The Next Recession Could Be Decades Away

by: Dividend Sensei

- Since the financial crisis Americans have lived in fear of an imminent recession.

- Despite strong fundamentals and rising consumer, small business, and corporate confidence, many still expect the economy to fall off a cliff relatively son.

- While economic growth continues to be weak by historical standards and expectations are falling for short-term growth, the economy remains on track to deliver where it counts.

- In fact, a slow but steady pace of gradual economic growth, coupled with an ever stronger labor market, could keep a lid on both inflation, and long-term interest rates.

- When combined with an eventual gradual rise in wages and increased investment into productivity boosting technology, this could result in a decades long economic expansion like seen in Australia.

- Despite strong fundamentals and rising consumer, small business, and corporate confidence, many still expect the economy to fall off a cliff relatively son.

- While economic growth continues to be weak by historical standards and expectations are falling for short-term growth, the economy remains on track to deliver where it counts.

- In fact, a slow but steady pace of gradual economic growth, coupled with an ever stronger labor market, could keep a lid on both inflation, and long-term interest rates.

- When combined with an eventual gradual rise in wages and increased investment into productivity boosting technology, this could result in a decades long economic expansion like seen in Australia.

(Source: imgflip)

Last week I pointed out all the reason why I think this bull market could run for several more years. In fact, given current economic conditions, it might potentially turn this into the longest, and strongest bull market in history.

Of course for that to happen a lot has to go right. So let's take a look at what those factors are, and more importantly, why I'm still optimistic that we could be set up for continued steady growth in stocks for years to come. In fact, there's even a chance that America might be on the brink of an economic expansion that lasts for decades.

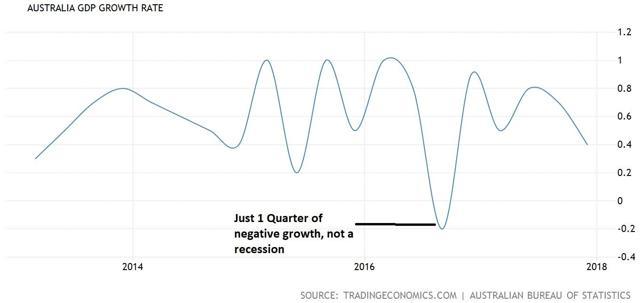

Australia: Land Of Perpetual, (But Slower), Growth

In July of 2017 Australia officially hit its 104th quarter without a recession, topping the Dutch record of 103 quarters. That streak that has now extended to 106 quarters, and by July of 2018 the nation is likely to hit 27 years without a recession (2 consecutive quarters of negative GDP growth). There were plenty of events that could have derailed that impressively consistent growth including:

- 1997 Asian Financial Crisis

- US dot com crash

- Global Financial Crisis

- Long-Term China Fueled Mining Boom ending in 2014

However, due to a number of factors, some of which the US has emulated (embracing free trade) and some it hasn't (about three times the level of immigration, balanced budgets), Australia managed to chug along; growing slowly but surely.

Of course that doesn't mean that the growth has been particularly strong. In fact, in the past decade the best growth Australia has achieved was 1.3%. In addition there are plenty of reasons for concern, just as in the US. For example, the household debt/GDP ratio has risen and now steadied at 121%, (in the US it's 78.5%). This high personal leverage ratio is potentially one reason the rate of growth has been so unimpressive.

But the point is that both Australia and Holland have proven that developed nation's can go decades without a recession. So can the US achieve the same thing? I believe it can, assuming five factors occur.

Factor One: Economic Growth Is Accelerating But At Very Gradual Pace

Many Americans were understandably disappointed by the anemic 2% or so rate of GDP growth since the financial crisis. Normally recoveries are far sharper, and V shaped. However, financial crashes caused by excessive household leverage, in this case the housing bubble, are a different beast altogether.

US households had to deleverage and they have, with household debt to GDP steadily falling up until 2016, when it stabilized. Since then the pace of economic growth has begun to noticeably accelerate.

- 2016: 1.5%

- 2017: 2.3%

- Q4 2017: 2.6%

In addition the New York Fed's nowcast real time GDP growth tracker is estimating that we hit 2.7% in Q1 of 2018, and 2.9% in Q2 of 2018. Now it's true that these estimates have been drifting lower over time, but that just means that they are lining up with other projections.

