Be Prepared For A Crash - Part II

by: William Koldus, CFA, CAIA

- Price discovery has taken a backseat to momentum and trend following, but that will change in the near future.

- Value investors, who have been routed for a decade, no longer provide a stabilizing presence (the marginal buyer is passive now), but that will change too.

- This idea was discussed in more depth with members of my private investing community, The Contrarian.

"A 60:40 allocation to passive long-only equities and bonds has been a great proposition for the last 35 years …We are profoundly worried that this could be a risky allocation over the next 10."

Sanford C. Bernstein & Company Analysts (January 2017)

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria”

Sir John Templeton

“Life and investing are long ballgames.”

Julian Robertson

Intro

Monday, February 5th, 2018 was quite a day in the investment world.

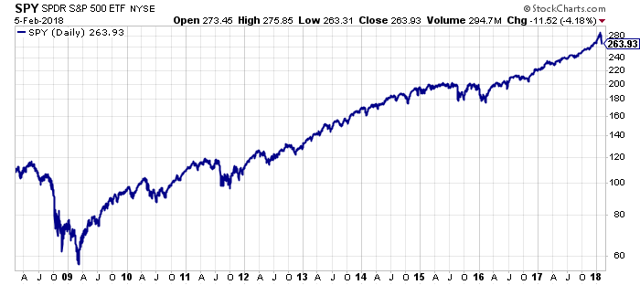

The S&P 500 Index, as measured by the SPDR S&P 500 Index ETF (SPY) declined -4.2% during Monday's session alone, which was on top of last week's -3.9% drop.

(Source: William Travis Koldus and stockcharts.com)

Cumulatively, the S&P 500 Index has now given back, in the matter of several days, all of its gains going back to November of 2017, as volatility has spiked ferociously, and unexpectedly.

(Source: WTK, stockcharts.com)

In fact, as I write this article late Monday evening, there are legitimate questions as to the viability of several volatility products, including the popular VelocityShares Daily Inverse VIX Short-Term ETN (XIV), which declined -14.3% during Monday's trading session, and an additional 79% in after hours trading.

(Source: WTK, stockcharts.com)

(Source: WTK, stockcharts.com)

(Source: CNBC)

The speed and magnitude of the declines is eye opening, particularly for a stock market that saw record low volatility in 2017, yet a bigger picture perspective reveals that the correction, thus far, is only a drop in the proverbial bucket.

(Source: WTK, stockcharts.com)

From the 10-Year chart above, the recent decline in SPY back to November of 2017's highs is barely visible, and one could argue that the recent decline is simply taking the S&P 500 Index back to its still intact uptrend.

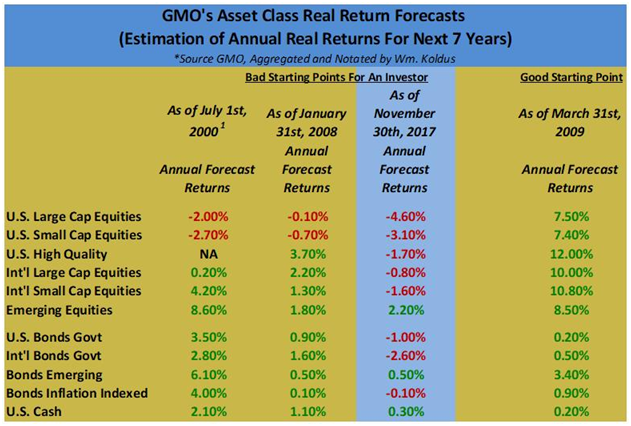

That is certainly true, at least so far, however, November of 2017's price/valuation levels were nothing to write home about from a forward looking real return perspective, as I showed with my November 30th, 2017 table of expected annual real returns, as forecast by GMO.

