Governments And Central Banks Got It Wrong, Will They Learn?

by: Ramy Taraboulsi, CFA

Summary

- Central Banks around the world have been raising the interest rates with the hope to slow down the sizzling economy.

- This seems to be a futile exercise which will hurt the "small guy" rather than slow down the rate of change we are experiencing.

- A new economic model based on the adoption of Artificial Intelligence/Deep Learning Neural Networks is emerging, and this model will be replacing the existing economic models.

- Central banks need to change how they set their monetary policies, governments need to change their fiscal policies, and investors need to change their investment strategies.

- Some companies will succeed and flourish under this economic model and the paper is providing an analysis of a portfolio composed of 12 companies that can thrive under this model.

Summary

- This seems to be a futile exercise which will hurt the "small guy" rather than slow down the rate of change we are experiencing.

- A new economic model based on the adoption of Artificial Intelligence/Deep Learning Neural Networks is emerging, and this model will be replacing the existing economic models.

- Central banks need to change how they set their monetary policies, governments need to change their fiscal policies, and investors need to change their investment strategies.

- Some companies will succeed and flourish under this economic model and the paper is providing an analysis of a portfolio composed of 12 companies that can thrive under this model.

Summary

Over the last two years, The Bank of Canada, the US Federal Reserve System, and other central banks around the world (collectively, the Central Banks) have been on a mission to cool down the economy by raising interest rates. They are right about the fact that the economy is hot: not only is it hot, but it is even sizzling. All we need to do to assess the status of the economy is to look at the largest company revenues and how they are growing in multiple digits year-over-year.

Twenty years ago, raising interest rates would have been the perfect movement from the central banks. The whole world, however, changed dramatically over the last twenty years.

Actually, some researchers claim that the changes we experienced in the last 20 years were so profound that they are comparable to the evolution of humanity since the beginning of time.

Actually, some researchers claim that the changes we experienced in the last 20 years were so profound that they are comparable to the evolution of humanity since the beginning of time.

These changes are resulting in a new economic model unbeknownst to the central banks. The hallmarks of this model will include:

- the economy will continue booming and we will not have a recession;

- there will be minimal demand on loans and interest rates will drop without the Central Banks's intervention;

- we will experience almost zero inflation and might even dip into deflation during a booming economy; and

- we will experience unprecedented unemployment with the number of employers limited to very large companies.

According to prevailing economic theories, the aforementioned indicators are conflicting and should never concurrently happen. This paper shows that it is inevitable that these features will concurrently happen. The paper also shows that the technological advancements we are continuously experiencing (aka, the Fourth Industrial Revolution) and their level of acceleration is the impetus for this economic model.

The paper concludes by looking at the impact of this new economic model on central banks, the world governments, and the investment strategies that investors can adopt. The paper finally identifies the characteristics of companies that are expected to benefit from and thrive under this new economic model.

Paper Thesis

This paper determines that the world is currently developing a new economic model that has not been experienced since humans started recording their history. This economic model will have profound impacts on the monetary policy of central banks, the fiscal policy of governments and the investment strategy of investors.

Central banks need to realize that they should not raise interest rates and that raising the interest rates will only further hurt the people who would be already suffering due to the effects of the Fourth Industrial Revolution. They also need to realize that raising the interest rates would not result in slowing down the technological changes. At the same time, lowering interest rates, surprisingly, would also have negative effects, and would also hurt the companies and the people who would be already suffering.

Governments need to review their fiscal policy as well. Even though the economy will be booming, reducing government spending, which governments typically do during a booming economy, would not be the correct approach. Reducing government spending would not slow down the economy from a GDP/GNP perspective, and would only have a negative impact on the employment rates which would already be on the rise. Governments would also need to look seriously at the potential of rolling out a Guaranteed Basic Income program to all its citizens.

Investor's strategies would also need to change. With the dropping interest rates, bonds would become very attractive investments; this attractiveness will continue until the interest rates settle at historically low values. At the same time, as we get over the hump of increased mergers and acquisition, the expected return on investment would shift to be highest for large-cap technology companies compared to utility companies and small/micro cap companies.

What prompted this analysis?

What prompted this analysis?

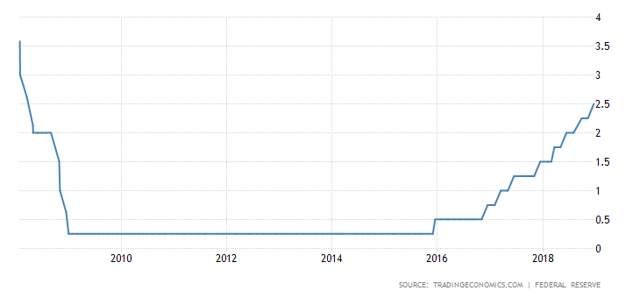

Recently, the US President, Donald Trump, publicly criticized the US Federal Reserve System, Jerome Powell, for raising the interest rates, and rumours have it that he has been discussing with his advisors the potential of firing him. This feud began not long after Trump appointed him in 2016, as the Fed has been raising interest rates on a steady basis since.

Source: Trading Economics

Upon further researching what was happening, I found that Trump's reason for the criticism is different from what I was expecting. Trump worries that the hikes will derail economic progress: "because we go up and every time you go up they want to raise rates again. I am not happy about it. But at the same time, I'm letting them do what they feel is best." In other words, he is concerned that raising the interest rates might result in pulling the economy into a recession. Based on the findings of this paper, raising the interest rate will have minimal impact on the growth of the economy, and it will mostly result in exacerbating the pain of the people who are at risk of losing their Jobs.

What is the new economic model and what is causing it?

The new economic model will be characterized by the following four attributes:

- the economy will continue booming, and we will not have a recession;

- we will experience almost zero inflation and might even dip into deflation;

- we will experience unprecedented unemployment;

- there will be minimal demand on loans resulting in dropping interest rates.

These four hallmarks will be further expounded later in the paper.

If we look at the history of mankind, we cannot find any time in the modern era where such characteristics happened concurrently. Actually, studying these characteristics, we will find that some of them are diametrically opposed; for example, all recessions of modern history have been accompanied with high unemployment, and a booming economy is rarely (never?) linked to "deflation".

This proposed economic climate is the ultimate result of the changes in the technology that we have been experiencing over the last twenty years. These changes practically started with the introduction of the World Wide Web on the Internet (the WWW is generally referred to as "the Internet"). The Internet gave rise to the democratization of information, where anyone now has access to all human knowledge at any time, literally, with a swipe of their finger. This availability of information increased the productivity in an amazing manner. For example, as a programmer, I can now do a particular task in one day whereas just ten years ago it would have taken me two weeks; the same applies to many other professions. In addition, conducting the research necessary to write this paper would have taken me at least 10 times as much time ten years ago. The Toronto Star has a casual article: "50 ways life has changed in the last 10 years" by Jocelyn Noveck that further shows how our life has changed in such a relatively short period of time.

Having said that, there are some researchers that claim that technology is making us less productive. This is certainly true for some disciplines (like management and supervisors), but based on my personal experience as a programmer, financial analyst, and researcher, I can attest that technology is generally helping mankind become more productive.

