Rome Is Burning - Again

by: The Heisenberg

- On Friday, Italian assets suffered another meltdown.

- Italian banks plunged the most since Brexit with multiple names halted for volatility.

- In bond land, BTPs were similarly under siege.

- It's possible this will be seen in retrospect as a buying opportunity, but whatever the case, Italy proved again why it's a mainstay on everyone's top worries list.

- Here's the full breakdown with the usual visual buffet.

On Tuesday, May 29, the Italian bond market suffered a dramatic meltdown.

Two days previous (so, on Sunday, May 27) the Five Star-League coalition's effort to form a government behind then premier-designate Giuseppe Conte collapsed, effectively leaving the country's political future up for grabs. Long story short, President Mattarella wasn't enamored with the idea of euro-skeptic Paolo Savona being finance minister.

That raised the specter of new elections.

Initially, the euro (FXE) responded favorably as investors were apparently prepared to accept the thesis that new elections were preferable (from a market perspective) to a populist government. But things went off the rails when investors digested comments from League's Matteo Salvini, who took to Facebook (as he's wont to do) to accuse Mattarella of subjugating the interests of Italians to the interests of the E.U. He also suggested he might try and form a populist government anyway with Savona as FinMin.

I documented that episode extensively here in a series of posts, the most popular of which was called "Rome Is Burning".

Since then, the situation in Italy has stabilized, but the tension between the populist government and Brussels remains palpable. That tension is readily apparent in Italian bonds. 10-year yields have never come close to retracing the blowout that accompanied the May 29 turmoil and the spread between 10Y Italian yields and their safe haven German counterparts remains stuck above 200bps.

Going into September, one of the key risks revolved around the intersection of ECB tapering and the unveiling of Italy's budget targets. Long story short, the worry was that Salvini and Five Star's Luigi Di Maio would override Finance Minister Giovanni Tria, who has been at pains to reassure the market that the deficit target for 2019 would betray some semblance of respect for E.U. budget rules and fiscal discipline more generally.

Of course, the populists didn't get elected in Italy on a platform that's conducive to fiscal restraint.

Rather, they were elected on a platform of nebulous promises, some of which require expansionary fiscal policy.

Well, the market doesn't really appreciate that, especially when there are already questions as to the sustainability of the country's debt load. The worry was that if the Salvini and Di Maio managed to prevail over Tria and push through an imprudent budget, Italian bonds would come under pressure at the same time the ECB moved to cut asset purchases to €15 billion/month from €30 billion (as a reminder, that taper is effective from September through December, after which monthly purchases will cease, reinvestment flows notwithstanding).

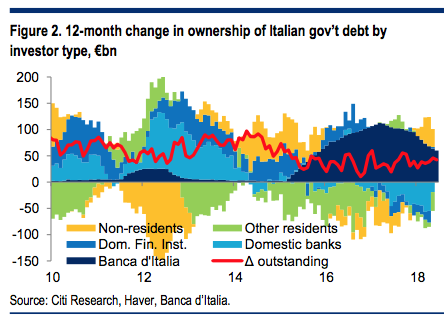

Here, courtesy of Citi, is why that's especially worrisome:

As illustrated in Figure 2, the Banca d'Italia's data on BTP ownership, running up to May this year, shows that the ECB became just about the only buyer of BTPs during the peak-QE period. Every other major investor type was a net seller.

This is where I get to remind you that when you hear armchair macro commentators with no real access to information suggest that QE distortions are somehow a thing of the past, you should note that there is a difference between amateur pontificating and real research. The former is fine to the extent not everyone aspires to professional analysis and there's more than a little utility in letting everyone participate in the global macro discussion. But at the end of the day, it's important to separate the stone, cold reality from the kind of seat-of-the-pants assessments you might find on, for instance, financial Twitter. In the real world, the ECB has been (basically) the only net buyer of BTPs (dark blue shaded area in the chart) for years. Let that sink in: On net, there was no other bid for Italian government debt.

Little wonder, then, that the Italian government has reportedly been mulling the possibility of asking the ECB to craft some kind of BTP-centric QE extension. Don't let the irony there be lost on you.

