The Coming China Shock

For years, China has defied the widely held view that political openness is necessary for long-term economic development. But recent macroeconomic developments now suggest that the country's exceptionalism is nearing its expiry date, with potentially devastating effects for the global economy.

Arvind Subramanian , Josh Felman

CAMBRIDGE – In September 2018, we argued that China’s economic and foreign policies were defying the “laws” of economics and geopolitics, and warned that the situation could not last. Since then, our assessment has been borne out, and our concerns have deepened.

Until recently, China had been able to pursue a unique development path, owing to the government’s far-reaching control over the economy (and society more generally). But those days are over. The country’s internal debts are mounting to unsustainable heights, and domestic investment levels have passed the point of diminishing returns and are veering toward negative territory.

Moreover, China’s strategy of fostering exports, promoting industrial “national champions,” and expropriating foreign technology has crossed the threshold of what the West, especially the United States, is willing to tolerate. Chinese President Xi Jinping’s Belt and Road Initiative is showing all the signs of imperial overreach. Not only does the BRI’s lending far exceed participating governments’ borrowing capacity, but its loan terms have become increasingly onerous – indeed, usurious – as Harvard University’s Ricardo Hausmann recently observed.

Back in September, we saw some discontinuity in China’s economic performance as inevitable. Even if the country was not heading for a full-blown crisis, we believed it would almost certainly experience some combination of rapidly decelerating growth and a sharply depreciating exchange rate.

That prognosis has since become even more likely. With global economic growth and exports declining, China’s economy is on track to slow further relative to the 6.4% growth recorded in the fourth quarter of 2018. The double-digit average achieved from the 1980s until recently has never seemed more distant.

In response to the current global slowdown, the Chinese government has decided to loosen restrictions on private and public borrowing. But this will merely aggravate the country’s debt and overinvestment problems. Or, as a famous Chinese saying goes, it is akin to “drinking poison to quench one’s thirst.”

Even without these macro developments, China’s defiance of well-established findings in development economics was never going to last forever. The economists Douglass North, Daron Acemoglu, and James A. Robinson have shown that long-run economic development tends to rely on strong state institutions and open political systems, because these are necessary to foster competition, investor confidence, dynamism, and innovation.