It should be noted: general technological advancements resulting in increased productivity are not the main impetus for introducing a new economic model. I am proposing that the new economic model will emanate from one specific technological advancement, albeit one that is still in its infancy. I am talking here about Deep Learning using Neural Networks, and I predict that it will propel general productivity to unprecedented levels.

What is Deep Learning?

What is Deep Learning?

Deep learning is part of a broader family of machine learning methods based on learning data representations, as opposed to task-specific algorithms. Learning can be supervised, semi-supervised or unsupervised. This video provides a brief explanation of what Deep Learning is.

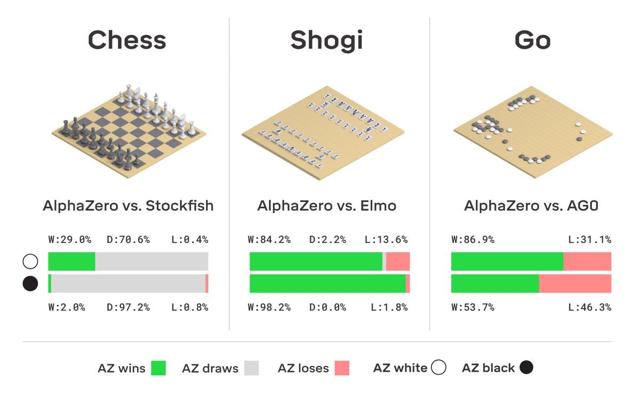

Simply put, deep learning is the ability of computers to come up with its own rules to solve a problem or create something new based on the availability of abundant training data. Using deep learning, computers can now beat humans in any game, including Go, the most complex board game ever created. This was demonstrated in March 2016 when AlphaGo, the leading program which uses deep learning, played against Lee Sedol, a South Korean Go player and winner of 18 world championship. Over 200 million people watched this match, which was famously titled The Google DeepMind Challenge, as AlphaGo stunned its viewers and emerged in victory, winning four games to one.

And, that was in 2016, about three years ago. Over the last three years, the computer intelligence has been growing at an exponential rate. For example, AlphaGo got a major upgrade last year, gaining the capability of teaching itself winning strategies with no need for human intervention. By playing itself over and over again, AlphaGo Zero (AGZ) trained itself to play Go from scratch in just three days and soundly defeated the original AlphaGo 100 games to 0. The only input AGZ received was the basic rules of the game. Not only did it teach itself Go, but other games as well, and was able to handsomely beat the reigning world champions (world champions are computer AI systems of course, as computers are now capable of beating any human in any game) as shown in the next diagram.

Source: Deepmind Technologies Ltd.

Source: Deepmind Technologies Ltd.I had personally expected that computers would not win against humans in no-limit Texas Hold'em Poker for apparent reasons, and you might have shared this expectation with me.

Fortunate for computers and unfortunate for humans, computers also took the reins in Poker when Libratus, an artificial intelligence robot, won chips worth $1.5M from four of the world's top poker players in a three-week challenge at a Pittsburgh casino in January 2017.

Scary as that might be, the impact of deep learning goes far beyond playing games. It can be used in almost anything that has a goal or requires making a decision, as long as historical data is available.

Typical existing applications of deep learning that we are currently using daily include natural language processing, image recognition, pattern recognition, games, self-driving, and the list goes on and on.

Typical existing applications of deep learning that we are currently using daily include natural language processing, image recognition, pattern recognition, games, self-driving, and the list goes on and on.

So far, deep learning has been used mostly for solving specific problems. This is called "narrow" artificial intelligence. Researchers are working on deep learning algorithms that can solve any problem, even create new neural networks to solve new problems that it did not even know about.

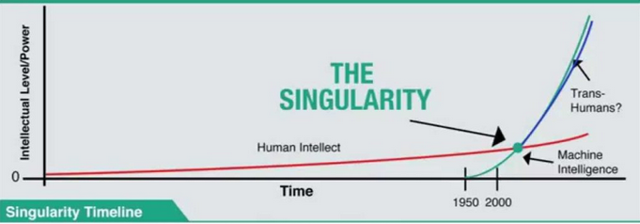

This is what is called "general" artificial intelligence. When computers using general artificial intelligence reach the level of intelligence of a human being (a point known as a "singularity", which we will discuss later in this paper), its intelligence could grow to virtually limitless levels, also known as Artificial Super Intelligence.

This is what is called "general" artificial intelligence. When computers using general artificial intelligence reach the level of intelligence of a human being (a point known as a "singularity", which we will discuss later in this paper), its intelligence could grow to virtually limitless levels, also known as Artificial Super Intelligence.

Deep Learning would have an overwhelming impact on the economy but we have not yet fully experienced this impact. Most researchers confirm that Deep Learning will accelerate the automation efforts in areas of the economy and will result in eliminating jobs in a manner never seen before. In 2017, McKinsey Global Institute published a report titled "A Future That Works: Automaton, Employment, and Productivity". The findings of this report indicate that "Almost half the activities people are paid almost $16 trillion in wages to do in the global economy have the potential to be automated by adapting currently demonstrated technology, according to our analysis of more than 2,000 work activities across 800 occupations. While less than 5 percent of all occupations can be automated entirely using demonstrated technologies, about 60 percent of all occupations have at least 30 percent of constituent activities that could be automated." This is consistent with the 2013 Oxford University report titled: "The Future of Employment: How Susceptible are Jobs to Computerisation?" which finds that 47% of jobs are at risk as a result of automation.

Having a 50% unemployment rate is something that mankind has never seen before and there are no existing economic theories that address this situation. Even during the great depression, the unemployment rate reached a high of 24.9% in 1933. What is also new is that this 50% unemployment is NOT the result of reduced demand on goods and services. That is, production would not slow down as a result of this high unemployment, and could even potentially increase. Simply put, we would not experience a recession but rather a growth in the GDP of countries. The World Economic Forum has coined this change as the Fourth Industrial Revolution.

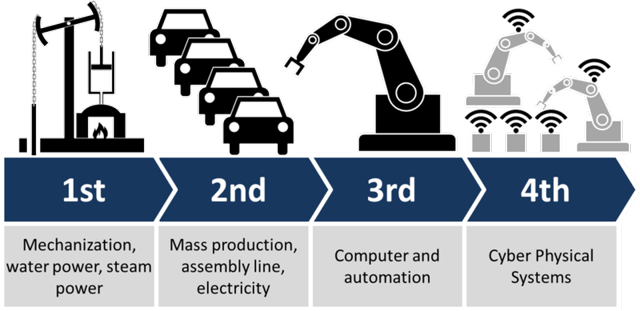

Source: Christopher Roser in AllAboutLearn.com

How is the Fourth Industrial Revolution different from other industrial revolutions?

How is the Fourth Industrial Revolution different from other industrial revolutions?

We have experienced similar situations related to increased productivity and higher unemployment in the previous three industrial revolutions. The first industrial revolution was associated with the creation of the steam engine. The second industrial revolution was the result of discovery and harnessing of electric power. The third industrial revolution was the creation of computers and the Internet World Wide Web.

All the modern industrial revolutions of the past resulted in the loss of jobs and in a fundamental change in the cultural fabric of our society. But the fourth industrial revolution (also known as Industry 4.0), the one associated with integrating physical equipment with computers using Artificial Intelligence, Machine Learning, and Deep Learning, is not the same as the prior industrial revolutions; the economic theories applied earlier cannot be applied now.

