Gold Weekly: Ready For Takeoff

by: Boris Mikanikrezai

- Gold bulls rush to the exit.

- Net long positions in Comex gold are their lowest since January 2016, the CFTC data reveals.

- ETF investors continue to liquidate their gold holdings in spite of rising risk aversion, FastMarkets’ estimates show.

- A short-term bottom in gold seems to be very likely at this juncture, thanks to a slightly friendlier macro backdrop.

- I am bullish on my gold outlook, hold a long position in BAR, and stand ready to lift the size of my position in case of an unexpected dip.

- Net long positions in Comex gold are their lowest since January 2016, the CFTC data reveals.

- ETF investors continue to liquidate their gold holdings in spite of rising risk aversion, FastMarkets’ estimates show.

- A short-term bottom in gold seems to be very likely at this juncture, thanks to a slightly friendlier macro backdrop.

- I am bullish on my gold outlook, hold a long position in BAR, and stand ready to lift the size of my position in case of an unexpected dip.

Source: Pinterest.

Introduction

Welcome to my Gold Weekly.

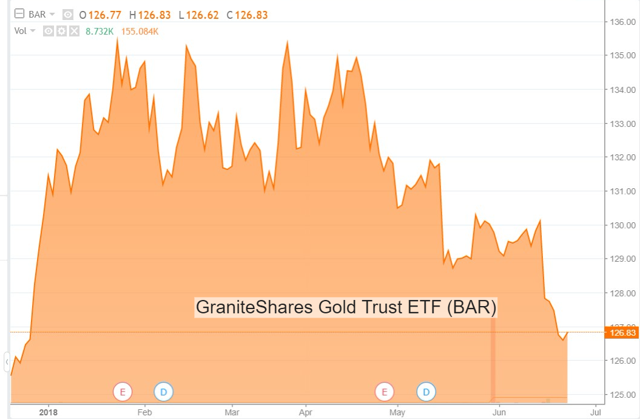

In this report, I wish to discuss mainly my views about the gold market through the GraniteShares Gold Trust ETF (BAR).

To do so, I analyse the recent changes in speculative positions on the Comex (based on the CFTC) and ETF holdings (based on FastMarkets' estimates) in a bid to draw some interpretations about investor and speculator behavior. Then, I discuss my global macro view and the implications for monetary demand for gold. I conclude the report by sharing my trading positioning.

While the CFTC statistics are public and free, the data about gold ETF holdings are from FastMarkets, an independent metals agency which tracks ETF holdings across the precious metals complex.

