And Then, The Fall

by: The Heisenberg

- Wall Street returns from the summer doldrums next week and there's a lot to digest headed into autumn.

- The divergence between U.S. equities and everything else has never been so pronounced and emerging markets continue to teeter on the brink.

- Some pros think a September rally is in the cards as hedge funds scramble to play catch up to a market that's left them behind.

- But looming large on the horizon are myriad domestic and geopolitical risks.

- The divergence between U.S. equities and everything else has never been so pronounced and emerging markets continue to teeter on the brink.

- Some pros think a September rally is in the cards as hedge funds scramble to play catch up to a market that's left them behind.

- But looming large on the horizon are myriad domestic and geopolitical risks.

Wall Street will return from summer vacation next week to a market narrative that features all manner of embedded contingencies.

With summer in the rearview mirror, traders are now casting a wary eye towards fall, and geopolitics is front and center when it comes to market risks.

When last I checked in with my readers here, I mentioned that some analysts believe a September rally is in the cards. The "consensus" hedge fund strategy that in part revolves around being long Growth (IVW) and short Value (IVE) had a miserable run following Facebook's (FB) post-earnings plunge and the concurrent FANG+ correction. That underperformance may lead some on the buy-side to play catch up to a U.S. equity market that refused to rollover in August despite the worst month for European equities (FEZ) since February and a fifth consecutive monthly loss for emerging market currencies.

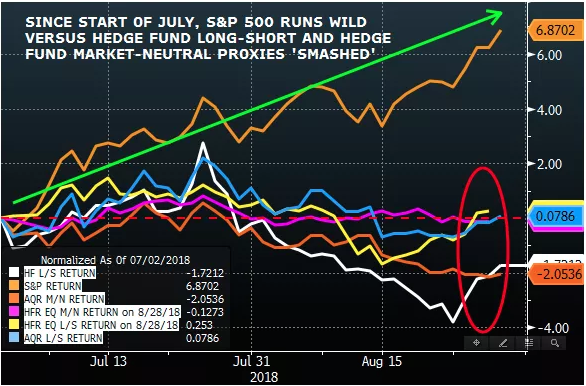

Here's a chart from Nomura's Charlie McElligott that illustrates the point made above about hedge fund underperformance since the FANG+ correction:

(Bloomberg, Nomura)

(Bloomberg, Nomura)

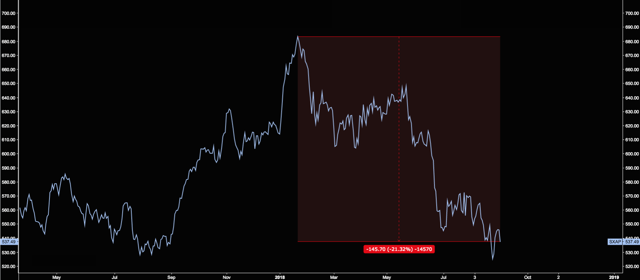

The following chart is the Hedge Fund Research HFRX equity fund index and the highlighted portion on the right shows how funds have failed to keep pace with the S&P (SPY) which motored higher over the same period:

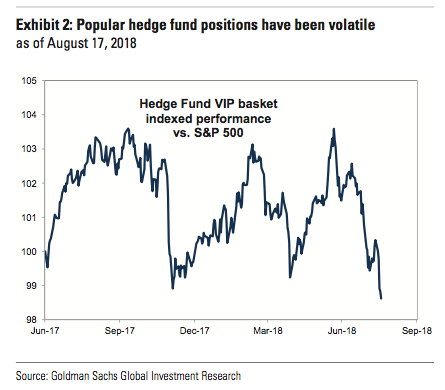

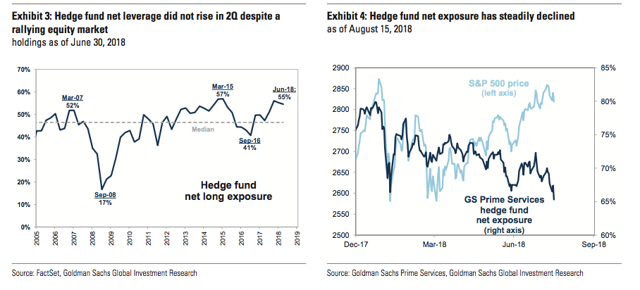

In order to provide some additional context, below find a bit of color and a couple of accompanying visuals from Goldman that together shed further light on how the late July stumble for tech heavyweights and falling exposure have conspired to dent hedge fund returns:

Volatility among the most popular stocks and low net leverage in a rising market have weighed on recent hedge fund returns. Despite outperforming earlier this year, our Hedge Fund VIP basket of the most popular long positions has lagged the S&P 500 by 118 bp YTD (7% vs. 8%).