One of the key differences, other than the scale of increased productivity and job loss, is that human intervention would not be needed in the industrial operations, except maybe in the machine maintenance arena. We are already seeing that in autonomous cars and automated Supply Chain Management in manufacturing operations. Every other week, we are hearing about yet another new operation that requires minimal or no human intervention.

The factory of the future will have only two employees, a man and a dog. The man will be there to feed the dog. The dog will be there to keep the man from touching the equipment.

Warren Bennis

Another key difference is the ability of computers to autonomously improve their operations. One of the most promising applications of neural networks is the creation of new neural networks to solve additional problems that are different from the original problems that they were originally created for.

This ability removes the sunset period for the benefits from the new technology.

Personal Opinión: We are not there yet, but with the speed at which we are progressing, I think we are just a few years away from neural networks creating other neural networks.

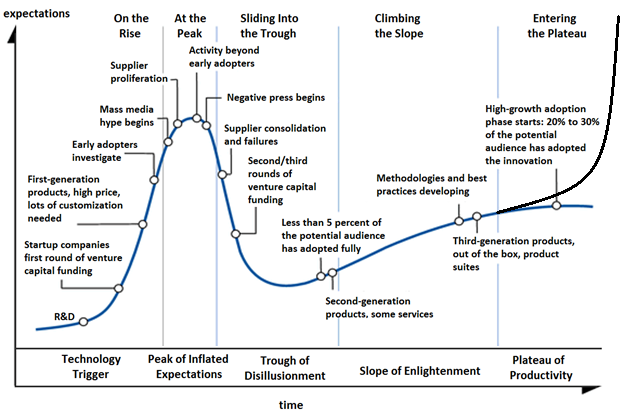

This autonomous ability leads to a different Gartner Hype Cycle for AI and deep learning.

Instead of reaching a plateau-like other technology, the next graph shows that the cycle will continue to grow at an exponential rate. In other words, the "Entering the Plateau" will not be a near-horizontal line as in the picture below, but rather it is expected to grow at an exponential rate (the black line in the Plateau of Productivity).

Source: Adapted from NeedCokeNow - Hype-Cycle-General.png; Black Line added by Author

Personal Opinión: I personally believe that we are currently somewhere in the Slope of Enlightenment in the Hype Cycle.

As of the time of writing this report, the "general" AI programs do not even have the intelligence of a cockroach.

At the present time, our most advanced robots, some of which are built in Japan and also at MIT, have the collective intelligence and wisdom of a cockroach; a mentally challenged cockroach; a lobotomized, mentally challenged cockroach.

Michio Kaku

This is however expected to change, and very soon. According to researchers and futurists, the singularity, the time when computers running General Artificial Intelligence reach the level of intelligence of a human being, is coming any time between 2029 and 2100, with a median of 2045, with everyone surveyed indicating that we will ultimately reach the singularity before 2100. Once we reach the intelligence of a mouse, we will be progressing very rapidly to the intelligence level of the proverbial "village idiot". A few months after the "village idiot" level, we will reach the intelligence levels of Albert Einstein and Stephen Hawking (both with IQ of 160). Within weeks, the computer's intelligence will exceed the 200 IQ level (new tests may need to be designed to accommodate the abnormally high IQ scores). For computers to reach IQ levels of 500, 1,000 or even 5,000, the "Artificial Super Intelligence", is not an unrealistic expectation.

Source: The Millennium Report

Regardless of when the singularity will come, from now until then, we will experience an escalating unemployment rate, a booming economy and a fundamental shift in the fabric of our society.

The Economic Impact of the Fourth Industrial Revolution

The Fourth Industrial Revolution, also known as Industry 4.0, will come with characteristics that were widely considered by economists as mutually exclusive. The next section takes each one of these four characteristics and discusses it in detail to provide a justification for the reason of their existence.

(1) A Continuously Growing Economy

As shown above, Industry 4.0 will have a major impact on the productivity. This productivity gain will come from various concurrent fronts. Transportation costs, which constitute a major part of the cost of products will experience a huge drop as a result of using autonomous vehicles, optimization of the supply chain and the introduction of green energy combined with the reduction of the number of transportation accidents. The manufacturing and services automation will have a significant positive effect on the product quality which will translate into higher productivity; this quality improvement will continue as we adopt deep learning algorithms in the manufacturing robots. The sheer quantity and variations of products produced will be growing significantly as a result of the automation and the implementation of 3-D printing in the manufacturing process. In addition, the automation of the services around the manufacturing will continue as well, which would give rise to even higher productivity.

Because of the continuous increase in the intelligence of computers resulting from deep learning, I do not see any end in sight for this growing economy.

Because of the continuous increase in the intelligence of computers resulting from deep learning, I do not see any end in sight for this growing economy.

(2) A Very Low Inflation

With the extensive automation and replacement of humans with more efficient and less expensive machines, the prices of products and services will continue dropping. We are already experiencing that in almost every area of our society, maybe with the exception of food products. We need to note that when the product prices seem to go higher, more features would be provided at no additional cost in these products.

Take a car for example: We are paying more in 2019 compared to the prior years, but the new base models now contain features that were only available in the premium models in the prior years. I remember, for example, when I bought my first car, air conditioning and electric windows were premium features, and they are now available as base features in most cars.

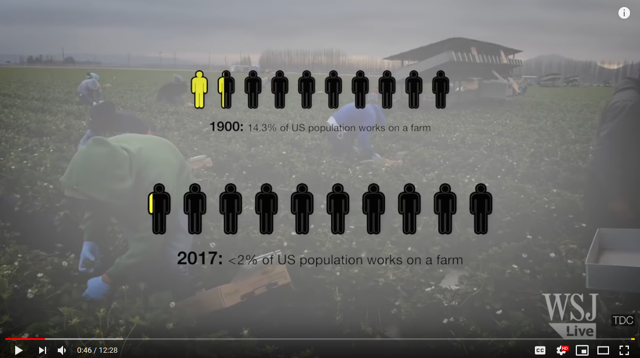

Even in agriculture, new technologies are having inroads at an alarming rate. Farmers now manage their farms from behind their desks with multiple screen monitors that display statistics and cameras from drones and autonomous vehicles. This relatively old video from WSJ (about 2-years old) shows how technology is impacting agriculture in ways that will ultimately result in increasing the agricultural throughput and reducing the cost of agricultural products.

Source: YouTube

Of course, we know that the price of electronics is dropping dramatically, and this drop is expected to continue. Add this to the big drive to use the less expensive renewable energy and the reduced dependency on oil, and we can see that the risk of high inflation is almost non-existent.

Personal Opinion: Based on the increased productivity, and despite the increase in the population on our planet, I am personally expecting that we will fall into a deflationary economic environment within the next 10 years. I cannot fully justify this speculation, and time will tell.

(3) Unprecedented Unemployment Levels

Automation will replace humans in many professions that were once thought secure. Take lawyers for example: There will always be a need for barristers, and I do not expect that they will be replaced by computers any time soon. However, when it comes to "legal" counselors, the picture is totally different. Computers can be used instead of many counselors, and remaining counselors will use computers to automate their job and get them to be more efficient. In other words, a major number of counselors will be replaced by computers and the increased efficiency will result in a higher unemployment. The same applies to most other professions.