Speculative positioning

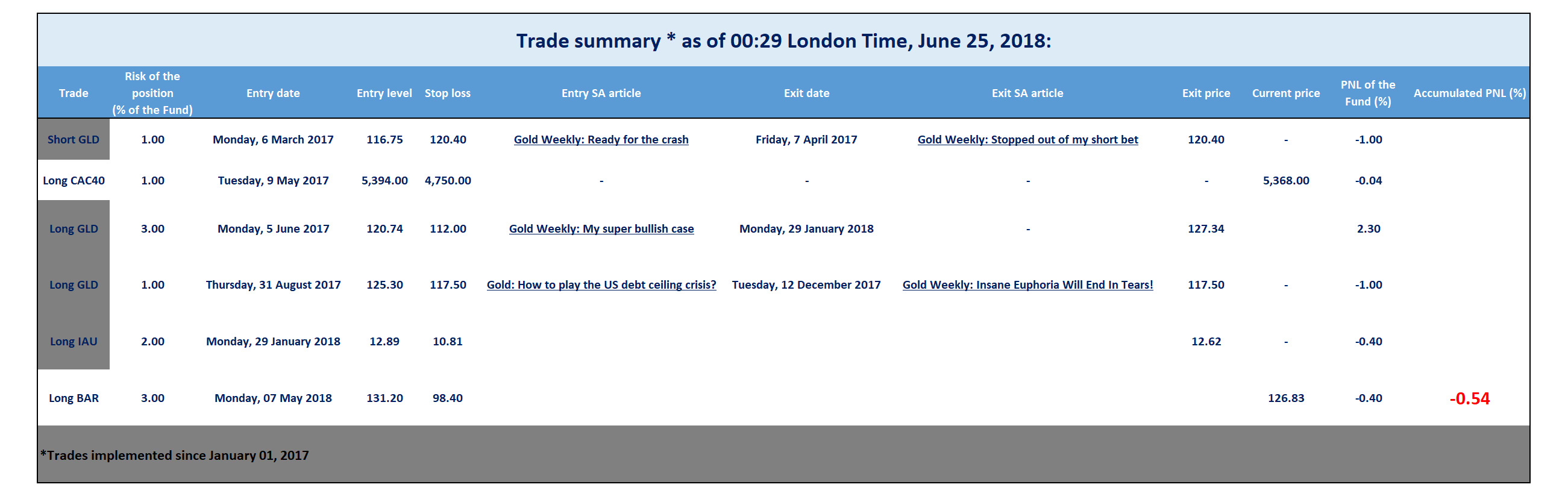

Source: CFTC

According to the latest Commitment of Traders report (COTR) provided by the CFTC, money managers slashed massively their net long positions in Comex gold over the reporting period (June 12-19), during which gold prices sold off 1.6% from $1,296 per oz to $1,275.

The net long fund position - at 29.85 tonnes as of June 19 - tumbled 127.50 tonnes or 81% from the previous week (w/w). This was primarily driven by short accumulation (+99.11 tonnes w/w) and further reinforced by long liquidation (-28.39 tonnes w/w).

The net long fund position is now at its lowest since January 2016 (1.24 tonnes) and close to its historical low reached on December 29, 2015, when money managers were net short of 77.11 tonnes.

The extremely low level of gold's net long speculative positioning suggests that a normalization is around the corner. The substantial accumulation of gross shorts (light blue) raises the likelihood of a powerful short-covering sooner rather than later. Be ready for takeoff!

According to my estimates, a mean-reversion process, whereby the net long fund position (currently at ~30 tonnes) would converge toward its long-term average (~325 tonnes), would produce an increase of $103 per oz in the spot gold Price.

As such, I expect gold prices to move higher toward $1,378 per oz at some point in the second half of the year.

Investment positioning

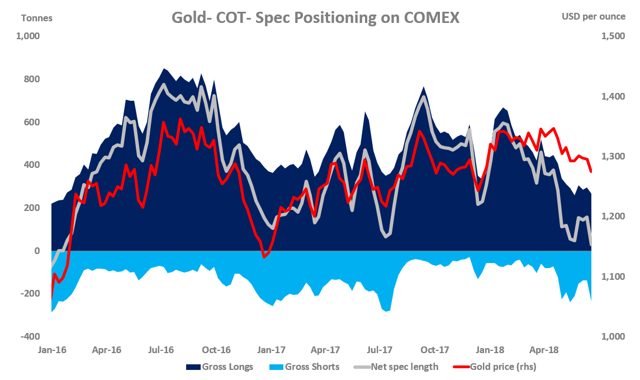

Source: FastMarkets

ETF investors sold roughly 10 tonnes of gold last week, which was the 7th consecutive week of outflows. Gold prices weakened 0.9% from $1,279 per oz to $1,268 over the period.

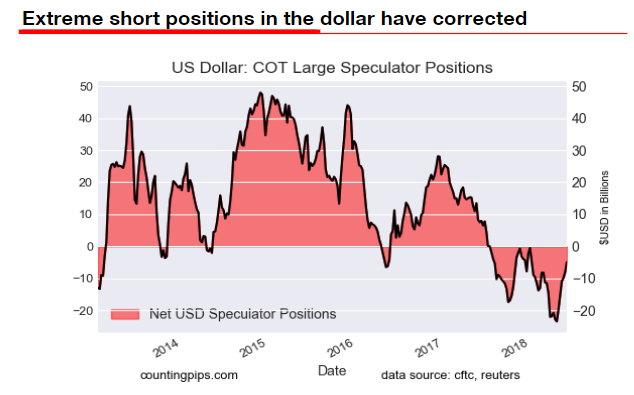

Despite the intensification of the gold sell-off in recent weeks, ETF investors have preferred to liquidate their holdings rather than buy the dips. The lack of buying interest in gold among ETF investors is primarily the result of the dollar rally, itself driven by a powerful bout of short-covering, as the chart below illustrates.

