What Blows Up First? Part 6: “Almost Junk” Bonds

by John Rubino

The key insight of the Austrian School of Economics (maybe the key insight of ALL economics) is that the amount you borrow matters, but so does the use to which you put the money.

A case in point is US corporate debt, which has changed structurally lately in very scary ways.

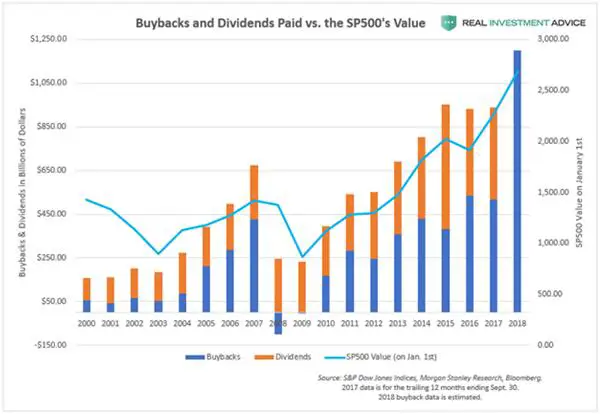

The short version of the story is that after the US cut interest rates to historically low levels to keep the Great Recession from swapping it’s capital R for a capital D, public companies figured out that they could borrow money for less than their stocks’ dividend yield, use the proceeds to buy back their outstanding shares, and generate free cash flow in the process. And – a nice added perk – the increased demand pushed their share price up and landed their CEOs even bigger year-end bonuses.

So that’s what they did, on an epic scale.

But – recall the Austrian School insight – the result was soaring debt without any new productive assets to offset the cost.

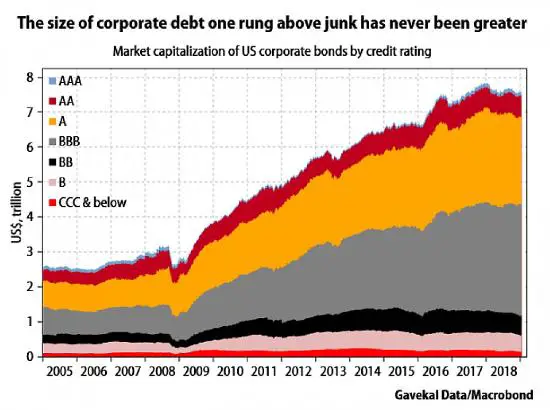

Generally speaking, debt rising faster than operating income equals diminished creditworthiness. So all that borrowing has produced several trillion dollars of debt that’s just one step above junk. Here’s an excerpt from money manager Louis Gave’s take on the subject.

The Size of Corporate Debt One Rung Above Junk Has Never Been Greater, Warns Louis Gave

Louis Gave at Gavekal Research says the greatest source of potential instability in the years ahead lies with the massive growth of the U.S. corporate debt market, particularly at the BBB-rated (near junk) level.

Gave recently told FS Insider that it has far outpaced the economy and could be due for a reset during the next downturn, which is increasingly becoming a concern by other strategists.

When it comes to potential trouble spots brewing in the financial markets or global economy, Gave said “if you ask a French client, they tend to point a finger at Italy. If you ask Italian clients, they point a finger at Deutsche Bank; and if you ask German clients, they point a finger at France. When I talk to my U.S. clients, most of them point a finger at China, which they see as having unsustainable high levels of debt and is an accident waiting to happen.”

However, Gave sees an even source of potential problems since, as he points out, the “size of corporate debt one rung above junk has never been greater” (see below).

The challenge today, Gave said, “is that part of the massive growth we’ve seen in the U.S. corporate bond market has really taken place in the BBB space. And so, if you start seeing an economic downturn (and the usual type of downgrades that occur in a downturn), then all of a sudden you have investment grade that becomes non-investment grade.”

Gave worries this could send shock waves through the financial markets since U.S. corporate debt is widely held by pension funds, investment banks, and large institutions all around the globe.

“There are real questions about all the energy debt that’s being issued by a lot of negative cash flow companies in the energy space,” he said, which also leads to questions about industrial, auto and real estate debt.

Gave asked listeners whether all this growth in debt has “funded the purchase of assets that allow the servicing of the debt and then the reimbursement of the debt or has this growth really funded a massive rise in share buybacks and financial engineering?” Gave said if the answer is the latter it would signify that our balance sheets are far more stretched out than they have been in previous cycles.

To sum up, hundreds of US companies are about to find their bond ratings cut to junk. They’ll then have to pay way up to refinance their debts (or in some cases to make payroll), setting off a death spiral that, if the history of past debt binges is any indication, will end with mass bankruptcies.

And as Gave notes, a ton of these bonds reside in the very same pension funds that are already due to implode in the next recession.

0 comments:

Publicar un comentario