King Kong

by: The Heisenberg

Summary

- Why aren't you more excited about the incredible start stocks got off to in the new year?

- According to the Wall Street Journal, it's because "you" might have missed the boat - where "you" means retail investors in general.

- I have my doubts about whether this is in fact "the most hated bull market in history" (a popular meme).

- My skepticism aside, there's something to be said for the idea that stock market rallies are increasingly meaningless for large swaths of the American public.

As for equities, they are performing a good job of doing it to portfolio managers all over again. It’s the third trading day of the year and already I can feel the agony of investors falling behind their indexes. Needing a dip to get back on side so early usually ends up forcing traders to chase the market.

That's from former trader-turned Bloomberg columnist Richard Breslow and it of course refers to how markets exploded off the starting blocks in the new year.

One amusing thing I've noticed lately about the retail crowd is that it isn't readily apparent that they're entirely aware of just how right they've been.

I mean sure, I've seen the usual snarky comments aimed at the skeptics over the past couple of days, but nothing that approximates the cacophony that should be emanating from the bulls based on the price action we witnessed during the first trading week of 2018.

Not to put too fine a point on it, but if I were a retail investor who is and has been "long and strong", I'd be doing whatever the online equivalent is of scaling the Empire State Building and pounding my chest like King Kong. You'd have to call in the Air Force to shoot me down off the building.

The S&P and the Nasdaq just had their best week in more than 13 months:

For its part, the Dow had its best start to a year since 2006.

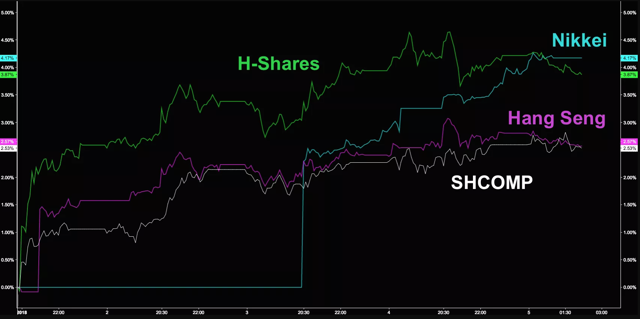

But that wasn't even the half of it. Look at Asia:

And here's Europe:

Do note that even the "worst" performer there (the FTSE) still hit a record high during the week.

Again, if I were a retail investor holding passive index funds and I had just gotten off to that kind of start to a year hot on the heels of last year's stellar gains, my significant other would have to drag me down off the roof because I'd be up there shouting about it at the top of my retail investor lungs.

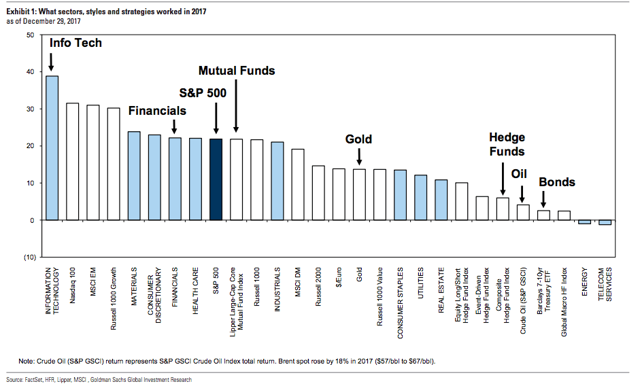

Underscoring the point Breslow makes in the passage excerpted here at the outset is the following chart from Goldman which shows that although pretty much everyone and every asset performed well in 2017, hedge funds lagged benchmarks by a country mile:

(Goldman)

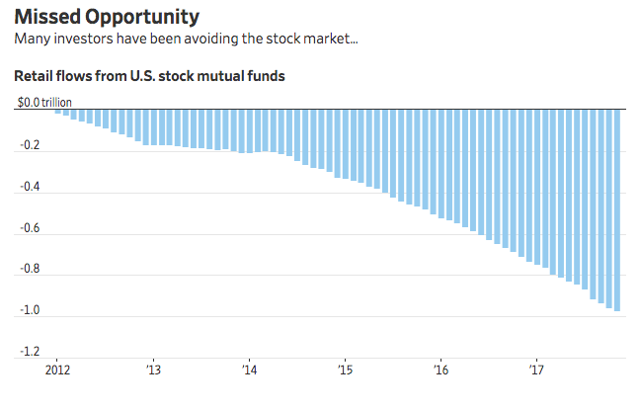

So why aren't retail investors shouting from the proverbial rooftops? Well, the Wall Street Journal was out with a feature piece this week suggesting that a whole lot of them have missed the boat. I wrote a lengthy (and colorful) piece on this called "Permabears Anonymous" on Friday, but for our purposes here, let me just highlight a couple of passages from WSJ:

