniel Taplin

Beijing and President Trump appear near to a trade deal: China buys a lot more U.S. stuff, gives some ground on auto-industry protections and intellectual property, and mostly ignores other U.S. complaints.

What would that mean in practice? Mainly, a boost to already-competitive U.S. industries like natural gas, agriculture and autos—and a big hit to other major exporting nations.

Some details emerged Sunday. As part of any deal, China could commit to buying $18 billion worth of gas from U.S. exporter Cheniere . LNG -0.70%▲ The period isn’t clear, but liquefied natural gas purchase agreements are often signed for 10 years or longer.

China might have ended up purchasing a lot of Cheniere’s gas anyway. Spot LNG prices in recent months have ranged between $6 and $12 per million British thermal units: Cheniere has previously estimated its break-even costs for Asian delivery from future projects at $7.50 to $8.50. If the purchase agreement is confirmed, Cheniere should be able to greenlight its sixth LNG train at Sabine Pass, La., which would lift the terminal’s annual capacity to 27 million metric tons—around 10% of current global demand.

So sorry, Australia. Photo: Lindsey Janies/Bloomberg News

The losers would be other big exporters that have invested or plan to invest billions in LNG, among them U.S. allies Australia and Canada. After years of waffling, investors approved a $30 billion LNG plant in British Columbia in 2018, and in eastern Canada another big project awaits a final investment decision. Australia, a dominant LNG supplier to China, has been banking on rising exports to offset falling coal revenue.

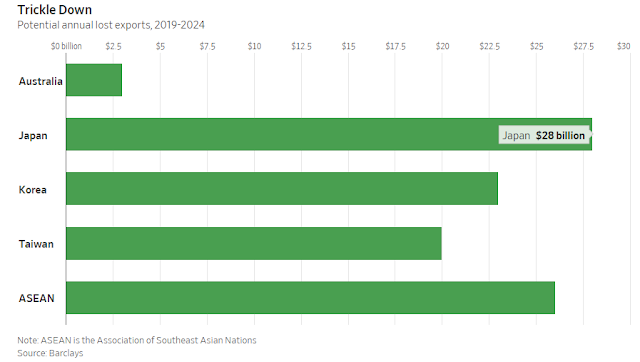

If the U.S. and China do conclude a deal, U.S. friends in Asia could get hit as well. An extra $1.35 trillion in U.S. exports to China over five years—close to the $1.2 trillion figure cited by Treasury Secretary Steven Mnuchin in December—would cost Japan $28 billion annually (3% of its exports), Barclaysestimates. Korea could lose $23 billion (3.1% of total exports); Taiwan, $20 billion (3.2% of exports).

Such a large diversion of trade may be impossible near-term. And some Japanese cars previously headed to China, for instance, would head to the U.S. instead. But the risk is that the U.S.-China pact will severely damage to the economies of the very allies the U.S. is counting on to help balance China’s rise in Asia.

For Beijing, that sounds like a very good deal indeed.

0 comments:

Publicar un comentario