Rising tide of debt to hit rich countries’ budgets, warns OECD

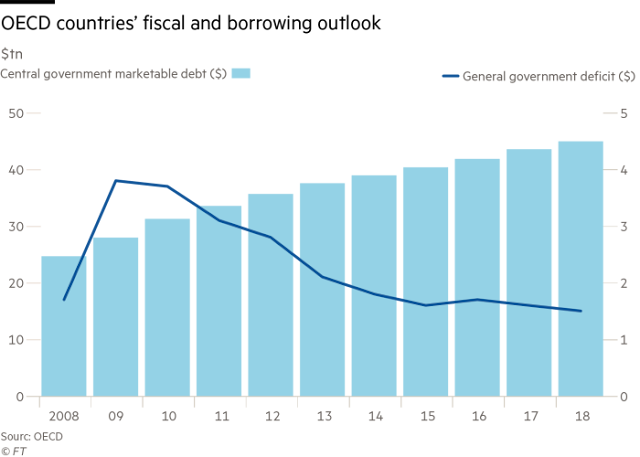

Members’ total sovereign debt has increased from $25tn in 2008 to more than $45tn

Kate Allen and Chris Giles in London

.

The total stock of OECD countries’ sovereign debt has increased from $25tn in 2008 to more than $45bn this year © FT montage; Dreamstime

The total stock of OECD countries’ sovereign debt has increased from $25tn in 2008 to more than $45bn this year © FT montage; DreamstimeDeveloped nations face a rising tide of government debt that poses “a significant challenge” to budgets as interest rates increase around the world, the OECD has warned.

Low interest rates have helped sustain high levels of government debt and persistent budget deficits since the financial crisis, according to the OECD, but the “relatively favourable” sovereign funding environment “may not be a permanent feature of financial markets”.

Fatos Koc, senior policy analyst at the OECD, cautioned that most members of the organisation — sometimes dubbed the rich nations’ club — confront an “increasing refinancing burden from maturing debt, combined with continued budget deficits”.

The warning on the longer-term consequences of high public borrowing marks a shift in stance by the OECD, which as recently as November was praising countries for easing fiscal policy to help global growth.

In an Economic Outlook, published at that time, the Paris-based organisation said that “even a lasting increase in 10-year government bond yields of 1 percentage point . . . might worsen budget balances on average by only between 0.1 per cent and 0.3 per cent of GDP annually in the following three years”.

But Ms Koc now argues that the wisdom of using fiscal measures as economic stimulus depends on an individual country’s budget position, and that it is “important to create strong fiscal roots in an economy while times are good”.

The total stock of OECD countries’ sovereign debt has increased from $25tn in 2008 to more than $45tn this year. Debt to GDP ratios across the OECD averaged 73 per cent last year, and its members are set to borrow £10.5tn from the markets this year.

Because much of the debt raised in the aftermath of the financial crisis is set to mature in the coming years, developed nations will have to refinance 40 per cent of their total debt stock in the next three years, the OECD said.

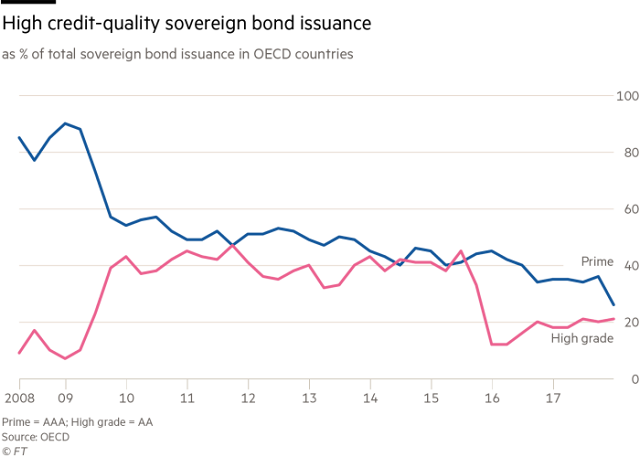

Many countries’ credit ratings have fallen as their debt levels have risen over the past decade, diminishing the attractiveness of some sovereign debt for investors looking for high-quality credit.

Fitch, the credit rating agency, warned last month that rising interest rates would pose a fiscal challenge for governments, which are set to increase borrowing from private investors this year for the first time in four years, a recent analysis by JPMorgan Chase found.

The global economy is experiencing a co-ordinated upswing in growth and policymakers are gradually unwinding the unprecedented monetary policy measures they implemented after the financial crisis. As central banks’ holdings of government debt reduce and interest rates begin to rise, bond yields have started to shift upwards.

The US is issuing significantly more debt to finance recent tax reforms, with the additional supply of Treasuries prompting some investors to forecast further rises in bond yields.

A sustained rise in yields would mean that governments would face higher costs to refinance existing debt and issue new bonds

“In the past decade [governments’ debt] refinancing was generally done at the same or only marginally different terms,” said Douglas Rediker, a former US representative on the IMF board now at the Brookings Institution think-tank. “Now, the reality is that the refinancing costs are likely to be a greater burden on the issuing country and so the question is about the impact of those debt servicing costs on the underlying economy.”

OECD countries are implementing some precautionary measures to cope with such concerns, the research noted, including increasing the amount of long-dated debt they issue so as to reduce their refinancing requirements in any one year.

This story has been amended to correct the figure for current OECD members’ outstanding debt, which is more than $45tn

0 comments:

Publicar un comentario