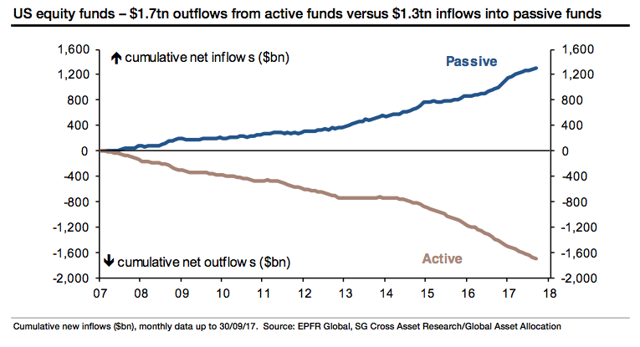

Nearly $1 trillion has been pulled from retail-investor mutual funds that target U.S. stocks since the start of 2012, according to EPFR Global, a fund-tracking firm. Over that same period through Wednesday, the S&P 500 soared 116% and, along with the Dow Industrials and Nasdaq Composite Index, rose to 190 all-time highs.

Of course, that's a bit misleading. A lot of what you see in that chart is the rotation from active to passive and as the Journal readily admits, “much of that nearly $1 trillion in mutual fund outflows likely made its way back into the stock market through lower cost exchange-traded funds.”

If you pan out a little further, what you find is that there's some $400 billion in "missing" flows.

Here's SocGen from a note out back in October:

Regular readers of this report may recall our special edition on active and passive funds. The divergence of investment flows between these two fund categories happened to be particularly strong for US equity. However, the $1.7tn of outflows from active funds was only partly offset by $1.3tn of inflows into passive funds (chart below).

"So what happened to the remaining $394bn?," SocGen goes on to ask, in the same note.

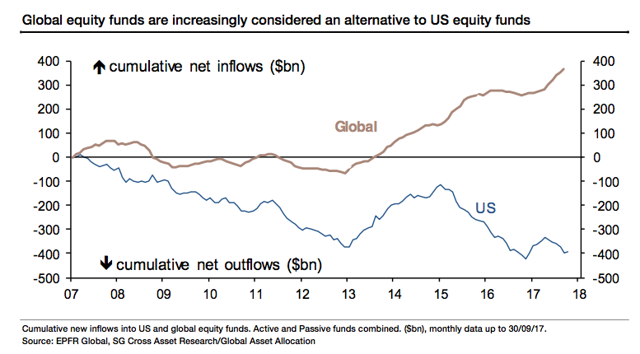

Well, the bank's conclusion is that some of that nearly $400 billion likely went into global equity funds which would mean it probably worked its way back into U.S. equities anyway. To wit:

Global equity funds form a distinct fund category and should not be confused with the sum of country and regional funds that are typically referred to as “All Funds”.

Global funds relieve investors from having to make more specific country choices, and they have proven to be highly popular: cumulative inflows of $363bn since 2007 (chart below). By construction and driven by momentum, more than half of these funds still end up in US equities – measured by market capitalisation, the weight of MSCI US in MSCI World is 59%.

As an overall conclusion, there seem to have been very little fund outflows from US equities, if any, that could have prevented the exceptional index performance.

Still, the Wall Street Journal piece cites myriad anecdotal evidence to suggest that retail investors have stayed away since the crash for a number of reasons, and guess what? Not a single one of those reasons has anything to do with anyone being deterred by bearish market commentary. In fact, at least one of the people who spoke to the Journal cites bullish commentary emanating from CNBC ahead of the crisis as the reason he's gun shy:

Shawn Goodspeed, 33, said he dipped his toes into investing shortly after college. After taking advice from CNBC, he said he invested small sums in bank stocks in 2007 and 2008, watching his small investment shrink during the ensuing crisis.

“It was a good learning experience,” he said. “Now I’ll invest only in things I understand.”

And then there's Nancy Langwiser-Kear, 60, in Wellesley, Mass., who doesn't agree with David Tepper about stocks being "just as cheap as they were":

She has been selling U.S. stockholdings in recent years, holding more cash and funds that own shares of companies in overseas markets.

“This market over the past year has been a mix of hope and fantasy as far as I can tell,” she said. “There’s no reason to be hanging out in stocks at the end of the bull market.”

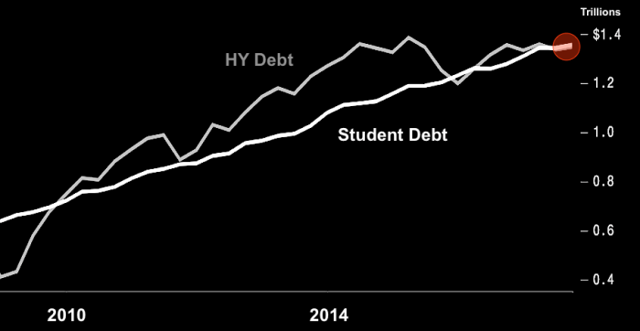

Of course, there's also the massive student debt overhang which makes investing a non-starter for Millennials. Here's yet another excerpt from the Journal's piece:

“My money is spent servicing student loans,” said Marcus Wallace, a 25-year-old waiter in Washington, D.C. Until that debt is reduced, he explained, the great stock market bull run will have to go on without him.

