Behind the Market Swoon: The Herdlike Behavior of Computerized Trading

The majority of trades come from machines, models, or passive investing formulas that move in unison and blazingly fast

By Gregory Zuckerman, Rachael Levy, Nick Timiraos and Gunjan Banerji

Steven Mnuchin, U.S. Treasury secretary, right, speaks with Jerome Powell, chairman of the U.S. Federal Reserve, during a Financial Stability Oversight Council meeting at in Washington, D.C. Wednesday. Al Drago/Bloomberg News

Steven Mnuchin, U.S. Treasury secretary, right, speaks with Jerome Powell, chairman of the U.S. Federal Reserve, during a Financial Stability Oversight Council meeting in Washington, D.C. last week.

Behind the broad, swift market slide of 2018 is an underlying new reality: Roughly 85% of all trading is on autopilot—controlled by machines, models, or passive investing formulas, creating an unprecedented trading herd that moves in unison and is blazingly fast.

That market has grown up during the long bull run, and hasn’t until now been seriously tested by a prolonged downturn.

Since peaking in late September, the S&P 500 index of U.S. stocks has fallen 19.8%. The S&P is down 15% in December alone. It isn’t just stocks. Crude oil stood above $75 a barrel in October. By Christmas Eve it was below $43. Monday was the worst Christmas Eve for the Dow Jones Industrial Average in its history.

To many investors, the sharp declines are symptoms of the modern market’s sensitivities. Just as cheery sentiment about the future of big technology companies drove gains through the first three-quarters of the year, so too have shifting winds brought the market low in the fourth quarter.

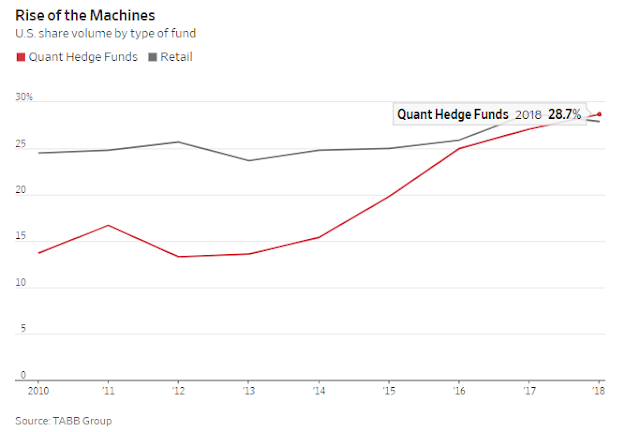

Today, quantitative hedge funds, or those that rely on computer models rather than research and intuition, account for 28.7% of trading in the stock market, according to data from Tabb Group--a share that’s more than doubled since 2013. They now trade more than retail investors, and everyone else.

Add to that passive funds, index investors, high-frequency traders, market makers, and others who aren’t buying because they have a fundamental view of a company’s prospects, and you get to around 85% of trading volume, according to Marko Kolanovic of JP Morgan .

“Electronic traders are wreaking havoc in the markets,” says Leon Cooperman, the billionaire stock picker who founded hedge fund Omega Advisors.

Behind the models employed by quants are algorithms, or investment recipes, that automatically buy and sell based on pre-set inputs. Lately, they’re dumping stocks, traders and investors say.

“The speed and magnitude of the move probably are being exacerbated by the machines and model-driven trading,” says Neal Berger, who runs Eagle’s View Asset Management, which invests in hedge funds and other vehicles. “Human beings tend not to react this fast and violently.”

Among the traders today are computers that buy and sell on models, and passive funds that seek only to hold the same securities as everyone else does. Meanwhile, bankers and brokers—once a ready source of buying and selling—have retreated. Today, when the computers start buying, everyone buys; when they sell, everyone sells.

The market of 2018 is a creation years in the making, and would be hard to quickly unwind give how much is now baked into the system.

