IS THIS THE TOP OF THE MARKET? / THE WALL STREET JOURNAL

Is This the Top of the Market?

The investing nirvana that has driven markets in recent years is under attack as central banks scale back stimulus

By Ken Brown

The rally has driven up valuations, though strong economic performance has meant assets are pricey but not at extreme levels. Photo: European Pressphoto Agency

A da Vinci sells for $450 million, one bitcoin is worth $7,700 and 99-year-old Austria issues a 100-year bond at an interest rate of 2.1%. Clearly there is too much money in the world.

That isn’t new, but how long can it last? With central banks scaling back stimulus, investments that appear attractive when interest rates are near, or below, zero suddenly look silly. And silly investments usually lose money, often bringing down less silly assets along with them.

The end may come soon, or the current investing nirvana could go on. Heard on the Street walks through the risks and likely scenarios for markets in the coming months.

MANY HAPPY RETURNS

Some of the best performers of past three years

Total return

The rallies have driven up valuations, though strong economic performance has meant assets are pricey but not at extreme levels.

S&P 500 cyclically adjusted Price/earnings ratio

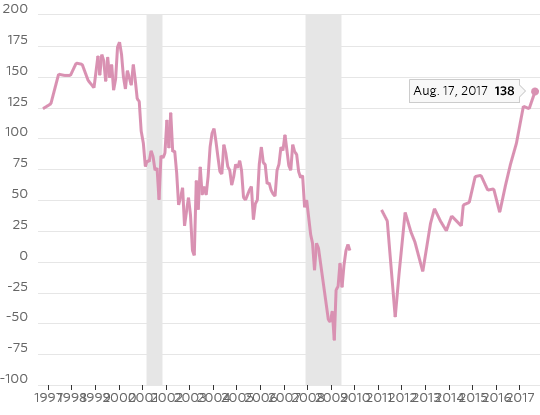

Investors are more confident than at any time since the tech bust, and high confidence typically means markets don’t perform well in the future.

Wells Fargo/Gallup Investor and Retirement Optimist Index

The biggest and most widely acknowledged risk is in the bond market where central bank stimulus has driven yields to record lows. But as economies have picked up, investors haven’t demanded higher yields to compensate for the risk that rates will rise.

0 comments:

Publicar un comentario