Many jobs will remain, but the total number of people required to perform the jobs will be dramatically reduced.

Many jobs will remain, but the total number of people required to perform the jobs will be dramatically reduced.

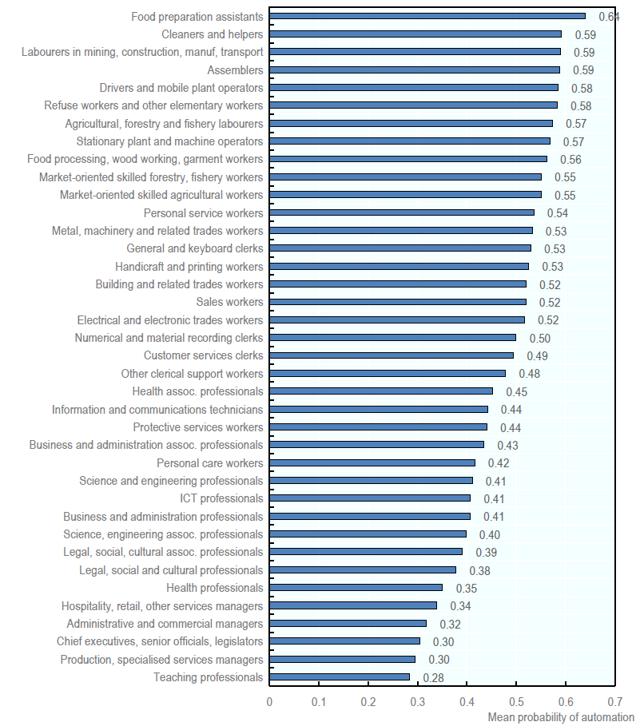

The following graph from the Organisation of Economic Cooperation and Development (OECD) shows the jobs that are at risk to be lost. The research study focuses on the risk of automation together with its interaction with training and the use of skills at work.

Personal Opinion: I personally consider the OECD report as one of the best and more comprehensive reports written on the topic of potential job losses resulting from machine learning and automation; I strongly recommend it for readers who are interested in this topic.

Source: Nedelkoska, L. and G. Quintini (2018), "Automation, skills use and training", OECD Social, Employment and Migration Working Papers

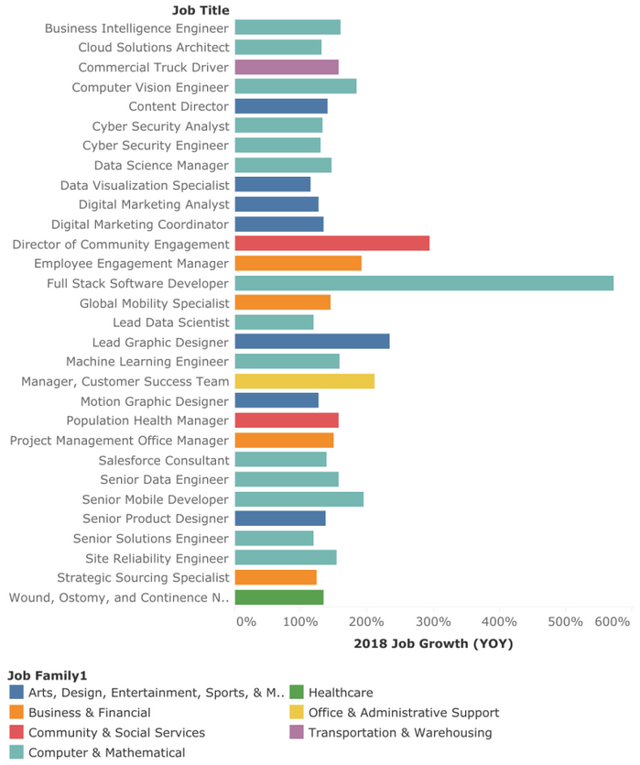

Not all jobs will be lost. There are some jobs that will prosper; Payscale released a new report in January 2019 showing the hot jobs for 2019 as shown in the next graph; You will notice that most of the hot jobs are in the field of computers, mathematics, design and human interactions.

Source: Payscale

(4) A Lower Demand for Corporate and Personal Loans and Dropping Interest Rates

With Industry 4.0, the demand for loans would have no choice but dropping. Companies that are successfully adopting automation would have such huge cash surpluses that would allow them to pay off their old loans and not require new loans.

Companies that are looking at automating their operations will opt for raising funds through equity rather than debt. The reason is that, in this changing environment, banks will not be willing to take on the risk of lending money to companies that are not yet automated because of the traditional nature of the banks. In addition, raising equity will provide the companies with more flexibility in a highly volatile market. While these companies might be issuing bonds, these bonds will most likely be convertible, and the interest rate on them will be lower than traditional bonds.

Companies that are not adopting automation in their business and operations will not be competitive in the marketplace and will go out of business; They would either go bankrupt or they would be acquired at a deeply discounted price by companies that have taken the steps to automate their operations. Thus, unautomated companies would not have the opportunity to raise new capital neither though debt nor through equity as investors will flock to companies that have adapted to the changing times. With the expansion of automation to the service areas, no companies will be safe from the need to automate their operations.

Switching from the corporate side, individuals in "hot jobs" will need loans and mortgages so that they may upscale their houses and properties. However, looking at the list from the Payscale chart above we will notice that these jobs represent a small percentage of the overall population. The individuals with declining jobs as shown in earlier chart of the OECD report represent a much bigger percentage of the population, and they will have no ability to upscale or to buy new properties. In other words, the demand for loans on the individual side will be dropping as well.

The main source of debt investing will be governments; Governments will continue rolling their existing debt and issuing new debt. The main source of tax revenue for governments will be larger corporations that have succeeded in automating their operations. The tax revenue from smaller corporations and individuals will drop dramatically as a result of the bankruptcies and high unemployment; this will most likely result in increasing the issuance of government debt.

Personal Opinión: I personally expect that the demand for government debt will be short-lived. Governments will soon realize the need to drop their deficits, and as a result will shrink the government budgets reducing the need to issue further debt.

Bottom line, there will be a much lower demand for loans. Larger companies will not need to borrow as they would have the cash to improve their automation, and a relatively limited number of individuals will need further loans to upgrade their properties. These larger companies will use their retained earnings and equity financing for funding the automation activities and most of them will not reach out to the debt markets.

In addition, with the increased unemployment and workers unable to find new jobs in their area of expertise, many of them will opt for personal bankruptcies, which will flood the market with debt and mortgage defaults. In other words, increased unemployment will result in further reducing the demand for loans.

The drop in the demand for loans will result in a lower interest rates, and the lower interest rates will be market driven instead of being driven by the Central Banks. As lower interest rates settle, the investors will be moving their funds to equity financing which will result in a rise in the stock market.

We will be further discussing this point and the types of companies that should be the target for investors as we discuss the investment strategy resulting from the introduction of the new economic model.

What should the Central Banks do about their monetary policy in such an economic environment?

What should the Central Banks do about their monetary policy in such an economic environment?