(Source: WTK, GMO)

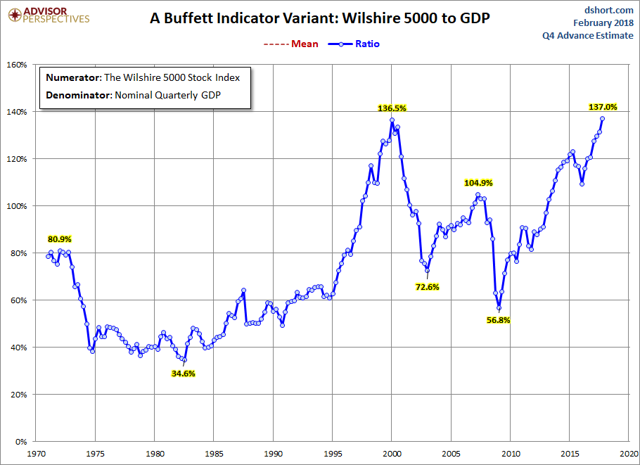

For those that have an aversion to GMO's estimates of real returns, Doug Short's variation on Buffett's Market-Cap To GDP chart showed a market in February of 2018 that was more overvalued than even 1999's peak valuations.

(Source: Advisor Perspectives)

In summary, we, collectively as investors and speculators, have been willing to ignore record valuations for years, as I articulated in my October 26th, 2017 Seeking Alpha article, "Be Prepared For A Crash".

The title of the article was certainly a warning (and to be fair I have been hesitant on market valuations for years - so I have been clearly wrong), as I had witnessed, and been on the wrong side of in many instances, sequences of price action, and valuation methodology that defied rationale or reason.

As a market historian, with over 25 years of investing and trading experience, including some extreme highs and lows that very few attain on either end of the spectrum, it was as if the whole market had collectively lost price discovery.

Well, price discovery, after being ignored for years, appears to be coming back in rapid fashion, and this has significant implication for all investors.

Thesis

Complacency has dominated the investment markets, as trend following and momentum trading have eviscerated value oriented investors, let alone those with a bearish bent, yet stocks and bonds are the most overpriced in history, and now they have downward price momentum.

Draw-down Could Happen Quicker In Today's Markets

In the opening summary paragraph of the first article in the series, I wrote the following:

In a world of over-the-top transparency, stability is going to lead to instability, per Minsky, and when the next severe draw-down happens, it could happen quicker than anytime previously in market history.

Think the “flash crash” on steroids, or a reprisal, and repeat, of Black Monday in 1987.

Only time is going to tell, but so far, the current decline is off to a rapid start. Additionally, it is instructive to note that the 2007-2009 decline and recovery played out much quicker that the 2000-2002 decline and recovery, including a steeper draw-down and greater recovery.

(Source: WTK, stockcharts.com)

If we are on the threshold of a significant correction (and that still remains to be seen) will it be similar to either of the previous two major bear markets?

Value Over Growth

For over a decade, growth equities have been outperforming value equities, and the relative performance is closing in on the 1999 peak.

(Source: WTK, stockcharts.com)

Are value stocks set for their time in the sun?

Where Is The Price Discovery?

In a September 21st, 2017 article I authored for members of The Contrarian, titled, "Investment Philosophy - A Golden Age For Active Investors Awaits", I pontificated on how there was very little price discovery in the market.

To illustrate this point, I referenced several quotes from Steven Bregman, president and co-founder of Horizon Kinectics, who presented at James Grant's October 4th, 2016 Investment Conference.

Here is the first quote I referenced:

A golden age of active investment management awaits only one signal event, Steven Bregman, president and co-founder of Horizon Kinetics, told the Grant’s conference-comers on Oct. 4. A collapse of the index/ETF bubble is that intervening disaster. To hear Bregman tell it, no crash would be so well-deserved

He called the exchange-traded fund excrescence the world’s biggest bubble. “It has distorted clearing prices in every sort of financial asset in every corner of the globe…,” asserted Bregman. “[I]t has created a massive systemic risk to which everyone who believes they are well diversified in the conventional sense are now exposed.”

While pondering whether we are in the middle of this signal event right now (Could today's collapse in volatility be the signal?) consider Bregman's next quote that I referenced regarding price Discovery:

There is no factor in the algorithm for valuation,” our speaker noted. “No analyst at the ETF organizer—or at the Pension Fund that might be investing—who is concerned about it; it’s not in the job description. There is, really, no price discovery. And if there’s no price discovery, is there really a market?

