The Titans Must Not Fall

by: The Heisenberg

- The lack of convincing follow-through from Tuesday's rally is disconcerting, especially in the context of Netflix's beat.

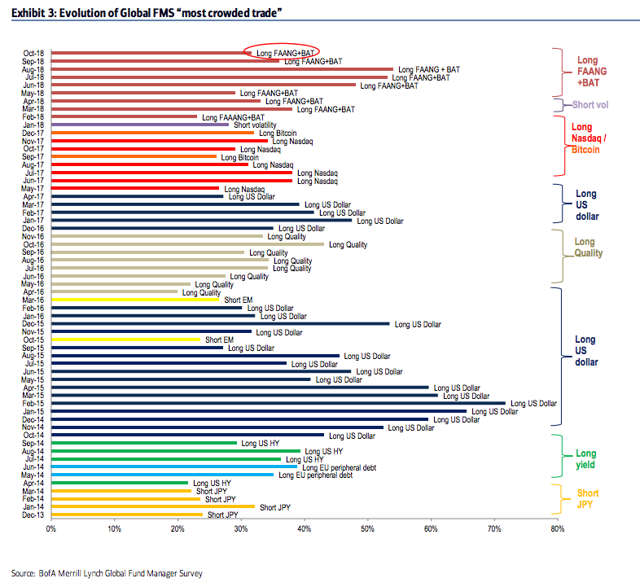

- "Long FAANG" remained the most crowded trade on the planet in October, topping the list for the 9th straight month.

- If you're bullish into year-end, Tech and Growth must not fall.

- "Long FAANG" remained the most crowded trade on the planet in October, topping the list for the 9th straight month.

- If you're bullish into year-end, Tech and Growth must not fall.

This reiterates a critical point I’ve been making over the past week while pitching the tactical “constructive Equities” call over the next 1m-3m: IF you think SPX rallies into year-end, you then too MUST have a positive view on Tech / Growth.

That's from a Wednesday morning note penned by Nomura's Charlie McElligott.

If you recognize the general thrust of it, that's because it echoes something I said on Tuesday afternoon while documenting what, by the end of the day, turned into a monumental bounce for U.S. equities (SPY). The following excerpt is from "Finger Pointing And Rotation Frustration: Thoughts On A Tuesday":

It is clear (to me anyway), that the market can't handle this rotation [from Growth to Value]. There's just too much leadership concentrated on one side of the equation.

Last week's technical rout unfolded against a backdrop of a what would eventually morph into a global Growth-to-Value rotation. Unsurprisingly (and really, by definition) that ultimately translated into a pretty epic unwind in Momentum (MTUM).

If you're (still) wondering what catalyzed Tuesday's surge, you can thank delta hedging, nearly $7 billion in CTA flows (SPX futs) and a precipitous squeeze in all manner of short factors.

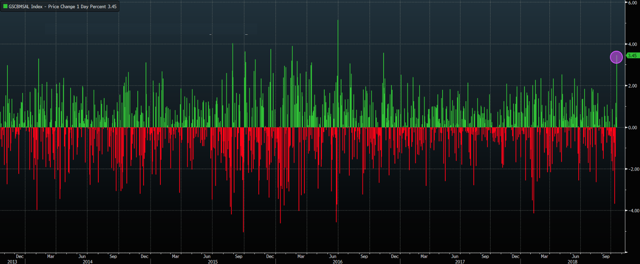

Here's the one-day Tuesday change in Goldman's most-shorted basket:

That's but one representation. Tuesday was also the largest one-day move in a variety of other short factors including, but by no means limited to, Citi's high short interest basket.

After the bell on Tuesday, Netflix (NFLX) delivered a stellar set of numbers which by many accounts "should" have translated into more risk-on sentiment Wednesday (and by the way, spare me your belabored attempts to explain why people "shouldn't" be excited about Netflix's numbers, because if anybody cared about cash burn, the stock would have collapsed a long time ago).

Despite the beat, there wasn't much enthusiasm on Wednesday when it came to building on Tuesday's gains. At a macro level, sentiment took a predictable hit from stalled Brexit negotiations and ongoing jitters about the Italian budget, but it's difficult to ascribe Wednesday's lackluster U.S. session to that.

The lack of follow-through at the broad-market level following the Netflix beat isn't great news for a variety of reasons, the first of which is simply that, as noted above, you have to be bullish on Tech (QQQ) and Growth (IVW) if you're going to maintain a constructive outlook on the market through year-end.