Source: SG

ETF investors are net sellers of ~46 tonnes of gold so far in June, the largest monthly pace of selling since July 2017 (~69 tonnes).

In the year to date, ETF investors are net buyers of a small 8 tonnes, marking an increase of only 0.4% in gold ETF holdings, in sharp contrast with the increase of 173 tonnes or 8% in the whole of 2017.

Macro backdrop for gold

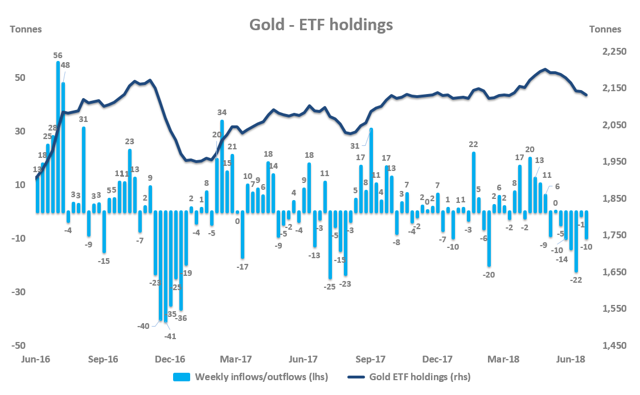

The macro backdrop for gold has turned friendlier of late, in part triggered by the escalation in trade tensions between the US and its largest trade partners.

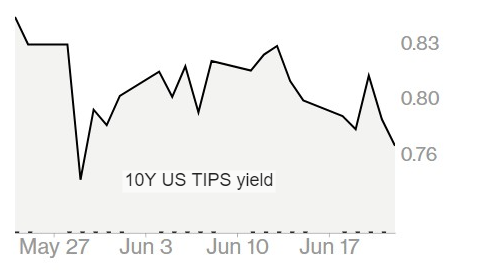

Source: Bloomberg

This has resulted in a renewed depreciation in the dollar and lower US real rates, which should theoretically support gold prices via a rebuilding of long speculative positions.

The tough stance on trade adopted by the US administration has resulted in retaliatory measures by its trading partners. The EU has imposed import tariffs on €2.8 billion worth of US products while the Chinese government has announced import tariffs on $34 billion of US goods (25%). But the US administration is already considering tit-for-tat actions. As a result, it is safe to argue that trade tensions are likely to worsen before getting any better.

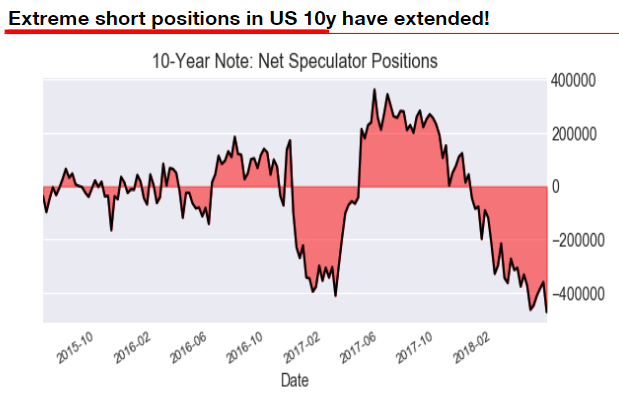

In the turn, global risk-taking appetite could decline more pronouncedly (even if central banks step in), the dollar could give back its earlier gains, and US real rates could accelerate their decline, especially when considering the extent to which short positions in the 10Y US bond are extended.

Source: SG

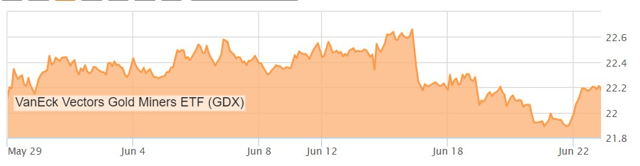

Against a friendlier macro backdrop for gold, I expect gold prices (proxied by SPDR Gold Trust ETF - GLD) and gold mining equities (proxied by the VanEck Vectors Gold Miners ETF - GDX) to move higher toward their monthly highs in the near term.