Nearly 100 hedge funds owned Facebook as a top 10 portfolio position at the start of 3Q, keeping it atop our Hedge Fund VIP list and weighing on fund returns as the stock tumbled in July. Our VIP list of the most popular long positions has suffered large performance swings this year, lagging the S&P 500 by 500 bp since June.

Declining net leverage as the equity market rebounded and outperformance of concentrated short positions have also worked against hedge fund returns.

If the buy-side ends up having to play catch up to the broader market rally and the consensus strategy of being long Growth and Momentum starts working again, it could catalyze still more gains for U.S. equities in September.

Meanwhile, some on the sellside have been forced to up their year-end targets for the S&P in order to account for the recent push to fresh record highs. Rationales vary across firms, but Barclays actually changed their model last month in order to get to a year-end target of 3,000 on the index. Here's a look at the evolution of Wall Street's year-end target for the S&P versus the index itself:

To be sure, the earnings backdrop has virtually never been better and everyone knows that buybacks have provided a reliable pillar of support.

That said, I can't emphasize enough how much this hinges on the dollar (UUP) in the months ahead. One the main reasons U.S. stocks were able to hit new highs late in August was down to the dollar taking a breather. That relieved some of of the pressure on emerging market currencies and equities (EEM), with the latter having fallen into a bear market earlier in the month.

To be clear, Jerome Powell has been proven at least partially wrong when it comes to his contention that EM economies would be resilient to Fed tightening. I suggested that would likely be the case in a series of posts for this platform earlier this year (you can read the second of those posts here and work your way back, although I've penned dozens more that touch on the same issue). In August, the collapse of the Argentine peso and the Turkish lira grabbed the headlines, but the pain was widespread. Volatility on the South African rand soared, for instance, and the Indonesian rupiah hit its weakest levels since the Asian financial crisis. Oh, and the yuan (CYB) is now more volatile than the euro (FEZ) based on 30-day realized. This has never happened before:

Here's a snapshot of the EM FX space:

Something has to stop that slide if U.S. investors hope to avoid spillover. While U.S. stocks have remained resilient this year in the face of EM turmoil, I cannot emphasize enough how important it is for folks to understand the dynamics at play. The same factors that have forced the Fed to lean ever more hawkish, driving the dollar higher and weighing on EM have helped create the conditions for record corporate profits and record buybacks in the U.S. I spent a lot of time documenting that in "Paradox: U.S. Stocks Need A Break From 'America First'" so I would have a comprehensive post to refer back to in the future. You can read that for the full story, but for our purposes here, just note that the sugar high from late cycle stimulus will wear off, and once it does, it would be extremely helpful for stretched valuations stateside not to have to contend with bear markets and generalized malaise in ex-U.S. assets.

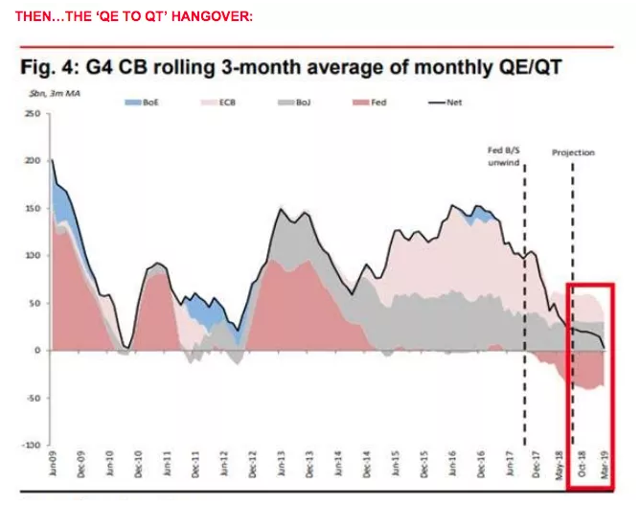

When assessing where things go after September, traders will be intently focused on quantitative tightening, trade and the U.S. midterms. On the former, do note that the ECB will taper asset purchases to €15 billion/month from September. Meanwhile, the Fed's balance sheet rundown is proceeding and on Friday, the Bank of Japan announced they will reduce the frequency of purchase operations this month. The October QT "hangover" (so to speak) is one reason the above-mentioned Charlie McElligott describes his bullish call on U.S. equities in September as "tactical". He believes it could be followed by a bout of rates volatility next month tied to the QT effect.

