Did The Fed Just End The Bear Market?

by: Victor Dergunov

Summary

- Chair Powell indicated the Fed is much more dovish than previously perceived.

- With the "Fed Put" essentially back on the table, the recent bear market may have just turned into a compelling buying opportunity by the Fed.

- Also, it's not just the Fed, other constructive fundamental, psychological, and technical factors are emerging.

- Stocks needed a catalyst to move higher, and now they appear to have the necessary ammunition to proceed with their rise.

- Sentiment is improving, and will likely continue to strengthen going forward, which may enable stocks to continue to appreciate over the next 3-6 months, possibly longer.

- With the "Fed Put" essentially back on the table, the recent bear market may have just turned into a compelling buying opportunity by the Fed.

- Also, it's not just the Fed, other constructive fundamental, psychological, and technical factors are emerging.

- Stocks needed a catalyst to move higher, and now they appear to have the necessary ammunition to proceed with their rise.

- Sentiment is improving, and will likely continue to strengthen going forward, which may enable stocks to continue to appreciate over the next 3-6 months, possibly longer.

The Fed Just Put An End To The Bear Market

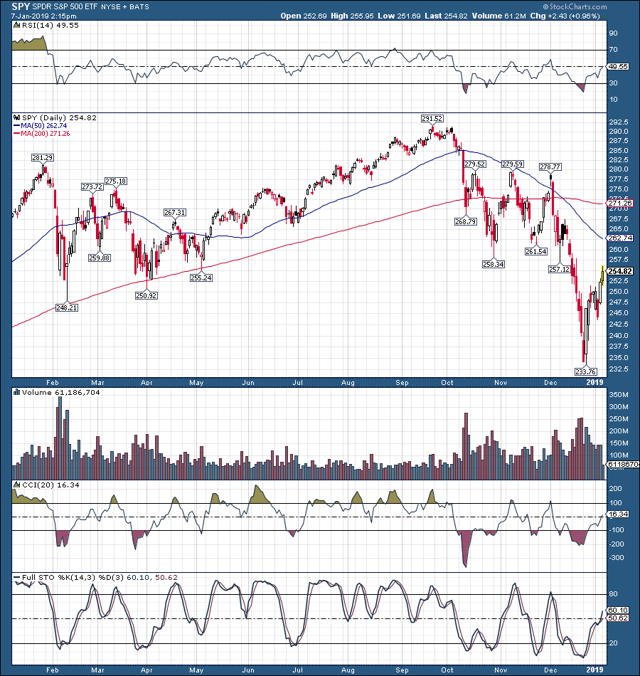

The S&P 500/SPDR S&P 500 Trust ETF (SPY) dipped into official “bear market” territory late last year, declining by as much as 20.2% at one point. However, this may turn out to be the shortest-lived bear market in history, as the Fed’s infamous put is essentially back on the table.

SPY 1-Year

Due to the Fed’s notably more dovish stance, coupled with other constructive short to intermediate term catalysts, sentiment is likely to improve considerably, and stocks are likely to rally substantially higher from here. In fact, the Fed may have just turned the bear market into another generous buying opportunity in equities.

About SPY

SPY is the first major and most popular ETF in the world. It's designed to mimic the exact movement of the S&P 500. The SPY index fund has roughly $240 billion in net assets, and each share in the fund represents a fraction of the holdings.

SPY provides investors with exposure to the S&P 500 index, which is widely regarded as the most significant stock market average for U.S. equities. Since SPY essentially tracks the exact movements of the S&P 500, I will use SPY and the S&P 500 interchangeably throughout this article.

What’s With the Fed?

It’s difficult to overstate just how impactful Fed policy is on markets and the overall economy. So much stems from the Fed’s actions, like borrowing costs, bond yields, credit standards, liquidity, economic growth, and perhaps most importantly for the stock market, sentiment.

It wasn’t so long ago that the Fed seemed committed to normalizing rates further (above 3%), and keeping the unwind of its balance sheet on “autopilot”. However, this policy path was putting significant strain on the economy as it was essentially pulling liquidity out of the system by raising borrowing costs, and introducing excess treasuries into the bond market. This created various consequences that began to suppress economic activity, and stocks took notice.

Some segments of the economy began to show substantial signs of an economic slowdown, some corporate earnings began to falter, the S&P 500 along with other major averages took a nose dive, talks of a bear market and a recession started to surface, and even the president seemed upset.