Source: Seeking Alpha

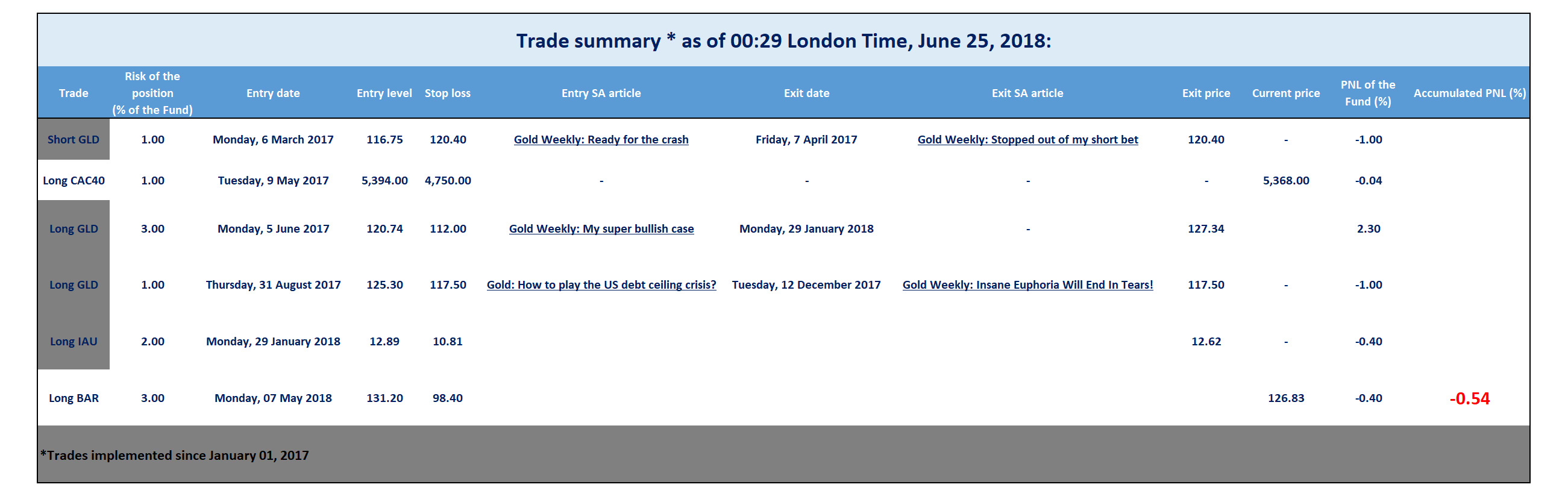

Trading positioning

I have a long position in the GraniteShares Gold Trust ETF - BAR. BAR is presently the lowest cost physical gold backed ETF in the marketplace, with an expense ratio of just 0.25%, the lowest across its competitors.

Source: Seeking Alpha

An increasing number of investors is likely to deploy their capital to BAR at the expense of more traditional, expensive ETFs (such as GLD), thereby resulting in a gradual improvement in liquidity conditions in BAR.

My time horizon is very long term, namely 5+ years, which is why the expense ratio is a crucial parameter to take into account when choosing the most suitable ETF to express my view.

For now, the risk of my long position in BAR is relatively small, at 3% of my portfolio. The reason is that I prefer to build a position at a steady pace rather than go all-in while all my trading criteria are not met. In the same spirit of my previous note (Gold Weekly: Patience Is Power), I would emphasize that gold may need time before rallying at a more convincing pace. From a long-term perspective, gold has bottomed out for the past two years, and like most bottoming-out processes, they are confusing at first before (1) getting clearer and (2) attracting an increasing number of investors in it.

Since I realize that I may be early, I refrain myself from taking a too large position but stand ready to build more aggressively in case of an unexpected dip in prices.

For the sake of transparency, I will update my trading activity on my Twitter account and post my trade summary at the end of each report.

.

0 comments:

Publicar un comentario