On trade, optimism around the bilateral deal struck between the U.S. and Mexico on Monday was quickly overshadowed by the breakdown of talks between the Trump administration and Canada on Friday. More worrying, though, was a Bloomberg story out on Thursday that suggested the U.S. is prepared to move forward with tariffs on an additional $200 billion in Chinese goods as early as next week. Remember, it will be impossible for the President to avoid a rise in the prices of consumer goods at home in the next round of tariffs on China. Multiple strategists have suggested that the effect on inflation could be substantial, and when you consider that the U.S. economy is operating at full employment with fiscal stimulus piled on top, you come away thinking the Powell Fed will be inclined to keep hiking until something "breaks" (so to speak).

Meanwhile, comments from Trump to Bloomberg about the prospect of tariffs on European autos suggest the U.S. position has not materially changed on that front. The Stoxx 600 automobiles and parts index is mired in a bear market.

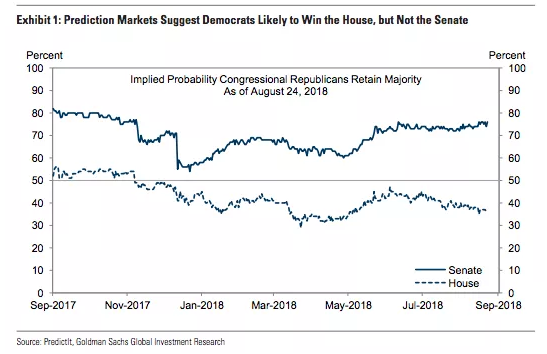

As far as the U.S. midterms are concerned, the risks are myriad and for investors, there are two key considerations when it comes to assessing the implications for market volatility. First, it is likely that the House will flip to Democrats. That's not me speculating, that's just what prediction markets say. Second, if the House does flip, it would likely prompt a series of investigations that could cause headaches for markets if they cloud the domestic political picture further. On the latter point (about the legal issues), Axios revealed the details of an internal Republican spreadsheet this week, and on the former point (the likelihood that the House flips), here are the odds:

(Goldman)

(Goldman)

While there are glaringly obvious reasons to believe that this time could be different, Goldman notes that "the median change in the S&P from the close the day before Election Day to the close the day after Election Day has been +0.7% in midterm elections back to 1954." The results are similar if you look only at elections that have resulted in Congress flipping from one party to the other or in years when the President’s party has performed poorly. In other words, if history is any guide, stocks should hold up fine in and around the actual voting, but again, we live in unprecedented times politically and investors should keep that in mind headed into November.

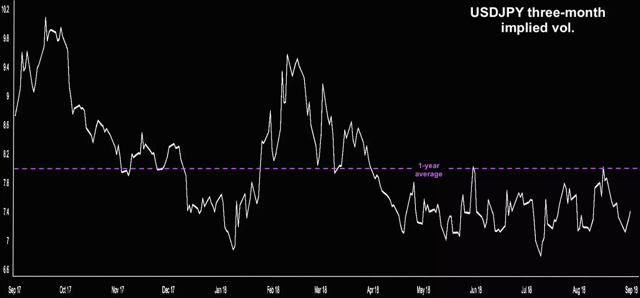

As far as how to hedge all of this, Goldman likes shorter-dated S&P put spreads and BofAML's FX team favors three-month USD/JPY volatility, which is sitting well below its one-year average.

It's also worth noting that Italy risk could resurface as it appears that a budget battle with Brussels is in the cards this month.

As ever, you can take all of that for what it's worth. Ultimately, the gist of it is that contingent on the dollar not rising too far, too fast in the very near term, people who do this for a living think September might be ripe for further gains.

After that, as summer officially turns to autumn, things could get dicey. Or, as I put it in the title, "and then comes the fall".

0 comments:

Publicar un comentario