Building on this narrative, Bregman then attempted to solve the riddle that he termed the "ETF Divide", and which I like to call the "Haves" and the "Have Nots". To illustrate his point, he used Exxon Mobil (XOM) as an example equity:

“Bregman lingered for a while on Exxon, a kind of ETF Swiss Army knife: “Aside from being 25% of the iShares U.S. Energy ETF, 22% of the Vanguard Energy ETF, and so forth, Exxon is simultaneously a Dividend Growth stock and a Deep Value stock. It is in the USA Quality Factor ETF and in the Weak Dollar U.S. Equity ETF. Get this: It’s both a Momentum Tilt stock and a Low Volatility stock. It sounds like a vaudeville act.”

Bregman proposed a mind experiment: “Say in 2013, on a bench in a train station, you came upon a page torn from an ExxonMobil financial statement that a time traveler from 2016 had inadvertently left behind. There it is before you: detailed, factual knowledge of Exxon’s results three years into the future. You’d know everything except, like a morality fable, the stock price: oil prices down 50%, revenue down 46%, earnings down 75%, the dividend-payout ratio almost 3x earnings. If you shorted, you would have lost money”—because the financial statement didn’t mention the coming bifurcation of the stock market that Bregman called the “ETF divide.”

On one side of the line are the anointed ETF constituent securities; on the other side is everything else.”

When the market is humming along like it was for a majority of the past nine years, this "ETF Divide" is beneficial for the targeted equities. However, a market sell-off can cause this dynamic to work in reverse, and that is why it will be important to watch the price action of index stalwarts like Exxon or Amazon (AMZN) if the current market sell-off continues (Dow Jones Industrial Average (DIA) futures are down another 1000 points as I am finishing up this article) because just as fast as they appreciated, they can depreciate even faster, as we saw with XIV today.

(Source: WTK, stockcharts.com)

While the price action in the index stalwarts will be the focus of the market's attention over the next few days and weeks, the real opportunity, at least on the long side, in my opinion, is in the out-of-favor equities, the "Have Nots" that have not been the beneficiaries of passive liquidity.

Conclusion - Price Discovery Is Returning With A Vengeance

The title of my conclusion in the first article in this series was, "Price Discovery Is Absent".

Well, three and a half months later, price discovery is certainly returning to the stock market, and value investors, who have been left by the wayside for nearly a decade, will now be the marginal buyers that set prices for equities based on fundamental valuations.

This is bad news for the broader stock market, in my opinion, particularly for the most expensive equities based on valuation parameters, as there are a dearth of value investors left today, (personally 2017 was my worst year ever, and paradoxically, this followed one of my best years ever as an analyst in 2016) and valuations are perhaps the highest in modern market history, so there is a huge gap between today's stock prices, particularly for the in-favor equities, and the price that a value investor would be willing to pay.

In the first article in this series, I asked the hypothetical question:

Imagine if you were a financial advisor domiciled in the U.S., and you went to your client, and said, “With a 60/40 Portfolio, we are projected to deliver -3.1% real returns, annually, for the next seven years.”

What would be the response?

Unfortunately, investors still face the same question today, as U.S. equity prices (and bond prices too) are still in the stratosphere, and now the market has downward price momentum, which like a runaway train, could be hard to stop.

Despite the beating I have taken in trying to find value in out-of-favor equities, I remain convinced that the next decade will be the best decade for active investors in modern market history, as the rise of passive/ETF investing, which has gone farther than I ever imagined a decade ago, combined with the dominance of quantitative and trend following investors has eradicated most active, value investors with independent thinking, creating the best environment for price discovery that I have seen in modern market history.

To close, it has been extraordinarily painful to get to this point for value investors, and I have a feeling the coming decade will be extraordinarily painful for passive/ETF investors, as active and passive need each other, but there has to be a semblance of balance, and like any area of the market that goes to extremes, the pendulum will swing the other way.

0 comments:

Publicar un comentario