A Bearish Summer Ends In Gold - What Next?

by: Andrew Hecht

- Gold broke a pattern of higher lows during the vacation season.

- The yellow metal is sitting at under the $1200 per ounce level with the Indian wedding season starting next month.

- Gold mining stocks followed the precious metal lower.

- The inflation versus higher interest rates conundrum in the gold market.

- Central banks continue to load their vaults with gold.

- The yellow metal is sitting at under the $1200 per ounce level with the Indian wedding season starting next month.

- Gold mining stocks followed the precious metal lower.

- The inflation versus higher interest rates conundrum in the gold market.

- Central banks continue to load their vaults with gold.

The summer of 2018 was a bearish period for the gold market, and it came out of the gate in September after the long holiday weekend with selling pushing the active month December futures contract on COMEX below the $1200 per ounce level once again.

A stronger dollar and the prospects of two interest rate hikes by the Fed in the U.S. by the end of this year have weighed heavily on the price of the yellow metal. Gold is a bellwether commodity that typically appreciates during periods of fear and uncertainty and when inflationary pressures begin to nip at the heels of an economy. Given the state of the geopolitical and even U.S. domestic political landscapes these days, the potential for events that would send investors flocking for safe-haven assets like gold remains high. At the same time, inflation has risen to the central bank's two percent target rate. However, the precious metal has ignored any potential reasons for a rally and instead has been making lower lows. Over the summer of 2018, the price action in the gold market destroyed the bullish pattern of higher lows that had been in place since December 2015.

Gold broke a pattern of higher lows during the vacation season

Gold had a rough summer as the price fell below levels of critical technical support.

Source: CQG

As the weekly chart highlights, in July, gold fell below support at the December 2017 low of $1236.50 per ounce. In August, the $1200 level gave way on the nearby COMEX futures contract, and the price fell to a low of $1161.40, the lowest price for the yellow metal since January 2017. Open interest at 466,584 contracts at the end of August was at the low end of the range for the metric for 2018. The slow stochastic, a momentum indicator, declined to oversold territory as a result of the downward trajectory of the price in July and August. While the price of the precious metal closed the month of August at just over the $1200 per ounce level, it moved back below on the first trading session of September. Perhaps the most significant factor when it comes to the price of gold has been the level of the U.S. dollar. When the dollar index rose to its highs of 2018 in mid-August, gold fell to its low. The correction back to the 95 level on the dollar index at the end of last week sent gold back over $1200, and a rally on the first session of September took it back below the round number.

The yellow metal is sitting at under the $1200 per ounce level with the Indian wedding season starting next month

Supply and demand fundamentals in the gold market is often a more complicated analysis that meets the eye. Central banks around the world hold a substantial percentage of all of the gold ever mined in the history of the world. Central bank reserves of the yellow metal are typically immobile as they sit in vaults within the borders of nations, and at central depositories for official sector reserves in London, Zurich, New York, and some other cities around the globe.

Gold has industrial uses because of its physical characteristics, but most demand each year comes from the fabricated, or jewelry sector. On the supply side, two of the biggest gold producing countries in the world, China and Russia, have consumed domestic output to build their reserves. The path of least resistance for the price of gold each year is a function of investment demand. The weakness in the gold price over the recent months is likely a result of the tepid state of investor buying.

As we enter the month of September, we are now one month away from the start of the 2018 wedding season in India. In the world's second most populous nation, tradition dictates that a dowry from the bride's family is a gift to the groom. Therefore, as the season approaches each year, investment demand for both gold and silver tends to rise. With gold close to its lowest price of 2018, it is likely that we will see more buoyant demand for the yellow metal in the coming weeks and into October which could support the price of precious metals. However, it has been the direction of the dollar that has been the most influential factor in the gold market on a daily basis. The dollar index rallied from the 95 level to almost 95.4 on the first day of September, and that triggered another round of selling in the gold market on September 4.

Gold mining stocks followed the precious metal lower

Gold fell to a new low for 2018 in May, it declined below the December 2017 in July, and below the $1200 level in August. However, gold mining stocks only fell to new lows for this year recently.

Source: CQG

As the chart of the VanEck Gold Miners ETF (GDX) shows, it waited to fall to a new low for the year in August. However, after its push to a new and lower level for 2018, it continued lower closing at $17.87 per share on Wednesday, September 5, the lowest price since back in February 2016.