Projects such as that of Toronto-Dominion Bank (TD) which is projecting: 2.7% GDP growth in 2018, 2.9% in 2019, 1.8% in 2020.

Meanwhile the Federal Reserve is projecting 2.1% growth in 2019 and 2.0% in 2020. Now of course no economic forecast should be taken as gospel since they are all based on models and assumptions that can ultimately prove wrong.

But the point is that it appears the US is on track for continued slow and steady growth. And while that may disappoint people who were hoping for 3% to 4% growth, the fact remains that the best thing for this expansion is for a very gradual increase that keeps us in the Goldilocks zone. Where growth is stronger, such as double the rate of Australia. But not fast enough to trigger inflation, and rising interest rates that have historically been a major contributor to recessions beginning.

Factor Two: Labor Market Booming But No Fast Wage Growth

The most recent jobs report was darn near perfect.

- 313,000 net jobs created in February (the 7th-strongest month since economic expansion started)

- 61,000 net jobs in construction (the top-performing industry)

- 31,000 net jobs in manufacturing (the other major blue collar industry)

- January and December revised up 54,000

- Average of last three months: 242,000, annual job creation rate 2.904 million

More importantly 806,000 people re-entered the labor force, as people's confidence in the job market and prospects for good employment increased.

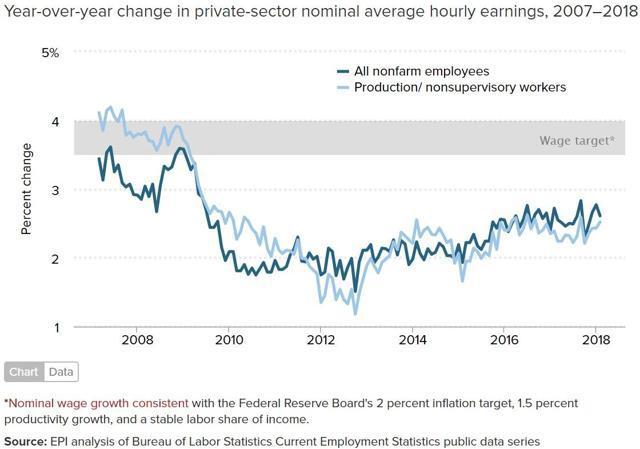

And what about wage growth? Well January +2.9% YOY rate freaked out the bond market and likely helped trigger the correction. But in February it was revised down to 2.8%, while February YOY wage growth was 2.6%. However, note that non managerial jobs (80% of all jobs), rose from + 2.4% in January to 2.5% in February.

In other words wage growth remains about 2.5%, the average in 2017.

That's actually far below the Fed's target range of 3.5% to 4% but is likely explained by the continued large number of people out of the labor forcé.

What's needed to move wage growth up, and help boost consumer spending while also improving the savings rate (to prevent another debt bubble), is time.

(Source: St. Louis Federal Reserve)

How much time? Well at the rate that prime age labor participation has been rising, it would take 16 months to get back to our pre-crisis high (83.4% in January 2007). Another 32 months are needed to get back to the all-time high of 84.6% set in January 1999.

Now we might not necessarily be able to get there. But the only hope we have is avoiding the biggest risk to this expansion. Which is high inflation and interest rates rising high enough to choke off both consumer and corporate spending.

Factor Three: Inflation Remains Tame

The worry that both the stock market (SPY), (DIA), (QQQ) and bond market is this. A tight labor market plus $1.8 trillion in fresh stimulus from tax cuts and $300 billion in extra spending will overheat the economy, drive up wages, causing inflation and the Federal Reserve to raise rates faster.

Fed moves is the Fed Funds rate. This is technically the interbank overnight lending rate and isn't what affects corporate borrowing. Those would be long-term rates, the proxy for which is 10 and 30 year treasury bonds.

However, banks do index their prime rates, (which affect consumer lending), to the Fed Funds rate. So things like credit cards rates could indeed go up faster, as could the cost of new consumer loans. That could slow consumer spending which drives 65% to 70% of the US economy.

In the meantime inflation expectations are ultimately what most affects long-term rates. So if inflation is rising then so are long-term interest rates and corporate borrowing. Theoretically new investments could fall, especially if consumers are spending less, and thus trigger a recession.

The reality is far more complicated than that, since consumer spending is highly individual. It depends on dozens of hard to predict factors like: confidence, employment, wage growth, savings rate, debt levels, etc.

