- Another day and weaker economic data. The consistency of poor economic reports is enough to turn investors away from markets overall.

- Yes, commodities continue to drop but that’s been going on since 2011. Are headline writers getting desperate for reasons suddenly?

- It’s a sign of ongoing deflation given weak demand from manufacturers globally. So, now we raise interest rates? Just more proof the Fed is late, maybe too late, to their duties.

Another day and weaker economic data. The consistency of poor economic reports is enough to turn investors away from markets overall.

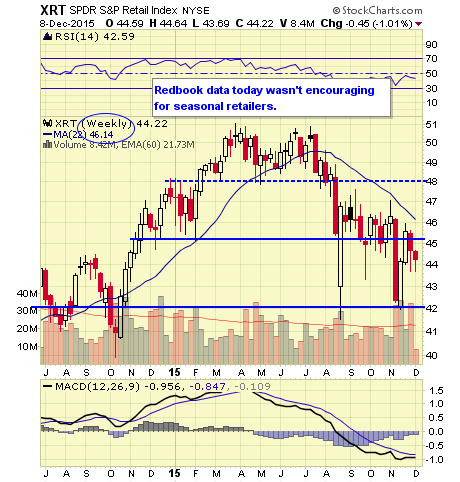

The NIFB Small Business Confidence report fell to 94.8 vs. 96 expected & prior 96.1; Retailer's Redbook fell YoY to only 1.9% vs. prior 3.9% (This is the season for a better reading, right?); JOLTS Survey of new job openings fell to 5.383M vs. prior 5.534M (here too, retailers should be hiring temp workers if nothing else).

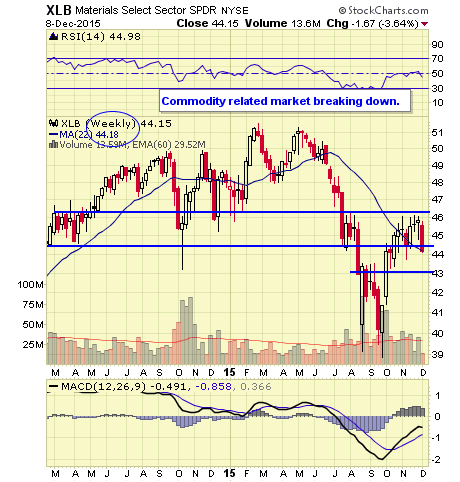

The headline from the WSJ Tuesday was "Weak Commodities Roil Stocks." Yes commodities continue to drop but that's been going on since 2011. Are headline writers getting desperate for reasons suddenly? Since 2011, high commodities overall as measured by PowerShares Commodity Tracking Index ETF (NYSEARCA:DBC) is down 59%. Nothing new here for those following those markets overall.

It's a sign of ongoing deflation given weak demand from manufacturers globally.

So, now we raise interest rates? Just more proof the Fed is late, maybe too late, to their duties.

S

tocks fell once again Tuesday led lower by energy, materials and financials.

Market sectors moving higher included: Biotech (NASDAQ:IBB) and Volatility (VIX) and not much else.

