The Fed 'Put' Is Dead, Long Live 'Buy-The-Dip'

by: The Heisenberg

Summary

- There was good news on Wednesday morning as investors took solace in earnings on the way to buying the mini-dip.

- I wanted to highlight two things for you today.

- First, the end of an era as the Greenspan/Bernanke/Yellen put expires.

- And second, a couple of visuals that depict another "first time since" moment, and the extent to which volatility returned in January, respectively.

- I wanted to highlight two things for you today.

- First, the end of an era as the Greenspan/Bernanke/Yellen put expires.

- And second, a couple of visuals that depict another "first time since" moment, and the extent to which volatility returned in January, respectively.

Well, the dip buying commenced as expected on Wednesday morning helped along by Boeing and a handful of other positive earnings reports.

That's good news as it underscores the contention that there's still a fundamental narrative bulls can cling to in the face of the bond selloff and stretched valuations.

We'll get the Fed later today, and notably, this is Janet Yellen's final FOMC meeting. I'm writing this hours ahead of the statement, and there's more than a little speculation that she'll attempt to kind of smooth the transition for Powell by steering the statement in a "hawkish" direction, where that simply means sounding an upbeat tone.

One thing you should note here is that some of the commentary out this week is flagging the Fed as a risk factor that's going to be become more worrisome going forward. In short, today marks the end of the fabled Greenspan/Bernanke/Yellen "put". NatAlliance Securities' Andrew Brenner has been talking up this idea recently in his client notes, suggesting that a veritable sea change is afoot and Wells Fargo was out on Tuesday with some similar commentary. Here's an excerpt from a note by Wells' Christopher Harvey:

In Feb ’18, Janet Yellen, who we believe is the biggest Dove on the face of the planet, is being replaced by Jerome Powell, not the biggest Dove on the face of the planet. While many market participants don’t expect a major change in Fed policy with the handoff, we think the improving growth environment and anyone not named Janet Yellen means more Hawkishness, at the margin.

Yes, "at the margin." What's unclear is whether a "marginally" more hawkish Fed is going to be enough to meaningfully tighten financial conditions which have of course loosened continually despite multiple Fed hikes.

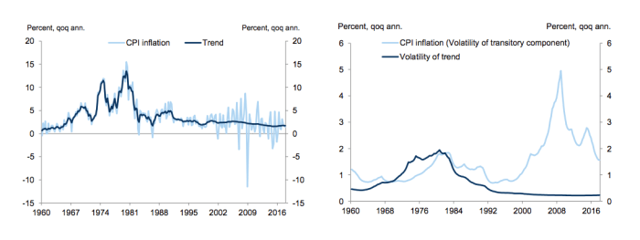

To be sure, there would still need to be a notable shift in the inflation backdrop to force the Fed into withdrawing transparency and severing its reflexive relationship with the market. Until we see that, volatility can probably remain anchored. Have a look at the moderation in trend inflation over time:

That's part and parcel of what allows central banks - the Fed in this case - to avoid tightening too quickly. There is no "motive for murder", to quote MIT economist Rudi Dornbusch.

A set of still tepid (yet not terrible) inflation data out of Europe underscored this on Wednesday morning. When you read the headline on the linked Bloomberg piece there, remember that the "battle" needs to remain just "uphill" enough to give central banks an excuse to remain gun-shy, but not "uphill" enough to signal a return to deflation.

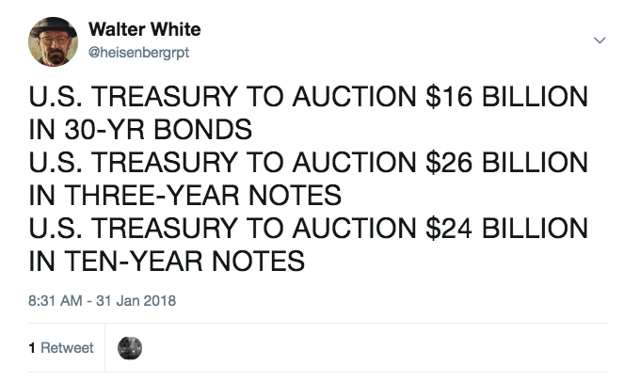

Another piece of good-ish news on Wednesday is that bonds look to have digested the Treasury refunding report relatively well. I won't bore you with the details, but suffice to say supply is rising as expected:

But the initial selloff was quickly faded as Treaurys pared losses on what looked like a block trade in TYH8 that pushed yields back below 2.70:

In other words, that went over ok, although as I'm writing this, yields are back above 2.728 again, so we'll see.

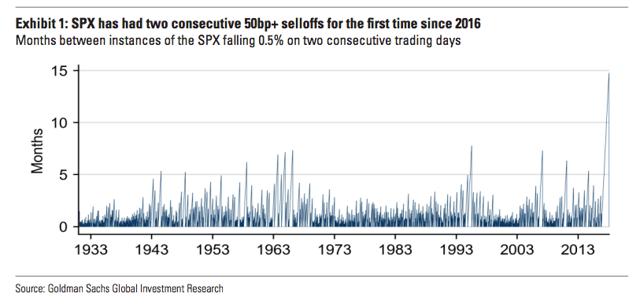

Anyway, something else you should note is that Monday and Tuesday marked the first time the S&P has sold off 50bp+ in consecutive sessions since 2016. As Goldman notes this morning, that is the longest streak on record - and by a mile:

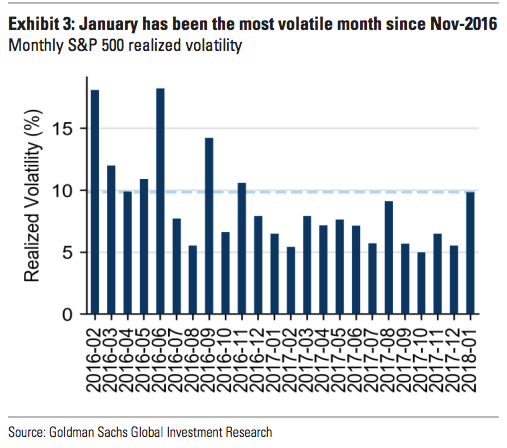

In testament to what everyone has been talking about in terms of 2018 so far being characterized as "vol. up, stocks up", January was the most volatile month since the election despite the sizable positive returns for stocks:

(Source: Goldman)

At least one persistently bullish commentator (Bloomberg's Mark Cudmore) doesn't like what he's hearing from the bears. Or, more accurately, he doesn't like what he's not hearing. I highlighted his Wednesday note in an amusing post called "The Silence Of The Bears" but for those who want the short version, here it is:

The Dow fell the most in eight months. Where are the bears? A 33% jump in the VIX across two days would normally have them very animated.

Yet they are silent.

Now that could be because, as Cudmore postulates, everyone is now on the same side of the boat; that is, there are no bears left. Or, more likely, it could be that the skeptics who aren't me have simply given up on this by now, thanks to a combination of ridicule and the fact that the dip-buying mentality has become so deeply entrenched that it's almost self-aware. One gets the feeling on some days that "buy-the-dip" is no longer a phenomenon that represents the willful actions of the people doing the buying, but rather some kind of reverse collective action problem that became aware of itself, escaped from the lab and is now running around on its own selling vol. Obviously, that's a joke, but you get the idea.

In any event, keep watching yields for clues as to whether the mini-correction has further to go or whether the early action on Wednesday marks a return to "normal" where "normal" means the post-crisis propensity to buy at the first sign of trouble.

Oh, and parse the Fed statement. Or take it to a palm reader.

0 comments:

Publicar un comentario