The economic environment explained above is something that central banks have never dealt with before. Historically, central banks have been looking at leading and lagging economic indicators to make their economic decisions; unfortunately, the current economic indicators are not highly representative of what is expected to happen. As a matter of fact, the economic indicators, especially the leading ones, are providing conflicting messages.

For example, we are having a flattening yield curve combined with strong corporate profits.

We are having an extremely volatile stock market bordering on the bear side combined with historically low unemployment rates. We are having stable inventory levels combined with slowing manufacturing activity. We are having rising retail sales with inflation remaining low.

We are having stable wages with a booming housing market.

We are having an extremely volatile stock market bordering on the bear side combined with historically low unemployment rates. We are having stable inventory levels combined with slowing manufacturing activity. We are having rising retail sales with inflation remaining low.

We are having stable wages with a booming housing market.

These conflicting indicators are the hallmark of a pending structural economic change; the best action for the central banks is to make their decisions based on the lagging economic indicators rather than the leading economic indicators which are seriously conflicting. This means that central banks need to adopt a reactive approach rather than a proactive one like they have been traditionally doing.

As of the time of writing this report, the lagging economic indicators (e.g. corporate profits, inflation, wages, unemployment …) are pointing to the need to not make any changes to the monetary policy and keep the interest rates at their current levels.

At a very high level, an increase in the interest rates would have a negative effect on the smaller companies and the individuals who are working in declining professions and may accelerate their hardship and possibly force them into bankruptcy.

A drop in the interest rates would accelerate the automation process which would not give enough time for individuals who are working in declining professions enough time to adjust to the changing economy, potentially resulting in political unrest similar to what is currently happening in France with the yellow vests movement.

In other words, any change of the interest rates would not have an impact on the inflation, which is the primary concern of the central banks. Rather, any change in the interest rates, in either direction, would result in an extra hardship for those who are already at risk of losing their jobs.

Personal Opinion: I personally expect that movements similar to the French yellow vests movement will spread all over the world within the next 10 years with the expected increase in the level of unemployment. My prediction, which I cannot fully justify, is despite the absence of unemployment as one of the causes of the French movement.

Coincidentally, as shown in the above two tweets, Trump is pushing for exactly the same action from the Central Banks, not to make any changes, but his impetus is different: Trump is suggesting that increasing the interest rates would slow the economy to the point of a recession.

While Trump's suggestion to stay put is consistent with the findings of this paper, he is most likely incorrect in suggesting that raising the interest rates will result in a recession. This paper suggests that raising the interest rates will have almost no impact on the GDP growth or decline and will primarily have a negative social impact on smaller companies, the middle class and the vast majority of the population.

Personal Opinión: I personally believe that the Central Banks raising the interest rates at the rate that they have done in 2018 constituted very irresponsible and incompetent moves.What are governments facing?

This new economic model will have a rather drastic impact on the government operations. Some of the economic changes that governments need to deal with include:

Dropping tax revenue: As shown earlier in the paper, with the higher level of unemployment, the individual tax income will be dropping; the growth in certain professions will be far from compensating for the decline of the other professions. Most profitable companies will be larger corporations, and this is where the tax revenue will come. But then again, the amount of corporate tax revenue increases from larger corporations will not compensate for the reduction of the tax revenue at the individual levels or smaller corporations.

Unprecedented high levels of unemployment: As shown earlier in the paper, the various academic reports are indicating that automation, combined with Artificial Intelligence and Deep Learning will soon be taking about 50% of the current jobs. Earlier industrial revolutions have also resulted in people losing their jobs to automation, but this time it is different from three key perspectives: First, the sheer number of jobs that are at risk is much higher than the other industrial revolutions, and it is the first time that service industries are impacted by a structural industrial revolution. Second, the earlier industrial revolutions have created new professions (like train drivers, auto mechanics, telephone operators, and programmers), whereas there are no new professions in sight for the fourth industrial revolution. Third, the Fourth Industrial Revolution has no plateau in sight and its impact is expected to continue accelerating at a potentially exponential rate.

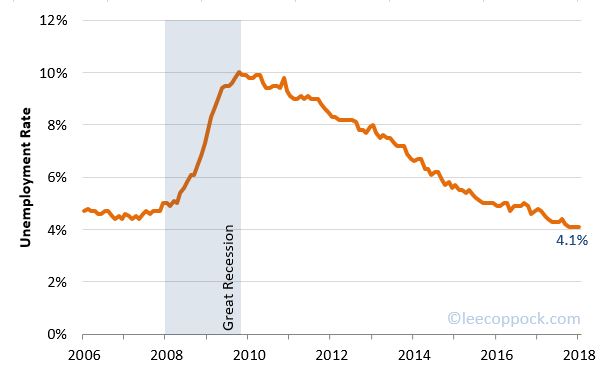

Personal Opinión: Although we are currently experiencing historically low unemployment rates in some countries, I am personally predicting that having double-digit unemployment will be the norm in North America starting from 2025. Contrary to what happened in the past, I do not expect this to be happening concurrently with a depression or even a recession.

Source: LeeCoppock.com

Increased welfare and employment insurance payments: Employment insurance government payments are expected to skyrocket with the increase in the unemployment. As employees fail to find new jobs, they will be moved to the welfare system. Looking at the list of "hot jobs" from Payscale, you will see that training for these jobs is not easy and very time-consuming. Moreover, these professions require certain abilities that many of the workers in the declining jobs may not possess. This means that we have a very low likelihood that these workers will be moving out of the welfare system at a fast rate even if they have undertaken the necessary education and training.

Higher deficits: The combination of the dropping tax revenue and the increased government expenditure related to the increased welfare and employment insurance payments will result in massive deficits for governments, the level of which is yet to be experienced. The governments will have to issue debt to cover this deficit, and most likely, only larger corporations will have the wherewithal to lend the money to governments. In other words, other countries, individuals and other smaller companies will not be able to buy government debt, and this will give larger corporations even more control than they currently have.

Increased power from larger corporations: Larger organizations, with capitalizations of $50B or more, would be the ones that either have the ability and funds to automate their operations using AI or are the ones producing automation and AI hardware and software. These companies will accumulate a large amount of funds from their operations, even if they distribute part of their cash as dividends. As shown earlier, these companies will most likely be the bigger investors in government debt. In addition, these large corporations will be the larger employers, and this will give them further power to demand tax concessions.

Example: A case in point for the power of corporations over governments is Amazon's search for its second headquarters. Amazon received enormous amounts of tax breaks/incentives/concessions from both the municipal and the state/provincial governments to entice them to choose a particular location for its headquarters.

A high level of personal and corporate bankruptcies: The above factors will result in an increased level of personal and corporate bankruptcies. We discussed the personal bankruptcies earlier, and they will primarily result from people losing their jobs and not having the skills to secure new jobs. Corporate bankruptcies will be for companies that missed the boat for the adoption of AI and automation. The companies that would have adopted AI in their automation effort will either buy these declining companies at a discounted price or force them into bankruptcies via entering into a price war with them. In both cases, the government will be losing tax revenue from these declining companies and the increased tax revenue from larger companies will not compensate for this loss; even in case of acquisitions, M&A synergies will play a major role in increasing the level of unemployment which will further exacerbate the government deficit.