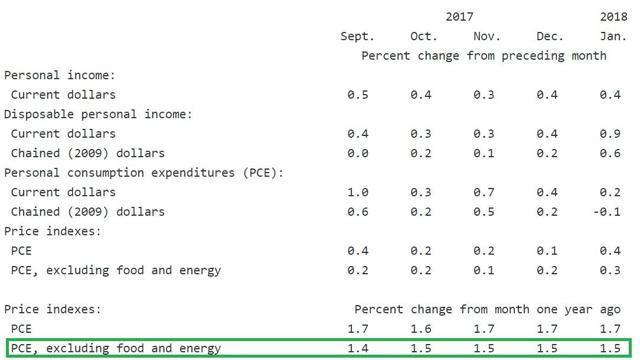

The good news is that the inflation that everyone is so worried about remains muted. In fact, based on the Fed's favorite inflation gauge, the core, (ex food & fuel), personal consumption expenditure index, inflation remains stuck at 1.5%, as it has the last three months.

CORE PCE

(Source: Bureau Of Economic Analysis)

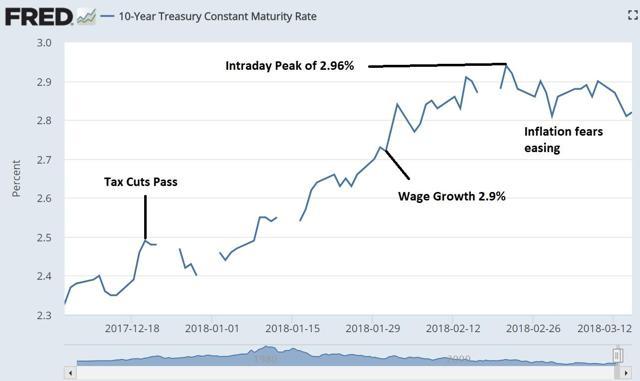

Currently the bond market is pricing in 2.1% long-term inflation, basically at the Fed's target level.

However, bond yields have already halted their previous fear inducing climb as the market realizes the truth that inflation continues to be surprisingly muted.

(Source: St. Louis Federal Reserve)

(Source: St. Louis Federal Reserve)

That's not actually that surprising given four major secular trends:

- demographics (aging populations tend to save more, younger ones spend more)

- technology (increased efficiency lowers prices for non labor intensive godos)

- trade: lower input costs across the board: 25% to 30% decline in average consumer goods prices (the so called "Walmart effect")

- decline of trade unions (partially due to globalization and shift to service economy)

The good news is that, if the expansion continues long enough, eventually all the slack in the labor force will be gone and wages will have to rise. But won't that just trigger inflation, rising rates and trigger the next recession? Not necessarily.

Factor Four: Productivity Boom Could Be Coming

Ultimately economic growth is due to two factors, labor force size and productivity. That's because this determines how much goods and services can be produced, and ultimately consumed.

America's aging demographics, (10,000 baby boomers reaching retirement age each day), have slowed the growth of the labor force and helped contribute to slower growth in recent years.

However, population growth, specifically of the labor force, has only accounted for about 33% of global GDP growth in developed nations over the past 50 years. Productivity was far more important because it allowed each worker to produce more output. Rising productivity also allows wages to grow without triggering inflation, since the unit price of the good or service actually falls.

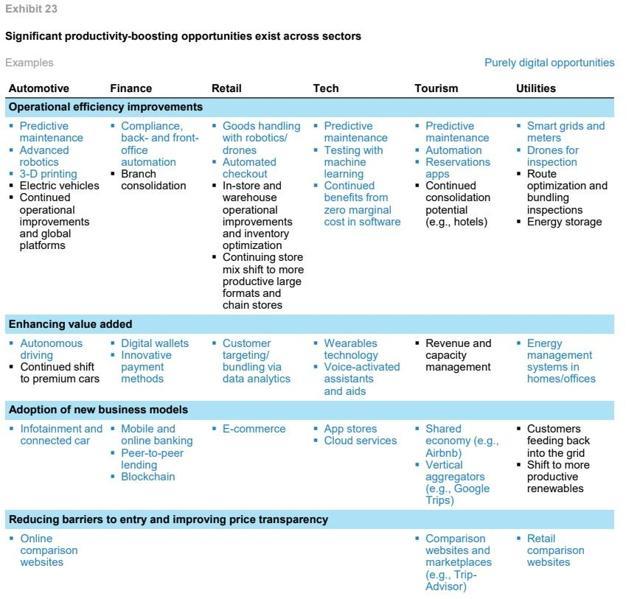

(Source: McKinsey)

(Source: McKinsey)

According to a study by analysts at McKinsey & Company, a good deal for the major slowdown in US productivity was due to ongoing effects of the financial crisis. These include both a decrease in demand causing under utilization of current resources, as well as a lack of wage growth meaning less incentive to invest in productivity boosting capital.