So, who’s at fault? Well, some market participants believe it’s the Fed. After all, if the Fed had taken its foot off the tightening gas pedal earlier, perhaps markets would not be going through this slowdown, and stock prices would not have imploded in the fourth quarter of last year.

Reportedly, President Trump even contemplated firing the Fed chair following the Fed’s latest rate hike which sent stocks into a tailspin. Now, I’m not suggesting that the President will or even can fire the Fed chairman. There appears to be no precedent for such action, and chair Powell has since said he would not resign, even if the President asked him to.

However, it isn’t about the President, it’s about Powell, and whether the current Fed chair wants to be remembered as the person responsible for pushing the U.S. economy off a cliff due to unreasonable monetary policy. The likely answer is no, and just like that, the “Fed Put” is firmly back on the table once again.

The Fed’s Unprecedented 180

Chair Powell struck a very different note on Friday, as he essentially capitulated across the board. “The Fed will now be patient in regards to interest rates”, meaning there may not be any hikes at all in 2019. Suddenly, the balance sheet unwind isn’t on autopilot any more. In fact, chair Powell mentioned that “We (the Fed) wouldn’t hesitate to change it (monetary policy) and that would include the balance sheet”. Powell also said, “the Fed is able to adjust policy quickly and flexibly”, suggesting that the Fed may be ready to cut rates, and this may happen a lot sooner than later according to markets.

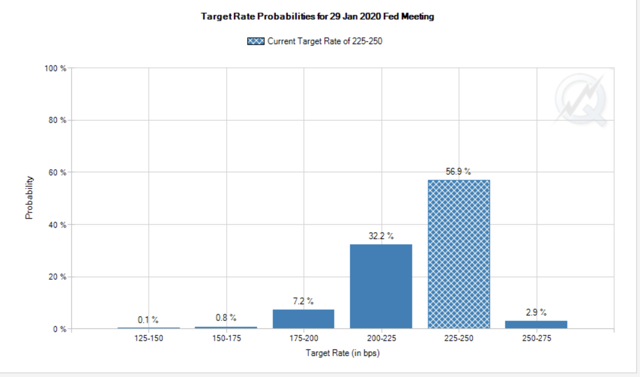

Remarkably, if we look at the Fed funds rate trajectory one year from now probabilities point to the funds rate being at or lower than it is today. So, the market is no longer expecting 2-3 rate hikes from the Fed this year. The market is expecting zero rate hikes or possibly even a rate cut or two this year.

Source: CMEGroup.com

Currently, there is about a 57% chance rates will remain the same, a 32.2% chance they will be a quarter point lower, a 7.2% chance they will be a half a point lower, and only a 2.9% chance they will be a quarter of a point higher one year from now.

What this Means for Stocks

The Fed Put is back on the table, which means that markets believe the Fed will act to support asset prices, much as it has throughout the last decade, since the recovery began in 2009. This means the Fed is extremely unlikely to raise rates again in this cycle, it may lower rates at any time, may put its QT program on hold, and yes, may even implement new rounds of QE if needed.

This eliminates a significant portion of the uncertainty from the equation. Stock markets hate uncertainty, and the fact that the Fed “gets it”, and is ready to act should improve sentiment substantially going forward.

Therefore, what we’ve seen transpire in stocks over the past several months is probably no longer the start of a bear market, but is much likelier the conclusion of a significant correction instead. Stocks needed a comprehensive catalyst to move higher, and the Fed likely provided the badly needed stimulus with its unprecedented 180-degree shift in monetary policy outlook.

Due to the significant shift in policy outlook, there appears to be a strong probability that the stock market rally can continue from here. It is now likely, that absent any extremely detrimental unforeseen challenges, stocks could stage a powerful rally in the first half of 2019.

Furthermore, the Fed is not alone, other favorable elements capable of propelling stocks higher in the near term are aligning as well.

Blowout Jobs Numbers

Although jobs are a lagging indicator, the most recent report was stellar, and does suggest that the economy was functioning at a relatively high level very recently. Nonfarm payrolls surged by 312,000 in December, a 77% beat over the consensus 176,000 number, quite remarkable.

Furthermore, wages grew by a very health 3.2% YoY, implying that the consumer’s salaries expanded nicely, which should reflect positively on consumer confidence, and overall spending.

Wage growth was tied with October, for the best month in nearly a decade. Amongst the top gainers were sectors like construction, manufacturing, healthcare, and restaurants, illustrating signs of a relatively healthy and somewhat vibrant economy.

Also, it’s not just jobs numbers, much of the financial data coming in recently, including consumer sentiment, personal spending, manufacturing, and even housing has been coming in as or better than expected in recent weeks.