What should the government do?

What should the government do?

While central banks have a limited set of tools that it can adapt to address the new economic model, governments can do a lot to address this new economic model through its fiscal policy. Following are some actions that governments can choose to adopt:

Reduce the government spending using AI and automation: With the expected high deficit as a result of reduced tax revenue, increased bankruptcies and increased unemployment and welfare expenditures, the government needs to work on balancing its budget or at least keep its deficit in check. With the limited control on the reduced tax revenue, the government will have no choice other than cutting the internal spending in the different ministries and departments.

With the availability of deep learning AI systems that can automate many of the government service operations, the government needs to move in this direction. Not only will this result in reducing the government spending, but it can also help in providing the government employees with the much-needed expertise that would help them transition into the "hot jobs" in the private sector, thereby removing much of the drawbacks that would come with laying off government employees.

With the availability of deep learning AI systems that can automate many of the government service operations, the government needs to move in this direction. Not only will this result in reducing the government spending, but it can also help in providing the government employees with the much-needed expertise that would help them transition into the "hot jobs" in the private sector, thereby removing much of the drawbacks that would come with laying off government employees.

Invest and increase the spending in technology and service automation projects: With the long-term vision of reducing the government spending, the government needs to first invest in projects that would position it to achieve this objective. The way to do that is to invest in technology and deep-learning service automation initiatives. These projects will require capital that the government may not have, and it would need to raise it from the capital markets using debt instruments. In other words, the government shall continue rolling its debt and even raise new debt. However, this would only be for a short period of time; as the deficit diminishes, the need for new debt would be reduced or even eliminated.

Provide incentives for teaching and learning the skills needed by the "hot jobs": Governments need to provide various incentives for encouraging educational institutions to change their curriculums to accommodate the industry needs. They can even adopt deep learning techniques to determine which programs would receive these incentives. These incentives can go to the students or to supplement the budgets of educational institutions that are providing these new programs. This action cannot take place overnight and would require some extensive research from the government to determine the amount of the incentives and the programs that for which it would be applicable.

Personal Opinion: I personally believe that the approach that some governments in some regions/countries (e.g. Ontario, Canada) are taking to reduce the budget for post-secondary education is very short-sighted. A wiser approach would have been for the governments to re-distribute the budget to focus on the "skills of the future".

Adopt universal guaranteed basic income programs instead of the welfare system: This is a controversial suggestion that many people may not agree with. I am suggesting here a "universal" system that would be available for all people, whether they are working or not. And, I am suggesting a "guaranteed" system that is provided with "no questions asked" similar to the one in Alaska, but on a larger scale.

Some opponents of this program will say that it will discourage people from finding work, but realistically, aren't the welfare systems around the world even more discouraging for people to find work? At least with a universal system, not working always puts someone at a financial disadvantage compared to someone who is working, while in a welfare system, the recipient may receive the same or higher income as someone who is working. There are also tons of other benefits for such a program, and they are elaborated on in many of the online resources. The Balance recently published an article that provides a good overview of the pros and cons of such a program.

According to the Basic Income Earth Network, many countries and regions are currently investigating the adoption of Guaranteed Basic Income pilots. The purpose of these pilots is to assess the social effects of such programs for the potential rollout across countries.

Adopting a Guaranteed Universal Basic Income program may be the only way for governments to avoid unrest. The benefits of such a program far exceed its massive cost, and may very well be the only method for stabilizing countries against the potential unrest resulting from abnormally high unemployment rates.

Personal Opinion: I do share the opinion of many thinkers and influential individuals (for example Dr. Martin Luther King, Edward Snowdon, Robert Reich, Jaron Lanier, …) about the importance of Universal Guaranteed Basic Income, and I believe that it may even be essential for the future human race's prosperity.How should our investment strategy change as a result of the introduction of this new economic model?

Asset allocation will remain as the key for any successful investment strategy and will continue to vary depending on the specific situation of every investor. However, there are still some fundamental changes in the asset allocation strategies that will result from the new economic model. With the new model, the interest rates shall continue dropping until they reach historical lows of potentially less than 1%. During the period in which the interest rates would be dropping, bond investments would be very attractive, and investors should start capitalizing on that by shifting their investments to bonds.

However, this attractiveness of bonds would not continue forever. Once the interest rates drop to the low historical levels and stabilize at these levels, the investors should start shifting their bond investments back into equity. The reason for this shift would not be because of the risk of the bond rates creeping higher, but rather because bonds rates would not likely further drop.

Personal Opinion: I personally expect the interest rates to be settling around a prime rate of 1% within the next 10 years with minimal chance of increasing in the foreseeable future after that.

The challenge would be how the investors should allocate their equity investments. This section of the paper will identify the key characteristics of companies (together with examples of companies) that are expected to grow under the new economic model. The paper assumes that the success of a company will depend on its current leadership position in at least one of the specific areas that are expected to grow under the new economic model. Simply put, new companies will appear and these companies may take over some of the existing leaders; whatever portfolio is created to capitalize on the new economic models would benefit from active management.

Leadership in AI software:

As described earlier, AI will be the primary driver for the new economic model. AI software is still behind and has a long way to go; companies that have a good leadership position in the AI software will be leading the charge. Companies that I particularly like in this area include:

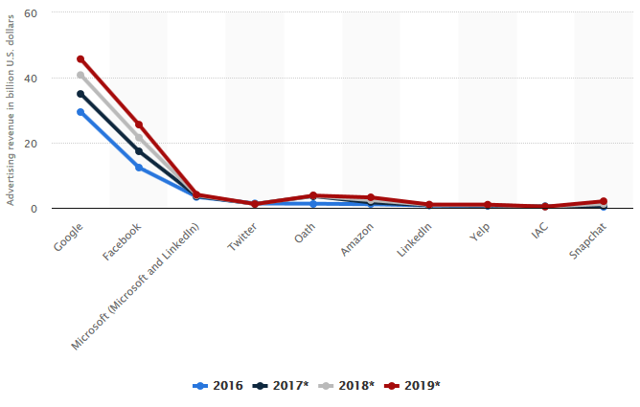

- Alphabet (GOOG) (NASDAQ:GOOGL): The company, through its DeepMind subsidiary, is probably ahead in the deployment of deep learning in its products and services compared to all other current companies. Deepmind applications are not only for beating humans in board games, but they extend to real-world impact in health, science, energy and other areas "to try to make the world a better place". I like Google financially because of its revenue generating capability and its market share of the digital ad revenue (over 30% and almost double the ad revenue of its next competitor, Facebook) and because of its diversification.

Personal Opinion: I got disenchanted with Google after they changed the design of their Google Finance. While it was in Beta, I sent them a few messages explaining the drawback of their new design, but it fell on deaf ears. Since then, I switched to Yahoo Finance and decided not to invest in Google. Other than this negative experience with Google, my research of the company indicates that they have an amazing potential for being the world leader in AI, primarily because of the abundance of data that they possess.