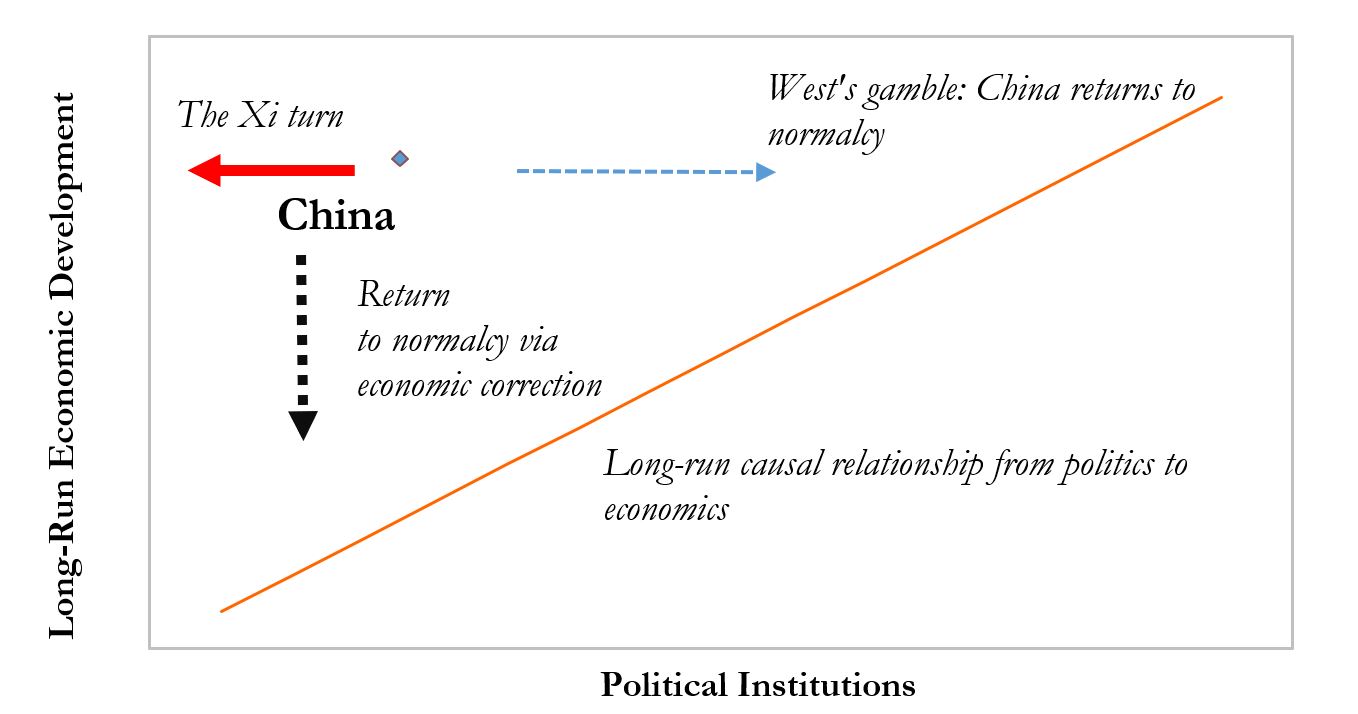

In the chart above, the upward sloping line represents the positive relationship between political and economic development. As the notable exception to an otherwise robust relationship, China has long posed a problem for this theory. With its closed political system, it should not be anywhere near as rich as it is.

In the 1990s and 2000s, the West made a gamble that China would cease to be an exception and would veer toward normalcy by adopting more open and democratic political institutions (as indicated by the dotted blue arrow). As a practical matter, that bet translated into Western policies to facilitate China’s rise, and decisions by US firms to transfer manufacturing capacity there.

But under Xi’s leadership, China has instead become less open (as shown by the red arrow). And, as Nicholas Lardy of the Peterson Institute for International Economics shows in a new book, its economy has also shifted back from a private-sector-driven growth model to state capitalism.

In other words, systemic political and economic changes are making China even more of an exception, thereby increasing the odds that its return to normalcy will come in the form of a sharp deterioration in economic performance (the downward dotted black arrow). There is no telling precisely when that correction will happen. But the more China defies the rules of economic development, the more likely it becomes.

Unfortunately, any discontinuity in China’s economic performance would have a seismic effect on the rest of the world, because it would lead to a significant weakening of the renminbi. In fact, China itself might engineer a depreciation of its currency in order to promote its exports and cushion the inevitable fall in domestic demand, particularly its investment component.

Such a scenario would have a tsunami-like impact on global currencies. Other major Asian countries would respond by pursuing their own devaluations to maintain their competitiveness, and Europe and the United States would experience sharp deflation as their currencies strengthened in kind.

For a historical comparison, consider that in the 1930s, the US dollar and British sterling depreciated by about 40% over four years, while the French and German currencies remained broadly stable (measured against gold). Like the US and Britain in 1929, just before the Great Depression, today the major Asian economies that would be affected by a Chinese currency shock account for around 30% of world trade.

Making matters worse, trade is much more important to the global economy today than it was 90 years ago. In 2017, merchandise exports accounted for 20-25% of global GDP, compared to just 8% in 1929. That means a depreciation in Asian currencies would have a significantly greater global impact than the dollar/sterling devaluation of the 1930s. Thus, a China shock could potentially dwarf the competitive currency depreciations of the early 1930s – one of the darkest economic periods in recorded history.

One way or another, China’s continued defiance of the “laws” of macroeconomics, geopolitics, and economic development will hasten its inevitable return to normalcy. When that happens, the world had better brace itself.

Arvind Subramanian, a former chief economic adviser to the government of India, is a senior fellow at the Peterson Institute for International Economics and a visiting lecturer at Harvard’s Kennedy School of Government. He is the author of Eclipse: Living in the Shadow of China’s Economic Dominance.

Josh Felman is Director of JH Consulting.

0 comments:

Publicar un comentario