President Donald Trump vowed he would not reopen the government until he gets $5 billion to fund his border wall, as the partial government shutdown dragged on. Photo: saul loeb/Agence France-Presse/Getty Images

Troubles in financial markets, rather than in global economies, best explain the recent market losses, argues Michael Hintze, chief executive officer of $18.1 billion London-based CQS LLP, which manages two big hedge funds that were positive for the year through November.

Mr. Hintze says “the market’s new structure,” featuring less trading by investment banks and more by algorithmic-focused funds, has reduced the ease with which investors can get in or out of markets. As a result, normal year-end nervousness has been amplified, and selling that in the past would have resulted in measured losses leads to deep drops.

Markets were remarkably placid in recent years, even as machine trading came to dominate, suggesting that these approaches didn’t cause problems during the bull market, or even contributed to the market’s extended calm.

One reason the dynamic might have changed: Many of the trading models use momentum as an input. When markets turn south, they’re programmed to sell. And if prices drop, many are programmed to sell even more.

The robots didn’t trigger the decline, of course. But they devoured a stew of red signals in the second half of the year:

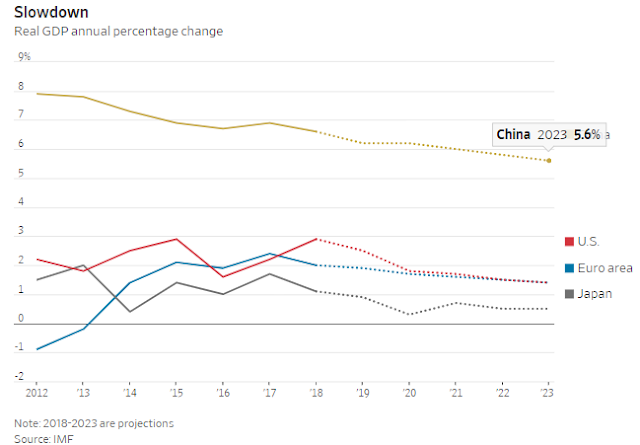

—A slowdown in growth in the economies of Japan, China and Europe, and suggestions the U.S. might be moderating a little bit too.

—The end of an era of low interest rates and easy money. In late September, the Fed pushed interest rates above the rate of inflation for the first time in a decade. This month, the ECB confirmed it would end its $3 trillion bond-buying program. For investors, higher rates mean something they haven’t seen in a while: You can earn money holding cash.

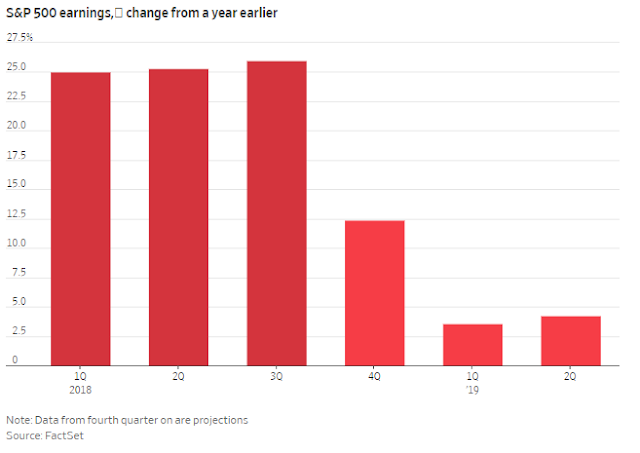

—A decline in the growth of corporate profits. In each of the first three quarters of the year, profits of S&P 500 companies rose about 25% from a year earlier, helped by the corporate-tax cut. According to FactSet projections, earnings growth for the S&P 500 in the fourth quarter will be less than half what it was earlier in the year. It will fall into single digits in 2019.

—Erratic politics in large parts of the world. The U.S. and China are embroiled in a trade dispute. President Trump is openly denigrating the Federal Reserve on Twitter. Britain is fumbling through Brexit and Italy through an economic drought with consequences for its giant bond market.

The bouts of automated selling have landed in a market ill-prepared for it.

One measure of this is liquidity, the ease with which buyers can find assets to buy and sellers can find people to take assets off their hands. When liquidity declines, prospective buyers have to offer more or prospective sellers have to accept less. That makes swings in market prices bigger. It works both on the way up and on the way down.