Think of it like this. If unemployment is high and workers are desperate, then they'll work for low wages, and so are cheaper than robots. But if the economy picks up? Then you have stronger demand, and need to hire more people. If there aren't enough then you have to raise wages to attract enough workers to grow, but that can hurt profit margins.

So what's the solution? Buy some robots, (or automation technology), so that you can hire fewer new workers but still meet growing customer demand. Instead of 10 you can make due with five. And yes each is getting paid more, but if they are twice as productive than your unit cost drops, and your profits rise.

This explains not just why productivity is so important for healthy and non inflationary wage growth, but also why investment is important as well. Without investment into improved production technology, productivity doesn't increase, neither do wages, and growth slows to a crawl.

So phase one is to get the economy recovering long enough to fully heal the labor market and get wages growing again. At which point rising labor costs, as well as a lack of sufficient labor supply, will likely drive greater investments into productivity boosting investment. This is why the best part of the tax reform was the instant expensing of capex, which lasts through the end of 2022.

What kind of investment are we talking about here?

(Source: McKinsey)

(Source: McKinsey)

Mostly automation, and AI driven digital technologies. But wait a second? Haven't we been hearing about the wonders/horrors of automation for years?

Aren't the robots coming to take all our jobs and shouldn't Alexa have replaced all the butlers by now? Well actually no. As McKinsey points out there is a substantial lag time between when technology is invented and when it can actually become useful to spurring productivity. In fact, this is known as the Solow Paradox. This is a historical observation that as investment into a new technology increases, productivity may actually fall before it starts to rise. That's because new technology is disruptive and both workers and companies don't initially know the best practices for how to use it efficiently.

For example, the computer was invented in the 1970's, and the internet in the late 80's.

However, it wasn't until the mid 1990's that companies actually figured out how to effectively use them to boost productivity and send the economy roaring.

McKinsey estimates that America's "digital utilization" is just 18%, meaning that we are just at the beginning of a great potential productivity boom. One that is likely to really kick off in the 2020's.

But how big of a boom are we talking?

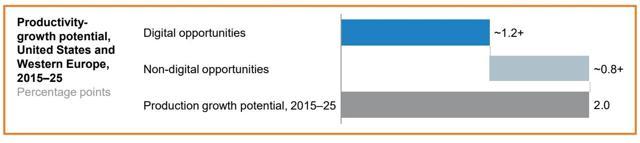

(Source: McKinsey)

(Source: McKinsey)

Well McKinsey's analysts estimate that greater investment in general will boost productivity growth by 0.8%, while the technology itself will add another 1.2%. That's a total of 2% addition to approximately 0.5% productivity we've been stuck with, for a total of about 2.5%. That's essentially the same level of productivity growth we had in 2000, at the tail end of the tech boom.

To put that in perspective if productivity is rising by 2.5% in 2025 then wages could be potentially growing at 4.5% annually and core inflation would be right around the Fed's target of 2%. Or to put another way 2.5% productivity means that inflation adjusted purchasing power could be rising at a rate that would double every 28.8 years.

Of course this study, while detailed, was ultimately based on models, and so might prove incorrect. However, if this decades' low productivity and growth is indeed mostly due to the financial crisis overhang and Solow paradox? Then it's just a matter of time before strong growth in productivity, (up to a 400% increase), sets off a prolonged and potentially strong 90's style economic boom.

The key is keeping the economic expansion growing long enough for that to happen. That means above all else, avoiding extreme levels of growth of any kind: economic, wage, inflation, or asset prices.

Which brings me to the final factor that's needed to allow the US economy to potentially avoid a recession, (and bear market), for decades.