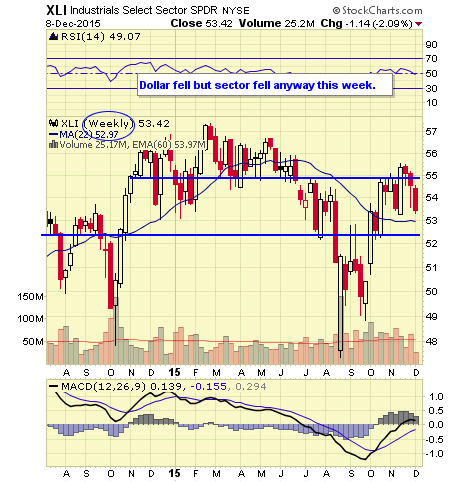

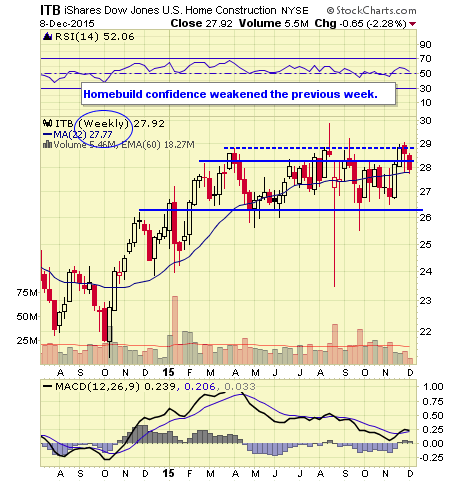

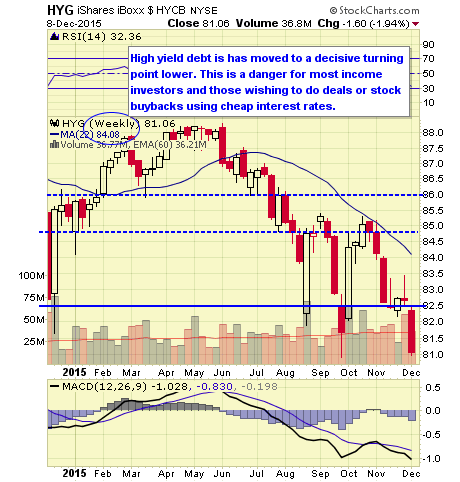

Market sectors moving lower included: Dow (NYSEARCA:DIA), S&P 500 (NYSEARCA:SPY), Small Caps (NYSEARCA:IWM),Financials (NYSEARCA:XLF), Regional Banks (NYSEARCA:KRE), Banks (NYSEARCA:KBE), Energy (NYSEARCA:XLE), Industrials (NYSEARCA:XLI), Materials (NYSEARCA:XLB), Homebuilders (NYSEARCA:ITB), Metals & Mining (NYSEARCA:XME), Europe (NYSEARCA:VGK), Hedged Europe (NYSEARCA:HEDJ), European Monetary Union (NYSEARCA:EZU), EAFE (NYSEARCA:EFA), Spain (NYSEARCA:EWP), Italy (NYSEARCA:EWI), UK (NYSEARCA:EWU), Japan (NYSEARCA:EWJ), Hedged Japan (NYSEARCA:DXJ), Asia ex-Japan (NASDAQ:AAXJ), Russia (NYSEARCA:RSX), India (NYSEARCA:EPI), Australia (NYSEARCA:EWA), Taiwan (NYSEARCA:EWT), South Korea (NYSEARCA:EWY), Mexico (NYSEARCA:EWW), Canada (NYSEARCA:EWC), Junk Bonds (NYSEARCA:HYG), Crude Oil (NYSEARCA:USO), Gold Miners (NYSEARCA:GDX) and many more.

The top ETF daily market movers by percentage change in volume whether rising or falling is available daily.

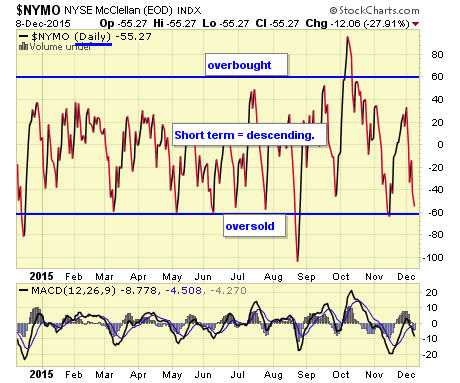

Volume rose on the day while breadth per the WSJ was negative. Markets are getting short-term oversold (see NYMO).

NYMO DAILY

The NYMO is a market breadth indicator that is based on the difference between the number of advancing and declining issues on the NYSE. When readings are +60/-60 markets are extended short term.

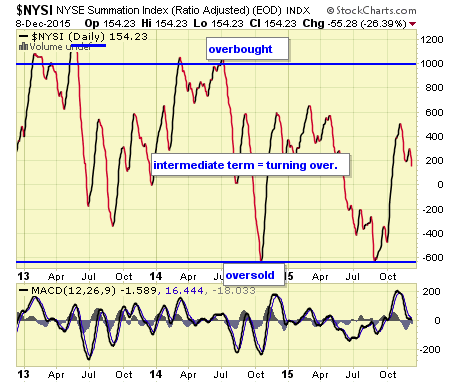

NYSI DAILY

The McClellan Summation Index is a long-term version of the McClellan Oscillator. It is a market breadth indicator, and interpretation is similar to that of the McClellan Oscillator, except that it is more suited to major trends. I believe readings of +1000/-1000 reveal markets as much extended.

VIX WEEKLY

The VIX is a widely used measure of market risk and is often referred to as the "investor fear gauge." Our own interpretation has changed due to a variety of new factors including HFTs, new VIX linked ETPs and a multitude of new products to leverage trading and change or obscure prior VIX relevance.

SPY 5 MINUTE

SPX DAILY

SPX WEEKLY

INDU DAILY

INDU WEEKLY

RUT WEEKLY

NDX WEEKLY

XLB WEEKLY

XLE WEEKLY

XLF WEEKLY

KRE WEEKLY

XRT WEEKLY

XLI WEEKLY

ITB WEEKLY

HYG WEEKLY

TLT WEEKLY

UUP WEEKLY

FXE WEEKLY

GLD MONTHLY

GDX MONTHLY

USO MONTHLY

DBC MONTHLY

XME WEEKLY

EFA WEEKLY

EZU WEEKLY

EEM WEEKLY

Closing Comments

Wednesday yields only Wholesale Trade and important Petroleum Inventories.

The balance of the week isn't that rich with data. I would think markets would be tense before next Wednesday's Fed announcement.

Let's see what happens.

0 comments:

Publicar un comentario