Here's the latest "most crowded trades" chart from BofAML's Michael Hartnett (as you're probably aware, these visuals come from Hartnett's popular Global Fund Manager survey, which is always good for a headline or five when the latest edition hits):

As you can see, "Long FAANG+BAT" extended its reign at the top of the "most crowded trade" list for a ninth consecutive month in October.

In the simplest possible terms, there's a ton of market leadership concentrated in those names and everyone is still parked in that trade. If it gets moving in the "wrong" direction and doesn't rebound quickly, the exodus will be amplified by that crowding. The "perpetual motion machine" (to quote Howard Marks) dynamic that pushed those names inexorably higher over the past several years will go into reverse.

Factor crowding could exacerbate the situation as it apparently did last week.

Recall how, on Tuesday, I highlighted some commentary from JPMorgan's Nikolaos Panigirtzoglou, who flagged what certainly looked like a pretty epic bout of de-risking by the Long/Short crowd in October. That's a ~$900 billion universe and hedge funds are notoriously predisposed to favoring tech. On the bright side, the recent collapse in the beta of that universe to the S&P suggests the current bout of deleveraging from those funds has run its course, but the fact that it occurred in the first place (and likely exacerbated the early October drawdown) is evidence to support the contention that ongoing problems for hedge fund favorites represent a risk to the market more generally.

As you can probably imagine, there's some ambiguity around this following the Communications Services sector reclassification. Below is a snapshot of sector performance through Tuesday (i.e., in the lead up to Netflix's report). As Bloomberg's David Wilson wrote earlier this week, "though it fared better than the S&P since its introduction on September 24, the communications services sector hasn't exactly been a standout".

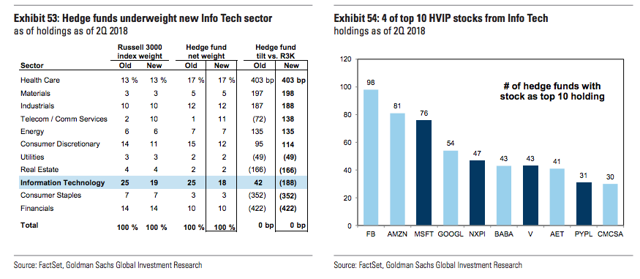

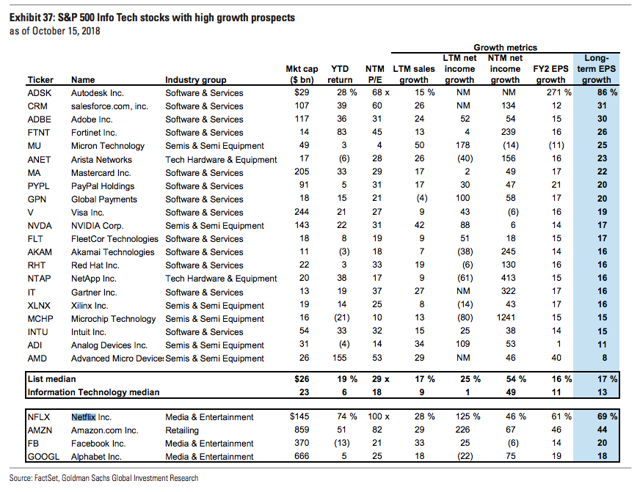

Goldman addresses this in a sweeping new note out Thursday which, in its entirety, serves as an attempt to dispel the idea that crowding and valuations are setting tech up for a tumble (in other words, it's a "calm down" type of note). Here is a short but useful excerpt on the reclassification as it relates to hedge funds:

InfoTech is certainly popular among hedge funds, but funds are actually underweight InfoTech following the reclassification of (FB) and (GOOGL) into the Comm Services sector. Info Tech continues to comprise the largest hedge fund net sector allocation (18%) and 24% of the constituents in our hedge fund VIP basket are Info Tech stocks. But the reclassification of a few popular growth stocks means that hedge funds will actually be 188 bp underweight the new Info Tech sector versus the Russell 3000.

Again, there's too much ambiguity in all of that for me to draw any conclusions right now, but let's just go ahead and assume that hedge funds are going to be long a whole lot of FANG and FAAMG (or whatever the "correct" acronym is these days) and also a lot of (BABA) until there's a compelling reason to not be long anymore, and that's precisely the point. The trade is crowded and if those names start to underperform and it begins to look like that underperformance might persist, one wonders whether aggressive paring of those longs could exacerbate said underperformance.

