Failing conventionally

Why Argentine orthodoxy has worked no better than Turkish iconoclasm

Both countries’ currencies have plunged. Only one is taking the prescribed medicine

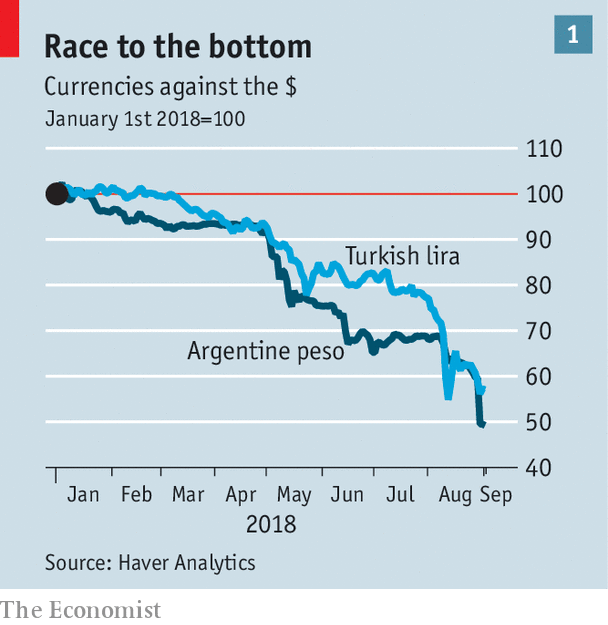

WHEN an emerging market loses favour with its creditors, how should its government respond? The policy prescriptions do not typically include intimidating the central bank, railing against the “interest-rate lobby”, falling out with allies, eschewing the IMF’s help, pouring scorn on the dollar or appointing the president’s son-in-law as finance minister. Turkey has done all of these things, and its currency has duly lost 40% of its value this year.

Argentina, by contrast, has stuck much closer to convention. Its finance minister has two economics-related degrees. Its central bank has raised interest rates through the roof (lifting them to 60% on August 30th), and its government has secured prompt and generous assistance from the IMF, which agreed to a $50bn loan in June, the largest in its history. And yet Argentina’s currency has lost over 50% of its value this year (see chart 1).

Why has Argentine orthodoxy yielded such poor results? The question is growing more urgent. America’s monetary tightening, and worries about President Donald Trump’s trade wars, mean many emerging markets are looking wobbly. On September 3rd Argentina’s government said it would tighten the ship still further, slashing the number of ministries from 19 to ten, raising export taxes and cutting subsidies on transport and utilities. It now aims to balance the budget (before interest payments) in 2019—an election year. It also plans to muster a budget surplus of 1% of GDP in 2020. That will require a fiscal turnaround matched by only the toughest 15% of IMF programmes, according to Sergi Lanau of the Institute of International Finance (IIF), a bankers’ think-tank. Is Argentina wrong to persist with such toughness? Should Mauricio Macri, its president, perhaps appoint one of his children as finance minister instead?

The answer, of course, is no. The peso’s underperformance is not, for the most part, an indictment of conventional economics. It instead reflects three other factors: idiosyncratic misfortunes; the structural differences between Argentina’s economy and Turkey’s more trade- and credit-intensive growth model; and the awful starting position that Mr Macri inherited from his predecessors, Cristina Fernández de Kirchner and her late husband, Néstor Kirchner, who indulged in years of mismanagement that would appal even Turkey’s iconoclastic government.

Start with the idiosyncrasies. Argentina’s worst drought in 50 years has damaged farm output and dried up an important source of hard currency. That bad luck has been accompanied by several eminently avoidable blunders. In a short video posted on YouTube on August 29th, Mr Macri attempted to quash any doubts over Argentina’s solvency by announcing that the IMF had agreed to hasten the disbursal of its loan, only $15bn of which was paid out upfront. But this claim was followed by neither clarification from the finance ministry nor confirmation from the IMF. Panic and confusion spread. The next day—soon dubbed “Black Thursday” by Argentines—the peso fell by almost a fifth.

That miscommunication may reflect a deeper failure of co-ordination. Whereas investors in Turkey worry that power is too concentrated in the hands of its president, Recep Tayyip Erdogan, investors in Argentina worry that economic authority has been dispersed too widely. The government entered the crisis with a finance minister and treasury minister whose remits intertwined, both of whom had to contend with a powerful cabinet chief. Investors did not know who was in charge.

Many still believe that Nicolás Dujovne, the finance minister, should be given a stronger mandate to set economic policy. “If you are a country at war you don’t send in one division at a time to fight,” says Marcos Buscaglia of Alberdi Partners, an economic consultancy. “You need to send them all in at once.” He reckons the government needs to secure a joint agreement with provincial governors to cut spending together. “The provinces are where the biggest waste lies,” he says.

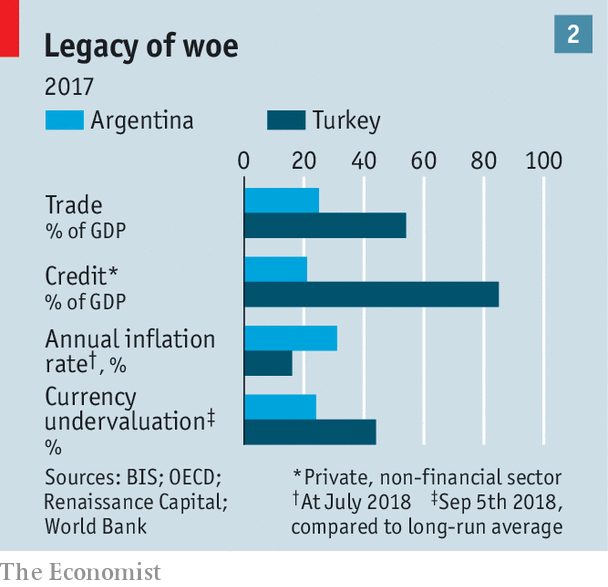

The peso’s plunge also reflects deeper differences between Argentina’s economic structure and Turkey’s. International trade, for example, plays a far bigger role in the Eurasian country, which belongs to a customs union with the European Union. Trade is equivalent to 54% of the country’s GDP, compared with only 25% of Argentina’s (see chart 2). A city like Istanbul generates foreign exchange from both antiquity and novelty. The Byzantine and Ottoman architecture in its city centre attracts droves of tourists, and the nimble textile firms on its outskirts serve fast-fashion retailers on Europe’s high streets.