Source: Statista

- Amazon (AMZN): According to Fast Company's article, "How AI is helping Amazon become a trillion-dollar company", AI shaped every aspect of Amazon's business, from its warehouses to Alexa, passing through its AWS operations, to become a trillion dollar company. Practically, every offering of Amazon is now relying on AI and deep learning to optimize its operations and provide the ideal customer experience. I personally like Amazon because it is the first, and usually the last resource for most of my online shopping. In addition, as a prime subscriber, I am using its streaming services. In addition, I also think that Amazon has reached the tipping point in terms of capital expenditures and that its net income will be growing at a steady high rate for the foreseeable future.

- IBM (IBM): IBM is one of the leading companies in AI software with its Watson Analytics product. According to Forbes, "Rather than only statisticians or computer scientists having access to the kinds of technologies that help us truly understand our customers, employees, and operations, Watson Analytics is making it possible for people in every department -- whether finance, HR, marketing, or operations -- to type in questions such as, 'What are the key drivers of my product sales?' or, 'Which deals are the most likely to close?' and get the answers they need." I specifically like IBM because of its relatively low PE ratio (19) compared to other technology companies in its caliber and its relatively high dividend yield (5.35%).

- Microsoft (MSFT): According to Microsoft's web site, their focus is on futuristic transformation of lives, industries, and societies. In doing that, they are "empowering developers' innovation, organizations' transformation, bringing AI to every application, business process and employee, and empowering people to transform society". As a leader in development tool production and operating systems, Microsoft is well positioned to play a leadership role in creating AI development tools and integrating AI into its new Windows operating system. For example, I would not be surprised if Microsoft comes up with a generic Neural Network application and make it available as an integral part of its operating system. I particularly like Microsoft because of the potential high growth in its Azure cloud services, its distribution of dividends, its diversified operations and its focus on developers and startup companies through its Microsoft Development Network and BizSpark, now called Microsoft for Startups.

- Palo Alto Networks (PANW): The company is specialized in creating security platforms. Hackers are already causing enough damage without the power of AI; with using AI, the hackers can potentially be unstoppable unless the security protection software is also using AI. PANW is focusing on using Machine Learning in its products, and many analysts consider it a market leader in this area. I financially like PANW as it is expected to turn a profit in the next earnings report and because I consider it as an acquisition target.

Leadership in hardware used in AI

With the focus on software and the establishment of deep learning neural networks capable of creating new deep learning neural networks, the hardware aspect of AI would start gaining prominence. Hardware has traditionally been ahead of software, but I think that with AI the balance is shifted, and hardware is now playing catch-up with software advancements in deep learning. Companies that I particularly like in this area include:

- Huawei: Despite the political pressures from Western countries, the company (180,000 employees and revenues of $90B) is still leading the world in 5G technology. 5G technology is essential for the usage of AI in the new economy; Deep Learning algorithms cannot operate without huge amounts of data going back and forth from cloud data storage to mobile devices, and having 5G networks is essential for fulfilling this. That is, 5G networks are an essential component of the new economical model described in this paper. As of the time of writing this paper Huawei is a private company and has no plans for listing on the public markets.

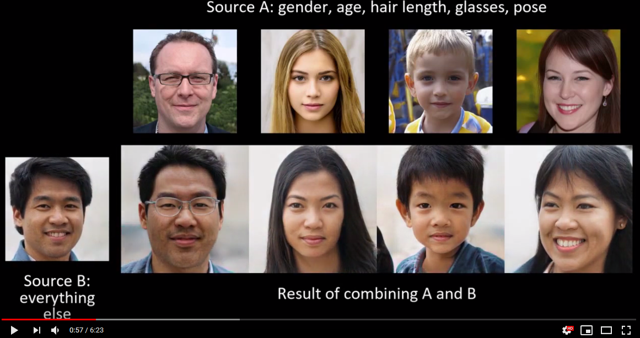

- Nvidia (NVDA): In addition to being the world leader in Graphical Processing Units (GPUs) and Application Specific Integrated Circuits (OTC:ASIC), Nvidia has a tremendous focus on AI applications from the software side as well. For example, Nvidia has created the first video game demo using AI-generated graphics in December 2018. In addition, it is now almost impossible to differentiate between AI generated human faces and real portraits as shown in this video. Most importantly, GPUs and ASICs are already playing a major role in the processing of deep learning algorithms. The technologies that we used to see in science fiction movies where computers can change an inconceivably blurred image to a crystal clear one are now a reality because of Nvidia's processors.

What I particularly like about Nvidia is its highly depressed price and low PE (18). I personally believe that NVDA was beaten hard in the last technology rout because of the drop in the demand for crypto mining equipment, but I consider this is more of a temporary event, and AI hardware demand increase will continue to fuel the company growth.

Source: YouTube

- Tesla (TSLA): The automotive industry (3% to 3.5% of the overall US GDP) is transforming in two key directions: Electrification and autonomous vehicles. Tesla is the world leader on both fronts and is investing huge amounts on its deep learning algorithms that are propelling the AI used in its autonomous vehicles. Despite all the challenges that Tesla may be facing, its leadership position will put it at an enviable position when operating under the new economic model. What I like about Tesla is its visionary direction, the strong following from its customers and the automation they have adopted in their manufacturing process. In addition, I like the focus that Tesla has on the battery production and electric power storage using batteries, which many consider as a unique growth industry. I believe that the company operational challenges are now over the hump and that its net income will continue increasing at a fast rate as its production volume increases.

Personal Opinion: I personally believe that the future is in hybrid vehicles rather than pure electrical vehicles. Most of the driving happens for less than 100KM per trip (average length of a commute to work is less than 30 minutes), and the weight of the batteries that are needed for longer ranges is much higher than the weight of an Internal Combustion Engine (ICE) motor. In other words, if a car has both an ICE motor and an electric motor, it will be lighter thereby consuming less energy, and will rarely use the ICE motor. This means that hybrid cars are generally more environmentally friendly, and given that the batteries are the most expensive component of cars nowadays, the next generation hybrid cars would most likely cost less than pure electric cars.

Leadership in database management and Data Storage

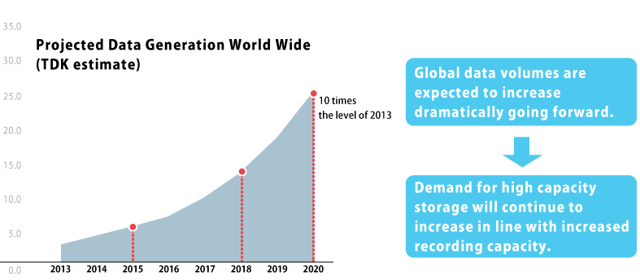

Deep Learning Neural Networks require huge amounts of data for their training phases, and there will be a big demand for companies that provide data storage platforms. There are companies that I discussed earlier like Microsoft and IBM that provide data storage hardware and software solutions, and I will not repeat them again here. I will rather discuss other database storage companies that have not been discussed earlier.

Source: TDK Global

- Oracle (ORCL): One of the hallmarks of the new economic model is the usage of data for driving deep learning neural networks training. As a result, companies that are specialized in data storage will play a major role in this new economic era. It is not very clear whether Microsoft or Oracle is the world leader in data storage software; the financial statements of both companies do not separate data storage revenues from other revenues. Having said that, Oracle is certainly one of top two contenders. Oracle is also expanding in the area of cloud computing, and its possession of the data storage hardware technology will position it for strong growth in this area. What I like about Oracle is its diversification into application software, its stable revenue sources and the stickiness of its products.