Source: CQG

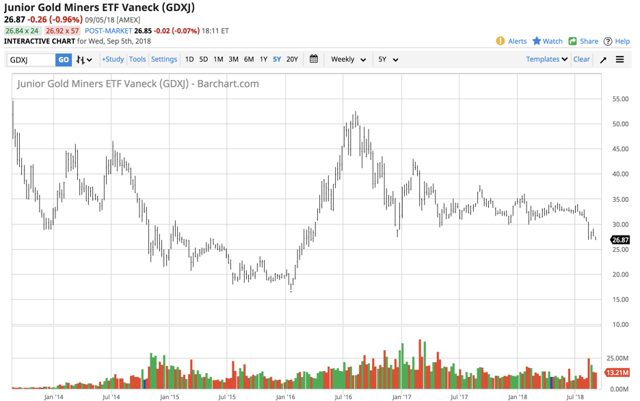

The price action in the VanEck Junior Gold Miners ETF (GDXJ) followed a similar path as it did not fall to a new low in 2018 until August. Meanwhile, on September 5, at $26.87 GDXJ was trading at the lowest price since March 2016. Gold mining shares were not a leader in the recent bearish price action in the gold market; it was a follower.

The inflation versus higher interest rates conundrum in the gold market

Rising interest rates in the United States have lifted the value of the dollar against the euro and other world currencies since the February low on the dollar index futures contract. A higher dollar and rising rates are a bearish combination for the price of the yellow metal. The long-standing inverse correlation between gold and the dollar has weighed on the price of gold and many other commodities. Higher rates increase the cost of carrying inventories and long positions which can also create selling pressure.

Meanwhile, interest rates in the United States are rising because of economic growth and the rise of inflation to the Fed's two percent target rate. Gold is also an effective barometer of inflationary pressures which eat away at the value of money. While the dollar has appreciated against other world currencies over the recent months, rising prices tells us that higher inflation is gradually eating away at the value of all money, including the dollar. The U.S. currency may be the world's strongest fiat means of exchange these days, but that does not mean that all of the currencies are not losing value and the dollar is the strongest instrument in a sector where all members are suffering from a decline in value.

Many participants in the gold market are watching the dollar rise alongside inflationary pressures with a central bank increasing short-term rates to battle the potential impact of inflation. While the kneejerk reaction is to sell gold, the long-term effects of inflation on the gold market could turn out to be supportive of the price of the yellow metal. If the Fed's two percent target rate is only a brief stop on the way to higher rates of inflation, gold will eventually take note of the rise of the economic conditions and buying will return to the market.

Central banks continue to load their vaults with gold

Even though the price of gold has been falling steadily since the April high at $1365.40 per ounce and found its most recent bottom at over $200 below that level, the official sector continues to be a net buyer of the yellow metal. Perhaps the most significant addressable market for gold is the world's central banks, monetary authorities, and governments. The official sector holds around 18 percent of all of the world mined in the history of the world. China and Russia, two countries with gold holdings that are well below the levels of the United States, Europe, and other nations on a percentage of total reserves, are building their holdings. The IMF classifies gold as a foreign exchange holding which means that the governments of the world believe that gold is a means of exchange just like the dollar, euro, yen, and other freely convertible world foreign exchange instruments.

Individual investment demand is the most significant factor when it comes to the price path of the yellow metal each year. However, the official sector continues to buy the yellow metal on price weakness which will stem the price fall over the coming weeks and months.

Meanwhile, many factors on the global economic and political landscapes could cause fear, uncertainty over the coming weeks and months, not to mention the rising level of inflationary pressures.

The bearish summer came to an end at the end of August in the gold market, but it continues to decline on the first day of September as the dollar rallied. Since April, the price of gold has declined in the past sixteen out of twenty-one weeks. Below the August low, the next level of critical technical support for the yellow metal stands at the December 2016 low at $1123.90.

Below there, the only thing that stands between the yellow metal and a bearish abyss below the $1000 level could be the December 2015 bottom at $1046.20. Gold has taken out the 2017 low, and time will tell if the two other support levels are in jeopardy. I will be watching the buying activity from the world's central banks as the price remains close to the lowest level of this year.

The path of least resistance for the price of gold continues to be lower, but it has declined to oversold territory on the weekly chart. The bullish impact of the Indian wedding season and official sector demand faces a strong dollar and rising interest rates to control inflationary pressures in the United States.

Right now, the bears are winning the gold battle, but that could change in the blink of an eye if fear and uncertainty about the future return to the markets over the coming weeks and months. I addition to gold, I favor the gold mining ETF products GDX and GDXJ when gold shows signals of a bottom. I am still standing on the sidelines in the yellow metal but prepared to pull the buying trigger with a tight stop on signs of a bottom to the bearish trend that has been in place since April.

0 comments:

Publicar un comentario