Around The Financial World In 2,000 Words

by: The Heisenberg

- One week into 2018 and I've got to tell you, I'm entertained.

- On Tuesday, everyone was searching for a "new" narrative. Then they realized there was nothing "wrong" with the old one.

- Here's a sweeping and highly amusing look across markets, touching on everything from equities, to EM, to commodities, to Ripple.

- On Tuesday, everyone was searching for a "new" narrative. Then they realized there was nothing "wrong" with the old one.

- Here's a sweeping and highly amusing look across markets, touching on everything from equities, to EM, to commodities, to Ripple.

Boy, I've got to tell you, this has been an interesting and highly amusing week.

On Tuesday morning, after analysts, pundits, and traders trudged wearily back to the office and plopped down at the desk still nursing the remnants of their New Year's Eve hangovers, there was a palpable sense of frustration. That seemed to emanate from the fact that nothing material had happened since last week.

Because nothing meaningful occurred in the three days between the close of business on Friday and Tuesday morning, no one had anything to write about, let alone trade on. And so, there was a bit of desperation in the air as everyone grasped at narrative straws in a largely fruitless attempt to find something easy to latch onto on a morning when everyone's lingering holiday headaches made the act of thinking more difficult than it would normally be.

For a second there, it seemed like everyone had forgotten that there was nothing wrong with the existing narrative, which is basically this: buy risk assets hand over fist because i) the global economy is accelerating rapidly and synchronously and ii) inflation isn't accelerating at all, which means there's exactly zero chance that DM central bankers are going to have an excuse to spoil this party with aggressively hawkish forward guidance.

Once everyone remembered that, things got back to "normal," where that means the Nasdaq rallied hard, outperforming for two consecutive sessions, setting the stage for the Dow to take the baton on Thursday on the way to blowing through 25,000 for the first time:

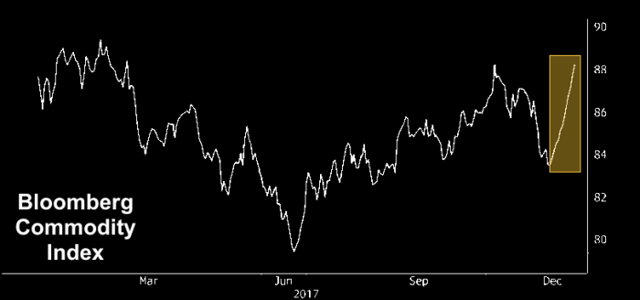

Meanwhile, the dollar's continued trials and tribulations helped extend the Bloomberg Commodity Index's rally to 14 straight days - that would be the longest run in history.

Also this week, gold extended its best win streak since 2011, after climbing for 10 consecutive days.

And I'm not done throwing fun charts and stats at you. All of these things have knock-on effects, and when you hear commodities rally with dollar weakness, you should immediately ask what EM FX is doing. Well, guess what? The MSCI EM FX index rose for a 10th consecutive day on Thursday. That would be the longest stretch in seven years. It’s now up something like 20% from its January 2016 low (that was back when oil was plunging and China risk was rearing its ugly head), and is sitting at its highest level since 2013:

Meanwhile, the Japanese came back from a long holiday on Thursday, and they had some catching up to do. No problem there. The Nikkei surged a remarkable 3.3% on the day to a 26-year high. Thursday's rally was the best single-session gain in more than a year:

All of this has come amid a steady stream of upbeat econ data. So in short, everyone who was aggravated about the perceived lack of a tradable narrative on Tuesday has now remembered that 2018 is widely expected to look a lot like 2017. That means buoyant stocks, an impressive econ, a struggling dollar, and everything that comes with a beleaguered greenback, including (and especially) EM exuberance.

"A massive snowstorm along the U.S. East Coast failed to cool financial markets [as] the Dow cruised past 25,000 for the first time, emerging-market stocks reached the highest since 2011, and commodities from oil to copper extended their impressive run," Bloomberg's Ye Xie wrote on Thursday evening, recapping the week before reminding you that "improving global data is keeping the rallies warm."

I can't believe I actually have to say what I'm about to say, but judging by some of the reader comments on my first couple of articles for this platform in 2018, it's apparently necessary. Describing what's going in front of people with working eyes and ears is not the same as saying I advocate continuing to chase a rally that is now laughably long in the tooth. It's kind of like how just because reality forces me to acknowledge the fact that there is a place called McDonald's which sells unhealthy food, acknowledging the existence of that place does not thereby mean I recommend eating at McDonald's.