Personal Opinion: The only thing that I do not like about Oracle is that the starting price point for Oracle software products is remarkably higher than its competitors; this might limit its penetration into the operations of the new technology companies. For this reason, I am not planning to include Oracle as part of my personal investments.

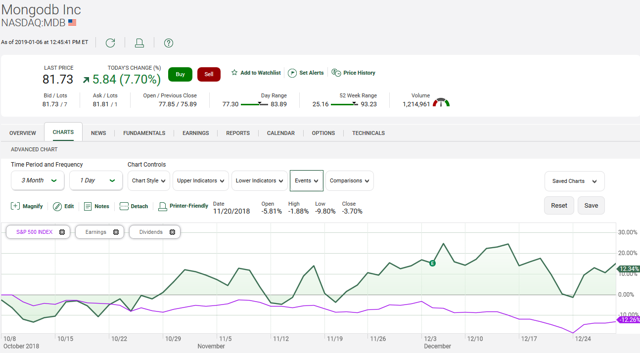

- MongoDB (MDB): MongoDB is a document database and it is specifically designed to handle "Big Data". The new economic model is characterized by using the vast amounts of data available in training the deep learning neural networks; given that most of the data generated in the world is not heavily structured, companies that provide unstructured big data platforms are well positioned for growth under the new economic model. What I financially like about MDB is that its stock price did not drop with the last technology rout compared with other companies and that its growth potential is very high. The company is relatively small compared to the other companies in this paper (capitalization is only $2.9B) and it is still not profitable. However, I strongly believe in the company product and think that it is a good takeover target within the next two years at the range of $4B to $6B.

- Dell EMC (DELL): Since the blockbuster $67 billion merger of server and PC maker Dell with data storage giant EMC in 2016, the combined company has lived up to the EMC's legacy. It remained atop the external enterprise storage systems market, essentially the arrays that make up a SAN and/or NAS. With the huge demand on data storage and the growth of data creation as the result of the expansion of the Internet of Things (IoT), the demand for storage will continue and Dell EMC will be there to reap these benefits. Dell became a private company in 2013 and became listed again in December 2019.

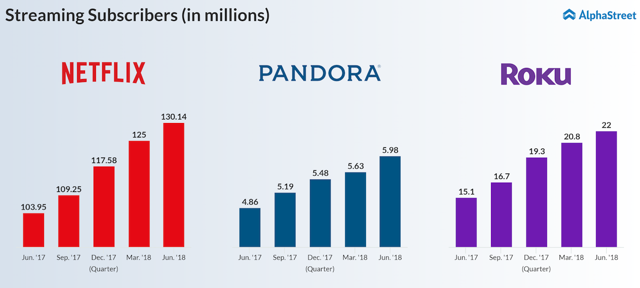

Leadership in entertainment and original content

With the increased unemployment, the reduced number of working hours and the introduction of the proposed Guaranteed Basic Income programs, entertainment will be an integral part of people's lives.

The key for entertainment will continue to be original content, and companies that generate original content will be the winners in this one. Many big companies realized the importance of original content and put lots of money into this area. Some of these companies have been presented earlier in this section, and I will not discuss them again (e.g. Amazon).

The key for entertainment will continue to be original content, and companies that generate original content will be the winners in this one. Many big companies realized the importance of original content and put lots of money into this area. Some of these companies have been presented earlier in this section, and I will not discuss them again (e.g. Amazon).

- Netflix (NFLX): Netflix is currently the largest distributor of entertainment content through video streaming. However, compared to its competition (maybe with the exception of Disney), Netflix is focusing on the creation of new video content. Netflix is planning to spend $8B next year on new video content. This puts Netflix at a leadership position from a content perspective among the video streaming companies, and it is expected to capitalize on that when operating under the new economic model. What I particularly like about Netflix is its steady source of revenue and its focus on original content. Without the original content that they are focusing on, the barriers to entry would be limited because of the low switching costs, and Netflix could potentially end up losing their subscriber base to the competition.

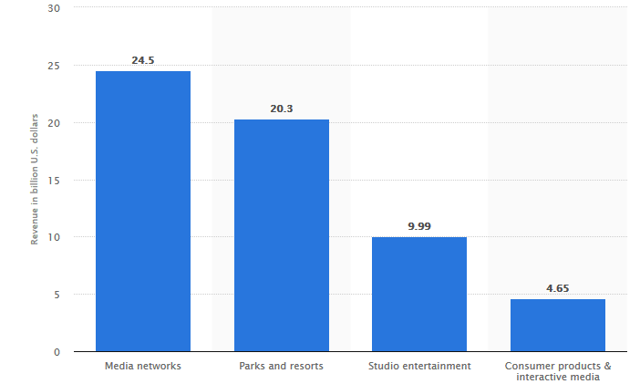

- Disney (DIS): By many measures, Disney can be considered the world leader in the entertainment business. It is the only company in the Dow that is in this sector, and while its capitalization is in the same range as that of Netflix ($129B for Netflix and $163B for Disney), the company has a much higher revenue, net income, and a much stronger balance sheet. In addition, Disney is planning to pull out its content (e.g. Star Wars and Marvel) from Netflix streaming and to launch its own streaming service. Disney is fairly unique from a financial perspective as the Disney balance sheet does not take into consideration the current value of its real estate; if the Disney financials are adjusted to take the value of the real estate into consideration, it could be easily valued at a few multiples above its existing valuation; just consider that Disney World in Florida is the size of San Francisco. What I particularly like about Disney is its brand, its creation of most of the blockbuster movies in the last decade, and its continued diversification into different entertainment areas.

Source: Statista, Revenue of the Walt Disney Company in the fiscal year 2018

I have presented here twelve public companies which I strongly believe in. It would be interesting to create a portfolio of the above-mentioned public companies and compare it against how the market would perform within the next five years. I am personally expecting this portfolio performance to far surpass that of the major indices. I have prepared a spreadsheet that would help in the analysis and comparison, and you might like to download it and play with it.

Conclusion

The technological advancements associated with the Fourth Industrial Revolution with the special focus on Artificial Intelligence, Deep Learning and automation of everything, including services, will have a profound effect on the culture and societies of all countries. At the same time, a new economic model that we have never experienced since humans started recording their history will emerge faster than many can imagine. The hallmarks of this new economic model will include consistent unemployment rates higher than the ones experienced in the great depression, continuous GDP and GNP growth (no recession), historically low interest rates combined with a shrinking debt capital market and consistent low inflation bordering on the edge of deflation.

Central banks, governments, and investors need to change the way they are operating to be able to properly address this change.

Central banks' hands will be tied in front of this overwhelming economic and cultural change, and the best approach for them is to be reactive rather than proactive.

Governments need to make fundamental changes in their fiscal policy to address their increasing deficit and the high unemployment.

Investors will have an opportunity to capitalize on this economic change by focusing on companies that are leading in the areas of Artificial Intelligence, Deep Learning and Automation. The paper identifies the following companies as potential investments: Alphabet, Amazon, IBM, Microsoft, Palo Alto Networks, Nvidia, Tesla, Oracle, MongoDB, Dell, Netflix, and Disney.

0 comments:

Publicar un comentario