AMERICANS ARE RICHER; WHY ARE THEY STILL CAUTIOUS? / THE WALL STREET JOURNAL

Americans Are Richer; Why Are They Still Cautious?

Household wealth hit a new high, but that hasn’t made Americans more willing to spend

By Justin Lahart

Ford Mustang GTs sit in a car dealership lot in Matteson, Ill. According to Federal Reserve data, U.S. household wealth has reached a record level, but consumer spending has been tepid, and people have been far less willing to tap wealth. Photo: Daniel Acker/Bloomberg News

Getting richer doesn’t make people spend like it used to. That should give the Federal Reserve less to worry about when it comes to consumers, but more to worry about when it comes to asset prices.

Lifted by rising home prices and a buoyant stock market, U.S. household net worth reached a record $96.2 trillion in the second quarter, the Fed reported Thursday, up $1.7 trillion from the first quarter. That compared with $68.2 trillion a decade earlier, just before the recession hit.

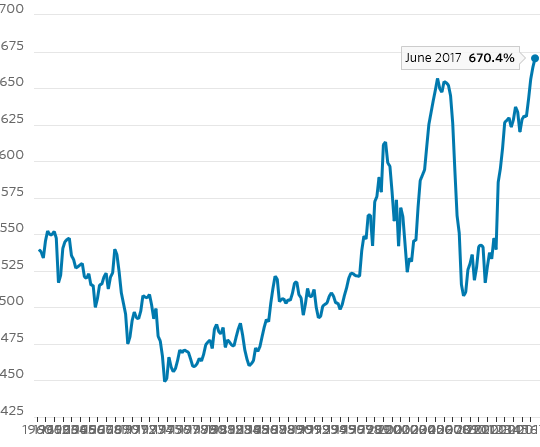

The wealth-to-income ratio hit a new high of 670%.

But if households are feeling flush they aren’t acting like it. Consumer spending has been tepid, and people have been far less willing to tap wealth to fuel spending than they used to be. Bank of America Merrill Lynch estimates that for each dollar gain in housing wealth, people increase their spending by just two cents, versus five cents in the mid-1990s. For stock gains, the figure has slipped to one cent from four cents.

RICH FEELING

Net worth as a share of disposable income (1960-2017)

There are few likely reasons for the change in behavior. First, people don’t put as much trust in the staying power of wealth gains. The big stock market drops following the dot-com bust and the financial crisis are hard to forget, and the housing bubble ended the old notion that home values are safe. Second, a greater share of U.S. stock market and housing wealth is concentrated in the hands of the rich, who don’t boost their spending in response to wealth gains as much as other people do. Finally, tighter lending standards have made it more difficult to tap into housing wealth than it was before the financial crisis.

During the early years of the recovery, as asset prices rebounded but the economy only trudged along, the Fed probably wished Americans weren’t so hesitant to spend their wealth. But now, with the economy healthier and the Fed tightening, the central bank is probably pleased that it does not have to rein in reckless consumer spending, points out Merrill economist Michelle Meyer.

The downside is that is that if consumer behavior and asset prices continue to diverge, the Fed could face some difficult choices. Say that consumer spending remains muted, the economy grows at the same steady pace and inflation remains low as a result. And say that stock prices keep on rising, stretching valuations to the point where they look frothy. Under those circumstances, should the Fed keep rates steady, and risk a bubble? Or raise rates to cool asset prices, and risk pushing consumer spending and inflation dangerously lower?

0 comments:

Publicar un comentario