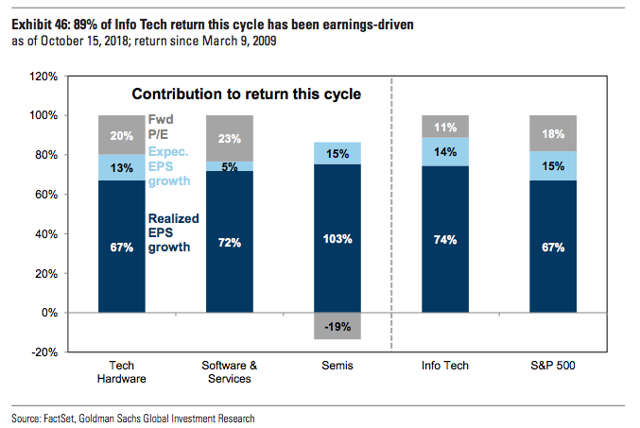

With all of the above in mind, consider a couple of additional excerpts and another visual from the same Goldman note:

Info Tech has returned 593% since the US equity market trough in March 2009. 74% of the rise from realized earnings growth and 11% from P/E expansion, compared with 67% and 18% for the S&P 500 respectively. Even if valuations are flat or contract going forward, the rapid growth prospects of the sector should continue to drive share price gains.

That's true, but the "rapid [earnings] growth prospects of the sector" can only "continue to drive share price gains" if the market responds to earnings beats. That's why the lack of convincing follow-through from Netflix's earnings report is concerning.

Just to reiterate, you can make all manner of classification-related arguments here (e.g., "Well, Netflix was in Consumer Discretionary", etc.), but you get the point. This is all the same trade. Here's Goldman one more time to underscore what I mean:

This report focuses on the newly redefined S&P 500 Information Technology sector. Although several large-cap “technology” stocks such as FB, GOOGL, NFLX, and AMZN are not classified as Information Technology stocks under the GICS classification, we have included line-items for these popular growth stocks in several analyses for reference.

It simply cannot be the case going forward that these market heavyweights start balking at robust earnings growth. Last week clearly demonstrated that a rotation from Growth to Value (IVE) isn't palatable and the crowding in these names means that the rush to the exits has the potential to accentuate any drawdowns.

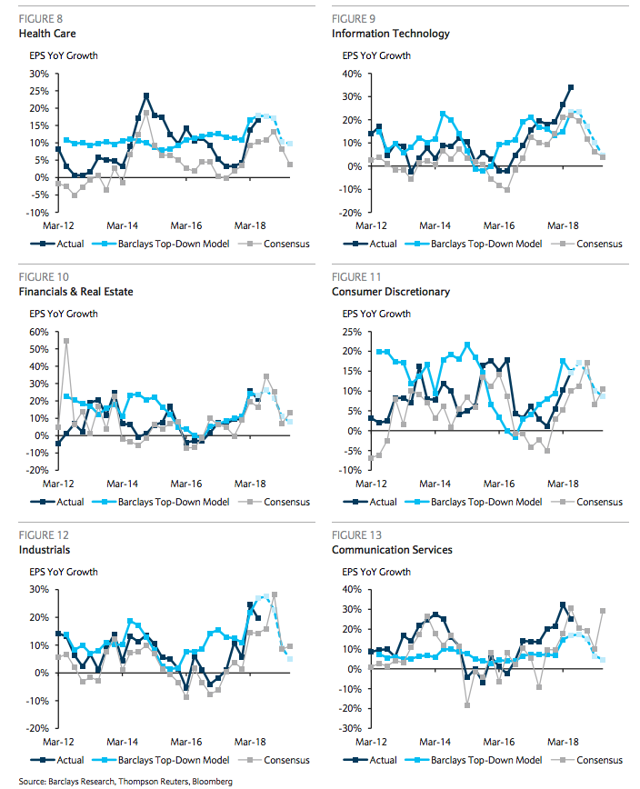

Critically, Q3 will likely mark "peak earnings" in the U.S. The effects of the tax cuts and stimulus are set to wane going forward, and you can expect fewer buybacks after this year as well.

In other words, to the extent you think robust earnings growth has helped shield U.S. equities from the international malaise this year, just note that this quarter is likely to be as good as it gets. Here's a sector-by-sector breakdown of current EPS growth versus consensus expectations and Barclays estimates:

(Barclays)

You could conceivably argue that as earnings growth for the rest of the market decelerates, investors will be even more enthusiastic about the growth prospects for the high-flyers that constitute the most crowded trade on the planet. But that kind of begs the question in the context of this post. That is, the response to the Netflix beat was fleeting at the stock level and non-existent at the index level. That doesn't seem like a market that's excited about chasing the leaders higher based on good earnings.

One final (largely unrelated) point: Rates vol. and FX vol. have come back down after last week's spike, which is good news from a 30,000 foot perspective.

0 comments:

Publicar un comentario