.

Turkey does not therefore need as big a devaluation for the same improvement in its trade balance. According to the IIF’s estimates, the combination of the economic slowdown and the lira’s fall is already enough to turn its current-account deficit of 6% of GDP into a surplus in due course. The greater fall in Argentina’s currency has merely narrowed its underlying current-account deficit, from about 5% of GDP to 3%, according to the IIF’s calculations.

Turkey’s economy also boasts greater financial depth than Argentina’s. Loans to the private sector (excluding lending between financial institutions) amounted to 85% of GDP at the end of 2017, according to the Bank for International Settlements. The figure for Argentina was under 22%. Thus Argentina needs a larger increase in borrowing costs for the same slowdown in growth, notes Charlie Robertson of Renaissance Capital, an investment bank.

Argentina’s debts, especially its dollar liabilities, mostly lie with the government; Turkey’s sit with firms. And though Turkey’s central bank has been slow to raise the official cost of borrowing for banks, those commercial lenders have been quick to raise interest rates for their decreasingly creditworthy borrowers. Banks now charge even big companies around 35%, according to a local economist.

When credit tightens, companies must cut back. Unlike governments, they cannot, and need not, wait for political approval to do so. As a consequence, Turkey’s private-sector austerity has been more swift and savage than Argentina’s public-sector version. The economy is already slowing sharply. Only half as many cars were sold last month as a year before, the distributors’ association said on September 4th.

.

Battered on the Bosphorus

Foreign investors may have become fixated on the shared vulnerabilities of Turkey and Argentina: high inflation, large foreign-currency debts, troublesome budget deficits and wide current-account gaps. But the underlying differences between the two economies are equally stark.

Mr Macri, who won office at the end of 2015, inherited a warped economy, in greater disrepair than Turkey’s is in even today. A dispute with holders of its defaulted debt had left Argentina’s government cut off from international credit markets. Currency controls meant the peso was artificially expensive and export taxes prompted producers to hoard grain.

If Argentina’s public debt remained modest, it was only because the government financed itself with freshly created money from the central bank. If inflation appeared manageable, it was only because the government fiddled the figures and capped prices. And if the trade balance looked favourable, it was only because the government banned many imports and rationed access to foreign exchange.

As these distortions were removed, Argentina’s problems became manifest. It faced high and stubborn inflation, perpetuated by many wage settlements tightly linked to past increases in the cost of living. It inherited an underlying fiscal imbalance that had to be financed by increased debt, if it were not to be financed by the central bank. And it was saddled with a sharply overvalued currency. According to Renaissance Capital, even after its recent plunge Argentina’s peso is only 25% below “fair value” (based on long-term, inflation-adjusted averages). The Turkish lira, by contrast, is already 44% undervalued.

Much of the blame for Argentina’s plight lies, then, not with the government’s conventional response to the crisis, but with its unconventional predecessor. Mr Macri’s application of orthodoxy has, however, proved to be counterproductive in three, indirect ways.

First, his reformist image helped attract copious capital flows from abroad, culminating in the sale of a 100-year bond in June 2017. That initial enthusiasm for its debt then lulled the government into complacency, convincing it to cut the fiscal deficit more gradually than originally planned. On September 3rd Mr Macri confessed that the government’s gradualism had been born of “excessive optimism”.

Second, in repairing the economy, the government also, on occasion, embraced microeconomic orthodoxy at the expense of macroeconomic stability. It lifted taxes on exports, which removed a clumsy distortion but also deprived it of much-needed revenue. It reduced fuel subsidies, which brought prices into closer alignment with costs but also contributed to inflation, especially as the subsidy reductions were coupled with tax cuts to ease the pain.

The incredibles

Lastly, Argentina’s policymakers made several highly orthodox commitments they proved unable to keep. The central bank adopted ambitious inflation targets it subsequently had to relax. After the IMF agreement, it promised to leave the peso to market forces, stepping into the currency markets only in extremis. Despite this pledge, it has repeatedly intervened, presumably because Argentina has rarely been out of extremis ever since.

The central bank’s decision on Black Thursday to raise interest rates by 15 percentage points also seems like an over-reaction. Instead of appearing resolute, the central bank seemed rattled.

No central bank can credibly promise to destroy the economy to save the currency.

Turkey’s approach has hardly served its economy well. Its finance minister, Berat Albayrak, is now also preaching the need for tighter fiscal policy. After inflation rose to nearly 18% last month, its central bank heavily hinted that it will raise interest rates at its meeting on September 13th.

Argentina, meanwhile, having already tried the Kirchners’ brand of populism, and Mr Macri’s earlier form of gradualism, has little alternative but to persist with its orthodox approach. Its miscommunications, however, are an object lesson on the dangers of overpromising. As a vulnerable emerging market, it should strive to be as economically sound as possible. But not more so.

0 comments:

Publicar un comentario