Factor Five: Few Signs Of A Dangerous Bubble

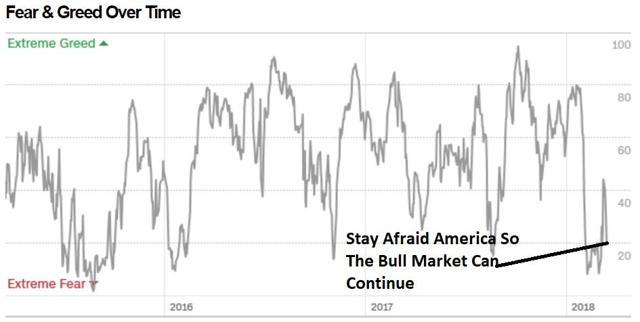

(Source: CNN)

(Source: CNN)

The last two economic recessions were triggered by bubbles bursting, in the stock market and housing market. Well some people are afraid the same thing might happen again.

That's a rational fear, since bubbles often end in tears, and can even cause decade long recessions.

However, as Factset Research points out, Q1 2018 S&P 500 EPS is expected to grow at 17%, the fastest rate since Q1 2011. Full year EPS is expected to rise 18.4%, with about 8% of that being from tax reform but about 10.4% being organic EPS growth.

That would put the S&P 500's forward PE ratio at 17.1, above the 10 year average of 14.3. But keep in mind that this average includes the financial crisis, so 17.1 isn't necessarily dangerously high. For sure it's not bubble territory.

Better yet? Analysts are expecting stocks to rise only 13% over the next year. Not only is that a good figure but it's slower than earnings growth. That means that multiples would decrease and the risks of a bubble style crash would get smaller. And if next year we get another strong 10% EPS increase, then the market could safely rise another 8% to 9%, (about historical average since 1871), and multiples would contract again. That would allow the bull market to continue with ever smaller probabilities of a crash.

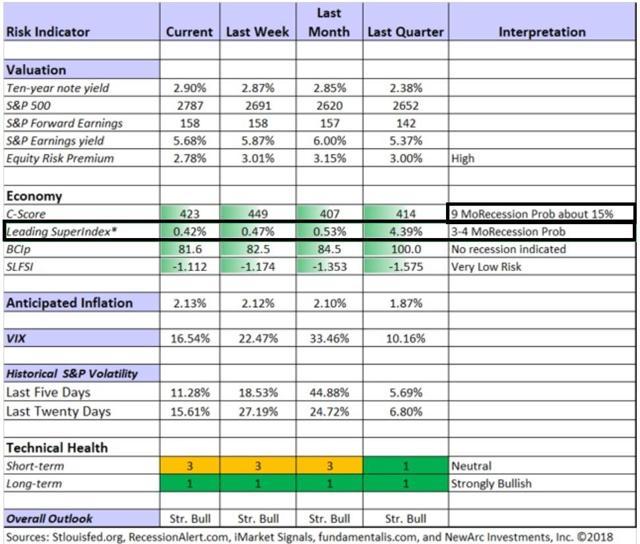

Now could a US recession cause a bear market? Sure, if the above five factors don't hold. But from a fundamentals point of view the risks of a recession are very small right now.

(Source: Jeff Miller)

(Source: Jeff Miller)

In fact, according to a meta analysis of leading economic indicators, the risks of a recession starting within the next 4 months, and nine months, are 0.42% and 15%, respectively.

So the bottom line is that as long as investors stay nervous about the markets, and thus stocks rise slower than earnings, then there is little chance of a market bubble triggering a recession.

Bottom Line: Slow And Steady Is What America's Economy Needs To Avoid A Recession And Keep Expanding For Decades

Source: imgflip

Source: imgflip

Don't get me wrong, I'm not saying that America will definitely go a quarter century or longer without a recession. Nor am I predicting that this bull market will necessarily last for anything close to that long.

However, most of the reasons that people are so afraid that both the expansion and bull market might end soon are simply overblown. The economy isn't overheating, wages aren't soaring, inflation is still stuck at historically low levels, and long-term rates are no longer threatening to soar to the heavens.

In addition while consumer, small business, and corporate confidence are at close to their highest levels in decades, there are few signs that the stock market is headed for insane bubble levels. Levels that might trigger a market crash so severe that it could single handedly trigger a recession.

So while there are plenty of things that could derail America's economic engine, thus far the risks appear to be small. So relax, keep working, saving, and investing for the future. It's likely to be a lot brighter than the pessimists would have you believe.

0 comments:

Publicar un comentario