The Global Trade Slowdown Will Get Worse Before It Gets Better

Surprisingly strong Chinese trade data for January are looking like an outlier, given this week’s soggy numbers from Japan and Korea

By Mike Bird

Containers at the Yangshan Deep Water Port in Shanghai, China. The big gap in Chinese and Japanese trade data is a bad sign for global economy optimists. Photo: aly song/Reuters

A week is a long time in global trade, apparently. Weak data from Japan and Korea this week suggest stronger-than-expected January trade numbers from China released last week were a blip. For investors focused on the outcome of U.S.-China trade talks, the message is clear: Pay more attention to the global slump that’s already under way.

The discrepancy between Chinese and Japanese trade data is one bad sign for global economy optimists. Chinese statisticians recorded a 2% month-over-month fall in imports from Japan in January, while Japan recorded a 31.7% fall in exports to China over the same period. That’s the biggest divergence between the two data sets in eight years.

The bad news is that such big data gaps are typically resolved to more closely match Tokyo’s numbers. In February 2011, Japanese and Chinese trade data diverged by 46.7 percentage points; the following month, Beijing recorded a 46.5% boom in imports from Japan. On that basis, China’s imports from Japan are likely to look miserable in February’s data.

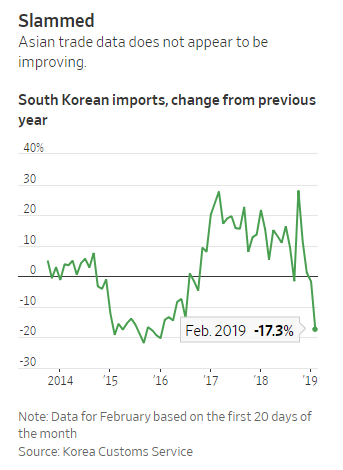

Korean trade figures released Thursday, which cover the first 20 days of February, also suggest that the contraction in global trade is continuing, not reversing. Exports and imports fell by 11.7% and 17.3% respectively year over year, the worst figures for each since mid-2016. Exports to China fell by 13.6%.

Korea’s weakness today means global weakness tomorrow thanks to its position at the center of many international supply chains. Machinery components exported from Korea to other Asian countries often become finished products that are exported to Europe or the U.S. weeks or months later.

Blaming U.S.-China trade tensions alone misses the mark: The current global trade slump began well before the U.S. first imposed tariffs last May. The true leading cause of the slowdown—particularly in intra-Asian trade where the steepest declines have been recorded—is China’s fading growth. So while any deal between Washington and Beijing would be good for their exporters and investors, it likely won’t reverse the broader global trade malaise.

A real global trade recovery will instead have to wait for China’s own economic stimulus efforts to feed through. That could yet take several months, even after January’s record rise in Chinese credit. The message for now: Don’t get carried away by one outlying set of trade data.

0 comments:

Publicar un comentario