Such a request would amount to Italy purposefully flouting E.U. fiscal guidelines and then turning around to the ECB and asking the bank to bail them out when the bond market tries to punish them for that very same flouting of budget rules.

Anyway, all of the above explains why the market was palpably anxious on Thursday when it became apparent that Salvini was prepared to support Di Maio in calling for a deficit target well in excess of the upper limit proposed by Tria.

Late yesterday, everyone's fears were confirmed when Salvini and Di Maio announced a deficit target of 2.4% for 2019, a decidedly unfriendly market outcome that sets the stage for a showdown with Brussels.

I was not at all surprised by that outcome and I didn't think markets would be either considering both Salvini and Di Maio have made no secret of their willingness to throw caution to the wind in the interests of funding campaign promises.

I (wrongly) ascribed my own expectations to the rest of the market, which led me to conclude that Italian assets likely wouldn't suffer too badly on Friday. But by roughly 2 AM ET, it was obvious that Europe was in a for a rough session. So, I penned a brief warning post about 45 minutes later over on my site and went to sleep for a few hours. By the time I woke up, it was a bloodbath.

December BTP futures were tanking:

10-year Italian yields were near YTD highs:

And at the short end of the curve, 2-year yields spiked 27bps on the day.

But the real pain was in Italian equities and especially in Italian bank stocks, which plunged the most since Brexit, falling nearly 8%:

Have a look at all the volatility halts (in order) for UniCredit (OTCPK:UNCFF), Banco BPM, and Intesa (OTCPK:IITSF):

More broadly, this was a terrible day for Italian equities in general (-3.7%) and for the Stoxx 600 banks index (-2.7%):

To be absolutely clear, analysts are not optimistic about this situation. The consensus on Wall Street is that Finance Minister Tria has now lost credibility with the market. That is bad news at a time when the ECB is attempting to wind down its balance sheet.

As ever, assessing "spillover risk" is inherently difficult. "Spillover risk" is an amorphous concept and although it's quantifiable to a certain extent, there's no way to put a number on deteriorating sentiment. You can monitor contagion in periphery spreads and you can assess who's exposed, but the problem is that this raises the specter of eurozone breakup risk again at a time when Theresa May's Brexit plans have gone off the rails.

Also bear in mind that there is still no resolution to the simmering trade dispute between the U.S. and the E.U. The last thing anyone needs right now is for Italy to spiral anew.

There's also the dreaded sovereign-bank loop to concern yourself with. It is not an accident that CDS spreads for UniCredit, Intesa and Italy itself move in tándem:

As ever, I'm sure there will be no shortage of comments here which suggest Italy isn't something U.S. equity investors need concern themselves with, but that really isn't true. For instance, as far as I can tell from the landing page for the ticker symbol, there are more than 3,000 people on this platform who follow the iShares MSCI Italy Capped ETF (EWI). That product is down nearly 4% on Friday.

Even beyond folks who have, for whatever reason, chosen to go out on a limb with Italian equities via an ETF, the prospect of Italy unraveling (again) just as the ECB pulls its support for the European bond market is disconcerting to say the least. Part of the reason ex-U.S. assets performed well last week was down to optimistic assumptions about Italy's budget. Those assumptions have now been proven to be erroneous.

This is, at the end of the day, yet another one of the market's key flashpoints which never seems to completely go away. The Italy "problem" has been hanging over everyone's heads for years on end. The fact that the new government is clearly inclined to testing the E.U.'s patience on fiscal targets is bad news going forward.

It also has the potential to put downward pressure on the euro, which in turn could exert upward pressure on the dollar. We don't need more dollar strength right now and if you need proof of that, just ask anyone who owns emerging market assets.

At the very least, U.S. investors should monitor this situation over the next couple of weeks for signs of further trouble. My guess would be that Friday's steep losses will be seen in retrospect as an overreaction, but that all depends on how willing Salvini and Di Maio are to strike a conciliatory tone going forward.

For anyone who has a sizable allocation to European equities (FEZ), this needs to be at the top of your priorities list over the weekend - or at least as regards your portfolio.

0 comments:

Publicar un comentario