Price Reflexivity - What's It Going To Take For People To Wake Up To The Potential Of Higher Oil Prices For Longer?

by: HFIR

Summary

- Market participants are still using lower for longer oil price scenario as a base case.

- We explain why oil prices have to move to a level where the bull thesis can no longer be ignored.

- Our view is that this will happen when WTI reaches $80/bbl, or our upside target for 2018.

- The thinking is that Saudi, knowing full well the depressed sentiment, will shock the market in the second half of 2018 via lower exports.

- This will put upward pressure on Brent, which would widen Brent-WTI spread and result in higher US crude exports.

- We explain why oil prices have to move to a level where the bull thesis can no longer be ignored.

- Our view is that this will happen when WTI reaches $80/bbl, or our upside target for 2018.

- The thinking is that Saudi, knowing full well the depressed sentiment, will shock the market in the second half of 2018 via lower exports.

- This will put upward pressure on Brent, which would widen Brent-WTI spread and result in higher US crude exports.

We are strong believers in the theory of reflexivity. In our opinion, George Soros’s theory of reflexivity is the most important behavior/economic/market theory ever created.

The theory of reflexivity states that market participants do not act on the reality of fundamentals, but the perception of fundamentals. Price itself is the catalyst for positive or negative behaviors.

Pain Capital, a contributor to HFI Research, wrote a piece on this titled, “Knowing When The Trend Is Your Friend, Lessons From Soros.” The write-up was about Soros’s observation on the dollar, and that the dollar was moving not based on fundamentals, but the perception of fundamentals.

Another example that was given by Soros was on the savings and loan crisis in the 80s and how the perception of positive fundamentals fueled a higher price to book ratio for many SNLs, which fueled higher value accretion through share issuances, which fueled even higher share prices. As Soros explained, this is why markets go through boom-bust cycles and never according to the laws of supply and demand or any academic economic theories, and why the markets are never truly efficient.

Taking the theory of reflexivity into heart, we can see how the oil price move from $26 to $60 hardly impacted investors' perception of the oil market fundamentals. This is true because in 2014, WTI was trading over $100/bbl, and we are only at $63/bbl today.

In our view, this is where price reflexivity has to come in. If the theory of reflexivity holds, and if price itself is the catalyst to changing fundamentals rather than fundamentals, then we will need sharply higher oil prices to shake the markets out of the “lower for longer” paralysis.

How high do oil prices have to go to shock the market out of its complacency?

How high do oil prices have to go to shock the market out of its complacency?

We think oil prices have to move to a level where no one can no longer ignore just how bullish fundamentals are. Our thinking is that it will be when WTI reaches above $80/bbl.

Now, this does not imply that energy stocks will not move higher from $63 to $80/bbl. No, far from it, but for there to be multiple expansions in energy stocks, we need the price reflexivity to shake the consensus out of the complacency. This means that the real move in energy stocks won’t come until the perception of oil changes from one that will be “lower for longer” to a “shortage is coming.”

Why is this perception change so important?

The Barron’s energy roundtable piece really allowed us a glimpse into the minds of market participants. While we had hunches on why energy stocks weren’t moving higher, the roundtable solidified our key assumptions.

The general market sentiment is that US shale will keep oil prices lower for longer, but this theme needs to change to, “we need all the US shale growth we can get because we are headed for a shortage.”

This sentiment change is also vitally important for the Saudis because the Aramco IPO valuation is dependent on investor perception of oil prices in the long term rather than the fundamentals of the company. And as we have highlighted numerous times in the past, the relative performance chart of XLE to SPY overlapped to WTI does not give the Saudis any comfort in the valuation of Aramco:

This is why we believe the Saudis will aim for a shortage in the second half of 2018…

Combining our variant perception take in section 1 of this WCTW and our theory of price reflexivity, we believe that Saudi will aim for a shortage in the second half of 2018. This also aligns with the comment Khalid al-Falih made recently that ROPEC should aim for an overtightening in the oil markets rather than scuttle the deal too early.

How will we see the shortage develop?

The second half of this year is when oil demand will be at its highest. IEA is still forecasting ~1.4 million b/d of oil demand growth in 2018, and despite a track record of perennially underestimating oil demand, the market continues to read and believe IEA’s analysis. This year will be the first year since the global financial crisis that we see global synchronized growth, and our view is that oil demand growth will be 1.9 million b/d with most of the increase coming in the second half of this year.

If Saudi does intend to push the markets into a shortage territory, then we will see Saudi exports move even lower in the second-half of this year. Why? Because Saudi’s domestic demand will increase, which will put more pressure on exports.

