The Dark Decade Ahead

by: Eric Parnell, CFA

- A potentially dark decade for stocks lies ahead.

- The journey may already be underway.

- What to do about it today while the S&P 500 Index continues to chase new all-time highs.

The U.S. stock market outlook is increasingly bleak.

It's not necessarily bleak for the next few months or over the next year for that matter. In fact, I continue to believe the U.S. stock market remains the best place in the world to concentrate equity exposures with a broad asset allocation framework for now. But the longest bull market in history by some measures will eventually meet its maker. And what lies after may prove most unpleasant for the zillions of investors that have piled into passive index products over the last several years. Are you ready?

- The journey may already be underway.

- What to do about it today while the S&P 500 Index continues to chase new all-time highs.

The U.S. stock market outlook is increasingly bleak.

It's not necessarily bleak for the next few months or over the next year for that matter. In fact, I continue to believe the U.S. stock market remains the best place in the world to concentrate equity exposures with a broad asset allocation framework for now. But the longest bull market in history by some measures will eventually meet its maker. And what lies after may prove most unpleasant for the zillions of investors that have piled into passive index products over the last several years. Are you ready?

The U.S. stock market is overvalued.

Sure, I know the S&P 500 Index is trading at a perfectly reasonable 16.3 times earnings based on 2019 Q4 non-GAAP estimates that may never come to pass, but I prefer to work with numbers that I can point to as more officially in the books. And even if I concede that 2018 Q3 GAAP earnings come in as currently forecasted (they will almost certainly end up somewhere below), we find that the cyclically adjusted price to earnings ratio (CAPE)) on the S&P 500 Index over the past 10 years is currently a frothy 32.6 times. This ranks in the third percentile of highest readings on this measure over nearly 140 years of stock market history. Now for those CAPE haters out there, it should be noted that today's P/E ratio based on 12-month GAAP earnings is nearly just as high in the fifth percentile, so today's song is essentially the same whether you adjust for the business cycle or not - stocks are expensive.

Sure, I know the S&P 500 Index is trading at a perfectly reasonable 16.3 times earnings based on 2019 Q4 non-GAAP estimates that may never come to pass, but I prefer to work with numbers that I can point to as more officially in the books. And even if I concede that 2018 Q3 GAAP earnings come in as currently forecasted (they will almost certainly end up somewhere below), we find that the cyclically adjusted price to earnings ratio (CAPE)) on the S&P 500 Index over the past 10 years is currently a frothy 32.6 times. This ranks in the third percentile of highest readings on this measure over nearly 140 years of stock market history. Now for those CAPE haters out there, it should be noted that today's P/E ratio based on 12-month GAAP earnings is nearly just as high in the fifth percentile, so today's song is essentially the same whether you adjust for the business cycle or not - stocks are expensive.

So what?

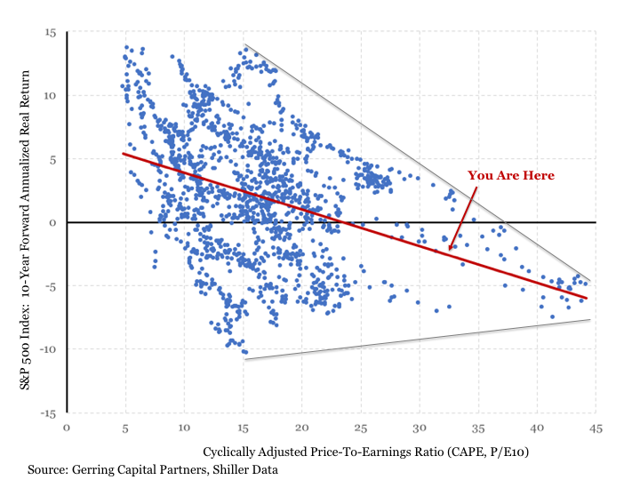

Stocks are expensive. Got it. Heard it before. Why should I care? Because stocks have a long history of not performing well over the subsequent decade when valued as high as they are today. Consider the chart below that shows the more than 1,500 monthly CAPE readings on the S&P 500 Index (X-axis) and the 10-year annualized inflation-adjusted return on the S&P 500 Index that followed in the decade ahead.

A few key takeaways are quickly apparent.

First, the more expensive the stock market becomes at any point in time, the worse stocks have performed over the subsequent 10 years. And given where we are with valuations today, the best real returns investors should expect from the U.S. stock market over the decade ahead are relatively modest at around +2% annualized at most. Instead, a more realistic annualized real return expectation for U.S. stocks as implied by the red trendline on the chart is more in the neighborhood of -2% to -3% annualized. For all of those recently minted passive index investors out there, I hardly think their expectation to lose money after adjusting for inflation on an annualized basis over the next decade is their primary objective. Yet this is what they have set themselves up for today.

The path to -3%, or even +2%.

On to the more important point. The prospects for a -2% to -3% annualized real decline on the S&P 500 Index may not sound all that bad at first. But here's the thing.

