The Next Recession Is Closer Than You Think

by: Hale Stewart

- The Australian economy is in a unique situation; there are large enough differences between the US and Australia to make a comparison difficult.

- The stock market is very expensive right now (one could argue either a bubble is forming or we already have one).

- The Fed could easily over-tighten.

Over the weekend, Dividend Sensei ("DS") published a very well-written and researched article titled, The Next Recession Could Be Decades Away. I agree with about 75% of his analysis.

However, I very respectfully disagree with his conclusion that the next recession could be decades away. I want to add that this is very much a situation where two people can look at the same set of facts and derive a different conclusion.

What I Agree With

My biggest point of agreement is with his analysis of the basic structure of the current expansion, where he writes:

Many Americans were understandably disappointed by the anemic 2% or so rate of GDP growth since the financial crisis. Normally recoveries are far sharper, and V shaped. However, financial crashes caused by excessive household leverage, in this case the housing bubble, are a different beast altogether.

I look at this situation through a different lens - Irving Fisher's 1933 article, "The Debt-Deflation Theory of the Great Depression," which explained the series of events that caused the Great Depression. In short order, they are:

- Consumers get caught up in some type of buying mania. They take on more and more debt to buy a good that continues to escalate in price at parabolic levels.

- The market crashes.

- On the other side of the crash, consumers are left with massive amounts of debt that they have to pay off. Instead of buying goods and services during the early parts of the expansion, they use a larger percentage of their earnings to pay off debt, which retards overall economic growth.

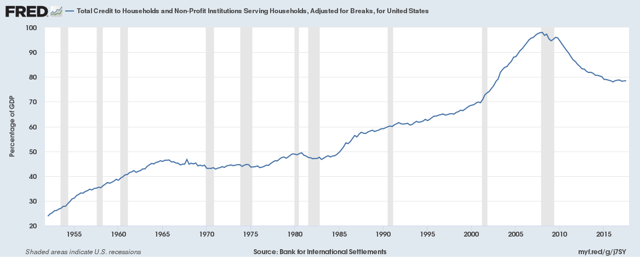

This chart places these events into historical context:

Notice the massive credit build-up preceding the last recession, which provided the necessary fuel for the housing bubble. After the recession, households had to pay off their excess. As a result, personal consumption expenditures grew at a slower rate:

During this expansion, the strongest PCE Y/Y growth rate was 5%. But PCE growth ranged from 3% to 5% for the last nine years which is far below the pace of previous expansions.

Despite different approaches, our conclusions are the same. Any economy that is trying to recover from a debt-fueled mania will take longer to recover as households and businesses deleverage on the other side of the recession.

Despite our agreement on the fundamental nature of the US economy's basic post-GFC structure, I disagree with the following foundations of this "decades away" argument.

Australia was in a Unique Situation

Australia grew consistently because of its unique relationship with China. Chinese growth is based on massive government-funded infrastructure spending. Australia has supplied the raw materials for this expansion. As a result, the Australian economy has had two large injections.

Capital investment:

Mining investment in Australia has increased at a near exponential rate for about 20 years.

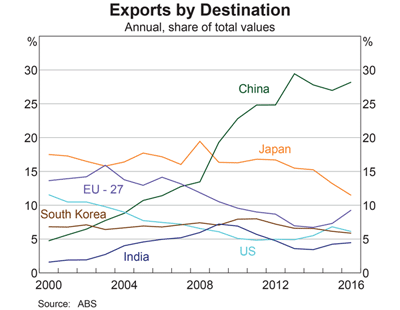

Exports:

Exports to China doubled after the GFC. Remember that China also avoided the recession by increasing its infrastructure spending.

The US doesn't have a comparable situation, which, in my opinion, makes the Australian comparison less than robust.

The Stock Market is Very Expensive

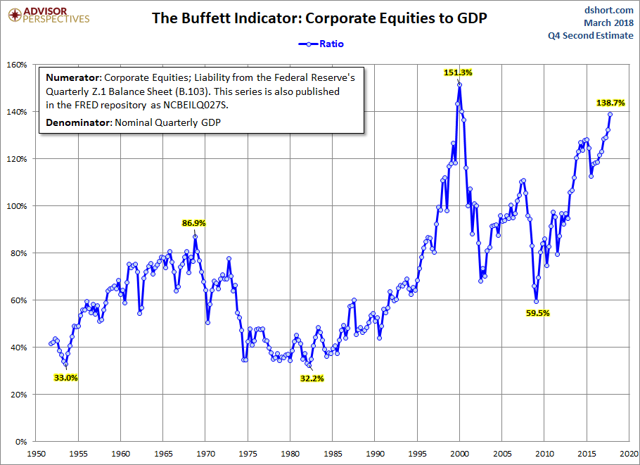

DS argues that there are few signs of a bubble. I would disagree with that. There are several market valuation measures that are nearing levels seen at the end of the dot-com bubble:

The market capitalization/GDP ratio is nearing levels seen at the end of the 1990s market.

Other valuation measures are also very high by historical comparison.

Markets revert to mean. And right now, the market is very stretched compared to its historical mean.

This is not to say that there are no fundamentals supporting this rally. As I've noted several times, corporate earnings are very strong. But that doesn't take away from the fact that current market valuations are very stretched by a number of standards.

The Fed is Set on Tightening

According to the latest "dot plot" from the Fed, we can expect at least three rate hikes this year:

We've seen various rationales from the Fed as to why it wants to raise rates, but two really stand out:

1) It doesn't want to be caught flat-footed as to inflation - it doesn't want to let inflation run too hot and then to play the game of catch-up. 2.) It very much wants to "normalize" policy - return interest rates to higher levels as a sign that the economy is "back to normal." However, the possibility exists that the Fed will tighten too much and send the economy into a recession.

The longest economic visibility anyone has is maybe 24 months - and that's a stretch

This is probably more an editorial than data issue. Given the sophistication of DS's analysis, I'd bet he knows that economists just can't see multi-decades into the future. As a general rule of thumb, the leading indicators can telegraph activity in the next 6-12 months and the long-leading indicators can guide you to maybe the next 18-24 months. But anything longer than that is just an outright guess.

Conclusión

Conclusión

I want to reiterate that DS's article could very well be right. His analysis was very well thought out and reasoned. I simply see it differently.

0 comments:

Publicar un comentario