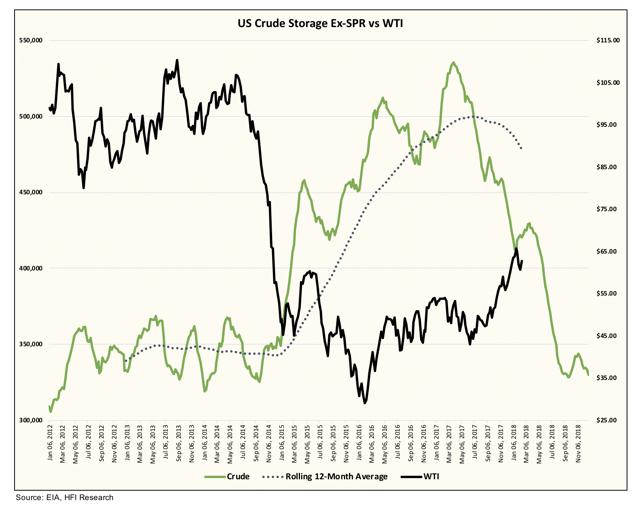

Saudi’s latest crude exports came in right around ~7 million b/d, and we have reasons to believe that this will fall to 6.3 to 6.5 million b/d. This decrease of 500k b/d to 700k b/d will put more upward pressure on Brent prices, which will translate into an even higher Brent–WTI spread.

If this forecast turns out to be true, we think US crude exports for the second half of 2018 could average 1.8 million b/d.

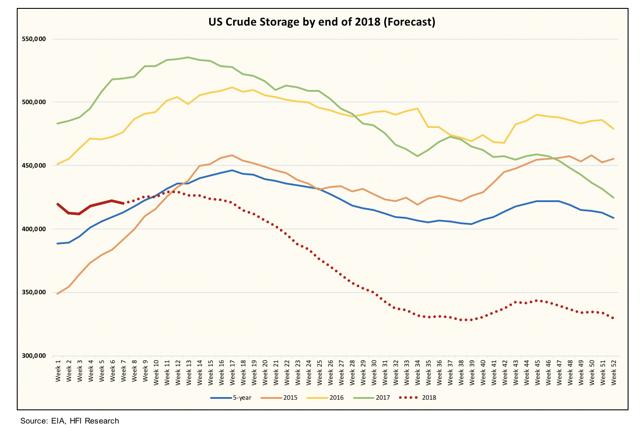

This is what US crude storage would look like if US averaged 1.8 million b/d:

And all the while US crude storage falls, US shale production will be on the rise prompting the sentiment shift of, “Look at storage decline even though shale production is on the rise. Are we headed for a shortage?”

This sudden sentiment shift from “US shale will keep oil prices lower for longer” will turn into “we need all the US shale growth we can get.” Simultaneously, the second half of this year is when Permian producers will face issues with takeaway capacity, so we could see well completion growth stall and translate into slower month-over-month production growth. This will further heighten the market’s awareness that we could be headed for a “shortage”.

If a shortage is what we need, then a shortage is what we will get...

Market participants remain complacent over the view that oil prices will stay “lower for longer”. The theory of reflexivity states that the price itself can be the catalyst that changes the perception of fundamentals. In the case of the oil markets, we think oil prices will need to climb above $80/bbl to start making analysts and investors question whether the thesis of “lower for longer” holds any ground.

To make matters worse, we believe that the market needs to change the mindset that “shale will keep prices lower for longer” to “shale is needed for the market to avoid a shortage.”

We believe the underperformance in energy stocks perfectly illustrate the prevailing sentiment bias, and as our section 1 of this report states, most energy investors remain agnostic to oil prices, and all one needs today is a view on oil prices to outperform.

Combining this observation with Saudi’s incentive for a $2 trillion valuation in Aramco, we believe that Saudi will use the excuse of higher domestic oil demand in the second half of 2018 to lower crude exports even more to prompt a shortage in the oil markets. This will then be reflected via higher Brent – WTI spread, which will boost US crude exports higher. In our scenario, if US crude exports average 1.8 million b/d for the second half of 2018, US crude storage will end at the same level as it was in 2014, or when WTI was over $100/bbl.

Is this extreme scenario, what’s needed for the crowd to start believing in “higher for longer” rather than “lower for longer”? We think so, and the theory of reflexivity works both ways. If a shortage is what we need, then a shortage is what we will get.

0 comments:

Publicar un comentario