Fed Will Be the Bearer of Bad News

Markets and the Fed disagree about the odds of rate increases this year now that stocks have retreated

By Justin Lahart

Declines in the stock market have led investors to expect the Fed will ease up on interest-rate increases in 2019. Photo: Andrew Harnik/Associated Press

Investors have convinced themselves that the Federal Reserve probably won’t be raising rates this year. Even if that bet turns out to be right, it presents a big problem for the Fed.

At their meeting last month, Fed policy makers projected they would raise rates twice in 2019.

That was a step down from the three 2019 hikes they projected in September, reflecting how trade tensions, slowing growth overseas and unsettled markets have thrown more uncertainty into the rate-setting equation.

Investors, staring at the steep declines in the stock market, now expect the Fed to do even less.

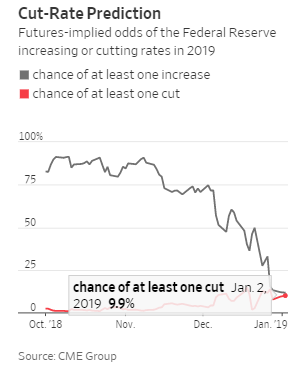

Interest rate futures imply there is only about a 10% chance that the Fed will raise rates at all this year, with a nearly equal chance that the central bank ends up cutting rates instead. In early November, the futures put the odds of at least one 2019 rate increase at close to 90%, with almost no chance of a cut.

But as long as the economic data continue to look decent, the Fed may want to at least maintain the option of raising rates as soon as its March meeting, points out Morgan Stanley economist Ellen Zentner. The risk, though, is that Fed policy makers decide there is a case for raising rates and the market continues to disagree.

“Right now, it’s just an extraordinary amount of heavy lifting they have to do if they want to go in March,” says Ms. Zentner.

That heavy lifting would most likely take the form of more hawkish commentary from Fed officials than investors are prepared for. Given how fragile markets are, it is a message that would be difficult to deliver without breaking something.

0 comments:

Publicar un comentario