When the stock market enters into a prolonged phase of declining value on an annualized basis, it almost never does so in a slow and steady straight line. Instead, it often arrives at an otherwise seemingly benign -2% to -3% over a decade's time with an incredible amount of violence along the way.

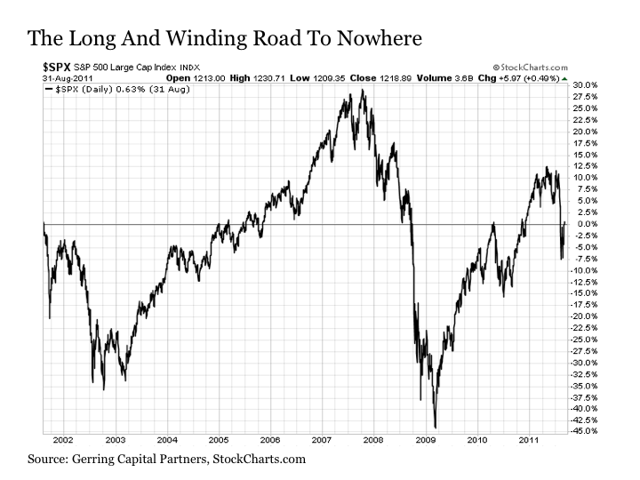

Consider the last time prior to the current cycle the S&P 500 Index was trading with a CAPE as high as 32 in the summer of 2001. Over the next decade, the S&P 500 Index generated a nominal price return that was essentially flat at +0.63%. The only problem for investors is that they had to survive the -35% additional decline that came at the end of the tech bubble, capture the subsequent rally as the housing bubble inflated, then survive the more than -50% decline as the financial crisis struck, and still be on board to participate in the recovery that came as the financial crisis calmed and today's bull market got underway. Not only is this an extraordinary journey to essentially nowhere over a 10-year time period, but also very few investors have the intestinal fortitude to weather such violent swings without reacting along the way. This is particularly true of retirees that can ill afford to see half of their portfolio principal value evaporate before their eyes. This is also particularly true of passive index investors that likely opted to "buy-and-hold" with the expectation of taking the easy road in enjoying steady stock market gains into the future.

The journey is already underway.

In reality, we are already a little less than one year into the 10-year forward returns on offer from the S&P 500 Index at this valuation level. For the benchmark index first crossed the 32 times earnings level on the CAPE back in December 2017 before hovering in this range in the months since. So far, so-so, but for how much longer?

Are you ready?

I can hear the knuckles cracking now as dissenting commenters prepare to take to their computer keyboards to proclaim the following. Sure, we know the stock market is overvalued, but we've been hearing this story for some time now. What we don't know is when, and that's the far more important question. And even if it eventually comes to pass, what are we supposed to do about it in the meantime? The answers to these questions are the following.

First, you should not be selling stocks on this theme. The CAPE is a strong predictor of stock market returns over the next 10 years, but it is a lousy predictor of stock market returns over the next 10 minutes, hours, days, or months. In short, it is not a sell indicator, but instead a future warning forecaster.

Second, you should know that the S&P 500 Index does not encompass your entire stock investment opportunity set. The passive indexers may think so. But the U.S. stock market has and will continue to be a market of stocks differentiated by style, size, and sector along with their various subcomponents. So even if the S&P 500 Index as a whole tumbles over a cliff in the next few years, know that various style, size, and sector pockets across the U.S. stock market are likely to perform quite well and generate impressive returns despite the broader market weakness.

Third, it is precisely during this "we know it's coming but we don't know when" period when investors should be actively thinking about those areas of the market that are best prepared to perform well even when the broader market as measured by the S&P 500 Index starts to fail.

For example, given the unprecedented outperformance of growth over value over the last many years, investors might be well served today to concentrate their focus on the opportunities currently available on the value side of the market today in preparation for what lies ahead.

Lastly and perhaps most importantly, investors should remember assuming they already know that the U.S. stock market and stocks in general are just one of many asset class categories where a meaningfully positive return can be generated at any given point in time. For example, consider asking Van Hoisington how he found the investing environment during the depths of the financial crisis from July 2007 through the end of 2008 when the S&P 500 Index had fallen by nearly half, and I suspect that he might respond that it was quite favorable given that his fund focused on the long-term U.S. Treasury market was higher by nearly +60% over this same time period. This is just one of the scores of asset class categories that investors should be considering outside of the U.S. stock market that so many investors know and love today.

.

Enjoy the journey.

The decade ahead may not be easy for U.S. stocks. But it does not mean that it has to be painful for investors. Enjoy the bull market in stocks while it lasts. But also use the time remaining wisely today to prepare yourself for what may eventually lie ahead. This way, instead of being left wondering "how could I have seen this coming?", you can continue to enjoy the investment journey with confidence, thanks to being prepared with a sound investment strategy in advance.

0 comments:

Publicar un comentario