As a reminder, the outstanding stock of student debt in America is now larger than the entire USD junk bond market:

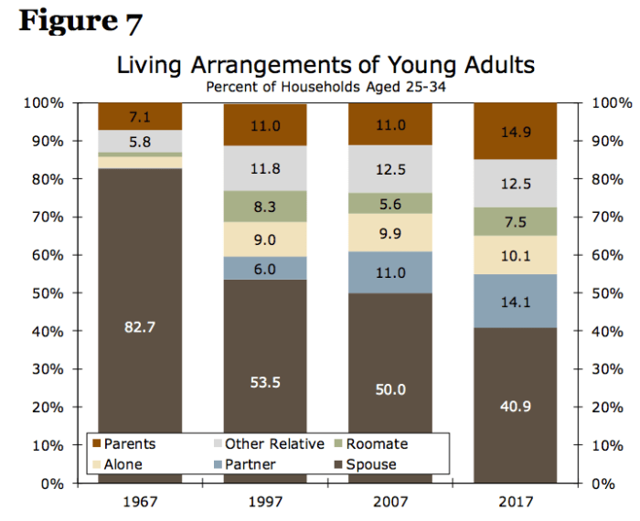

And that's having an effect on household ownership:

(Wells Fargo)

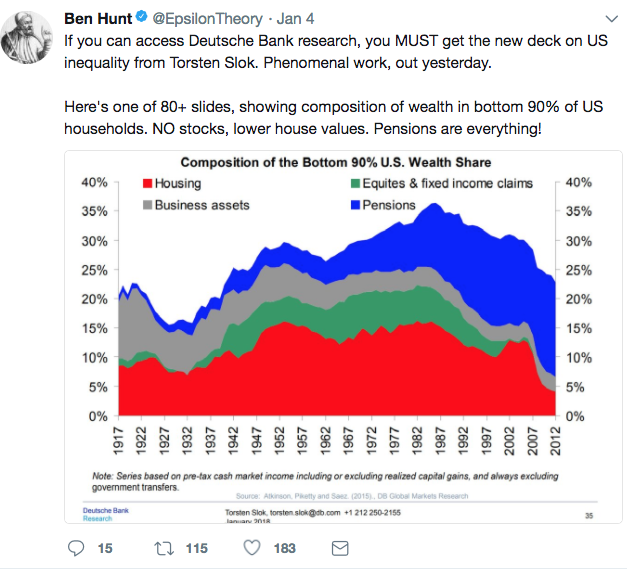

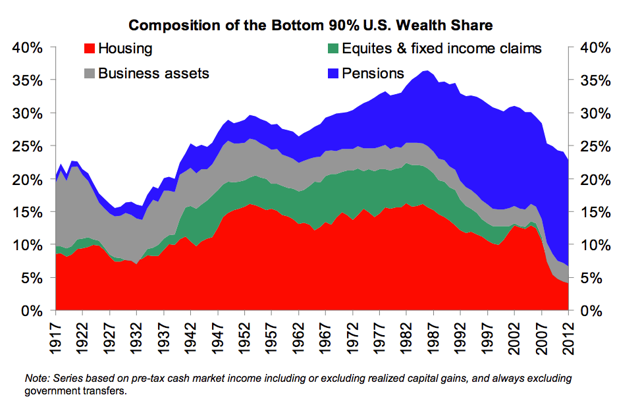

I'd be remiss if I didn't point out the fact that if this dynamic continues apace, inequality in America is going to get progressively worse. Have a look at this chart from a brand new Deutsche Bank presentation on the subject:

(Deutsche Bank)

Look at that green area there. For the bottom 90%, ownership of stocks and bonds has all but disappeared. Here's what an incredulous Ben Hunt tweeted when that presentation started to hit clients' inboxes this week:

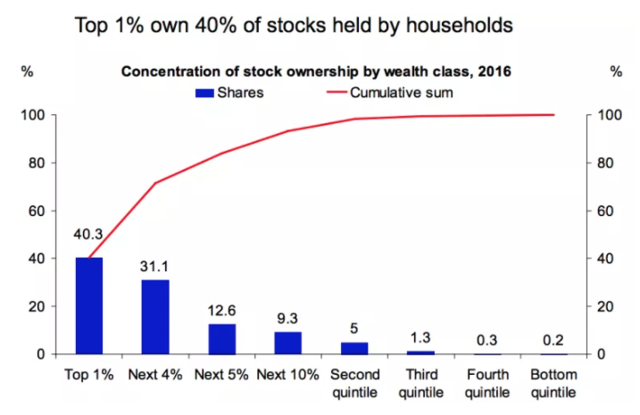

Now have a look at an even more disturbing chart:

(Deutsche Bank)

Maybe - just maybe - one of the reasons why this rally seems to some folks like "the most hated bull market in history," is because participation is increasingly confined to a small percentage of the populace.

Then again, I'm incredulous about the whole idea of this being a "hated" rally. Because based on my extensive experience with readers both on this platform and on my own site, a whole lot of people are loving every minute of it.

And I'm sure that will be reflected in the comments section here.

0 comments:

Publicar un comentario