Central banks alone cannot deliver stable finance

Government policy must counter the growing risk of a crash in asset valuations

by Martin Wolf

© James Ferguson

Favourable global economic prospects, particularly strong momentum in the euro area and in emerging markets led by China and India, continue to serve as a strong foundation for global financial stability.” This statement opened the International Monetary Fund’s April 2007 Global Financial Stability Report. Since this benign view was published on the eve of the most devastating financial crisis in nearly eight decades, it has to be viewed, in hindsight, as a spectacular misjudgment. The fund is determined not to be caught out again. The question is whether the concerns it pours forth in its latest Global Financial Stability Report are well judged or whether it is crying wolf. As important, what might be the implications, especially for policy, of its worries?

The underlying argument of the report is that “near-term risks to financial stability continue to decline”, but “medium-term vulnerabilities are rising”. The return of global economic growth, combined with comfortable monetary and financial conditions, together with sluggish inflation, strengthens investors’ reach for yield and appetite for risk. With market and credit risk premiums at decade-low levels, asset valuations are vulnerable to a “decompression” of risk premiums — in blunter words, a crash.

As the report notes, shocks to credit and financial markets well within the historical range could have large negative impacts on the world economy: “A sudden uncoiling of compressed risk premiums, declines in asset prices, and rises in volatility would lead to a global financial downturn.” Many hold the room for monetary policy manoeuvre to be limited. The result might then be a less deep, but still more intractable, global recession than that of 2009.

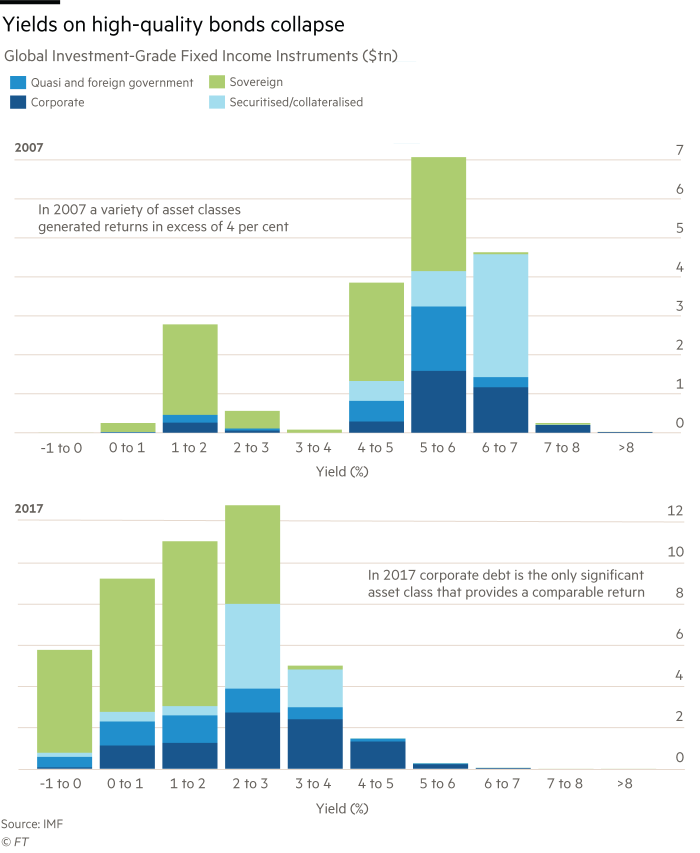

One element in these risks is yield compression. Yields on investment-grade fixed income instruments have collapsed since 2007, with almost none now yielding over 4 per cent. This has also encouraged greater capital flows to — and so more borrowing by — emerging countries. Non-resident capital inflows of portfolio capital reached an estimated $205bn in the year through August 2017 and are on track to reach $300bn in 2017, more than twice the total in 2015-16. In addition, argues the fund, low yields, compressed risk spreads and abundant financing are encouraging a build-up of debt on corporate balance sheets. Reversals in these spreads could cause a jolt: to reach the average levels for 2000-04, market risk and term premiums would have to rise by about 200 basis points for investment-grade bonds. Market volatility is also highly compressed. (See charts.)