It is, more than ever, my contention that chasing this rally makes increasingly less sense the longer it runs. That goes double and triple (literally, if you got in during 2009) for anyone who has been long for the duration of the bull market. To me, chasing this further is nothing more than pure, unadulterated greed for anyone who is not obligated to remain invested by virtue of a mandate. In other words, if you are not a fund manager who is compelled to explain why you're not fully invested at a time when your peers are still squeezing this for all it's worth, I cannot fathom why you would want to push your luck.

But that's just me, apparently. Because two industry titans were out over the last 48 hours explaining why investors might indeed want to stay invested. David Tepper, for instance, said the following on CNBC on Thursday:

Explain to me where this market is rich? It’s not rich with the tax thing that just changed earnings projections. With earnings forecasts going up and interest rates where they are, how is this market expensive? I don’t see the overvaluation. World growth is higher.

There’s no inflation. The market coming into this year doesn’t look rich, in fact, it looks almost as cheap as coming into last year.

Well, since you asked, David, here's how I "explained" my contention that the market is "rich" over at Heisenberg Report:

Actually it doesn’t “look cheap.” On the contrary, it looks really – really – expensive.

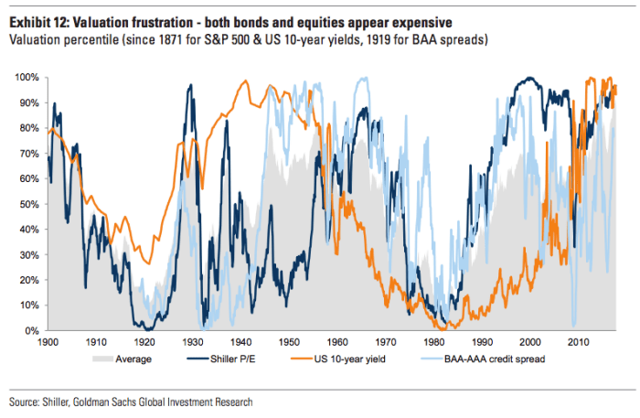

But remember, this is a world where “cheap” is a relative term. As Goldman will be happy to remind you, in absolute terms stocks, bonds, and credit haven’t been this simultaneously expensive in 100 years:

But relative to bonds, there’s still some “value” in equities – I guess. That’s what Tepper is getting at.

Jeremy Grantham agrees - both with me and with Tepper. Here's what he said in his latest investor letter (which you should definitely read in full):

I find myself in an interesting position for an investor from the value school. I recognize on one hand that this is one of the highest-priced markets in US history.

On the other hand, as a historian of the great equity bubbles, I also recognize that we are currently showing signs of entering the blow-off or melt-up phase of this very long bull market.

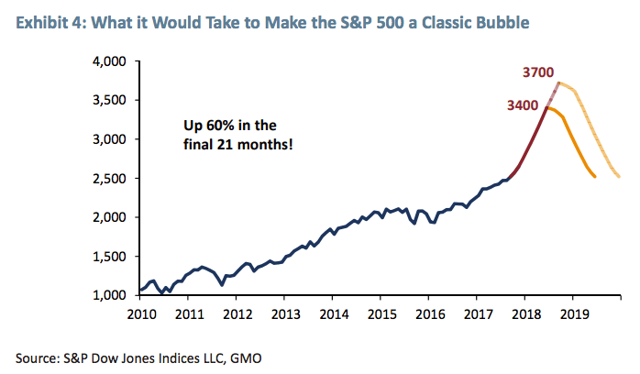

Exhibit 4 represents our quick effort at showing what level of acceleration it might take to make 2018 (and possibly 2019) look like a classic bubble.

A range of 9 to 18 months from today and a price rise to around 3,400 to 3,700 on the S&P 500 would show the same 60% gain over 21 months as the least of the other classic bubble events.

That's all fine and good, but with all due respect to Grantham, I'm not sure that is a solid investment thesis. I'm not going to allocate based on an assumption about what it would mean if the current state of affairs turned into "other classic bubble events." To be fair, his note is thorough and contains myriad evidence to support his conclusions, so I am in no way trying to disparage his analysis.

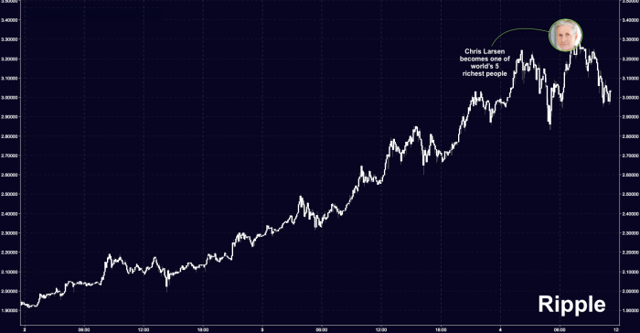

I'd be remiss if I didn't at least mention the fact that playing out in the background this week is one of the most egregious examples of speculation I have ever witnessed. Yes, I'm talking about Ripple. Bear with me and I'll explain why this is relevant.