Signs of diminishing liquidity can be found all across the markets.

The number of contracts available to buy or sell S&P 500 futures at the best available price has dwindled in recent years and dropped 70% over the past year alone, hitting a decade low, according to Goldman Sachs.

Boaz Weinstein, founder of credit hedge fund Saba Capital Management LP, said the market had been underpricing uncertainty. Now it’s taking into account political issues “at the same time as the Fed is hiking, the economy is slowing, and a lot of people are feeling like the best days for markets are over,” he said.

Mr. Weinstein says there are dangers building in the junk-bond market. One worry, he says, is that so many junk bonds—he estimated about 40%—are held by mutual funds or exchange-traded funds that allow their investors to sell any day they like, even though bonds inside the funds are hard to sell.

When enough investors want to cash out, such a fund has to start selling bonds. But without much liquidity, finding buyers could be hard.

A selloff could start simply, he said. “It has its own gravity.”

There are no apparent signs, analysts and portfolio managers say, of the economic imbalances that fueled the 2008 meltdown, which started with a housing bust that went on to infect the banking sector and eventually morphed into a full-fledged financial crisis.

The depth and speed of the market downturn are forcing a re-examination of conditions in the global economy and comparisons to previous market downturns that took place without economic recessions.

Some analysts see similarities to the late 1998 pullback in U.S. stocks that followed a year of turmoil in emerging markets, punctuated by the Asian financial crisis of 1997 and the Russian default of 1998 and culminating in the collapse of the highly leveraged Long Term Capital Management hedge fund.

Others point to the market shakeout in late 2015. Like the current episode, it lacked an obvious trigger and was accompanied by anxiety over the Federal Reserve’s plans to raise interest rates—in that case, the Fed’s first rate increase in nearly a decade. Like this year, the 2015 retreat featured a sharp decline in oil prices and a significant drop in the S&P 500.

In both those cases the market bounced back when investors regained confidence that the U.S. economic expansion was intact.

Most U.S. economic data and surveys of consumers and businesses are still optimistic. This month, the Federal Reserve moderately lowered its median projection of next year’s economic growth from 2.5% to a still-respectable 2.3%. Markets are telegraphing a darker message. Yields on 10-year Treasury bonds have fallen from 3.24% in early November to 2.74% just before Christmas, a sign investors think the economy won’t be solid enough to make steady interest-rate increases possible.

“There is a disconnect between what the financial markets are signaling about the economy and what the data are signaling,” said Catherine Mann, chief global economist at Citigroup.

Those sirens also include large drops in commodities like oil and copper, which hint at slowing global demand, and stress in the corporate-bond market. The spread between riskier high-yield debt and Treasury bonds widened to five percentage points from three percentage points in early October. Spreads moved at similar ranges between July and November 2007, one month before the most recent recession began.

Sentiment among chief financial officers, who help set budgets that will shape investment and hiring decisions, has also soured. Half of CFOs believe a recession will start within a year, and 80% think a recession will hit by the end of 2020, according to a Duke University survey.

“It’s not just about the equity market throwing a temper tantrum, it’s far deeper than that,” said David Rosenberg, chief economist at Gluskin Sheff & Associates in Toronto. “This is a much broader global liquidity story.”

Encouraged by signs of economic strengthening, the Fed has been gradually raising interest rates from rock-bottom levels and selling back the trillions of dollars in bonds it bought in the postcrisis years. The central bank says the roll-back of stimulus is smooth. Others aren’t so sure what comes next. There has never been such a huge stimulus, and one has never before been unraveled.

Some believe there's a hidden risk in debt that consumers and companies took on when borrowing was inexpensive. The Fed’s campaigns were “fundamentally designed to encourage corporate America to lever up, which makes them more vulnerable to rising borrowing costs,” said Scott Minerd, chief investment officer at Guggenheim Partners. “The reversing of the process is actually more powerful,” he said.

0 comments:

Publicar un comentario