Monetary policy

After lift-off

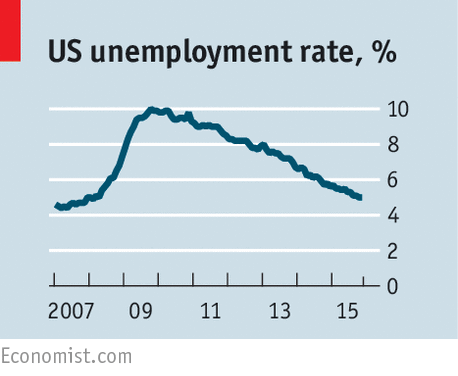

The Federal Reserve is set to raise interest rates for the first time since 2006. Its next step matters more

.

THERE was a time when a nudge up or down in interest rates was seen not just as normal, but testament to central bankers’ ability to fine-tune the economy. Not now.

The Federal Reserve is widely expected to raise its benchmark interest rate, currently close to zero, by a quarter of a percentage-point on December 16th. That would be its first increase since June 2006.

Unfortunately, the Fed’s reasons for moving this month reflect its fear of losing credibility with the markets as much as its mastery of the economy.

Having talked endlessly about an imminent move, the central bankers now feel bound to keep their word. That is a poor rationale for making monetary policy. One small, widely heralded rate rise is unlikely to fell America’s economy. The important question is when the next ones will follow. That is where the Fed must signal now that it will be cautious.

Data-dependent, not date-dependent

The risks of tightening too much too soon still seem greater. Despite a combined stimulus from zero interest rates and $3.8 trillion of asset purchases by the Fed, GDP in America has risen at an annual average rate of around 2% since 2010. The strong dollar and weakness in emerging markets will weigh on America’s economy—and the divergence between the Fed’s tightening and looser monetary policy elsewhere, especially in the euro area, Japan and China, means that the dollar is likely to strengthen further. Because its starting-point is near-zero interest rates, the Fed has more scope to deal with an unexpected surge in inflation by shoving rates upward, than it has to address any threat of recession by bringing them down again.

Even if the risks that the Fed faces are stubbornly lopsided, the consequences of one premature quarter-point rate rise are unlikely to be disastrous. A series of premature increases would be another matter. And that is where the Fed’s apparent plans are worrying. The central bank’s forecasts suggest that interest rates will rise by a quarter-point roughly every three months in 2016. Such a schedule of increases would unsettle the bond markets (which have priced in a slower pace of tightening) and drive up the dollar yet further.

A rapid tightening cycle would also ratchet up pressure abroad. There is a sense that many emerging markets are in so deep a funk that the Fed cannot make things much worse. Capital has flowed out of emerging-market shares and bonds in four of the past five months, according to the Institute of International Finance. The currencies of commodity exporters, hurt by China’s waning appetite for raw materials, have already fallen. But sharply higher American interest rates would put more pressure on countries that rely on foreign capital to plug their trade gaps. Central banks in Chile, Colombia, Peru and South Africa have recently raised interest rates in anticipation of the Fed, at some cost to economic growth. The Fed’s concern is the American economy, of course, but sluggish demand abroad and a strong dollar have effects on exporters.

The recent experience of other central banks offers salutary lessons in the dangers of moving too fast to get off the interest-rate floor. In 2011 the European Central Bank twice raised its main interest rate, but was swiftly forced to reverse course and has since cut even more deeply. On December 3rd it cut the rate it pays on commercial-bank deposits to minus 0.3%. Interest rates in Sweden were increased from 0.25% to 2% before the Riksbank had to march them back down again (its main lending rate is now negative). Central banks in Canada and Israel have suffered similar reversals.

The Fed’s apparent determination to get going on monetary tightening is a worrying signal of how fast it plans to move thereafter. Before attempting a second rise, America’s central bank should give itself time to assess the impact of the first.

0 comments:

Publicar un comentario