Accommodative or Not, Rates Are Going Up

The Fed’s policy statement means more rate increases are on the way

By Justin Lahart

Federal Reserve Chairman Jerome Powell Photo: jim lo scalzo/epa-efe/rex/EPA/Shutterstock

Worried about the Federal Reserve’s rate-raising campaign? With the economy strong and unemployment extremely low, it would have been more worrisome if the Fed had left rates where they were.

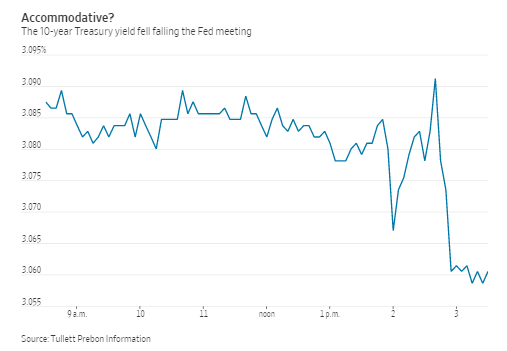

In a well telegraphed decision, the Fed on Wednesday raised its target range on overnight rates by a quarter point, marking its third rate increase of the year. And it signaled that it plans to raise rates once more this year, and three times next year.

But despite its plans to keep on raising rates, policy makers in their postmeeting statement removed a phrase describing policy as accommodative. On the face of it, that seems strange. When rates increase to the point they aren’t accommodative, they would first become neutral, meaning they aren’t juicing or slowing the economy. So if they are neutral, why would the Fed be planning to raise them by a full point over the next year?

The truth is Fed officials dropped “accommodative” not because they don’t want to use the word “neutral,” but because they, and Fed Chairman Jerome Powell in particular, are trying to get away from the idea that they precisely know where neutral is. Mr. Powell took pains to explain that during his postmeeting news conference, pointing out that every policy maker said that they expect interest rates over the long run to be above current levels—an indication that, policy makers think the current level of rates really is accommodative.

Not that investors should need the Fed to tell them that. Pushed along by growing confidence, lower taxes and increased government spending, the economy is growing strongly. Absent more rate increases, it is easy to imagine the unemployment rate falling through 3%, and for inflation and financial-market excesses to start causing serious problems.

So the Fed is going to keep raising rates, and will stop not when they reach some preconceived right level but once the increases start to affect the economy and the dangers of overheating are allayed. One risk is that by the time those signs emerge, the Fed will have raised rates by too much, but at this point that might be better than the alternative of keeping rates too low.

0 comments:

Publicar un comentario