Meet the New Payment Champions, Same as the Old Ones

New ways to pay for things still lead back to Visa and Mastercard

By Aaron Back

Photo: Alicia Tatone

A couple of years ago, the payments landscape in the U.S. looked like it was up for grabs. Hardware companies like Appleand Samsung, online ones like Google and Amazon, banks like JPMorgan Chaseand retailers like Walmartwere all unveiling their own new ways for Americans to make purchases, especially with their phones.

Now that the dust is beginning to settle, it is increasingly clear that the ultimate winners are likely to be the same old credit-card companies that already dominated: Visa and Mastercard . MA -0.53%▲ Among less traditional players, PayPallooks best positioned, thanks largely to a flexible strategy that accommodates these giants.

That would be a disappointment to many—especially merchants—who had hoped that the rise of digital payments would disrupt these incumbents. Along with banks that issue the cards, Visa and Mastercard take a slice of every debit and credit-card transaction that runs over their networks. That costs merchants money, but it often works out to the benefit of consumers as these transaction fees pay for cash back or other card rewards.

In recent years there has been a somewhat bewildering proliferation of ways to pay for things. Some retailers like Starbucksand Dunkin’ Donuts let you pay at the register by scanning a code on your phone. Other systems like Apple Pay use a chip embedded in a smartphone; you just pass your phone over a checkout terminal to pay in a “contactless” transaction.

The vast majority of the time, though, all these methods are really just different means of delivering your credit- or debit-card information to the merchant.

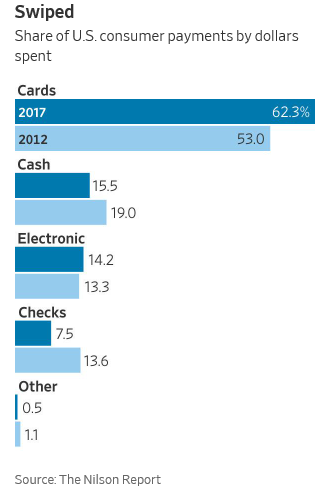

As a result, the centrality of Visa and Mastercard has only been reinforced. The Nilson Report, a payments-industry-focused publication, estimates that debit and credit cards accounted for 62% of total consumer payments in 2017, up from 53% in 2012. They see this rising to 70% in 2022, while truly online payments that bypass the card networks will remain fairly stable at around 14% total. Cash and checks are steadily disappearing as ways to pay.

This differentiates the U.S. from how mobile payments have developed in certain emerging markets, especially China, where WeChatPay and Alipay are far more ubiquitous and allow merchants to save substantial amounts on transaction fees by leaving out credit-card networks.

PayPal’s decision to open up more to Visa and Mastercard in 2016 was a crucial turning point. It began to allow consumers to more easily link their accounts to credit and debit cards, as opposed to funding purchases with their PayPal balances or bank accounts. In return, the card networks began allowing PayPal to use their contactless payment technology so customers could use their PayPal mobile wallets to pay for purchases in stores.

This means that when consumers buy something with PayPal, or Venmo, its more youth-oriented brand, the company gives up a more substantial cut of every transaction since it has to pay fees to the card networks and card-issuing banks. Indeed, for contactless in-store payments PayPal earns exactly zero.

At the heart of PayPal’s business model now is its online checkout button that appears on vendor websites. It saves consumers the trouble of having to input their card numbers, which also has the effect of increasing merchants’ sales by making it more convenient to check out. The fees that PayPal collects from merchants for this now account for around 85% of its revenue, and it has 50 times the volume of its closest competitor Amazon Pay, according to MoffettNathanson.

PayPal also owns Braintree, which is a platform used by highly mobile companies like Uber and Grubhubto process payments.

PayPal’s main weakness remains in-store payments. Until recently it had very limited point-of-sale offerings for merchants to accept payments in stores. Last year it acquired iZettle, a Swedish company that makes payment terminals, bringing it into direct competition with companies like Square, which makes credit-card readers popular with small merchants.

But PayPal Chief Executive Dan Schulman has made it clear he doesn’t see this as the most important area long term as mobile devices blur the distinction between online and offline purchases. For instance, customers may order and pay for something on a mobile device and then pick it up in a store.

A truly “omnichannel” system that helps merchants accept any kind of payment through any channel, at a checkout counter or on a mobile device, is “the Holy Grail of payments right now,” says MoffettNathanson analyst Lisa Ellis.

“Most retailers of any size have very different systems for processing in-store payments versus website payments. It’s actually extraordinarily difficult,” she added.

No one is quite there yet, but PayPal looks closest to being able to integrate these seamlessly by bringing together Braintree, its iZettle acquisition and its online checkout button.

Even if this Holy Grail is attained, it won’t change the fact that most transactions run over the card network rails. That would make Visa and Mastercard the ultimate winners of the quest.

0 comments:

Publicar un comentario