Oil And The Black Swan - The Final Countdown

- Bad news for stocks always starts in debt markets.

- The day OPEC died.

- Stocks in lock step with crude.

It's been a little over a year since I published the first in the series, Oil & the Black Swan. Just days' earlier Saudi Arabia had announced they would no longer be the world's swing producer willing to cut production and support oil prices. There hasn't been a funeral or even a death certificate issued but effectively that was the day OPEC died.

The collapse in oil has been a favorite topic for the press and bloggers at times even approaching the attention garnered by the Federal Reserve. The rhetoric that followed ranged from; "it will be a tax cut for consumers" to others saying "it's the end of life as we know it." Of course it's the extremes that rarely get it right and the truth usually lies somewhere closer to center.

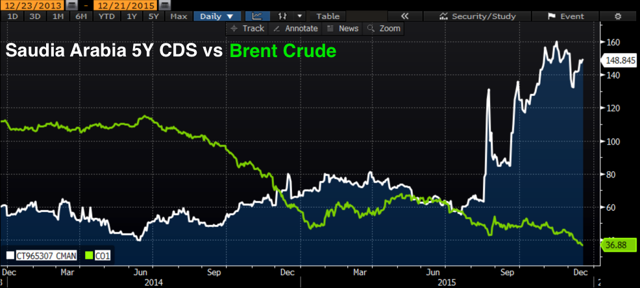

Bad news for stocks can come from almost anywhere but the really challenging concerns always show up in debt markets first. A year ago, I focused on the credit default swaps of leading oil companies as well as the sovereign debt of OPEC's largest producer Saudi Arabia. As you might have guessed with oil down 67% from its June 2014 highs, the picture isn't any brighter. Saudi Arabia's war against the U.S. energy complex to maintain market share is coming at a steep cost. CDS spreads are starting to rise along with the cost of protection.

The cost of insuring these bonds is climbing dramatically with each leg down in energy markets.

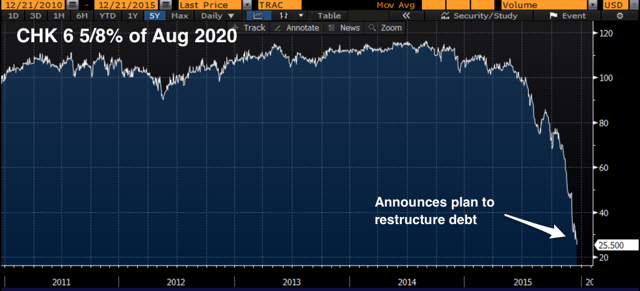

When portfolio managers are forced to focus on balance sheets it's never a good sign and today you can bet it's the first place we turn. No one wants to be caught off guard holding a Chesapeake (NYSE:CHK) or even worse a Magnum Hunger (OTCPK:MHRCQ). (Magnum Hunter has filed for bankruptcy)

Chesapeake Bonds

Unfortunately, it isn't just marginal players that has investors concerned. Even large oil companies in the Energy Select SPDR Fund (NYSEARCA:XLE) like Chevron (NYSE:CVX) are seeing an alarming rise across the entire CDS curve as compared to a year ago.

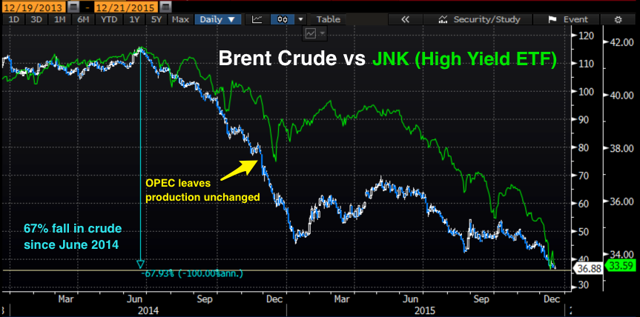

High Yield

Falling oil is already causing huge disruptions in high yield markets. Recently, Third Avenue shut the doors to their Focused Credit fund denying investors the ability to withdraw capital. Forced to shut down because of illiquid securities they halted redemptions and will take their time unwinding the fund. Who knows what the value of these securities will be once they finish.

What's the relationship of Junk Bonds to the Price of Oil?

One look at a chart comparing oil prices to junk bonds says it all. About 16% of the junk bond market is in the energy patch so the price of oil has an outsize effect on this very important asset class. Each leg lower in crude pushes these companies closer to default. Standard & Poor's rating service is on record saying 50% of these companies are "distressed" meaning they are at risk of default. The domino effect and likely spillover to other asset classes is a concern for investors already rattled by increasing volatility.

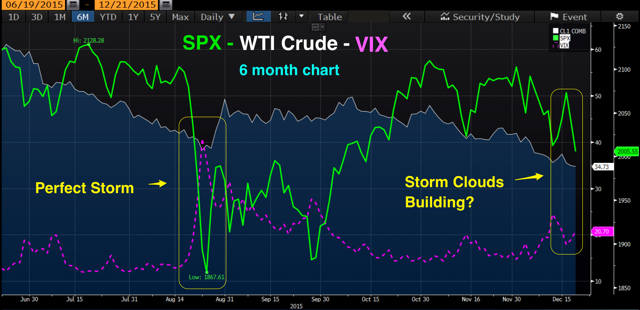

Earlier in the year, markets ignored falling crude as low prices seemed to only hurt the energy sector.

Tech, consumer discretionary and even industrials all had their day in the sun. Today, with each drip lower correlations are rising and low oil seems to consistently point to lower stock prices.

Have we hit the tipping point where any benefit to the consumer wallet is being more than offset by the potential of rising defaults? It's a question that needs an answer before it dominoes into other sectors of our economy.

A continued fall in energy prices can only add to geopolitical tensions that today spills onto our shores. Oil producing nations at the heart of Middle-East firestorm become more desperate with each tick lower challenging their ability to fund social programs and provide jobs giving radical jihadist groups even more fuel to recruit supporters.

Stocks have struggled all year to maintain their footing but each leg lower in crude has pushed the VIX (Volatility Index) higher and stocks lower. The August lows for stocks coincided with a push lower in crude and massive spike in the VIX. The V shaped recovery that followed was matched by a $10 per barrel rise in oil in just 6 days. With less than 2 weeks to close out the year crude once again is heading south taking stocks with it.

The Final Countdown

Widening cracks in credit markets may be an indication that the final countdown to another correction has begun. By definition Black Swan events are rare, hard to predict and identified only in hindsight.

The last chapter hasn't been written on what the collapse in oil prices will mean for society and world markets. However, if there is a Black Swan lurking there's a good chance you'll spot it floating by an oil rig.

0 comments:

Publicar un comentario