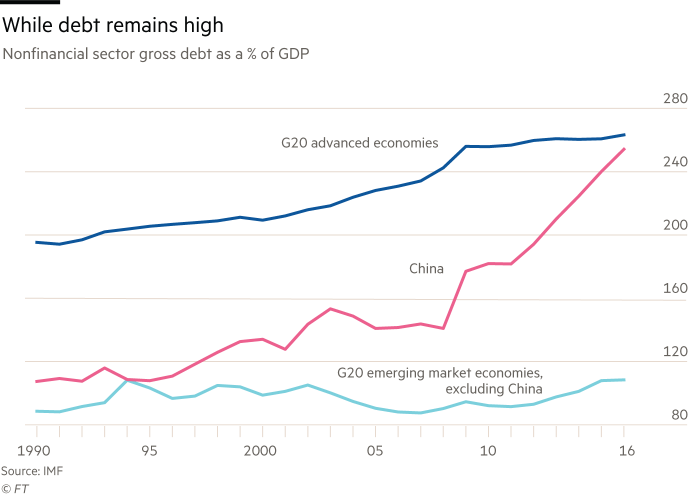

Possibly most important, leverage continues to rise across the world, notably in China. In the high-income countries, the net asset position of the private sector has improved somewhat since the crisis, but the governments’ has worsened. Moreover, assets are currently valued at high, quite possibly unsustainable, levels. Debt service burdens are generally low, at current interest rates. But this would change if those rates rose sharply. Moreover, in several economies debt service burdens in the private non-financial sectors are greater than average — notably in China, but also in Australia and Canada.

Such analyses bring worries into the open. This is helpful: the more worried people are, the safer the system. Yet it is also essential to tease out the implications of the fragility the fund describes so clearly. I would identify four.

First, investors must be very wary.

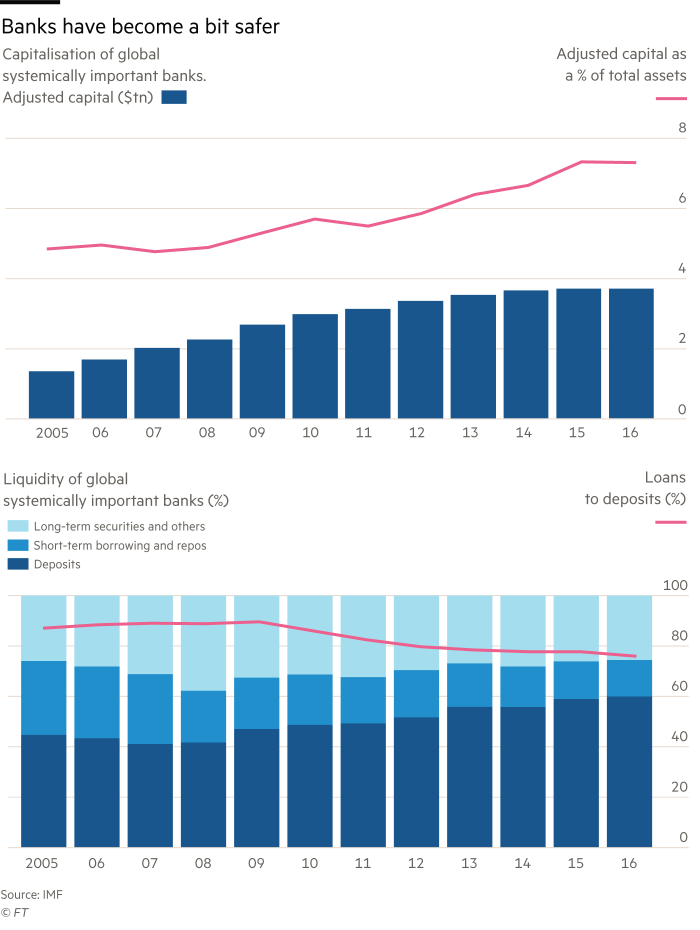

Second, it has to be possible for the financial system to cope with changes in asset prices without blowing up the world economy. This should not need saying. An essential part of achieving this is deleveraging and in other ways strengthening intermediaries, notably banks. That has indeed happened, but not, in my view, nearly enough.

Third, the generation of demand sufficient to absorb potential supply has become far too dependent on unsustainable growth in credit and debt and also on consumption (especially in high-income countries) or wasteful investment (as in China). We might break this linkage in several ways. One is to redistribute income, via the tax system, from savers to spenders.

Another is to increase incentives for investment, especially by profitable businesses. Another is to remove the tax-favoured position of debt and rely more on equity financing throughout the economy. A final one is to rely more on government spending and borrowing, especially spending on public investment.

Finally, we should not conclude that central banks have to abandon the priority of stabilising the economy in favour of the possibly conflicting goal of stabilising the financial system. One reason is that monetary policy is a blunt instrument for achieving the latter. A more fundamental objection is that we cannot tell people they must remain stuck in a deflationary economy because it is the only way to stop the financial system from exploding. They will rightly respond that these priorities are wrong. Similarly, ensuring creditors get the returns they think they deserve is not the job of the central banks. If governments think creditors are so deserving, they should change taxes accordingly.

Again, if they think the financial sector remains excessively unstable, they should regulate it.

Criticising the success of our central banks in reflating our crisis-hit economies, because this created today’s financial risks, is not a valid reaction to their actions. It is, however, an extremely valid criticism of finance. It is also a valid criticism of the failure of governments to address the many frailties that still lead to financial excess. The central banks did their job.

Unfortunately, almost nobody else has done theirs.

0 comments:

Publicar un comentario