I'm not going to go into the background here (there's plenty over at Heisenberg Report), but suffice to say that overnight on Thursday, Ripple co-founder and former CEO Chris Larsen became the fifth richest person on the planet, surpassing Larry Ellison and Google founders Larry Page and Sergey Brin.

Obviously, that is absurd on all kinds of levels. Part of what you're seeing in the cryptosphere is a revolt against central bank profligacy - or at least that's part of the rationale for the rally in Bitcoin.

The idea is that with central banks engaged in round after round of what amounts to competitive devaluations, Bitcoin represents something of a safe haven from what should, all things equal, be hyperinflationary monetary policy. To the extent that makes some measure of sense in Bitcoin (which is itself a debatable proposition), it's now driving people into Bitcoin alternatives where that argument is simply not applicable. So there's a direct connection to what you see in Ripple and what went on with Bitcoin in 2017.

Make no mistake, this is a problem. I've been saying for some time now that unrealized gains in cryptocurrencies are already finding their way into the real economy. There's no way to know the extent to which these paper gains are effectively collateralizing loans and/or serving as the basis for financial decisions that people wouldn't make were it not for their newfound crypto wealth. I wrote about that on this platform in "It's A Mad, Mad, Mad World," but I wanted to give you a more concrete example.

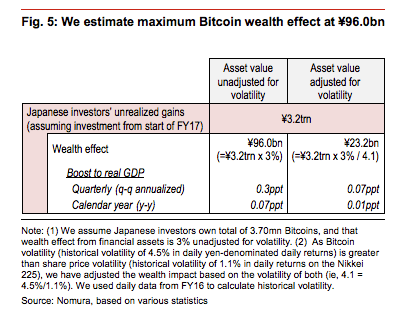

According to Nomura, Japanese margined FX traders are sitting on an unrealized Bitcoin gain pegged at roughly ¥3.2 trillion. That, the bank claimed in a note out late last month, is set to boost the Japanese economy. Here's an excerpt from my piece documenting this:

The assumption here is that an increase of ¥10bn in the value of assets of Japanese people boosts consumption by roughly ¥0.2-0.4bn. That’s based on prior studies. So, if you assume that, then the ¥3.2trn unrealized gain could result in “an increase of around ¥96.0bn in personal consumption [and] given that Japan’s real GDP is around ¥522trn, the y-y boost to GDP from this spending works out at just 0.07ppt," Nomura calculates:

Never mind the small number. The fact that anyone is even discussing this is alarming. These are unrealized gains on a cryptocurrency that is insanely volatile. If there's even an outside chance that people are going to start increasing their spending based on those paper gains, well then the stage is set for all kinds of trouble in the event those gains evaporate. Here's Nomura again:

[There is] a difference between the wealth effect impact resulting from an increase in asset value caused by a rise in the price of Bitcoin, and an increase in asset value resulting from share price gains.

Indeed, there is. But one can't help but wonder if these same people are more inclined to take risk in "safe" stocks based on their Bitcoin gains. If those stocks then rise (as they did on Thursday in Japan), then the equity market gains could serve as a rationale for increased spending. Don't forget, those equity gains are themselves underwritten by the Bank of Japan, which is printing yen out of thin air to buy ETFs. That policy is part and parcel of why people got into Bitcoin in the first place.

It's laughably circular. We're just pyramiding risk here. It's a castle in the sky on top of another castle in the sky.

In any event, far from making me more confident in the durability and/or the viability of what you're seeing in the markets, everything I've seen of late (including the bullish commentary from Tepper and the "blow-off" top bit from Grantham) just makes me even more convinced that people have lost perspective.

Speaking of perspective, allow me to leave you with a quote from SocGen's Andrew Lapthorne, who reminds you (and he's being sarcastic, so "no," no one is conjuring a conspiracy theory here) that if global equities were a fund, the implausibly low volatility and suspiciously consistent returns we saw in 2017 would probably ring the ponzi scheme alarm:

Not only did global equity markets perform well during 2017 (MSCI World delivered a total return of 20.1%), but they did so with such low volatility and consistency that if this were a fund, it would perhaps merit a visit from the authorities to check exactly what you were up to!

0 comments:

Publicar un comentario