Corporate Earnings Could Surprise

Another factor that is likely to support the recently adopted rally in stocks are corporate earnings.

Earnings season is about to kick off into full swing, and many companies' bars have been lowered by previously revised earnings, and/or expectations of a slowing economic atmosphere.

This phenomenon, coupled with the continuation of the relatively constructive economic data, suggests that the earnings slowdown may not be as significant as some had envisioned. In fact, it is possible, likely even, that this earnings season may be quite strong, with many companies likely to beat their EPS estimates.

Trade Agreement Likely Imminent

Another potential constructive element to consider is the formulation of a trade deal with China.

Almost nobody wants a prolonged trade war. It’s bad for business, bad for President Trump’s reelection aspirations, but perhaps most of all, it’s extremely bad for China. The U.S. imports far more products from China than China imports from the U.S., therefore, the Chinese economy has a lot more to lose and is therefore far more effected by the ongoing trade war between the two nations.

Plus, the pressure is on the President to deliver a trade deal, and to end this trade skirmish before it begins to deeply effect the U.S. economy and stocks in general. Donald Trump is known for being a businessman, was elected on many promises about improving the economy, and never forgets to take a victory lap when the stock market goes up. Likewise, when stocks decline, it casts an enormous shadow over his entire administration and questions his productiveness while in office. It certainly decreases his chances of being reelected as well.

Therefore, the pressure is on the President to get a deal done, and get one done soon.

Incidentally, China’s leader also finds himself in a tight spot where a deal needs to get done, as China’s economy is beginning to show signs of a slowdown, and the U.S. appears to be in a better position to withstand a trade war. Thus, a deal is likely to get done, and it will likely get done soon, as it serves the interests of both countries, as well as both presidents, and stocks should benefit as a result.

Technical Forces

Yet, another factor suggesting the S&P 500’s rally is likely to continue is the overall technical image surrounding stocks.

SPX 5-Year

The S&P 500 declined by 20.2% from a high in early October to a low in early December. This is essentially borderline between the start of a bear market, or the end of a deep correction. In any case, the SPX became incredibly oversold in the process, registering its highest volume day in at least 5 years.

On December 23rd, in an incredibly volatile trading session which saw an intraday move of over 100 points, roughly 5 billion shares traded in S&P 500 companies. This is more than double the daily average.

Moreover, this was the day prior to the shortened day before Christmas which capped the month’s epic decline, during which the S&P 500 crashed by 16% from 2,800, all the way down to 2,346 in just 3 weeks. During these last two days of the decline, the SPX moved by more than 150 points, or roughly 6%, these were the days of panic and capitulation.

Additionally, the SPX made a clear retest of this level the day after Christmas day, when markets reopened, and then went on to close at the highs of the session, in a clear reversal day, a day in which the SPX moved by more than 125 points or 5% intraday. This kind of price action is strongly suggestive of at least a firm short- to intermediate-term bottom in stocks.

Sentiment Shift Occurring

The Fed is a master at shifting sentiment because of the enormous influence it wields over the economy, and sentiment is an incredibly important psychological force that moves markets. The Fed’s openness and apparent flexibility to a policy reversal, coupled with the alignment of constructive fundamental and technical elements, are very likely to shift sentiment to a much more positive tone going forward. Therefore, SPY and stocks in general are likely to move higher going forward.

The Bottom Line: We Just Got Our Catalysts

Last month it wasn’t quite clear what catalysts would prevent stocks from going into a bear market, and what factors, if any, would enable the S&P 500 to move substantially higher once a short-term bottom had occurred. The Fed seemed hard-set on continuing its tightening path, some economic data appeared very sluggish, there was a certain degree of pessimism hanging over corporate earnings, and overall sentiment seemed rather abysmal.

However, now that the “Fed Put” is back on the table, and several constructive fundamental, technical, and psychological elements have emerged, it appears the market may have the badly needed catalysts it needed to substantially improve sentiment and ultimately send stocks higher over the next several months.

I expect the S&P 500 can have a productive Q1, and the rally may spill over into Q2 as well.

Overall, the first half of 2019 may prove to be a good period to own stocks.

Nevertheless, the economy and the stock market are still likely to face some economic headwinds in the latter half of 2019, and in 2020. The Fed cannot fix all the problems in the economy. While a policy shift will likely prolong the current economic expansion by a few quarters, a recession is still likely to materialize, possibly as early as late 2019 or early to mid-2020.

0 comments:

Publicar un comentario